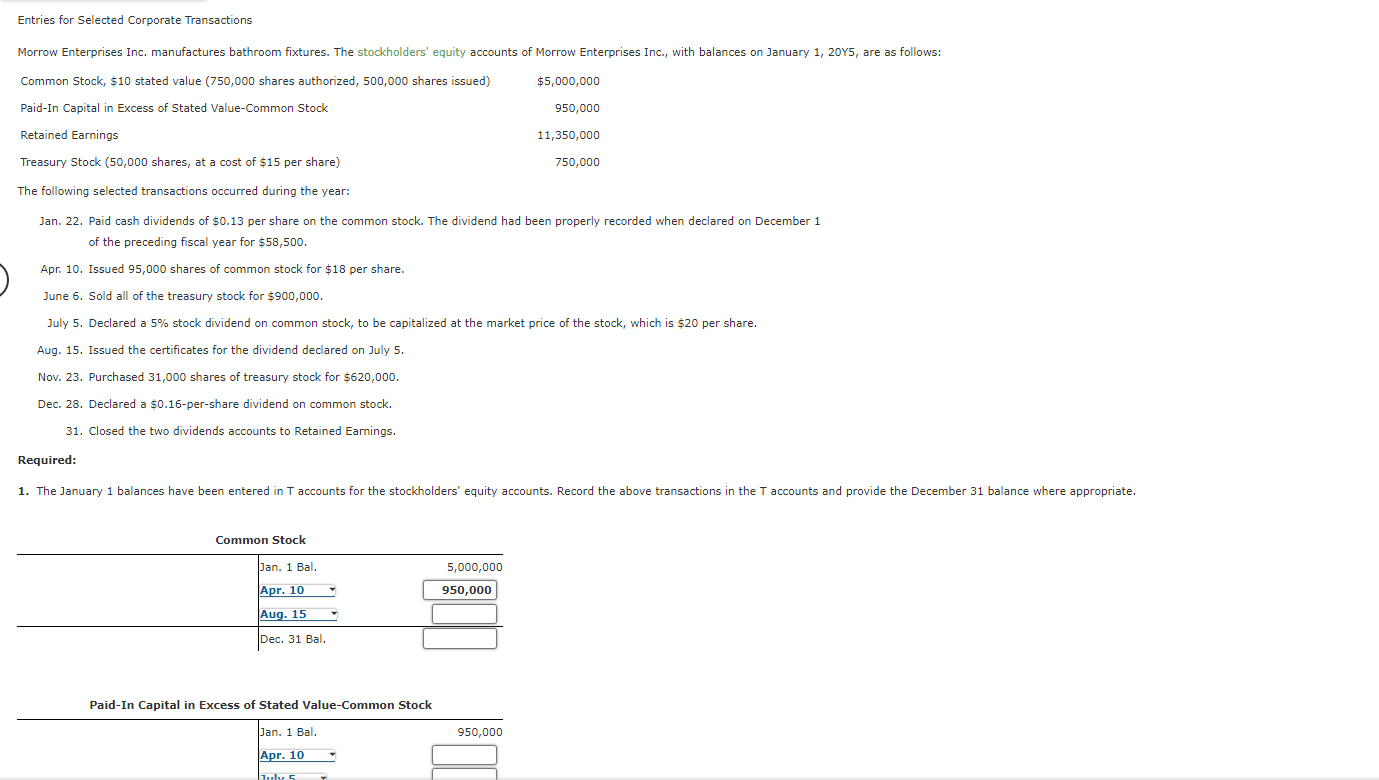

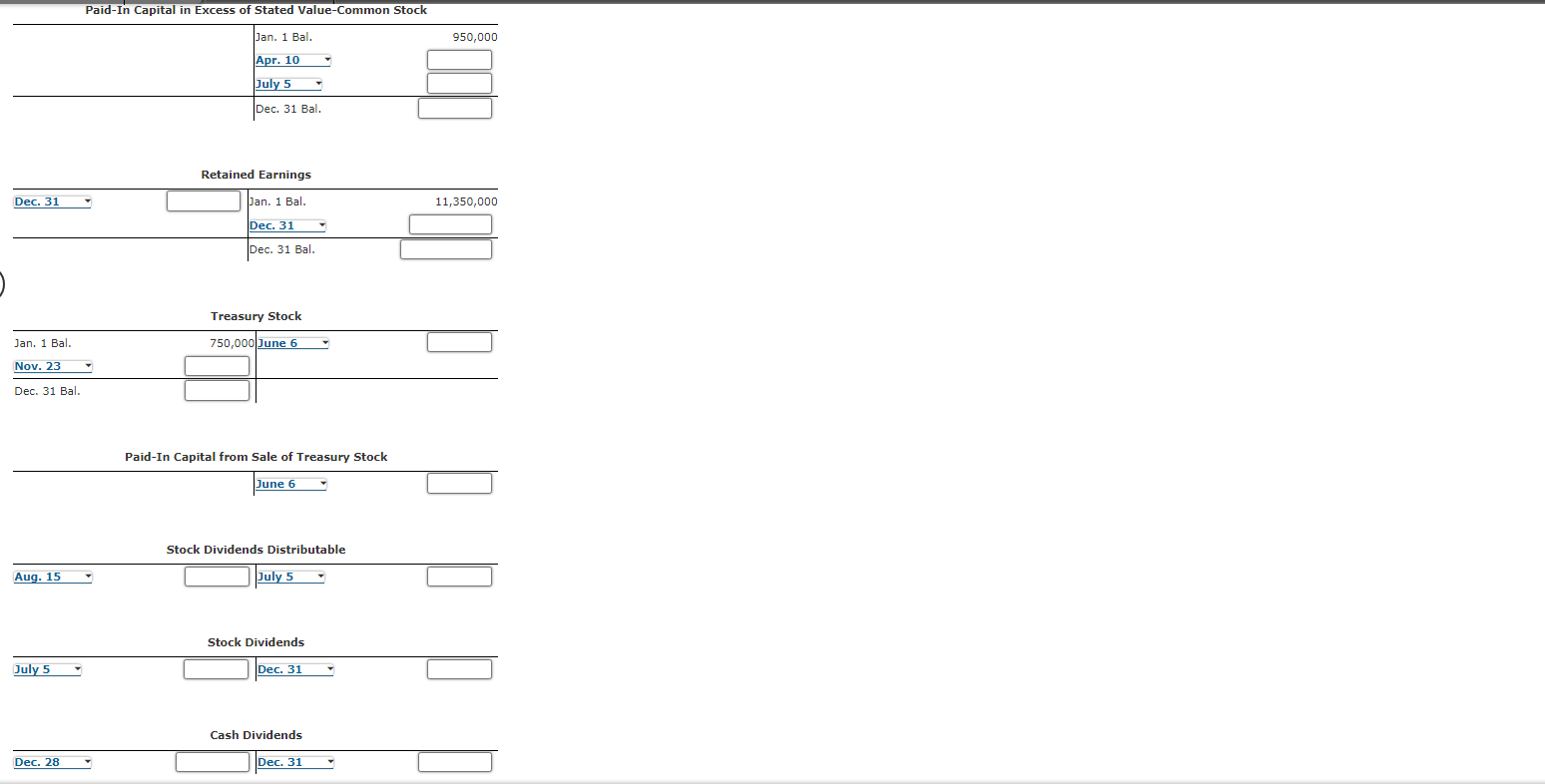

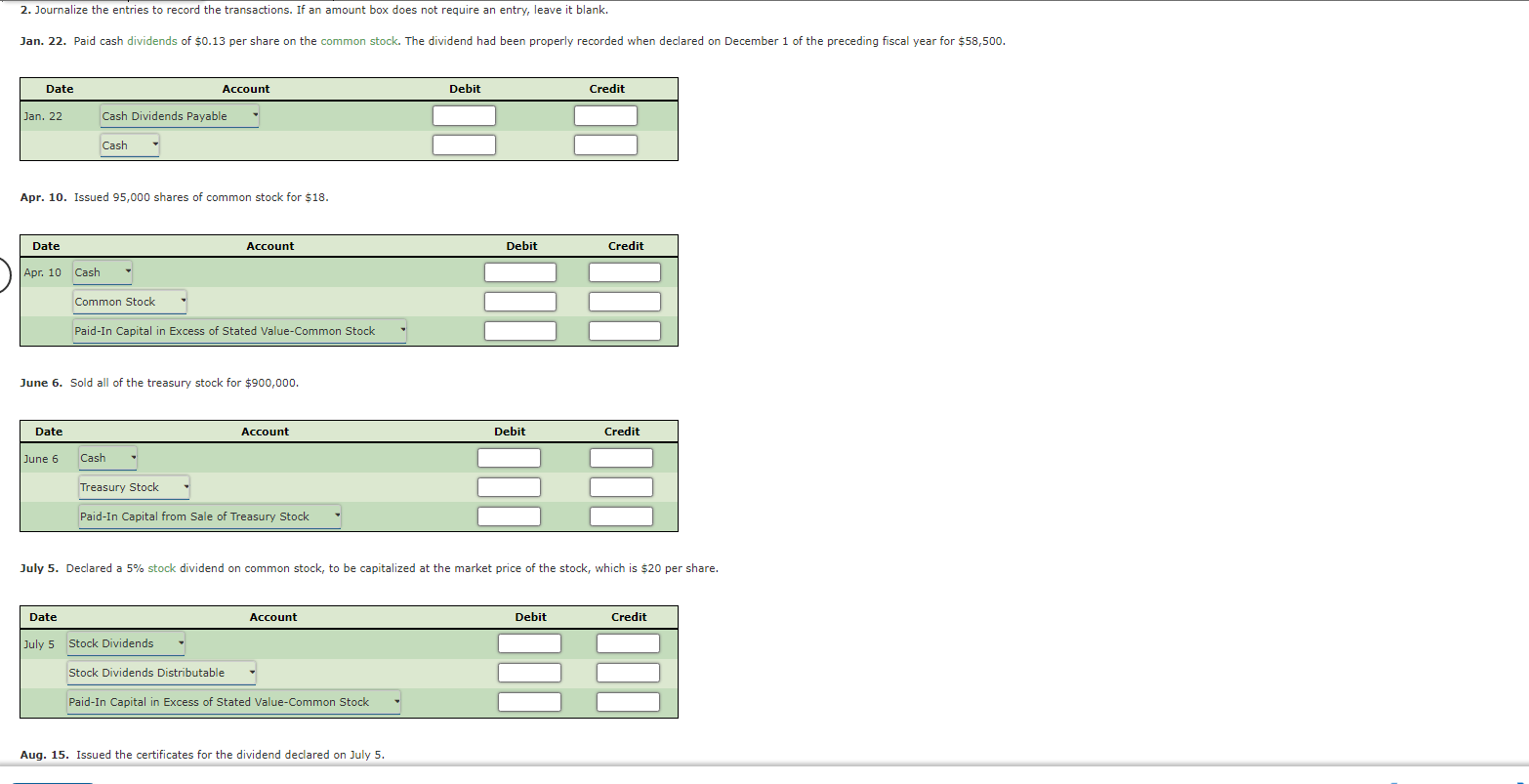

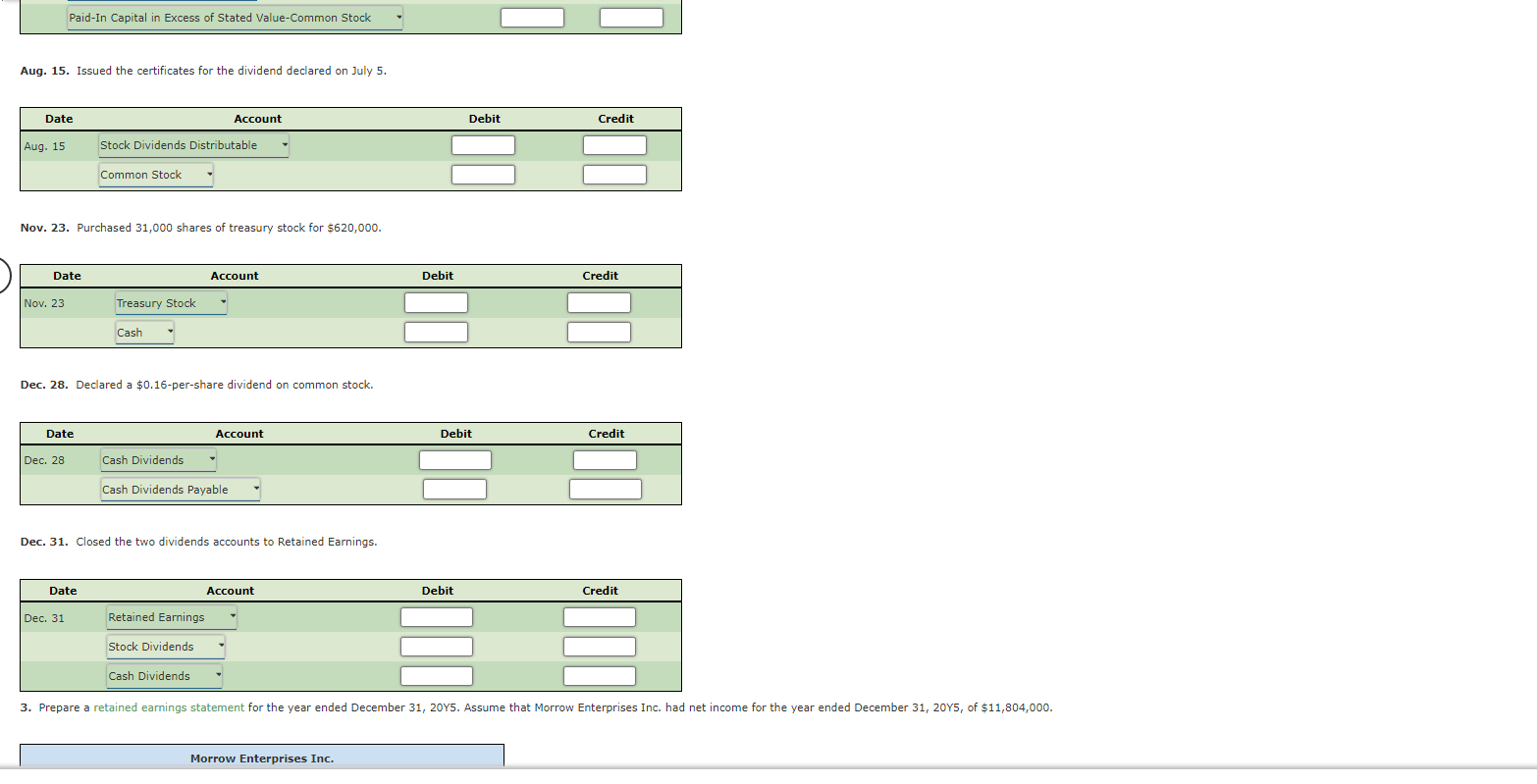

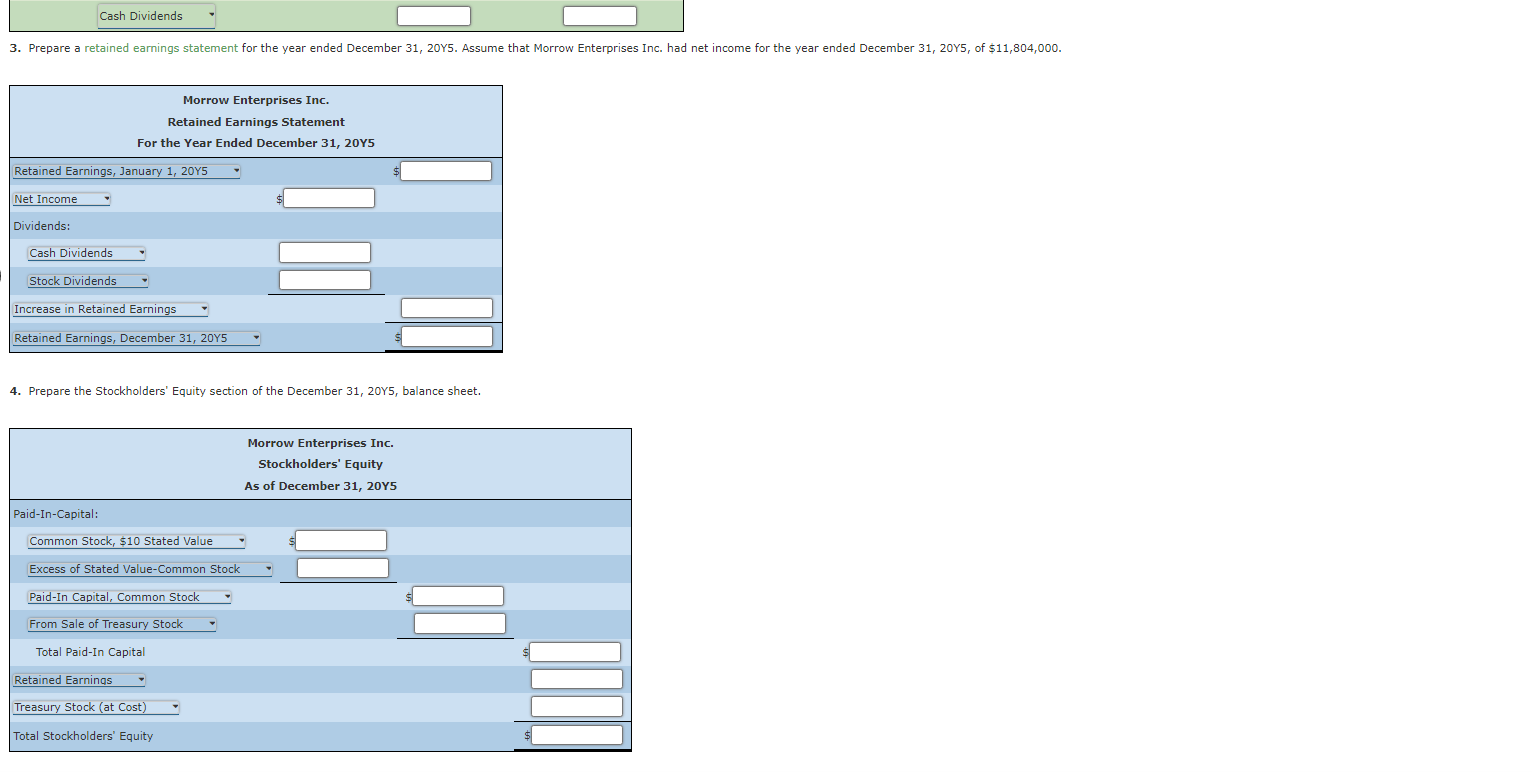

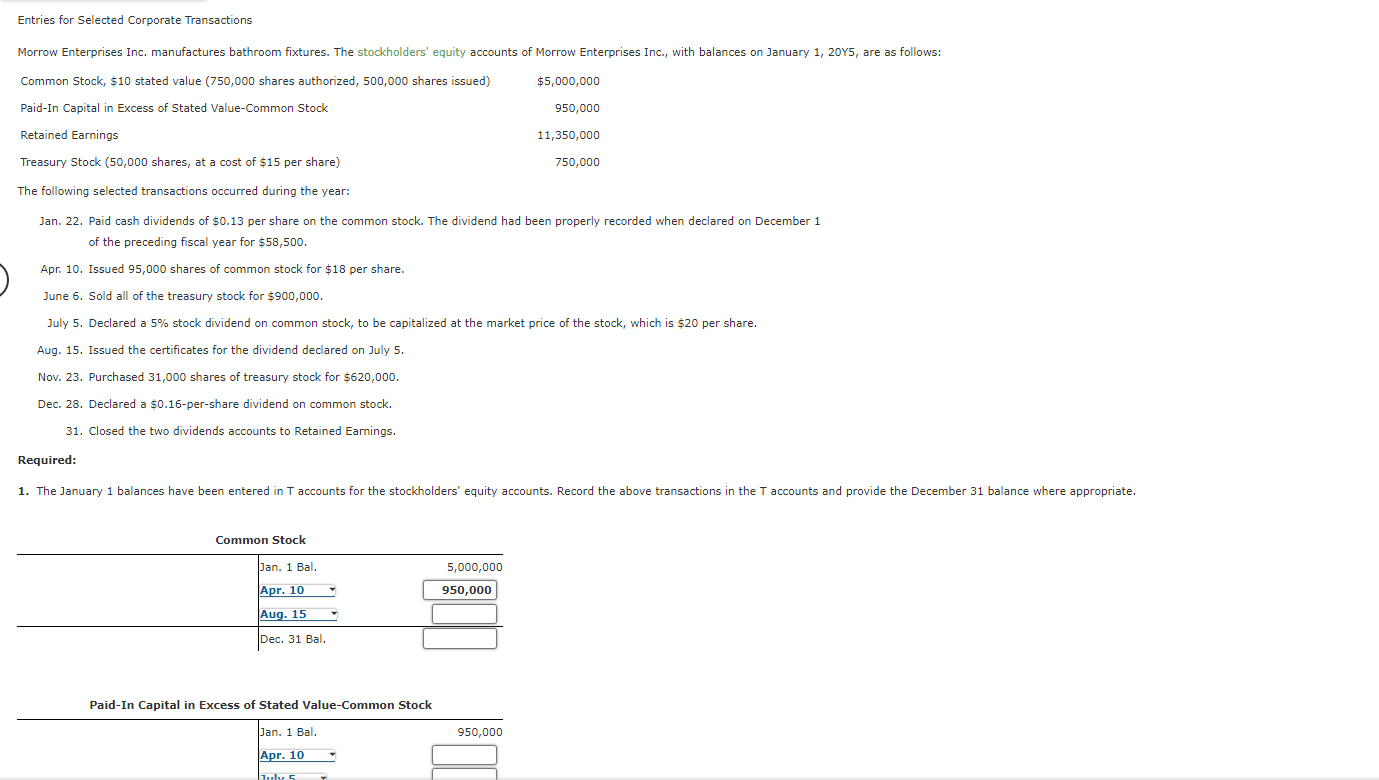

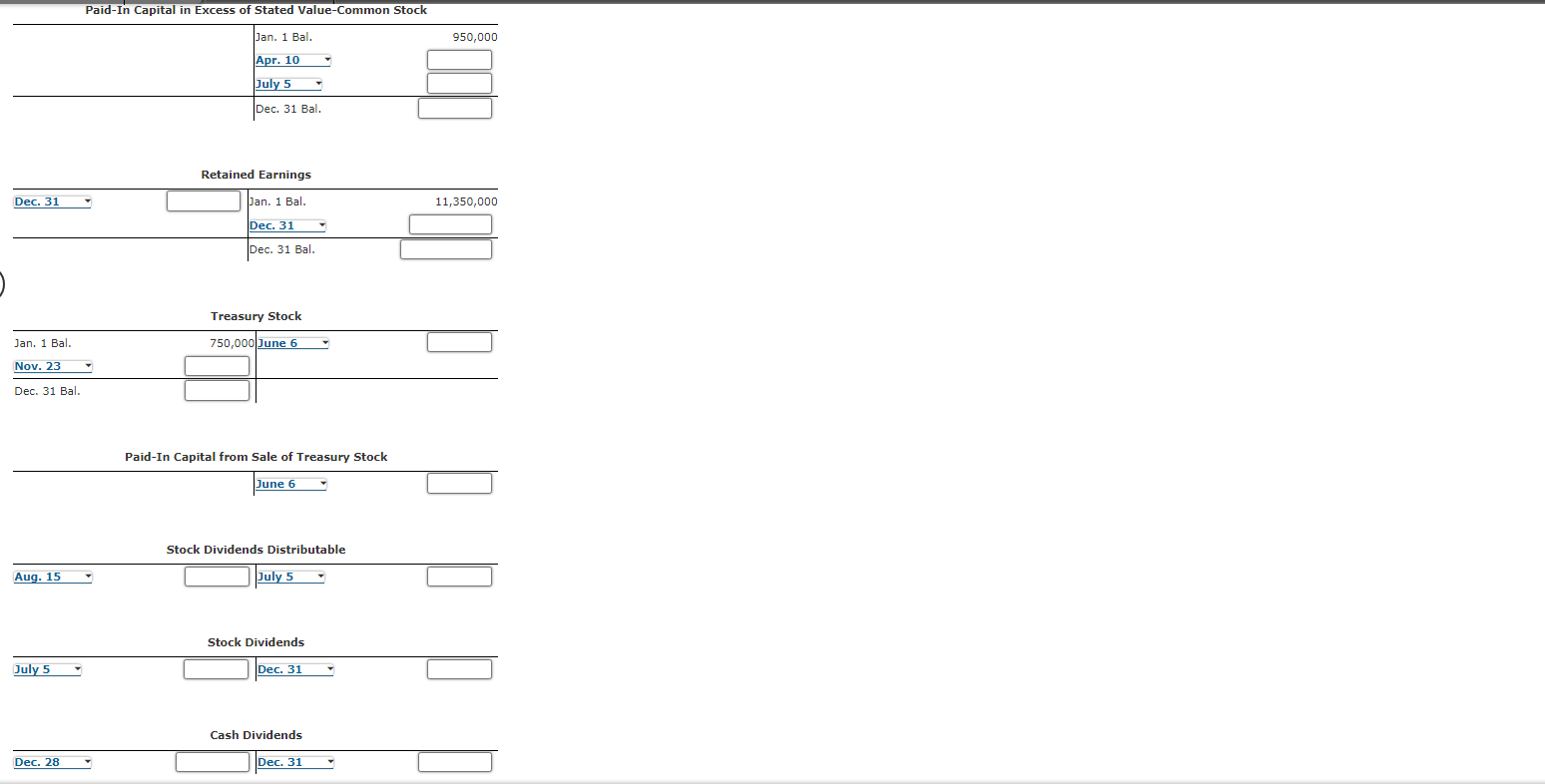

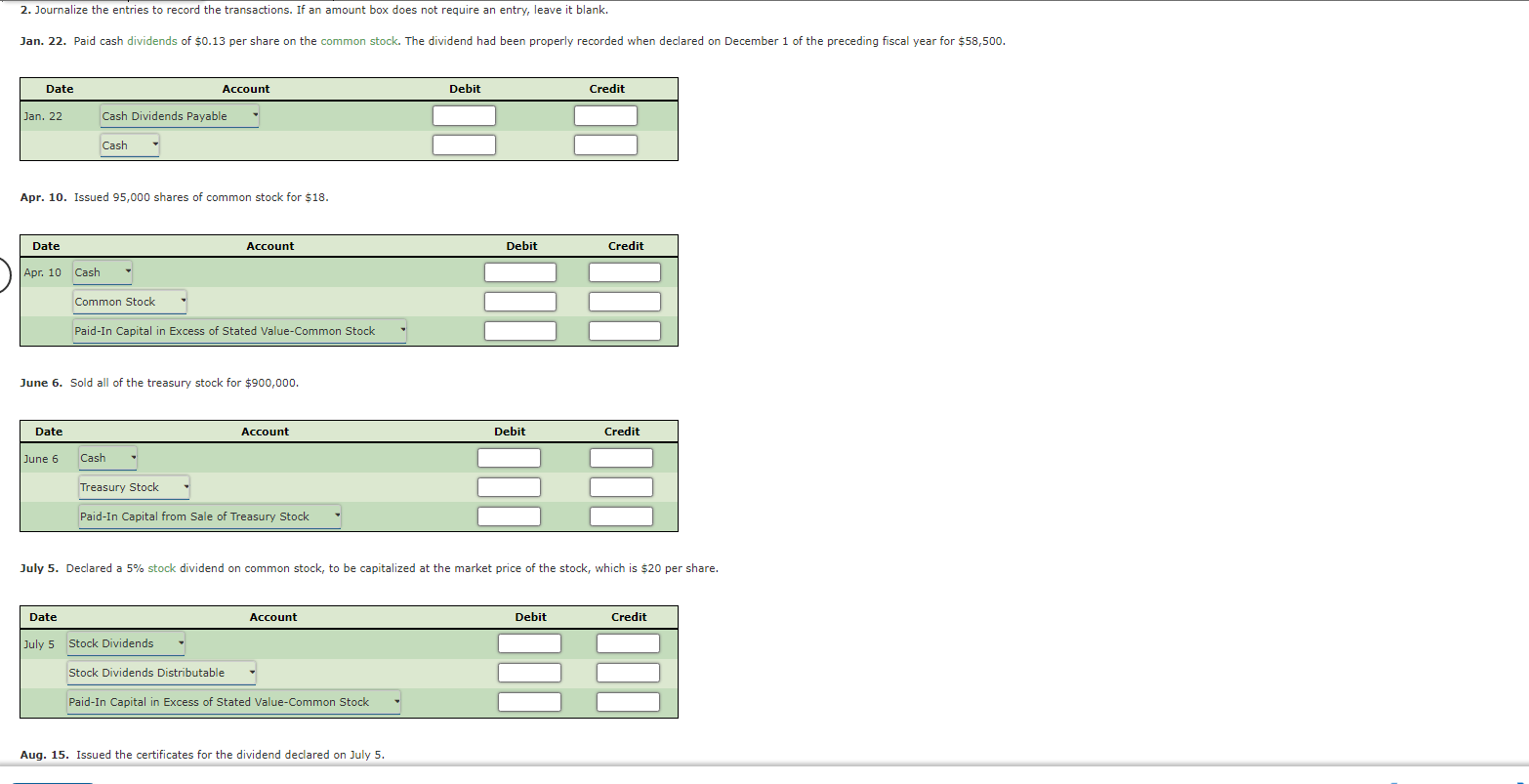

