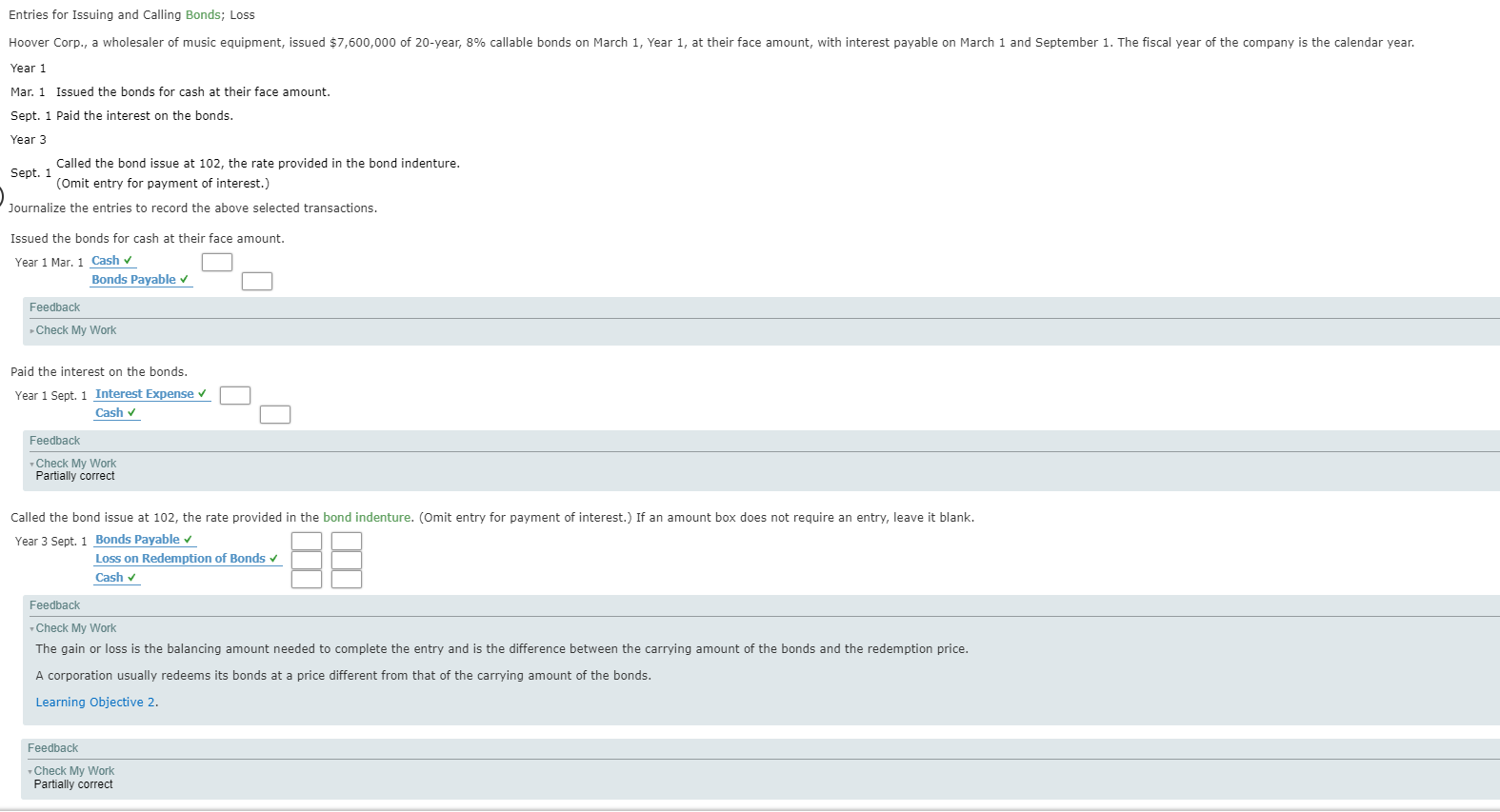

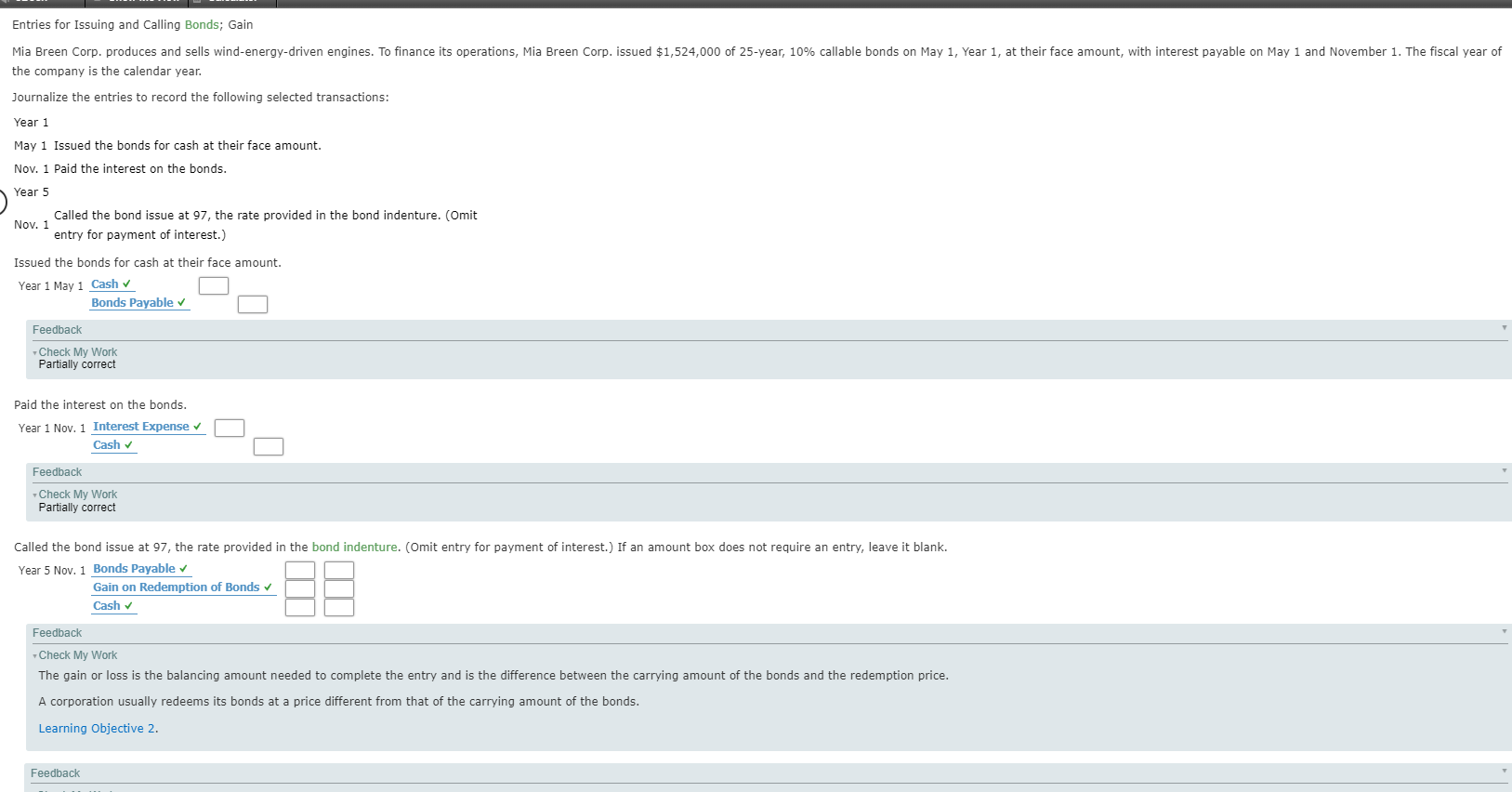

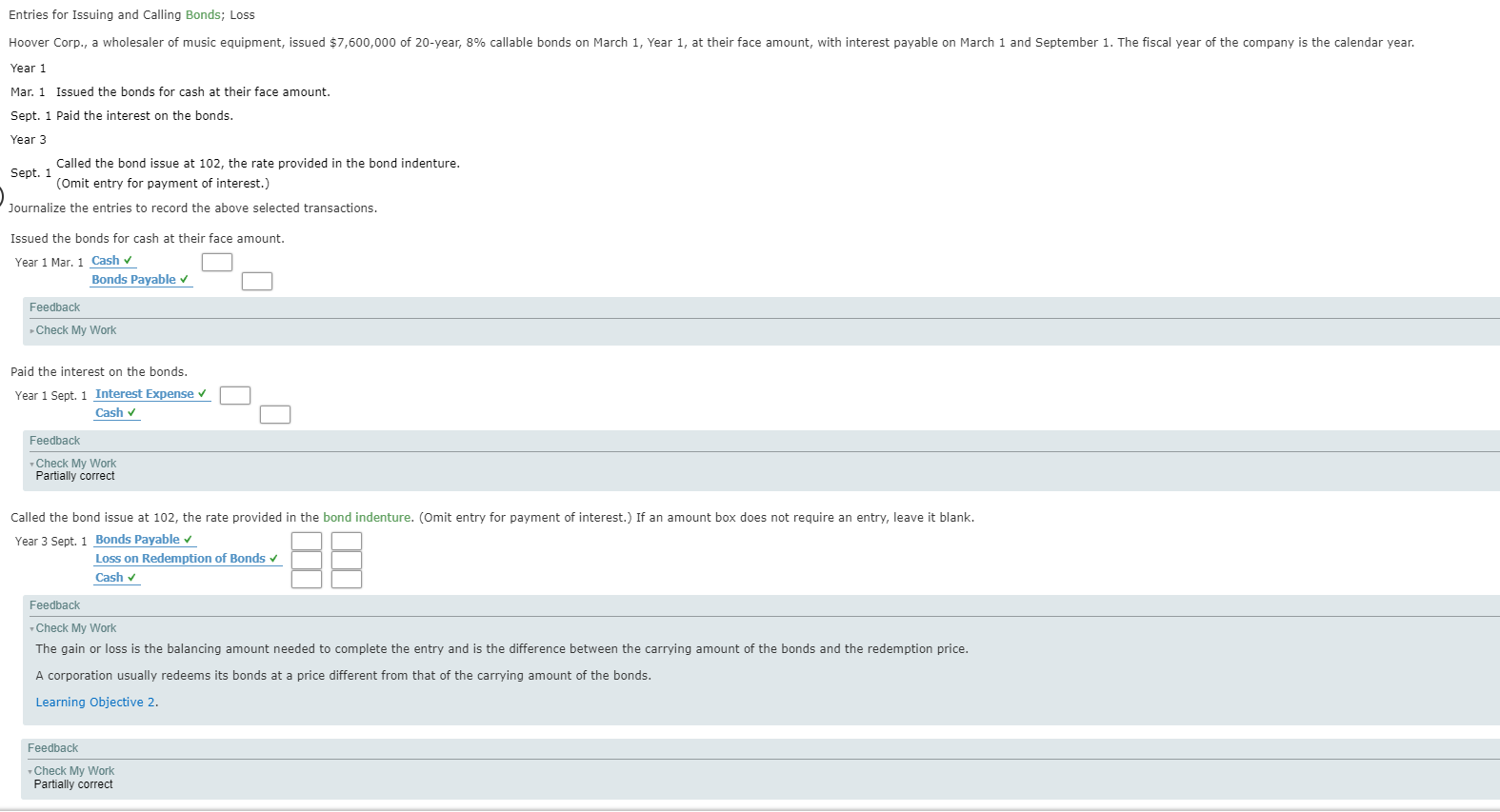

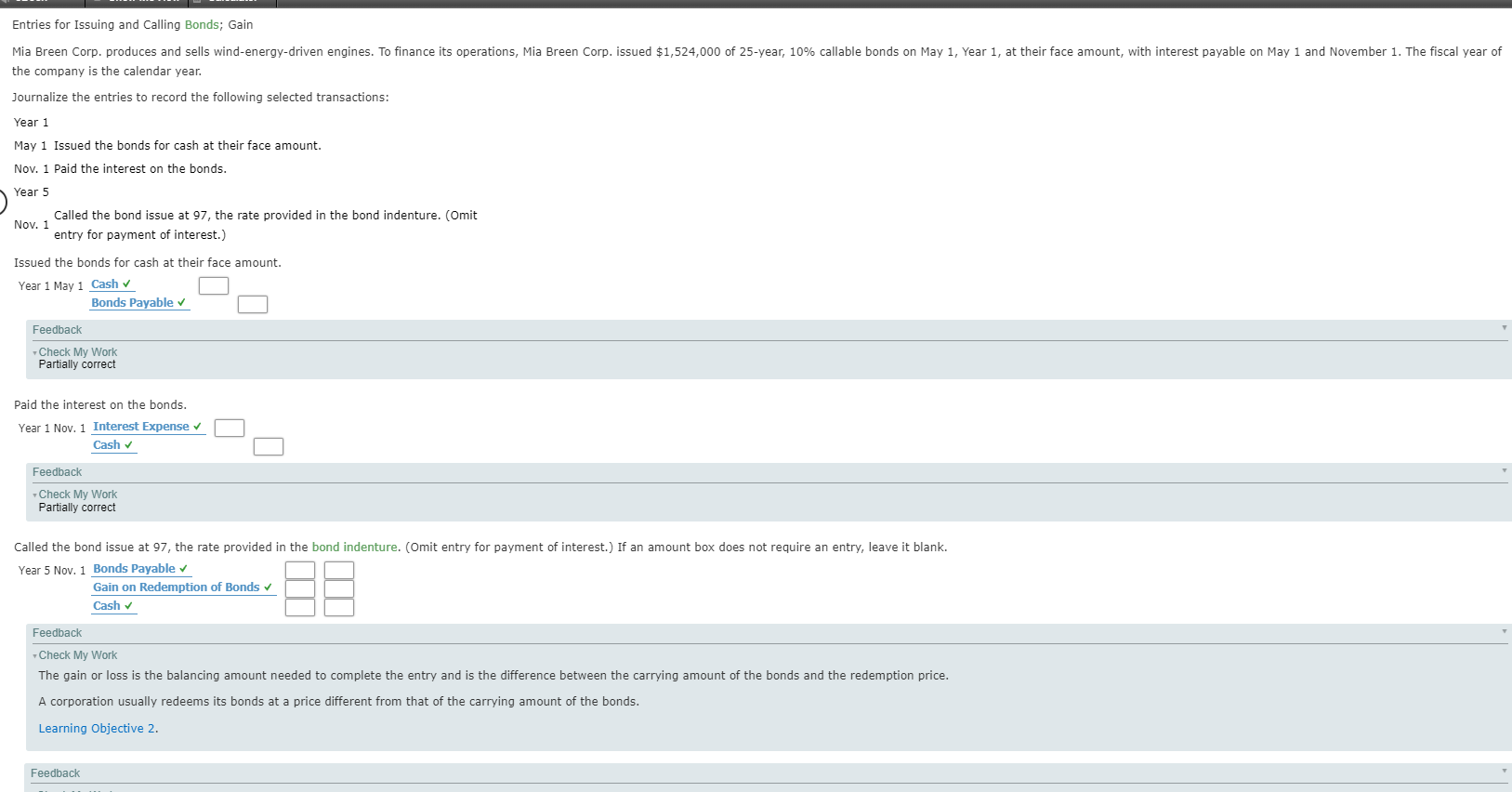

Entries for Issuing and Calling Bonds; Loss Hoover Corp., a wholesaler of music equipment, issued $7,600,000 of 20-year, 8% callable bonds on March 1, Year 1, at their face amount, with interest payable on March 1 and September 1. The fiscal year of the company is the calendar year. Year 1 Mar. 1 Issued the bonds for cash at their face amount. Sept. 1 Paid the interest on the bonds. Year 3 Called the bond issue at 102, the rate provided in the bond indenture. Sept. 1 (Omit entry for payment of interest.) Journalize the entries to record the above selected transactions. Issued