Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Entry into a market by new competitors evokes a reaction. As a result , a competitive dynamic-action and response begins. Before responding to a competitor,

Entry into a market by new competitors evokes a reaction. As a result , a competitive dynamic-action and response begins. Before responding to a competitor, firms must understand the competitive dynamics of the business in order to succeed with growth opportunity. Suggest and critically discuss a model that helps mangers to meet this objective. *** Words between 450 to 550 Alot informatin to help with competitive dynamics for the answer

Now ok ?

Now ok ?

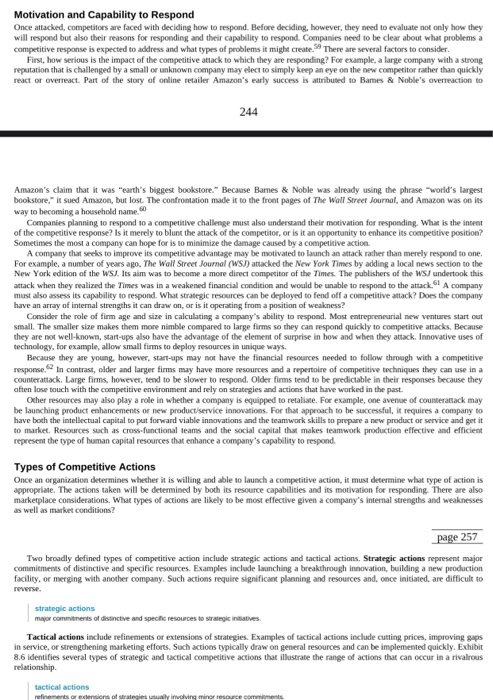

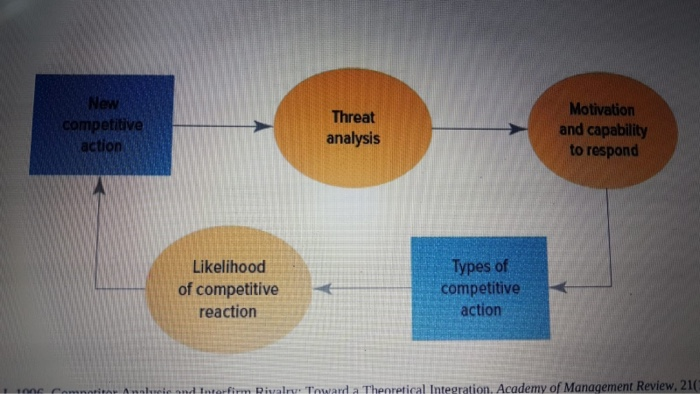

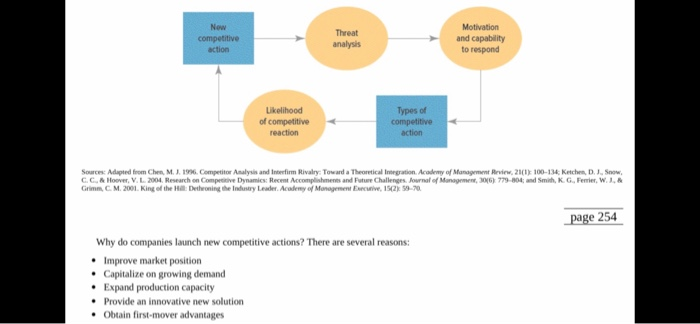

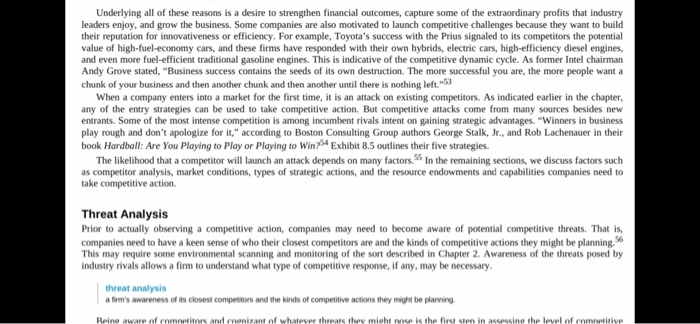

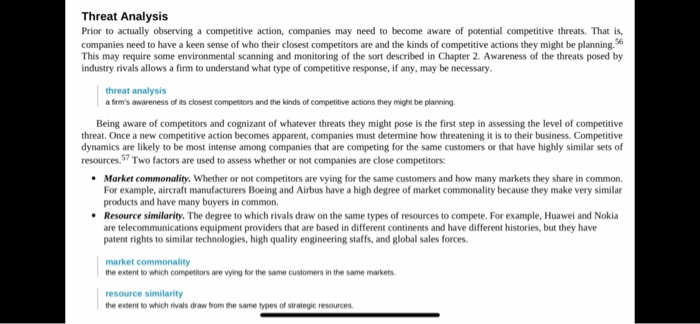

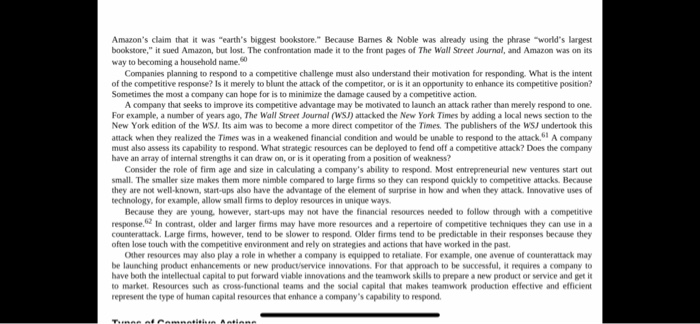

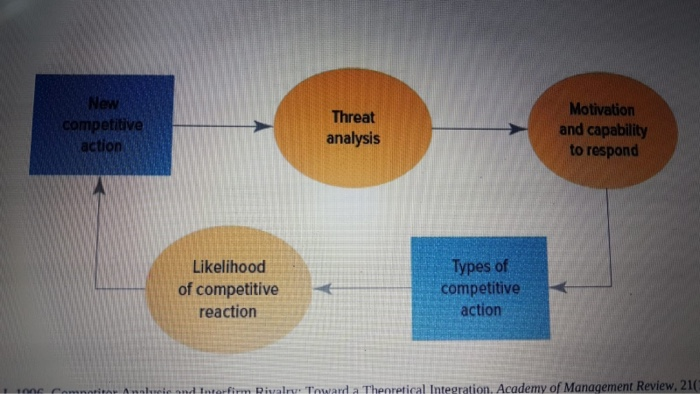

New competitive action - threat analysis - motivation and capacity to respond - types of competitive action - like hood of competitive reaction Underlying all of these reasons is a desire to strengthen financial outcomes, capture some of the extraordinary profits that industry leaders enjoy, and grow the business. Some companies are also motivated to launch competitive challenges because they want to build their reputation for innovativeness or efficiency. For example, Toyotas success with the Prius signaled to its competitors the potential value of high-fuel-economy cars, and these firms have responded with their own hybrids, electric cars, high-efficiency diesel engines, and even more fuel-efficient traditional gasoline engines. This is indicative of the competitive dynamic cycle. As former Intel chairman Andy Grove stated, Business success contains the seeds of its own destruction. The more successful you are, the more people want a chunk of your business and then another chunk and then another until there is nothing left.53 When a company enters into a market for the first time, it is an attack on existing competitors. As indicated earlier in the chapter, any of the entry strategies can be used to take competitive action. But competitive attacks come from many sources besides new entrants. Some of the most intense competition is among incumbent rivals intent on gaining strategic advantages. Winners in business play rough and dont apologize for it, according to Boston Consulting Group authors George Stalk, Jr., and Rob Lachenauer in their book Hardball: Are You Playing to Play or Playing to Win?54 Exhibit 8.5 outlines their five strategies. Prior Actually observing a competitive action, companies may need to become aware of potential competitive threats. That is, Being aware of competitors and cognizant of whatever threats they might pose is the first step in assessing the level of competitive threat. Once a new competitive action becomes apparent, companies must determine how threatening it is to their business. Competitive dynamics are likely to be most intense among companies that are competing for the same customers or that have highly similar sets of The likelihood that a competitor will launch an attack depends on many factors. as competitor analysis, market conditions, types of strategic actions, and the resource endowments and capabilities companies need to take competitive action. Threat