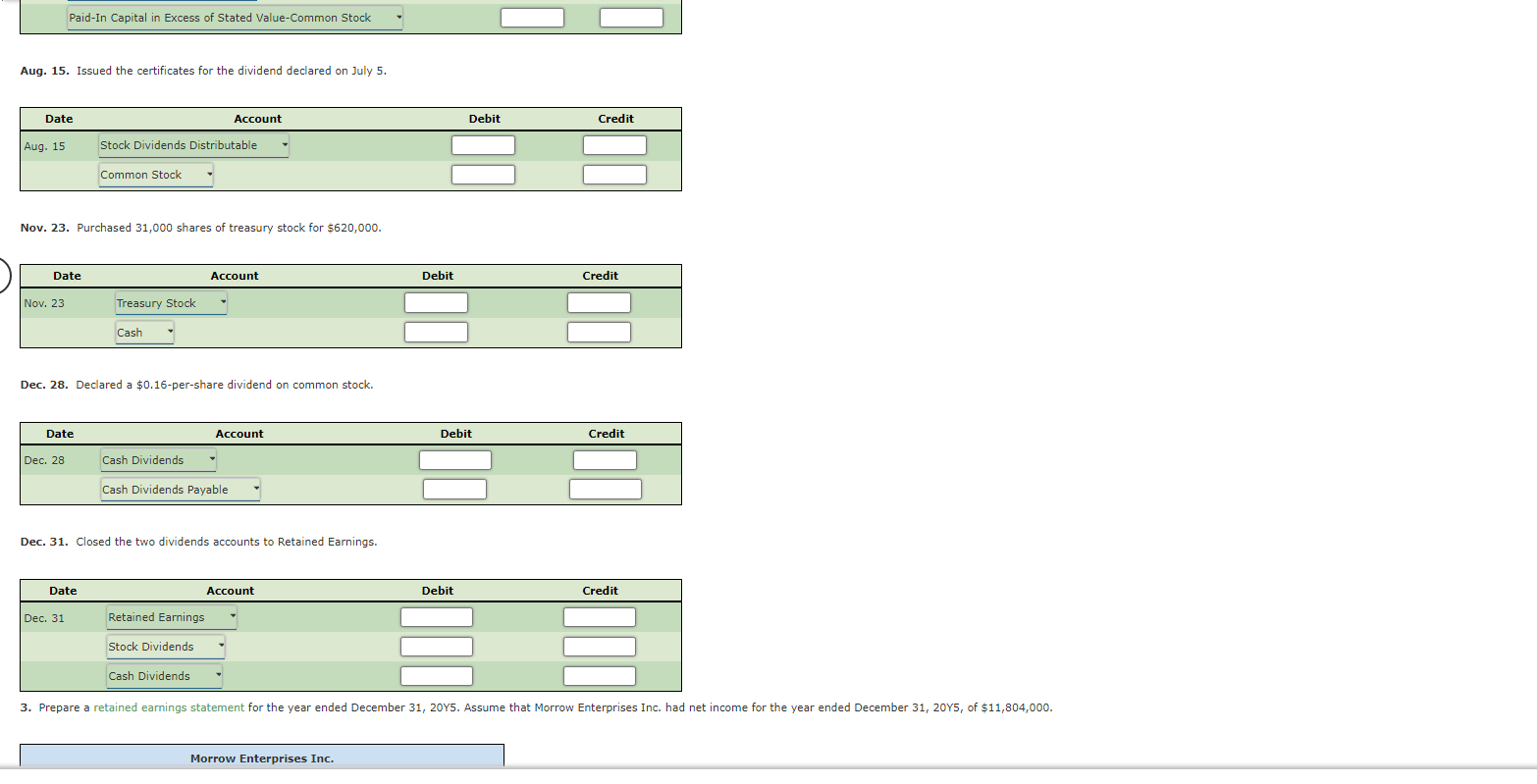

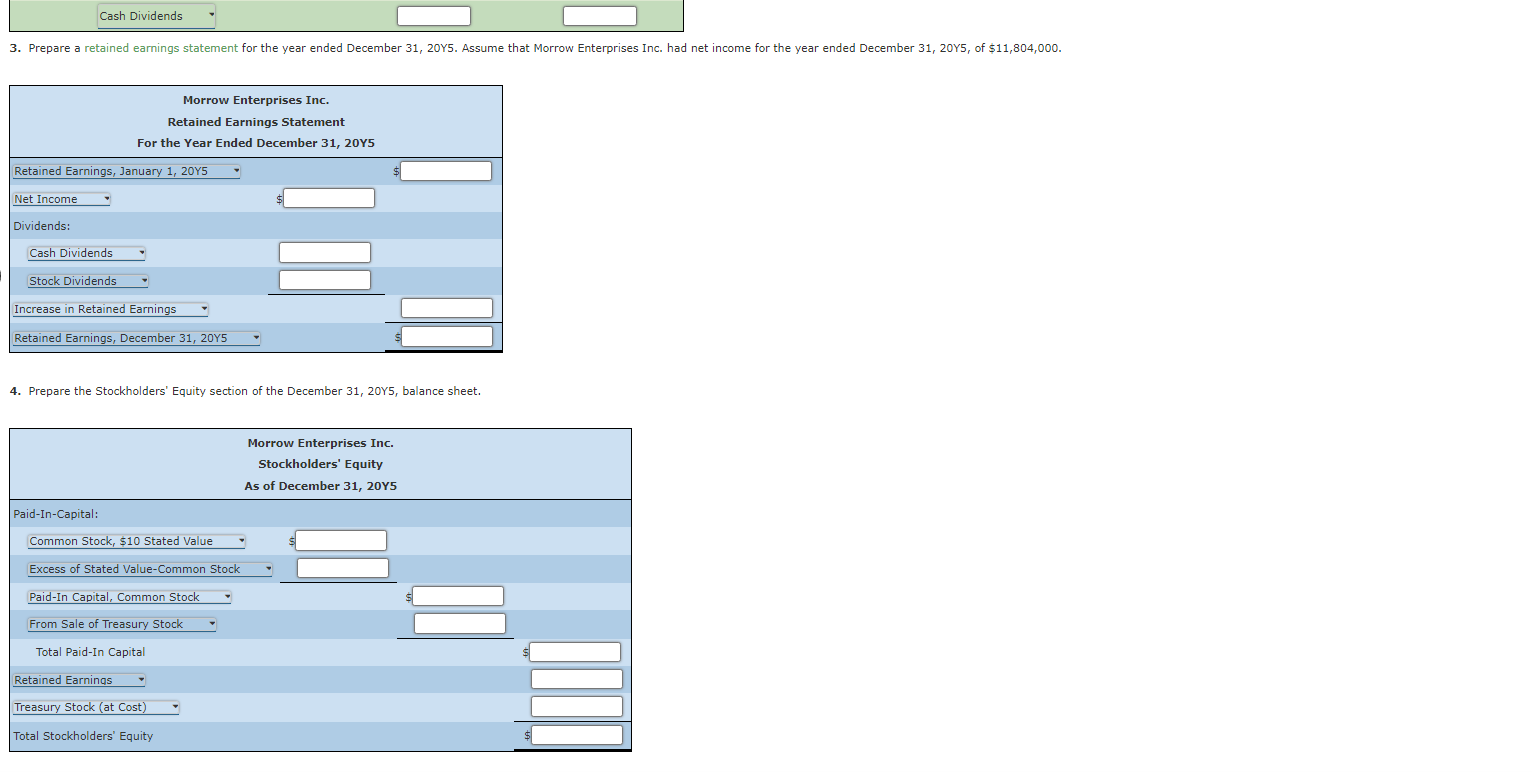

Entries for Selected Corporate Transactions Morrow Enterprises Inc. manufactures bathroom fixtures. The stockholders' equity accounts of Morrow Enterprises Inc., with balances on January 1 , 20Y5, are as follows: The following selected transactions occurred during the year: Jan. 22. Paid cash