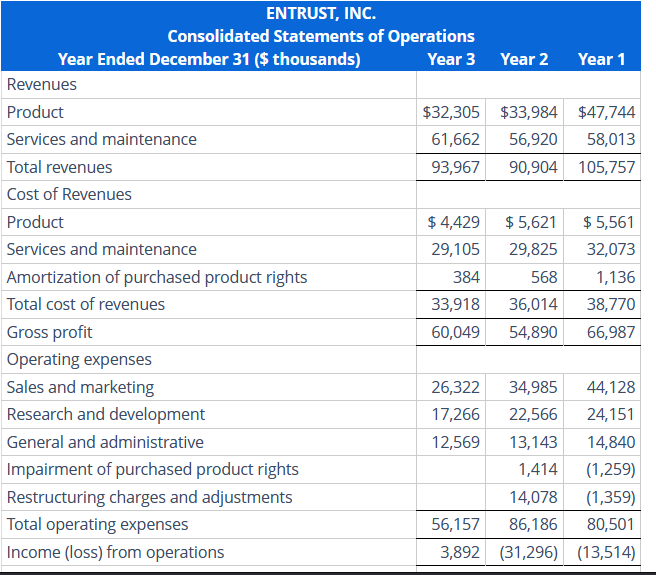

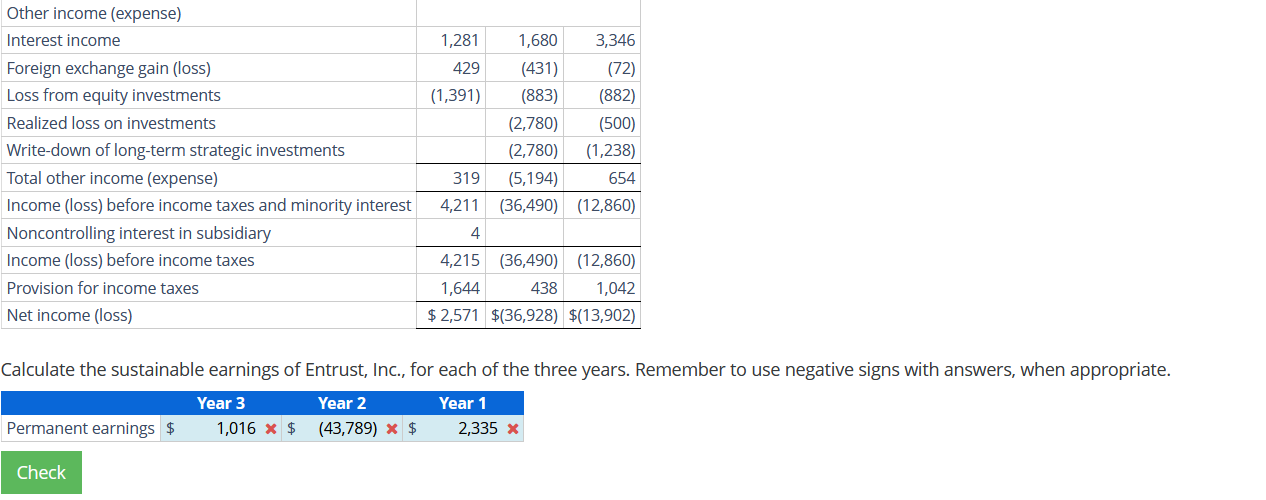

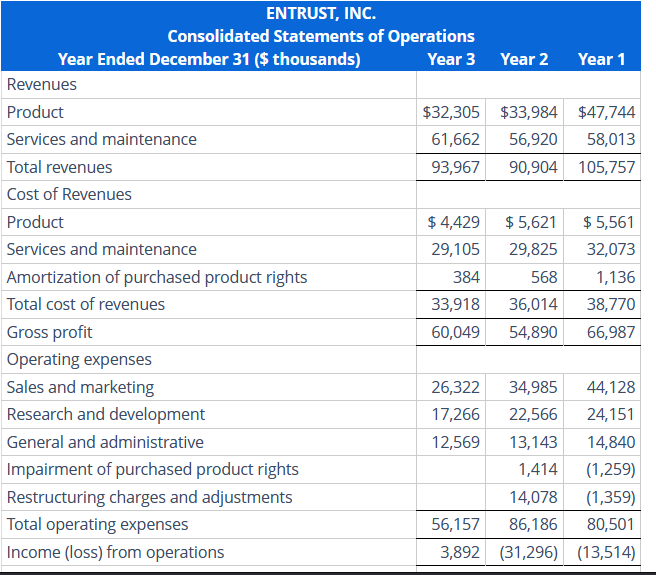

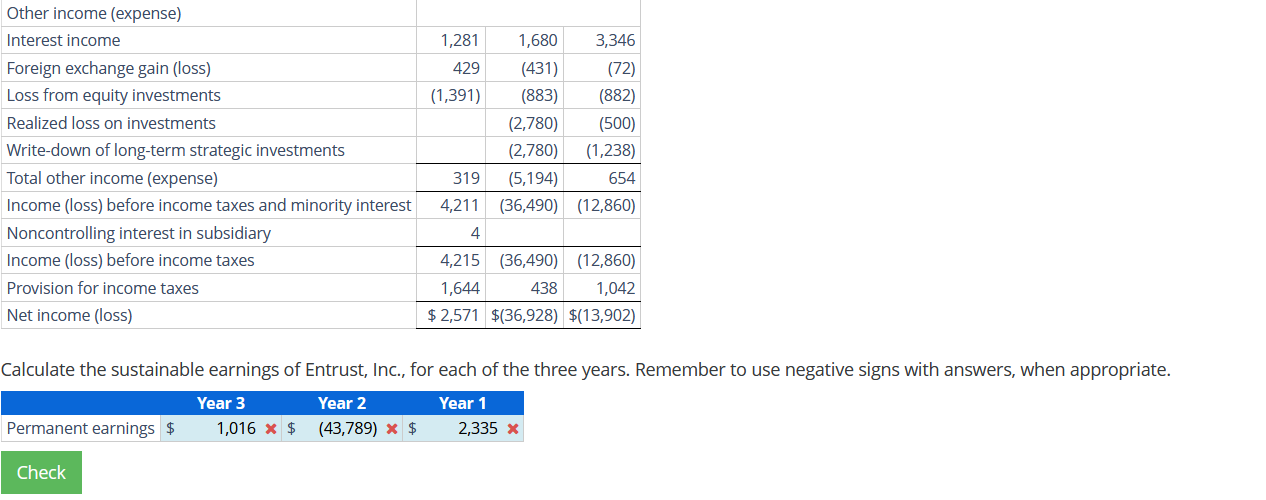

Entrust, Inc., is a global provider of security software; it operates in one business segment involving the design, production, and sale of software products for securing digital identities and information. The consolidated statements of operations for a three-year period (all values in thousands) follows. On January 1, Year 1, the Entrust common shares traded at $10.40 per share; by year end Year 3, the shares traded at $3.80 per share. The companys cash flow from operations was $(27,411), $(20,908), and $9,606, for Year 1, Year 2, and Year 3, respectively.

Calculate the sustainable earnings of Entrust, Inc., for each of the three years.