Analysis companies need to have a keen sense of who their closest competitors are and the kinds of competitive actions they might be planning. This may require some environmental scanning and monitoring of the sort described in Chapter 2. Awareness of the threats posed by industry rivals allows a firm to understand what type of competitive response, if any, may be necessary Market commonality. Whether or not competitors are vying for the same customers and how many markets they share in common. For example, aircraft manufacturers Boeing and Airbus have a high degree of market commonality because they make very similar products and have many buyers in common. Resource similarity. The degree to which rivals draw on the same types of resources to compete. For example, Huawei and Nokia are telecommunications equipment providers that are based in different continents and have different histories, but they have patent rights to similar technologies, high quality engineering staffs, and global sales forces. When any two firms have both a high degree of market commonality and highly similar resource bases, a stronger competitive threat is present. Such a threat, however, may not lead to competitive action. On the one hand, a market rival may be hesitant to attack a company that it shares a high degree of market commonality with because it could lead to an intense battle. On the other hand, once attacked, rivals with high market commonality will be much more motivated to launch a competitive response. This is especially true in cases where the shared market is an important part of a companys overall business. How strong a response an attacked rival can mount will be determined by its strategic resource endowments. In general, the same set of conditions holds true with regard to resource similarity. Companies that have highly similar resource bases will be hesitant to launch 58 an initial attack but pose a serious threat if required to mount a competitive response Once attacked, competitors are faced with deciding how to respond. Before deciding, however, they need to evaluate not only how they will respond but also their reasons for responding and their capability to respond. Companies need to be clear about what problems reputation that is challenged by a small or unknown company may elect to simply keep an eye on the new competitor rather than quickly react or overreact. Part of the story of online retailer Amazons early success is attributed to Barnes & Nobles overreaction to competitive response is expected to address and what types of problems it might create. First, how serious is the impact of the competitive attack to which they are responding? For example, a large company with a strong There are several factors to consider Amazons claim that it was earths biggest bookstore. Because Barnes & Noble was already using the phrase worlds largest bookstore, it sued Amazon, but lost. The confrontation made it to the front pages of The Wall Street Journal, and Amazon was on its 60 of the competitive response? Is it merely to blunt the attack of the competitor, or is it an opportunity to enhance its competitive position? Sometimes the most a company can hope for is to minimize the damage caused by a competitive action. A company that seeks to improve its competitive advantage may be motivated to launch an attack rather than merely respond to one. For