Answered step by step

Verified Expert Solution

Question

1 Approved Answer

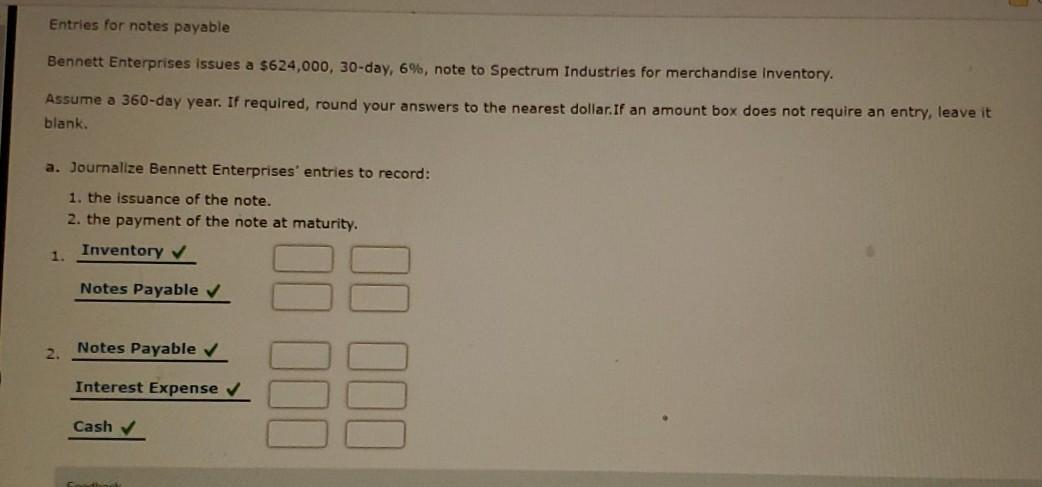

Entries for notes payable Bennett Enterprises issues a $624,000, 30-day, 6%, note to Spectrum Industries for merchandise inventory. Assume a 360-day year. If required, round

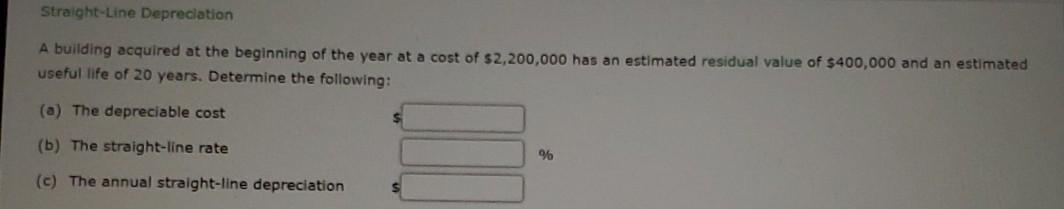

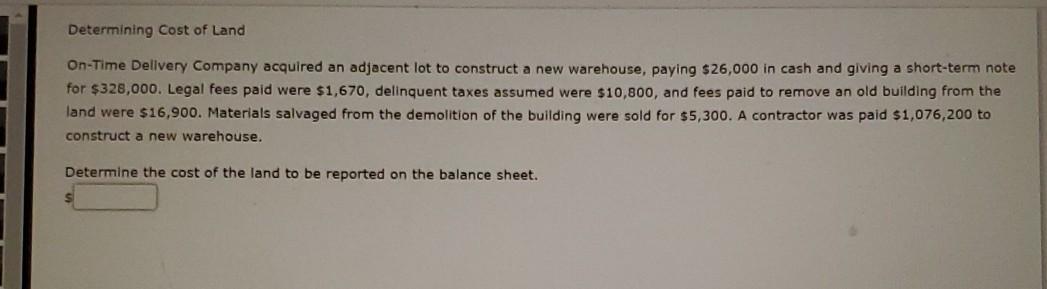

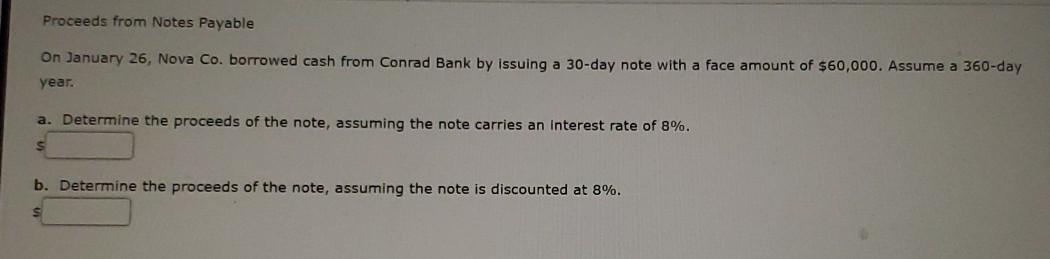

Entries for notes payable Bennett Enterprises issues a $624,000, 30-day, 6%, note to Spectrum Industries for merchandise inventory. Assume a 360-day year. If required, round your answers to the nearest dollar. If an amount box does not require an entry, leave it blank. a. Journalize Bennett Enterprises' entries to record: 1. the issuance of the note. 2. the payment of the note at maturity. 1. Inventory Notes Payable 2. Notes Payable Il llo Interest Expense Cash Straight-Line Depreciation A building acquired at the beginning of the year at a cost of $2,200,000 has an estimated residual value of $400,000 and an estimated useful life of 20 years. Determine the following: (a) The depreciable cost $ 946 (b) The straight-line rate (c) The annual straight-line depreciation Determining Cost of Land On-Time Delivery Company acquired an adjacent lot to construct a new warehouse, paying $26,000 in cash and giving a short-term note for $328,000. Legal fees paid were $1,670, delinquent taxes assumed were $10,800, and fees paid to remove an old building from the land were $16,900. Materials salvaged from the demolition of the building were sold for $5,300. A contractor was paid $1,076,200 to construct a new warehouse. Determine the cost of the land to be reported on the balance sheet. Proceeds from Notes Payable On January 26, Nova Co. borrowed cash from Conrad Bank by issuing a 30-day note with a face amount of $60,000. Assume a 360-day year. a. Determine the proceeds of the note, assuming the note carries an Interest rate of 8%. b. Determine the proceeds of the note, assuming the note is discounted at 8%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started