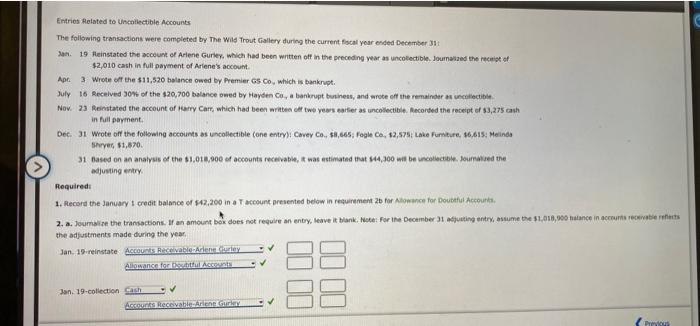

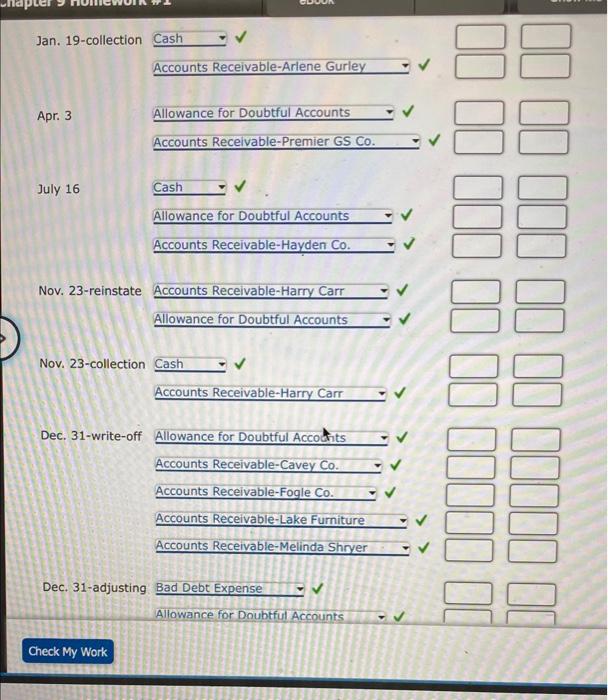

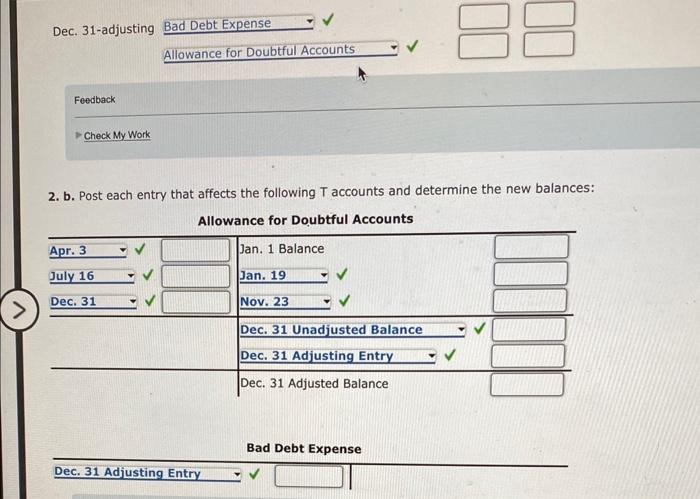

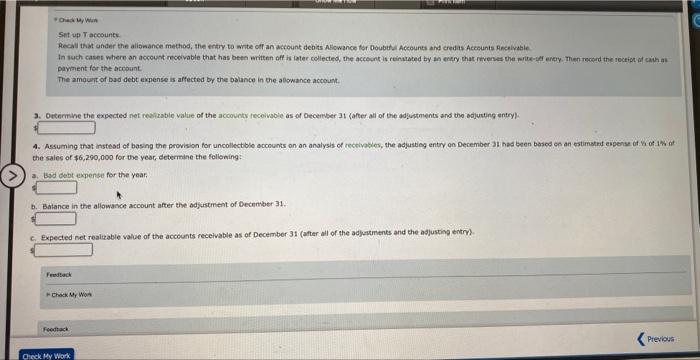

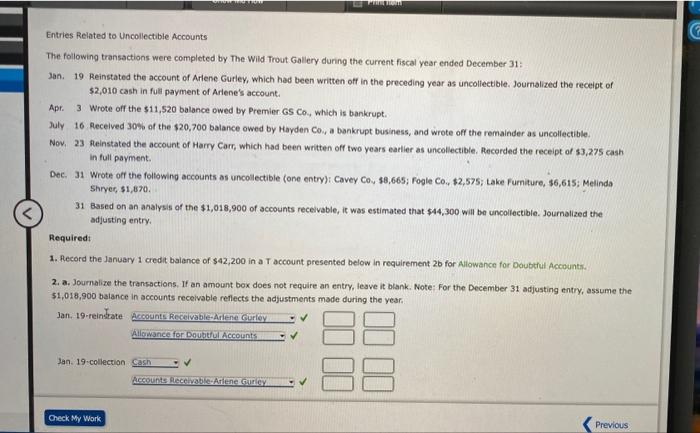

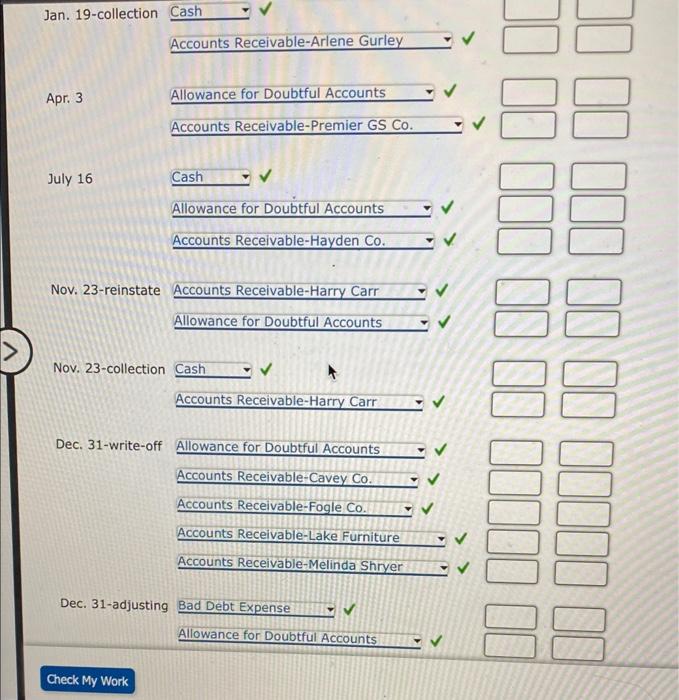

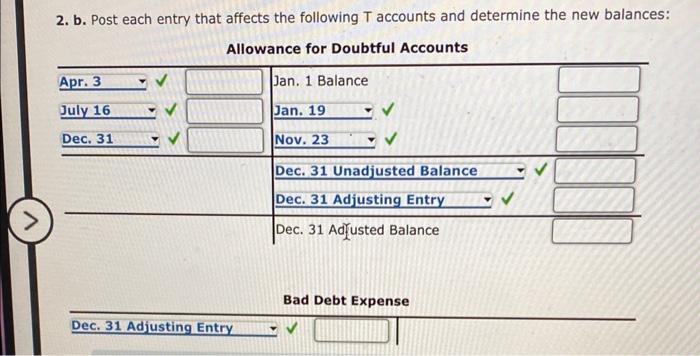

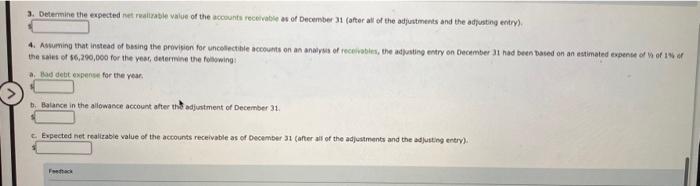

Entrios Related to Wacailectible Accounts The following transacions were completed by. The Wild Trout ciallery during the current facal yoar ended becember JII 34.7. 19 Aeinstated the acceunt of Ariene Gurley, which had been written off in the preceding year as uncolectible. Jounalaed the recigt of \$2,010 cash in full pavenent of Ariene's account. Apc. 3 Wrote eft the $11,520 balance owed by Premier Gs Co which is bankrupt. July 15 Received 30% of the $20,700 balance owed by Hayden Co, a bankrupt burineas, and wrobe cft the remainder at unceilectible. Nov. 23 Reiostated the account of IMrry Carr. which had been arabes eer two yeas earfier as uncollectible. Meconted the receipt of s3,275 cash in fuli parinent. Shrrec, 11,870. adjusting entry. Pleguired: Jan. 19-collection Cash Accounts Receivable-Arlene Gurley Apr. 3 Allowance for Doubtful Accounts Accounts Receivable-Premier GS Co. July 16 Cash Allowance for Doubtful Accounts Accounts Receivable-Hayden Co. Nov. 23-reinstate Accounts Receivable-Harry Carr Allowance for Doubtful Accounts Nov. 23-collection Cash Accounts Receivable-Harry Carr Dec. 31-write-off Allowance for Doubtful Accothits V Accounts Receivable-Cavey Co. Accounts Receivable-Fogle Co. Accounts Receivable-Lake Furniture Accounts Receivable-Melinda Shryer Dec. 31 -adjusting. Bad Debt Expense Allowance for Doubtful Accounts =V Check My Work b. Post each entry that affects the following T accounts and determine the new balances: "Deir My Wian Set up T Taccounte. Aecall that under the alibnance method, the entry to write off an account debits Alowance for Doubthur Accounts ahd credis Acceunts Aeceivabie paynent for the bccount. The ampue t of bad debt expense is affected by the balanice in the allowance account. 