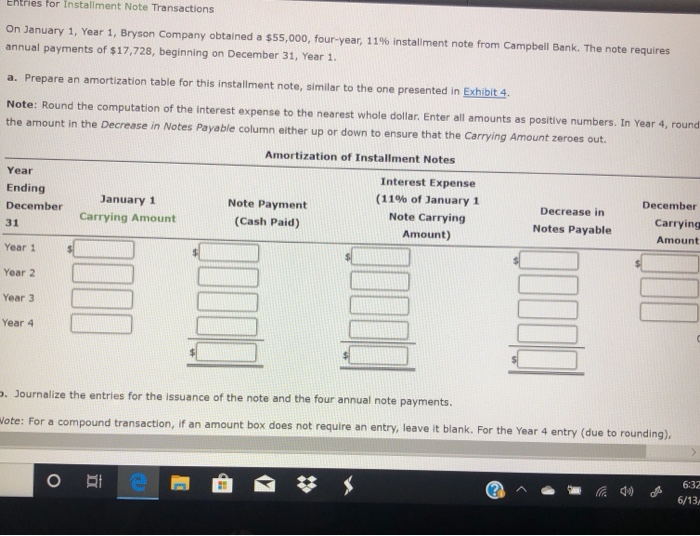

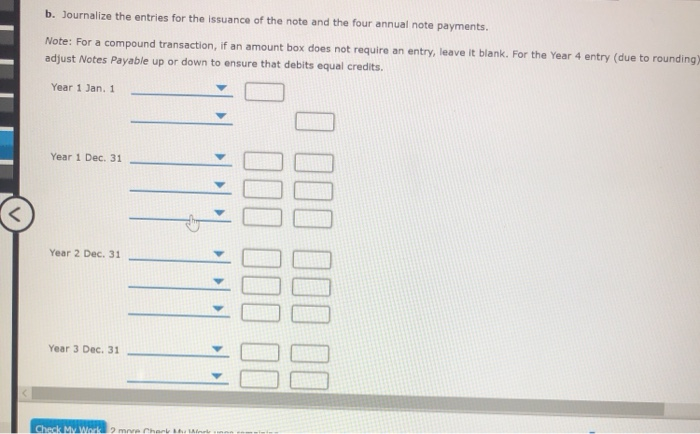

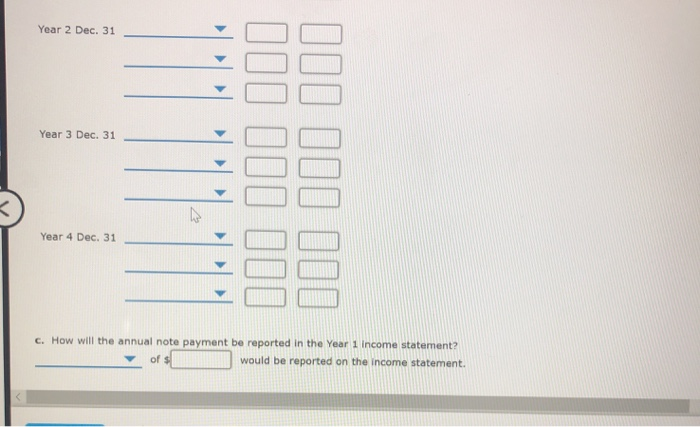

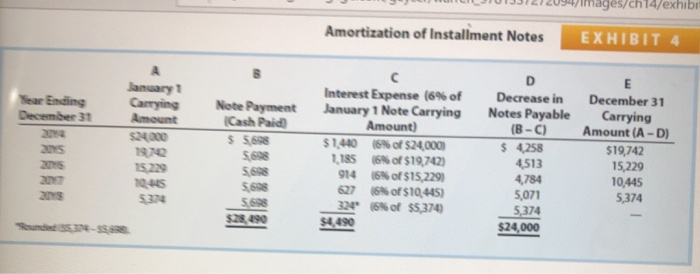

Entries for Installment Note Transactions On January 1, Year 1, Bryson Company obtained a $55,000, four-year, 11% installment note from Campbell Bank. The note requires annual payments of $17,728, beginning on December 31, Year 1. a. Prepare an amortization table for this installment note, similar to the one presented in Exhibit 4. Note: Round the computation of the interest expense to the nearest whole dollar. Enter all amounts as positive numbers. In Year 4, round the amount in the Decrease in Notes Payable column either up or down to ensure that the Carrying Amount zeroes out. Amortization of Installment Notes Year Interest Expense Ending (11% of January 1 December January 1 Note Payment Decrease in December Note Carrying Carrying Carrying Amount (Cash Paid) Notes Payable 31 Amount) Amount Year 1 $ Year 2 Year 3 Year 4 5. Journalize the entries for the issuance of the note and the four annual note payments. Wote: For a compound transaction, if an amount box does not require an entry, leave it blank. For the Year 4 entry (due to rounding), ORE S 6:32 6/134 b. Journalize the entries for the issuance of the note and the four annual note payments. Note: For a compound transaction, if an amount box does not require an entry, leave it blank. For the Year 4 entry (due to rounding) adjust Notes Payable up or down to ensure that debits equal credits. Year 1 Jan. 1 Year 1 Dec. 31 I III II Year 2 Dec. 31 II III III I Year 3 Dec. 31 Check My Work mive Charlie Year 2 Dec. 31 Year 3 Dec. 31 II1 III III 000 110 111 112 Year 4 Dec. 31 c. How will the annual note payment be reported in the Year 1 income statement? of s would be reported on the income statement. images/ch14/exhibi Amortization of Installment Notes EXHIBIT 4 Year Ending December 31 A January 1 Carrying Amount $24000 Note Payment Cash Paid $ 5698 Interest Expense (6% of January 1 Note Carrying Amount) $ 1.4408% of $24,000 1,185 18% of $19,742) 914 8 of 5152291 627 Sof$10,445) 32" (8 of $5,374 $4490 2S 2015 2013 D Decrease in Notes Payable (B-C) $ 4258 4513 4784 5,071 5374 $24,000 E December 31 Carrying Amount (A-D) $19,742 15,229 10,445 5,374 10.45 5698 5698 5698 $28.490