the bonds for cash at their face amount. Year 1 Mar. 1 Cash Bonds Payable Year 1 Mar. 1 Cash v a Feedback Check My Work Paid the interest on the bonds. Year 1 Sept. 1 Interest Expense Cash Feedback Check My Work Partially correct Called the bond issue at 102, the rate provided in the bond indenture. (Omit entry for payment of interest.) If an amount box does not require an entry, leave it blank. Year 3 Sept. 1 Bonds Payable Loss on Redemption of Bonds Cash Feedback Check My Work The gain or loss is the balancing amount needed to complete the entry and is the difference between the carrying amount of the bonds and the redemption price. A corporation usually redeems its bonds at a price different from that of the carrying amount of the bonds. Learning Objective 2. Feedback Check My Work Partially correct Entries for Issuing and Calling Bonds; Gain Mia Breen Corp. produces and sells wind-energy-driven engines. To finance its operations, Mia Breen Corp. issued $1,524,000 of 25-year, 10% callable bonds on May 1, Year 1, at their face amount, with interest payable on May 1 and November 1. The fiscal year of the company is the calendar year. Journalize the entries to record the following selected transactions: Year 1 May 1 Issued the bonds for cash at their face amount. Nov. 1 Paid the interest on the bonds. Year 5 Called the bond issue at 97, the rate provided in the bond indenture. (Omit Nov. 1 entry for payment of interest.) Issued the bonds for cash at their face amount. Year 1 May 1 Cash Bonds Payable Feedback Check My Work Partially correct Paid the interest on the bonds. Year 1 Nov. 1 Interest Expense Cash Feedback Check My Work Partially correct Called the bond issue at 97, the rate provided in the bond indenture. (Omit entry for payment of interest.) If an amount box does not require an entry, leave it blank. Year 5 Nov. 1 Bonds Payable Gain on Redemption of Bonds Cash Feedback Check My Work The gain or loss is the balancing amount needed to complete the entry and is the difference between the carrying amount of the bonds and the redemption price. A corporation usually redeems its bonds at a price different from that of the carrying amount of the bonds. Learning Objective 2. Feedback