example, a number of years ago, The Wall Street Journal (WSJ) attacked the New York Times by adding a local news section to the New York edition of the WSJ. Its aim was to become a more direct competitor of the Times. The publishers of the WSJ undertook this 61 Consider the role of firm age and size in calculating a companys ability to respond. Most entrepreneurial new ventures start out small. The smaller size makes them more nimble compared to large firms so they can respond quickly to competitive attacks. Because they are not well-known, start-ups also have the advantage of the element of surprise in how and when they attack. Innovative uses of technology, for example, allow small firms to deploy resources in unique ways. Because they are young, however, start-ups may not have the financial resources needed to follow through with a competitive 62 way to becoming a household name. Companies planning to respond to a competitive challenge must also understand their motivation for responding. What is the intent attack when they realized the Times was in a weakened financial condition and would be unable to respond to the attack. must also assess its capability to respond. What strategic resources can be deployed to fend off a competitive attack? Does the company have an array of internal strengths it can draw on, or is it operating from a position of weakness? In contrast, older and larger firms may have more resources and a repertoire of competitive techniques they can use in a response. counterattack. Large firms, however, tend to be slower to respond. Older firms tend to be predictable in their responses because they often lose touch with the competitive environment and rely on strategies and actions that have worked in the past. Other resources may also play a role in whether a company is equipped to retaliate. For example, one avenue of counterattack may be launching product enhancements or new product/service innovations. For that approach to be successful, it requires a company to have both the intellectual capital to put forward viable innovations and the teamwork skills to prepare a new product or service and get it to market. Resources such as cross-functional teams and the social capital that makes teamwork production effective and efficient represent the type of human capital resources that enhance a companys capability to respond. Types of Competitive Actions Once an organization determines whether it is willing and able to launch a competitive action, it must determine what type of action is appropriate. The actions taken will be determined by both its resource capabilities and its motivation for responding. There are also marketplace considerations. What types of actions are likely to be most effective given a companys internal strengths and weekness As well as market condition? Two broadly defined types of competitive action include strategic actions and tactical actions. Strategic actions represent major commitments of distinctive and specific resources. Examples include launching a breakthrough innovation, building a new production facility, or merging with another company. Such actions require significant planning and resources and, once initiated, are difficult to reverse Some competitive actions take the form of frontal assaults, that is, actions aimed directly at taking business from another company or capitalizing on industry weaknesses. This can be especially effective when firms use a low-cost strategy. The airline industry provides a good example of this head-on approach. When Southwest Airlines began its no-frills, nomeals strategy in the late 1960s, it represented a direct assault on the major carriers of the day. In Europe, Ryanair has similarly directly challenged the traditional carriers with an overall cost leadership strategy. 