3. Drtemine the expected net reailiabie value of the accounts recoivabie as of Oecertiber It after all of the dipustments and the adjusting entry\}. the sales of $6,200,000 for the year, eetermine the folloning; Bad debt expense for the year. Baiance in the aliowance account after the adjustment of December 31. Expected net realizable value of the accounts receivable as of December 31 (after all of the adjeatments and the adjusting entry? Entries Related to Uncollectible Accounts The following transactions were completed by The Wild Trout Gallery during the current fiscal year ended December 31 : 3an. 19 Reinstated the account of Arlene Gurley, which had been written off in the preceding year as uncolfectible. Journalized the receipt of $2,010 cash in full payment of Ariene's account. Apr. 3 Wrote off the $11,520 balance owed by Premier 65Co, which is bankrupt. July 16 Recelved 30% of the $20,700 balance owed by Hayden Co. a bankrupt business, and wrote off the remainder as uncollectible. Nov, 23 feinstated the account of Harry Car, which had been written off two years earlier as uncoliectible. Recorded the receipt of 53,275 cash in full payment. Dec. 31 Wrote off the following accounts as uncollectible (one entry) i Cavey Coy 58,665; fogle Co.4 52,575 ; Lake Furniture, 56,615 ; Melinda Shryer, 51,670. 31 Based on an analysis of the $1,018,900 of accounts recelvable, it was estimated that $44,300 will be uncollectible. Journalized the adjusting entry. Requiredt 1. Pecord the January 1 credit balance of $42,200 in a T account presented below in requirement 2b for Allowance for Doubtrui Accountis. 2. a. Journalize the transactions. If an ameant box does not require an entry, leave it biank. Note: For the December 31 adjusting entry, assume the 51,018,900 baiance in accounts receivable reflects the adjustments made during the year. Jan. 19-collection Cash Accounts Receivable-Arlene Gurley Apr. 3 July 16 Allowance for Doubtful Accounts Accounts Receivable-Hayden Co. Nov. 23-reinstate Accounts Receivable-Harry Carr V Allowance for Doubtful Accounts Nov. 23-collection Cash Accounts Receivable-Harry Carr Dec. 31-write-off Allowance for Doubtful Accounts Accounts Receivable-Cavey Co. Accounts Receivable-Fogle Co. Accounts Receivable-Lake Furniture Accounts Receivable-Melinda Shryer Dec. 31 -adjusting Bad Debt Expense Allowance for Doubtful Accounts Check My Work 2. b. Post each entry that affects the following T accounts and determine the new balances: 3. Determine the expected ret realizable value of the accounts recovabse 4 of December 31 (after all of the adjustments and the adfusting entry). the saies of 56,290,000 for the veat, determine the fospowing: a. Bod detit expense for the year: b. Balunce in the aliowasce account atter tht adjuntment of December 31 . Expected not realizabie value of the accounts receivable as of 0ecember 31 (after as of the adjuaments and the adjusting entry). Entrios Related to Wacailectible Accounts The following transacions were completed by. The Wild Trout ciallery during the current facal yoar ended becember JII 34.7. 