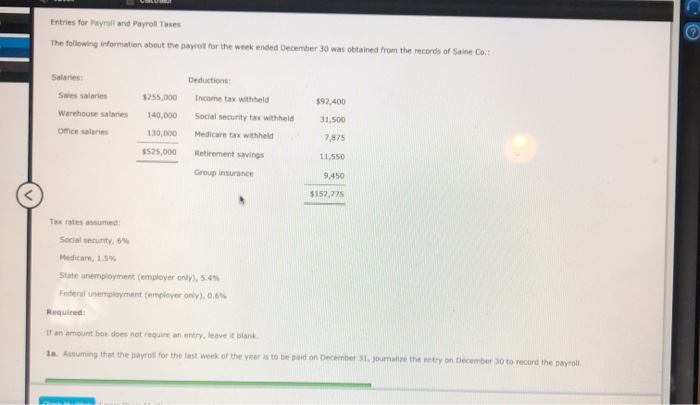

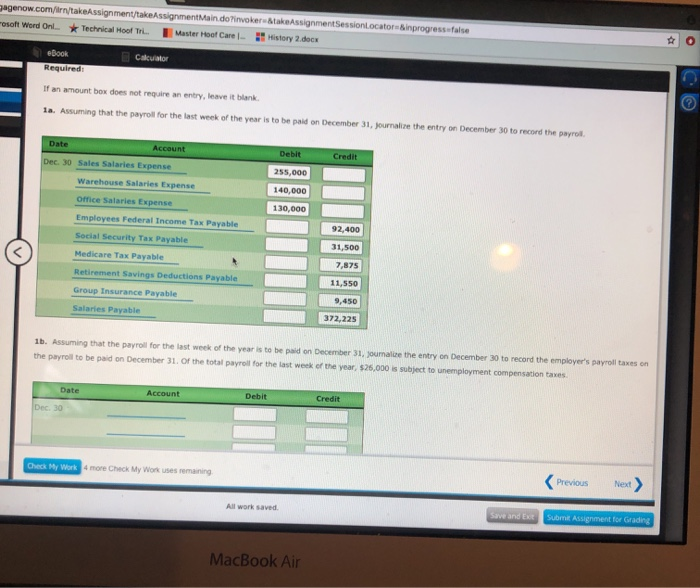

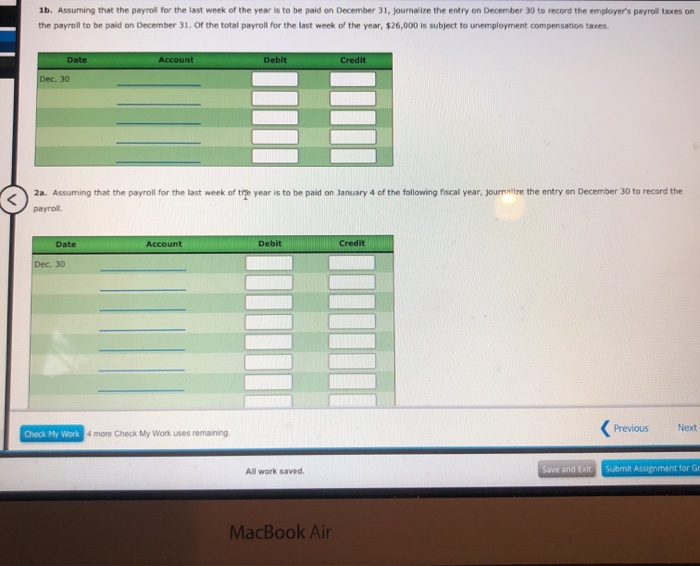

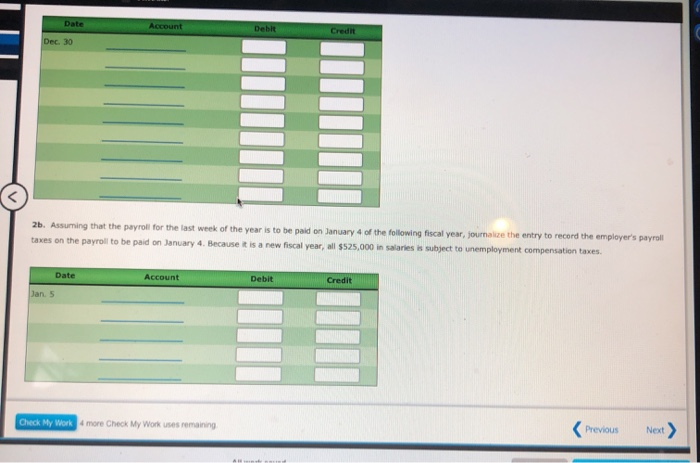

Entries for Payroll and Payroll Taxes The following information about the payroll for the week ended December 30 was obtained from the records of Saine Co. Salaries Deductions: Sales salaries $255,000 Income tax withheld $92,400 Warehouse salaries 140.000 Social security tax withheld 31,500 Once salaries 130,000 Medicare tax withheld 7.875 $S25,000 Retirement savings 11.550 Group insurance 9,450 Tax rates assumed: Social Security, 6% Medicare, 1.5% State unemployment (employer only), 5.4% Federal unemployment employer only), 0.6% Required: If an amount box does not require an entry, leave it blank 1a. Assuming that the payroll for the last week of the year is to be paid on December 31, journalize the entry on December 30 to record the payroll genow.com/in/takeAssignment/takeAssignmentando invokerStassignment Session locator Binprogress false oft Word Onl * Technical Hoof Ti Master HoofCarel History 2.docx Calculator book Required: If an amount box does not require an entry, leave it blank 1a. Assuming that the payroll for the last week of the year is to be paid on December 31, journalize the entry on December 30 to record the payrol Debit Credit Date Account Dec. 30 Sales salaries Expense Warehouse Salaries Expense 255,000 140,000 Orice Salaries Expense 130,000 Employees Federal Income Tax Payable 92.400 Social Security Tax Payable Medicare Tax Payable Retirement Savings Deductions Payable Group Insurance Payable Salaries Payable 372,225 1b. Assuming that the payroll for the last week of the year is to be paid on December 31. joumalue the entry on December 30 to record the employer's payroll taxes on the payroll to be paid on December 31. of the total payroll for the last week of the year, 526,000 is subject to unemployment compensation taxes Date Account Debit Credit Dec. 30 Check My Work 4 more Check My Worses remaining All work saved Save and Submit Assignment for Grading MacBook Air 1b. Assuming that the payroll for the last week of the year is to be paid on December 31, journalire the entry on December 30 to record the employer's payroll taxes on the payroll to be paid on December 31. or the total payroll for the last week of the year, $26,000 is subject to unemployment compensation taxes. Account Debit Credit Date Dec. 30 2a. Assuming that the payroll for the last week of the year is to be paid on January 4 of the following fiscal year, journalize the entry on December 30 to record the payrol. Account Debit Credit Date Dec. 30 Check My Work 4 more Check My Work uses remaining Previous Next All work saved Save and Exit Submit Assignment for MacBook Air Date Account Debit Credit Dec. 30 2b. Assuming that the payroll for the last week of the year is to be paid on January 4 of the following fiscal year, journalize the entry to record the employer's payroll taxes on the payroll to be paid on January 4. Because it is a new fiscal year, all $525,000 in salaries is subject to unemployment compensation taxes Date Account