63 Guerrilla offensives and selective attacks provide an alternative for firms with fewer resources. services by creating buzz or generating enough shock value to get some free publicity. TOMS Shoes has found a way to generate interest in its products without a large advertising budget to match Nike. Its policy of donating one pair of shoes to those in need for 64 every pair of shoes purchased by customers has generated a lot of buzz on the Internet. rating on TOMSs Facebook page. The policy has a real impact as well, with over 60 million shoes donated as of January 2017. Some companies limit their competitive response to defensive actions. Such actions rarely improve a companys competitive advantage, but a credible defensive action can lower the risk of being attacked and deter new entry. Several of the factors discussed earlier in the chapter, such as types of entry strategies and the use of cost leadership versus differentiation strategies, can guide the decision about what types of competitive actions to take. Before launching a given strategy, 66 The final step before initiating a competitive response is to evaluate what a competitors reaction is likely to be. The logic of competitive 67 How a competitor is likely to respond will depend on three factors: market dependence, competitors resources, and the reputation of the firm that initiates the action (actors reputation). The implications of each of these are described briefly as follows. Market Dependence If a company has a high concentration of its business in a particular industry, it has more at stake because it must depend on that industrys market for its sales. Single-industry businesses or those where one industry dominates are more likely to mount a competitive response. Young and small firms with a high degree of market dependence may be limited in how they respond due to resource constraints. market dependence degree of concentration of a firms business in a particular industry. Competitors Resources Previously, we examined the internal resource endowments that a company must evaluate when assessing its capability to respond. Here, it is the competitors resources that need to be considered. For example, a small firm may be unable to mount a serious attack due to lack of resources. As a result, it is more likely to react to tactical actions such as incentive pricing or however, assessing the likely response of competitors is a vital step. Likelihood of Competitive Reaction dynamics suggests that once competitive actions are initiated, it is likely they will be met with competitive responses. before mounting an attack is to evaluate how competitors are likely to respond. Evaluating potential competitive reactions helps companies plan for future counterattacks. It may also lead to a decision to hold offthat is, not to take any competitive action at all because of the possibility that a misguided or poorly planned response will generate a devastating competitive reaction.