19 Aeinstated the acceunt of Ariene Gurley, which had been written off in the preceding year as uncolectible. Jounalaed the recigt of \$2,010 cash in full pavenent of Ariene's account. Apc. 3 Wrote eft the $11,520 balance owed by Premier Gs Co which is bankrupt. July 15 Received 30% of the $20,700 balance owed by Hayden Co, a bankrupt burineas, and wrobe cft the remainder at unceilectible. Nov. 23 Reiostated the account of IMrry Carr. which had been arabes eer two yeas earfier as uncollectible. Meconted the receipt of s3,275 cash in fuli parinent. Shrrec, 11,870. adjusting entry. Pleguired: Jan. 19-collection Cash Accounts Receivable-Arlene Gurley Apr. 3 Allowance for Doubtful Accounts Accounts Receivable-Premier GS Co. July 16 Cash Allowance for Doubtful Accounts Accounts Receivable-Hayden Co. Nov. 23-reinstate Accounts Receivable-Harry Carr Allowance for Doubtful Accounts Nov. 23-collection Cash Accounts Receivable-Harry Carr Dec. 31-write-off Allowance for Doubtful Accothits V Accounts Receivable-Cavey Co. Accounts Receivable-Fogle Co. Accounts Receivable-Lake Furniture Accounts Receivable-Melinda Shryer Dec. 31 -adjusting. Bad Debt Expense Allowance for Doubtful Accounts =V Check My Work b. Post each entry that affects the following T accounts and determine the new balances: "Deir My Wian Set up T Taccounte. Aecall that under the alibnance method, the entry to write off an account debits Alowance for Doubthur Accounts ahd credis Acceunts Aeceivabie paynent for the bccount. The ampue t of bad debt expense is affected by the balanice in the allowance account. 3. Drtemine the expected net reailiabie value of the accounts recoivabie as of Oecertiber It after all of the dipustments and the adjusting entry\}. the sales of $6,200,000 for the year, eetermine the folloning; Bad debt expense for the year. Baiance in the aliowance account after the adjustment of December 31. Expected net realizable value of the accounts receivable as of December 31 (after all of the adjeatments and the adjusting entry? Entries Related to Uncollectible Accounts The following