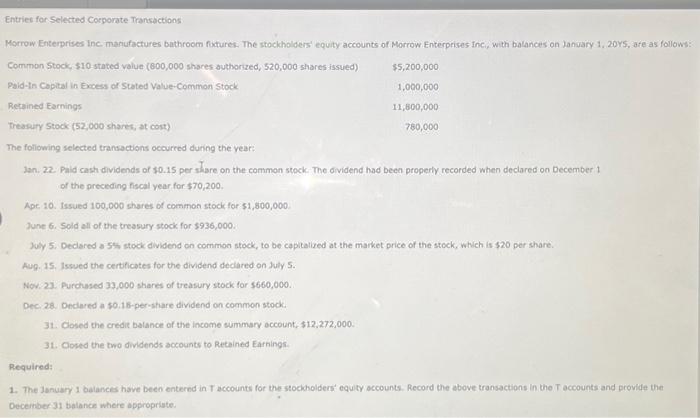

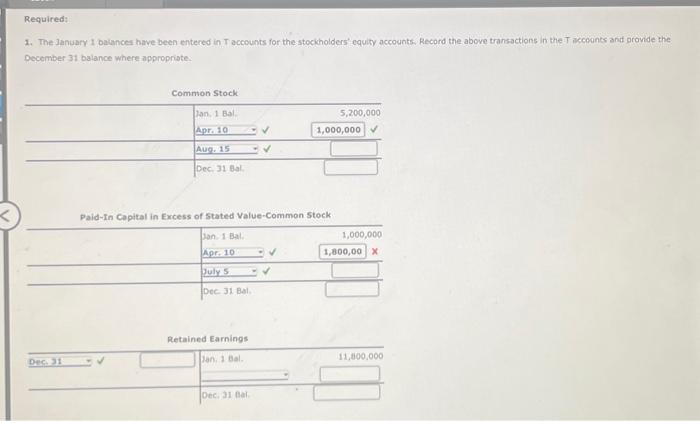

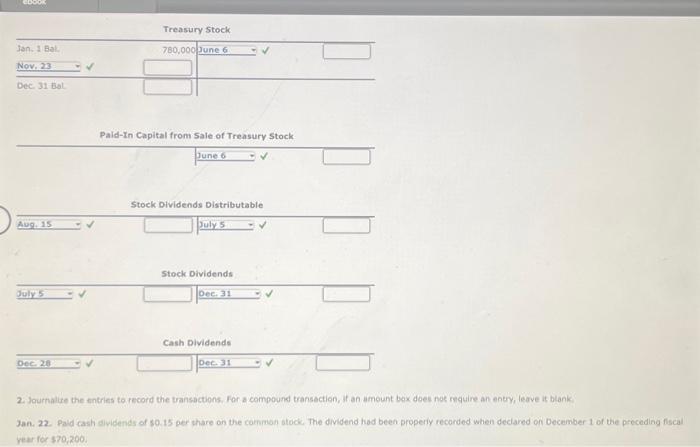

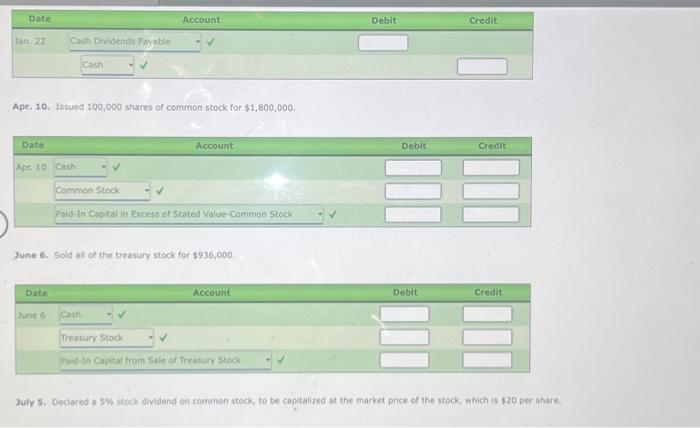

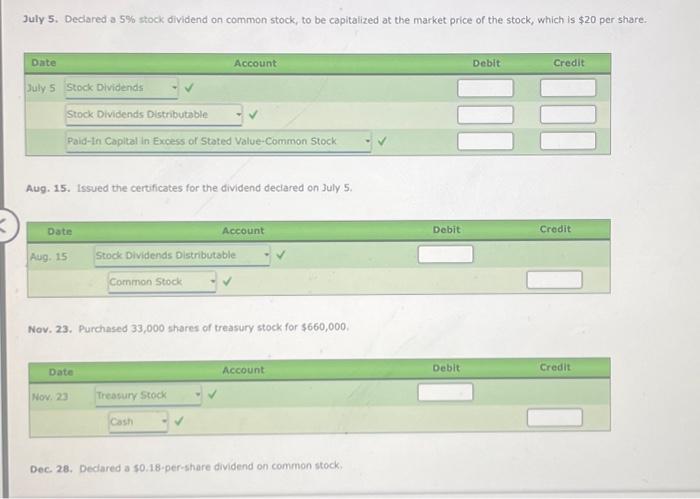

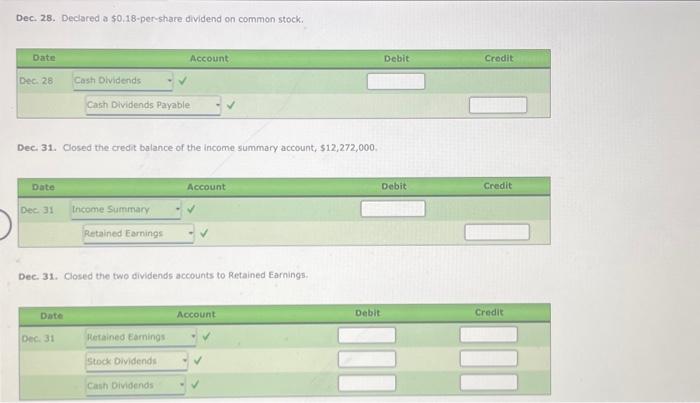

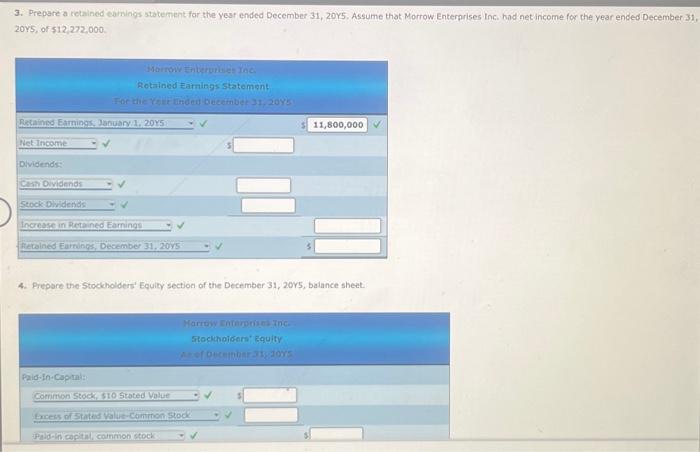

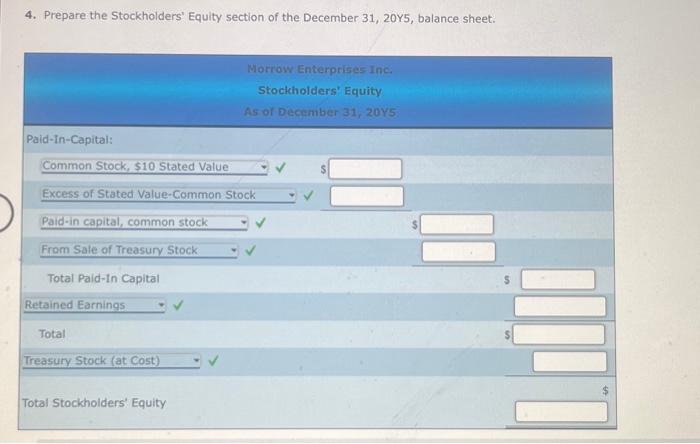

Entries for Selected Corporate Transactions Marrow Enterprises Inc. maniufactures bathroom focures. The stockholders' equity accounts of Morrow Enterprises inci, with bolances on Janyary 1. 20ys, ate as follows: ane ronowing seiected transactons occurred ounng the year: Jan. 22. Paid cash dividends of $0.15 per thitare on the common stock. The oividend had been progerly recorded when declared on Becember 1. of the preceding fiscal year for $70,200. Ape 10. Issued 100,000 shares of common stock for 51,800,000 June 6. Sold all of the treasury stock for $936,000. July 5. Deciared a Sth stock dividend on common stock, to be capitalized at the market price of the stock, which is s20 per share. Au9. 15. 1ssued the certificates for the dividend dedared on July 5. Nov. 23. Purchased 33,000 shares of treasury stock for $660,000. Dec- 28. Declured a \$0.16-per-share dividend on common stock. 31. Cosed the credit balance of the income summary account, $12,272,000. 31. Cosed the two dividends accounts to Retained Earnings. Required: 1. The January 1 balances have been entered in T accounts for the stociholders' equity accounts. Record the above transactions in the T accounts and provide the December 31 balance where appropriste. 