New competitive action - threat analysis - motivation and capacity to respond - types of competitive action - like hood of competitive reaction Underlying all of these reasons is a desire to strengthen financial outcomes, capture some of the extraordinary profits that industry leaders enjoy, and grow the business. Some companies are also motivated to launch competitive challenges because they want to build their reputation for innovativeness or efficiency. For example, Toyotas success with the Prius signaled to its competitors the potential value of high-fuel-economy cars, and these firms have responded with their own hybrids, electric cars, high-efficiency diesel engines, and even more fuel-efficient traditional gasoline engines. This is indicative of the competitive dynamic cycle. As former Intel chairman Andy Grove stated, Business success contains the seeds of its own destruction. The more successful you are, the more people want a chunk of your business and then another chunk and then another until there is nothing left.53 When a company enters into a market for the first time, it is an attack on existing competitors. As indicated earlier in the chapter, any of the entry strategies can be used to take competitive action. But competitive attacks come from many sources besides new entrants. Some of the most intense competition is among incumbent rivals intent on gaining strategic advantages. Winners in business play rough and dont apologize for it, according to Boston Consulting Group authors George Stalk, Jr., and Rob Lachenauer in their book Hardball: Are You Playing to Play or Playing to Win?54 Exhibit 8.5 outlines their five strategies. Prior Actually observing a competitive action, companies may need to become aware of potential competitive threats. That is, Being aware of competitors and cognizant of whatever threats they might pose is the first step in assessing the level of competitive threat. Once a new competitive action becomes apparent, companies must determine how threatening it is to their business. Competitive dynamics are likely to be most intense among companies that are competing for the same customers or that have highly similar sets of The likelihood that a competitor will launch an attack depends on many factors. as competitor analysis, market conditions, types of strategic actions, and the resource endowments and capabilities companies need to take competitive action. Threat Analysis companies need to have a keen sense of who their closest competitors are and the kinds of competitive actions they might be planning. This may require some environmental scanning and monitoring of the sort described in Chapter 2. Awareness of the threats posed by industry rivals allows a firm to understand what type of competitive response, if any, may be necessary Market commonality. Whether or not competitors are vying for the same customers and how many markets they share in common. For example, aircraft manufacturers Boeing and Airbus have a high degree of market commonality because they make very similar products and have many buyers in common. Resource similarity. The degree to which rivals draw on the same types of resources to compete. For example, Huawei and Nokia are telecommunications equipment providers that are based in different continents and have different histories, but they have patent rights to similar technologies, high quality engineering staffs, and global sales forces. When any two firms have both a high degree of market commonality and highly similar resource bases, a stronger competitive threat is present. Such a threat, however, may not lead to competitive action. On the one hand, a market rival may be hesitant to attack a company that it shares a high degree of market commonality with because it could lead to an intense battle. On the other hand, once attacked, rivals with high market commonality will be much more motivated to launch a competitive response. This is especially true in cases where the shared market is an important part of a companys overall business. How strong a response an attacked rival can mount will be determined by its strategic resource endowments. In general, the same set of conditions holds true with regard to resource similarity. Companies that have highly similar resource bases will be hesitant to launch 58 an initial attack but pose a serious threat if required to mount a competitive response Once attacked, competitors are faced with deciding how to respond. Before deciding, however, they need to evaluate not only how they will respond but also their reasons for responding and their capability to respond. Companies need to be clear about what problems reputation that is challenged by a small or unknown company may elect to simply keep an eye on the new competitor rather than quickly react or overreact. Part of the story of online retailer Amazons early success is attributed to Barnes & Nobles overreaction to competitive response is expected to address and what types of problems it might create. First, how serious is the impact of the competitive attack to which they are responding? For example, a large company with a strong There are several factors to consider Amazons claim that it was earths biggest bookstore. Because Barnes & Noble was already using the phrase worlds largest bookstore, it sued Amazon, but lost. The confrontation made it to the front pages of The Wall Street Journal, and Amazon was on its 60 of the competitive response? Is it merely to blunt the attack of the competitor, or is it an opportunity to enhance its competitive position? Sometimes the most a company can hope for is to minimize the damage caused by