dividends of $0.13 per share on the common stock. The dividend had been properly recorded when declared on December 1 of the preceding fiscal year for $58,500. Apr. 10. Issued 95,000 shares of common stock for $18 per share. June 6. Sold all of the treasury stock for $900,000. July 5. Declared a 5% stock dividend on common stock, to be capitalized at the market price of the stock, which is $20 per share. Aug. 15. Issued the certificates for the dividend declared on July 5. Nov. 23. Purchased 31,000 shares of treasury stock for $620,000. Dec. 28. Declared a \$0.16-per-share dividend on common stock. 31. Closed the two dividends accounts to Retained Earnings. Paid-In Capital in Excess of Stated Value-Common Stock \begin{tabular}{l|ll} \hline & Jan. 1 Bal. \\ \hline Apr. 10. \\ \hline July 50,000 \\ \hline \end{tabular} Retained Earnings \begin{tabular}{l|l|ll} \multicolumn{2}{c}{ Treasury Stock } \\ \hline Jan. 1 Bal. & 750,000 & June 6 & \\ \hline Nov. 23 & & \\ \hline Dec. 31 Bal. & & \end{tabular} Paid-In Capital from Sale of Treasury Stock June 6 . Stock Dividends Distributable \begin{tabular}{ll|lll} \hline Aug. 15 July 5 & & \end{tabular} Stock Dividends July 5 Dec. 31 - 2. Journalize the entries to record the transactions. If an amount box does not require an entry, leave it blank. Jan. 22. Paid cash dividends of $0.13 per share on the common stock. The dividend had been properly recorded when declared on December 1 of the preceding fiscal year for $58,500. Apr. 10. Issued 95,000 shares of common stock for $18. June 6. Sold all of the treasury stock for $900,000. July 5. Declared a 5% stock dividend on common stock, to be capitalized at the market price of the stock, which is $20 per share. Aug. 15. Issued the certificates for the dividend declared on July 5 . Aug. 15. Issued the certificates for the dividend declared on July 5. Nov. 23. Purchased 31,000 shares of treasury stock for $620,000. Dec. 28. Declared a $0.16-per-share dividend on common stock. Dec. 31. Closed the two dividends accounts to Retained Earnings. 4. Prepare the Stockholders' Equity section of the December 31,20Y5, balance sheet