1. The January 1 balances have been entered in T accounts for the stockholders' equity accounts. Record the above transactions in the T acceants and grovide the December 31 balance where appropriste: Paid-In Capital in Excess of stated Value-Common stock 2. Journalibe the entries to record the Uansactions. For a compound transaction, if an amount box does noe require an enery, leave it blank Jan. 22. Pald cash dividends of so. 15 per share on the common dtock. The dividend had been properiy recorded when deciared on becember 1 of the preceding fiscal year for 370,200 . Apr. 10. Issued 100,000 shares of common stock for $1,800,000. June 6. Sold al of the treasury stock for $936,000 July 5. Deciared a 5% stock dividend on common stock, to be cap talized at the market price of the stock, which is 120 per share July 5. Deciared a 5% stock dividend on common stock, to be capitalized at the market price of the stock, which is $20 per share. Aug. 15. Issued the certificates for the dividend deciared on July 5. Nov. 23. Purchased 33,000 shares of treasury stock for $660,000. Dec. 28. Deciared a 50.18-per-share dividend on common stock. Dec. 28. Declared a 50.18 -per-share dividend on common stock: Dec. 31. Cosed the credit balance of the income summary account, $12,272,000. Dee. 31. Closed the two dividend5 accounts to Retained Earnings. 3. Prepare a retained earnings statement for the year ended December 31,20Y5. Assume that Morrow Enternrises Inc. had net income for the year ended December 31 20ys, of $12,272,000. 4. Prepere the Stockholders' Equity section of the December 31, 20r5, balance sheet. 4. Prepare the Stockholders' Equity section of the December 31,20 Y, balance sheet