a competitive action. A company that seeks to improve its competitive advantage may be motivated to launch an attack rather than merely respond to one. For example, a number of years ago, The Wall Street Journal (WSJ) attacked the New York Times by adding a local news section to the New York edition of the WSJ. Its aim was to become a more direct competitor of the Times. The publishers of the WSJ undertook this 61 Consider the role of firm age and size in calculating a companys ability to respond. Most entrepreneurial new ventures start out small. The smaller size makes them more nimble compared to large firms so they can respond quickly to competitive attacks. Because they are not well-known, start-ups also have the advantage of the element of surprise in how and when they attack. Innovative uses of technology, for example, allow small firms to deploy resources in unique ways. Because they are young, however, start-ups may not have the financial resources needed to follow through with a competitive 62 way to becoming a household name. Companies planning to respond to a competitive challenge must also understand their motivation for responding. What is the intent attack when they realized the Times was in a weakened financial condition and would be unable to respond to the attack. must also assess its capability to respond. What strategic resources can be deployed to fend off a competitive attack? Does the company have an array of internal strengths it can draw on, or is it operating from a position of weakness? In contrast, older and larger firms may have more resources and a repertoire of competitive techniques they can use in a response. counterattack. Large firms, however, tend to be slower to respond. Older firms tend to be predictable in their responses because they often lose touch with the competitive environment and rely on strategies and actions that have worked in the past. Other resources may also play a role in whether a company is equipped to retaliate. For example, one avenue of counterattack may be launching product enhancements or new product/service innovations. For that approach to be successful, it requires a company to have both the intellectual capital to put forward viable innovations and the teamwork skills to prepare a new product or service and get it to market. Resources such as cross-functional teams and the social capital that makes teamwork production effective and efficient represent the type of human capital resources that enhance a companys capability to respond. Types of Competitive Actions Once an organization determines whether it is willing and able to launch a competitive action, it must determine what type of action is appropriate. The actions taken will be determined by both its resource capabilities and its motivation for responding. There are also marketplace considerations. What types of actions are likely to be most effective given a companys internal strengths and weekness As well as market condition? Two broadly defined types of competitive action include strategic actions and tactical actions. Strategic actions represent major commitments of distinctive and specific resources. Examples include launching a breakthrough innovation, building a new production facility, or merging with another company. Such actions require significant planning and resources and, once initiated, are difficult to reverse Some competitive actions take the form of frontal assaults, that is, actions aimed directly at taking business from another company or capitalizing on industry weaknesses. This can be especially effective when firms use a low-cost strategy. The airline industry provides a good example of this head-on approach. When Southwest Airlines began its no-frills, nomeals strategy in the late 1960s, it represented a direct assault on the major carriers of the day. In Europe, Ryanair has similarly directly challenged the traditional carriers with an overall cost leadership strategy. 63 Guerrilla offensives and selective attacks provide an alternative for firms with fewer resources. services by creating buzz or generating enough shock value to get some free publicity. TOMS Shoes has found a way to generate interest in its products without a large advertising budget to match Nike. Its policy of donating one pair of shoes to those in need for 64 every pair of shoes purchased by customers has generated a lot of buzz on the Internet. rating on TOMSs Facebook page. The policy has a real impact as well, with over 60 million shoes donated as of January 2017. Some companies limit their competitive response to defensive actions. Such actions rarely improve a companys competitive advantage, but a credible defensive action can lower the risk of being attacked and deter new entry. Several of the factors discussed earlier in the chapter, such as types of entry strategies and the use of cost leadership versus differentiation strategies, can guide the decision about what types of competitive actions to take. Before launching a given strategy, 66 The final step before initiating a competitive response is to evaluate what a competitors reaction is likely to be. The logic of competitive 67 How a competitor is likely to respond will depend on three factors: market dependence, competitors resources, and the reputation of the firm that initiates the action (actors reputation). The implications of each of these are described briefly as follows. Market Dependence If a company has a high concentration of its business in a particular industry, it has more at stake because it must depend on that industrys market for its sales. Single-industry businesses or those where one industry