transactions were completed by The Wild Trout Gallery during the current fiscal year ended December 31 : 3an. 19 Reinstated the account of Arlene Gurley, which had been written off in the preceding year as uncolfectible. Journalized the receipt of $2,010 cash in full payment of Ariene's account. Apr. 3 Wrote off the $11,520 balance owed by Premier 65Co, which is bankrupt. July 16 Recelved 30% of the $20,700 balance owed by Hayden Co. a bankrupt business, and wrote off the remainder as uncollectible. Nov, 23 feinstated the account of Harry Car, which had been written off two years earlier as uncoliectible. Recorded the receipt of 53,275 cash in full payment. Dec. 31 Wrote off the following accounts as uncollectible (one entry) i Cavey Coy 58,665; fogle Co.4 52,575 ; Lake Furniture, 56,615 ; Melinda Shryer, 51,670. 31 Based on an analysis of the $1,018,900 of accounts recelvable, it was estimated that $44,300 will be uncollectible. Journalized the adjusting entry. Requiredt 1. Pecord the January 1 credit balance of $42,200 in a T account presented below in requirement 2b for Allowance for Doubtrui Accountis. 2. a. Journalize the transactions. If an ameant box does not require an entry, leave it biank. Note: For the December 31 adjusting entry, assume the 51,018,900 baiance in accounts receivable reflects the adjustments made during the year. Jan. 19-collection Cash Accounts Receivable-Arlene Gurley Apr. 3 July 16 Allowance for Doubtful Accounts Accounts Receivable-Hayden Co. Nov. 23-reinstate Accounts Receivable-Harry Carr V Allowance for Doubtful Accounts Nov. 23-collection Cash Accounts Receivable-Harry Carr Dec. 31-write-off Allowance for Doubtful Accounts Accounts Receivable-Cavey Co. Accounts Receivable-Fogle Co. Accounts Receivable-Lake Furniture Accounts Receivable-Melinda Shryer Dec. 31 -adjusting Bad Debt Expense Allowance for Doubtful Accounts Check My Work 2. b. Post each entry that affects the following T accounts and determine the new balances: 3. Determine the expected ret realizable value of the accounts recovabse 4 of December 31 (after all of the adjustments and the adfusting entry). the saies of 56,290,000 for the veat, determine the fospowing: a. Bod detit expense for the year: b. Balunce in the aliowasce account atter tht adjuntment of December 31 . Expected not realizabie value of the accounts receivable as of 0ecember 31 (after as of the adjuaments and the adjusting entry)