Debit Credit Jan 5 Check My Work more Check My Work uses remaining Previous Next > Entries for Payroll and Payroll Taxes The following information about the payroll for the week ended December 30 was obtained from the records of Saine Co. Salaries Deductions: Sales salaries $255,000 Income tax withheld $92,400 Warehouse salaries 140.000 Social security tax withheld 31,500 Once salaries 130,000 Medicare tax withheld 7.875 $S25,000 Retirement savings 11.550 Group insurance 9,450 Tax rates assumed: Social Security, 6% Medicare, 1.5% State unemployment (employer only), 5.4% Federal unemployment employer only), 0.6% Required: If an amount box does not require an entry, leave it blank 1a. Assuming that the payroll for the last week of the year is to be paid on December 31, journalize the entry on December 30 to record the payroll genow.com/in/takeAssignment/takeAssignmentando invokerStassignment Session locator Binprogress false oft Word Onl * Technical Hoof Ti Master HoofCarel History 2.docx Calculator book Required: If an amount box does not require an entry, leave it blank 1a. Assuming that the payroll for the last week of the year is to be paid on December 31, journalize the entry on December 30 to record the payrol Debit Credit Date Account Dec. 30 Sales salaries Expense Warehouse Salaries Expense 255,000 140,000 Orice Salaries Expense 130,000 Employees Federal Income Tax Payable 92.400 Social Security Tax Payable Medicare Tax Payable Retirement Savings Deductions Payable Group Insurance Payable Salaries Payable 372,225 1b. Assuming that the payroll for the last week of the year is to be paid on December 31. joumalue the entry on December 30 to record the employer's payroll taxes on the payroll to be paid on December 31. of the total payroll for the last week of the year, 526,000 is subject to unemployment compensation taxes Date Account Debit Credit Dec. 30 Check My Work 4 more Check My Worses remaining All work saved Save and Submit Assignment for Grading MacBook Air 1b. Assuming that the payroll for the last week of the year is to be paid on December 31, journalire the entry on December 30 to record the employer's payroll taxes on the payroll to be paid on December 31. or the total payroll for the last week of the year, $26,000 is subject to unemployment compensation taxes. Account Debit Credit Date Dec. 30 2a. Assuming that the payroll for the last week of the year is to be paid on January 4 of the following fiscal year, journalize the entry on December 30 to record the payrol. Account Debit Credit Date Dec. 30 Check My Work 4 more Check My Work uses remaining Previous Next All work saved Save and Exit Submit Assignment for MacBook Air Date Account Debit Credit Dec. 30 2b. Assuming that the payroll for the last week of the year is to be paid on January 4 of the following fiscal year, journalize the entry to record the employer's payroll taxes on the payroll to be paid on January 4. Because it is a new fiscal year, all $525,000 in salaries is subject to unemployment compensation taxes Date Account Debit Credit Jan 5 Check My Work more Check My Work uses remaining Previous Next >