dominates are more likely to mount a competitive response. Young and small firms with a high degree of market dependence may be limited in how they respond due to resource constraints. market dependence degree of concentration of a firms business in a particular industry. Competitors Resources Previously, we examined the internal resource endowments that a company must evaluate when assessing its capability to respond. Here, it is the competitors resources that need to be considered. For example, a small firm may be unable to mount a serious attack due to lack of resources. As a result, it is more likely to react to tactical actions such as incentive pricing or however, assessing the likely response of competitors is a vital step. Likelihood of Competitive Reaction dynamics suggests that once competitive actions are initiated, it is likely they will be met with competitive responses. before mounting an attack is to evaluate how competitors are likely to respond. Evaluating potential competitive reactions helps companies plan for future counterattacks. It may also lead to a decision to hold offthat is, not to take any competitive action at all because of the possibility that a misguided or poorly planned response will generate a devastating competitive reaction.  242 24 Why de companies and competitive There are several Expedia desenes, and grow the busies. Some companies are also move found competitie came walue light cancy can, and the time mpended with the back on my and more folefice degre. This is indicative of the competitive mode Asema Andy Greated in c.contain the wall diction. The com you. When a company to market for the first time, the competens indicati any of the eyes can be used to le competitive action et comprends come tant. Some of the most competition incumbentang book Modell Are You Playing Pleyor Playing Wines the fores The bod that a compete will depend on many changed competiciones.com.mm.com Threat Analysis rullering competition companies wederom the companied behee.com and the complete This may requirement in and ag of the watcribed in Chapter 2. Ames lleingar of competion and come of what that they might otheep that crew complete become pam.componente danks wekely to be more among companies . Maria Wher recompensare wing for the man For emplaceme Bongd Aibus love high degree of market commerce products and a buyers in com elecommunications provides that when it comes and how it be prestige gesigsuis, and telles par255 Despre ava Recent Com company harmacy became cases where there is an importa.company website How gamme de vacances will be determined by se aadition is pair. pare is here in mabut pe in the descoperite pe Motivation and Capability to respond Owencompete with desting how to deciding way will pand berheases for pined the capabiliyopdagede de int, few series to be part of the competitiveneck to which they were ample, post called by a smaller.company way electing 244 Aman's claim that it was a boolecam & Nobleway wing the Companies posing to respond to competitive dig med mig Whe of the competitive problemack of the competere pyar Sometimes the most company can hope for is the media comed by competection Fanpa runter fyras aps. The Wall Sever for the New York Times by linge New York die bestemme direct competition. The ack when they all the Times was in de financial condition and would be mustasch op Whabe das fadalla.com Save an anyol el sghandwerkerngroepe we? Comide the role of fimage and share in calculating a company's eyed More wal. The alle samme compued lapsed heya wapewe of the low and where they technology, for example, allow all form to deploy cucina pome.com older larger im may have made of compete with Come around to be perfumesc lock with the comedy scelente Other mon may playaradelles.com benching products production. For the prachem have both the challe to make much functional man the capital them Types of competitive Actions propriate. The maker will be determined by the wala. What faciley, armering with the company. Such action gick Tactical actions includes ressogies Eames marketing elit. Sed typically 36 several types of age and will competitive contengo Charging production caping online wens. This can be especially elective wheel.com desangle for Wheels beim direct in the major care of the day. In Europe. Har handlar directly challenge wervices by creating being hack vare publicity TOMS Shoes ne in its products with a large averting bulgt i madh kelis policy of ting rating TOMS boke. The policy has mal impacts will with honda Some companies in their competitive metodelline action such any.com advantage, but credible determine action can lower the real bring med den Several of the factor de care le the chapas, kas palygio differences, compute the decise be what types of competech.com Likelihood of Competitive Reaction kwa lowcow well companie informed, med de Because of the possibility and oppose wiedeg come How a competitor is likely respond will depend on the market dependence.com the firm that in the action car's iets. The come ad edited Mark Dependence company has accions espany, depend on the industry's market for Single-industry una competitive due to its Computer Rear Previously with less that com cap a pond. He is the compresses had become Foreca 246 nhanced writing because they are only the locale Acer portation whether a company should respond to come denge will be dependenced the market. As com is how well price it Compared to live aller forms with mr pour company opend shwe bomo por com din orice, lahodd Chrysler comme 8.5 STRATEGY SPOTLIGHT ETHICS CLEANING UP IN THE SOAP BUSINESS Consumer product companies Colgate-Palmolive