Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Entries for Investment in Bonds, Interest, and Sale of Bonds Bocelli Co. purchased $90,000 of 7%, 12-year Sanz County bonds on May 11, Year 1,

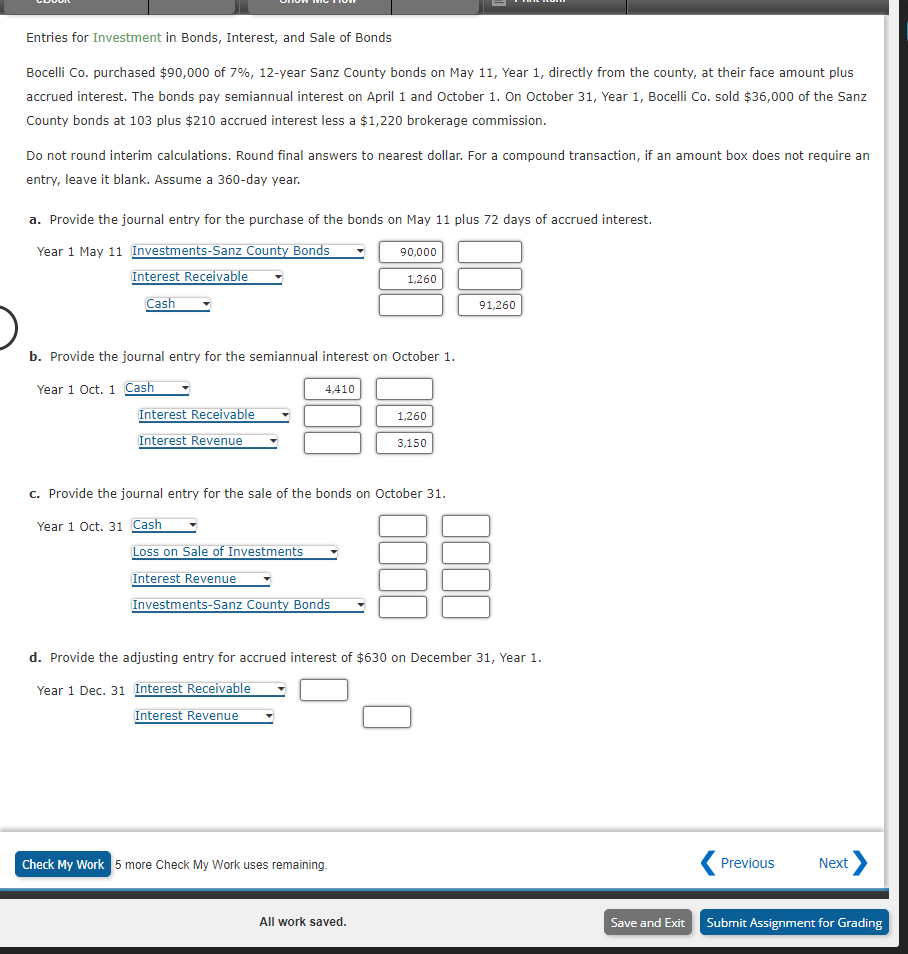

Entries for Investment in Bonds, Interest, and Sale of Bonds Bocelli Co. purchased $90,000 of 7\%, 12-year Sanz County bonds on May 11, Year 1, directly from the county, at their face amount plus accrued interest. The bonds pay semiannual interest on April 1 and October 1 . On October 31, Year 1, Bocelli Co. sold $36,000 of the Sanz County bonds at 103 plus $210 accrued interest less a $1,220 brokerage commission. Do not round interim calculations. Round final answers to nearest dollar. For a compound transaction, if an amount box does not require an entry, leave it blank. Assume a 360 -day year. a. Provide the journal entry for the purchase of the bonds on May 11 plus 72 days of accrued interest. Yea b. Provide the journal entry for the semiannual interest on October 1 . Year c. Provide the journal entry for the sale of the bonds on October 31 . Year : d. Provide the adjusting entry for accrued interest of $630 on December 31 , Year 1

Entries for Investment in Bonds, Interest, and Sale of Bonds Bocelli Co. purchased $90,000 of 7\%, 12-year Sanz County bonds on May 11, Year 1, directly from the county, at their face amount plus accrued interest. The bonds pay semiannual interest on April 1 and October 1 . On October 31, Year 1, Bocelli Co. sold $36,000 of the Sanz County bonds at 103 plus $210 accrued interest less a $1,220 brokerage commission. Do not round interim calculations. Round final answers to nearest dollar. For a compound transaction, if an amount box does not require an entry, leave it blank. Assume a 360 -day year. a. Provide the journal entry for the purchase of the bonds on May 11 plus 72 days of accrued interest. Yea b. Provide the journal entry for the semiannual interest on October 1 . Year c. Provide the journal entry for the sale of the bonds on October 31 . Year : d. Provide the adjusting entry for accrued interest of $630 on December 31 , Year 1 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started