\begin{tabular}{|l|r|r|r|} \hline \multicolumn{1}{|c}{\begin{tabular}{c} ENTRUST, INC. \\ \multicolumn{1}{|c|}{ Yearsolidated Statements of Operations } \\ Year 3 \end{tabular}} & Year 2 & Year 1 \\ \hline Revenues & & & \\ \hline Product & $32,305 & $33,984 & $47,744 \\ \hline Services and maintenance & 61,662 & 56,920 & 58,013 \\ \hline Total revenues & 93,967 & 90,904 & 105,757 \\ \hline Cost of Revenues & & & \\ \hline Product & $4,429 & $5,621 & $5,561 \\ \hline Services and maintenance & 29,105 & 29,825 & 32,073 \\ \hline Amortization of purchased product rights & 384 & 568 & 1,136 \\ \hline Total cost of revenues & 33,918 & 36,014 & 38,770 \\ \hline Gross profit & 60,049 & 54,890 & 66,987 \\ \hline Operating expenses & & & \\ \hline Sales and marketing & & & \\ \hline Research and development & 26,322 & 34,985 & 44,128 \\ \hline General and administrative & 17,266 & 22,566 & 24,151 \\ \hline Impairment of purchased product rights & 12,569 & 13,143 & 14,840 \\ \hline Restructuring charges and adjustments & & 1,414 & (1,259) \\ \hline Total operating expenses & & 14,078 & (1,359) \\ \hline Income (loss) from operations & 56,157 & 86,186 & 80,501 \\ \hline \end{tabular} \begin{tabular}{|l|r|r|r|} \hline Other income (expense) & & & \\ \hline Interest income & 1,281 & 1,680 & 3,346 \\ \hline Foreign exchange gain (loss) & 429 & (431) & (72) \\ \hline Loss from equity investments & (1,391) & (883) & (882) \\ \hline Realized loss on investments & & (2,780) & (500) \\ \hline Write-down of long-term strategic investments & & (2,780) & (1,238) \\ \hline Total other income (expense) & 319 & (5,194) & 654 \\ \hline Income (loss) before income taxes and minority interest & 4,211 & (36,490) & (12,860) \\ \hline Noncontrolling interest in subsidiary & 4 & & \\ \hline Income (loss) before income taxes & 4,215 & (36,490) & (12,860) \\ \hline Provision for income taxes & 1,644 & 438 & 1,042 \\ \hline Net income (loss) & $2,571 & $(36,928) & $(13,902) \\ \hline \end{tabular} Calculate the sustainable earnings of Entrust, Inc., for each of the three years. Remember to use negative signs with answers, when appropriate. \begin{tabular}{c|cccc} & Year 3 & Year 2 & Year 1 \\ \hline Permanent earnings $ & 1,016$ & (43,789) & 2,335 \end{tabular} Check \begin{tabular}{|l|r|r|r|} \hline \multicolumn{1}{|c}{\begin{tabular}{c} ENTRUST, INC. \\ \multicolumn{1}{|c|}{ Yearsolidated Statements of Operations } \\ Year 3 \end{tabular}} & Year 2 & Year 1 \\ \hline Revenues & & & \\ \hline Product & $32,305 & $33,984 & $47,744 \\ \hline Services and maintenance & 61,662 & 56,920 & 58,013 \\ \hline Total revenues & 93,967 & 90,904 & 105,757 \\ \hline Cost of Revenues & & & \\ \hline Product & $4,429 & $5,621 & $5,561 \\ \hline Services and maintenance & 29,105 & 29,825 & 32,073 \\ \hline Amortization of purchased product rights & 384 & 568 & 1,136 \\ \hline Total cost of revenues & 33,918 & 36,014 & 38,770 \\ \hline Gross profit & 60,049 & 54,890 & 66,987 \\ \hline Operating expenses & & & \\ \hline Sales and marketing & & & \\ \hline Research and development & 26,322 & 34,985 & 44,128 \\ \hline General and administrative & 17,266 & 22,566 & 24,151 \\ \hline Impairment of purchased product rights & 12,569 & 13,143 & 14,840 \\ \hline Restructuring charges and adjustments & & 1,414 & (1,259) \\ \hline Total operating expenses & & 14,078 & (1,359) \\ \hline Income (loss) from operations & 56,157 & 86,186 & 80,501 \\ \hline \end{tabular} \begin{tabular}{|l|r|r|r|} \hline Other income (expense) & & & \\ \hline Interest income & 1,281 & 1,680 & 3,346 \\ \hline Foreign exchange gain (loss) & 429 & (431) & (72) \\ \hline Loss from equity investments & (1,391) & (883) & (882) \\ \hline Realized loss on investments & & (2,780) & (500) \\ \hline Write-down of long-term strategic investments & & (2,780) & (1,238) \\ \hline Total other income (expense) & 319 & (5,194) & 654 \\ \hline Income (loss) before income taxes and minority interest & 4,211 & (36,490) & (12,860) \\ \hline Noncontrolling interest in subsidiary & 4 & & \\ \hline Income (loss) before income taxes & 4,215 & (36,490) & (12,860) \\ \hline Provision for income taxes & 1,644 & 438 & 1,042 \\ \hline Net income (loss) & $2,571 & $(36,928) & $(13,902) \\ \hline \end{tabular} Calculate the sustainable earnings of Entrust, Inc., for each of the three years. Remember to use negative signs with answers, when appropriate. \begin{tabular}{c|cccc} & Year 3 & Year 2 & Year 1 \\ \hline Permanent earnings $ & 1,016$ & (43,789) & 2,335 \end{tabular} Check