Procw Gamle the business regions found her a long tin, of prices for early a decade in the word of been them and clean up the market. The Art de la Concurce, tingin ter coming soon The ones sharing rong women 1000 bytes Pulsuste ning see our brand directory agreed to contengon They agreed to reach of whers. They were for Hugue tornard Christian Polive From www meetings fous ayew The meetings, which they called on checked med hende soon. They would be complepring schemes. For example PG ale product and coordinadora come mademy would be asha y complembut whether and to ofertad ending The counted for a broke down in 2004 Price with Choosing Not to React: Forbearance and Co-opetition The above discuss that there may be many cross in which the best Barbearance-ing from acting Motivation and Capability to respond Once attacked, competitors are faced with deciding how to respond. Before deciding, however, they need to evaluate not only how they will respond but also their reasons for responding and their capability to respond. Companies need to be clear about what problems a competitive response is expected to address and what types of problems it might create. There are several factors to consider. First, how serious is the impact of the competitive attack to which they are responding? For example, a large company with a strong reputation that is challenged by a small or unknown company may elect to simply keep an eye on the new competitor rather than quickly react or overreact. Part of the story of online retailer Amazon's early success is attributed to Bames & Noble's overreaction to 244 Amazon's claim that it was earth's biggest bookstore." Because Bames & Noble was already using the phrase "world's largest bookstore." it sued Amazon, but lost. The confrontation made it to the front pages of The Wall Street Journal, and Amazon was on its way to becoming a household name.co Companies planning to respond to a competitive challenge must also understand their motivation for responding. What is the intent of the competitive response? Is it merely to blunt the attack of the competitor, or is it an opportunity to enhance its competitive position? Sometimes the most a company can hope for is to minimize the damage caused by a competitive action A company that seeks to improve its competitive advantage may be motivated to launch an attack rather than merely respond to one. For example, a number of years ago. The Wall Street Journal (WSJ) attacked the New York Times by adding a local news section to the New York edition of the WS). Its aim was to become a more direct competitor of the Times. The publishers of the WS/ undertook this attack when they realized the Times was in a weakened financial condition and would be unable to respond to the attack. A company must also assess its capability to respond. What strategic resources can be deployed to fend off a competitive attack? Does the company have an array of internal strengths it can draw on, or is it operating from a position of weakness? Consider the role of firm age and size in calculating a company's ability to respond. Most entrepreneurial new ventures start out small. The smaller size makes them more nimble compared to large firms so they can respond quickly to competitive attacks. Because they are not well-known, start-ups also have the advantage of the element of surprise in how and when they attack. Innovative uses of technology, for example, allow small firms to deploy resources in unique ways. Because they are young, however, start-ups may not have the financial resources needed to follow through with a competitive response. In contrast, older and larger firms may have more resources and a repertoire of competitive techniques they can use in a counterattack. Large firms, however, tend to be slower to respond. Older firms tend to be predictable in their responses because they often lose touch with the competitive environment and rely on strategies and actions that have worked in the past. Other resources may also play a role in whether a company is equipped to retaliate. For example, one avenue of counterattack may be launching product enhancements or new product service innovations. For that approach to be successful, it requires a company to have both the intellectual capital to put forward viable innovations and the teamwork skills to prepare a new product or service and get it to market. Resources such as cross-functional teams and the social capital that makes teamwork production effective and efficient represent the type of human capital resources that enhance a company's capability to respond. Types of Competitive Actions Once an organization determine whether it is willing and able to launch a competitive action, it must determine what type of action is appropriate. The actions taken will be determined by both its resource capabilities and its motivation for responding. There are also marketplace considerations. What types of actions are likely to be most effective given a company's internal strengths and weaknesses as well as market conditions? page 257 Two broadly defined types of competitive action include strategic actions and tactical actions. Strategic actions represent major commitments of distinctive and specific resources. Examples include Launching a breakthrough innovation, building a new production facility, or merging with another company. Such actions require significant planning and resources and, once initiated, are difficult to reverse strategic actions major commitments of distinctive and specific resources to strategic initiatives Tactical actions include refinements or extensions of strategies. Examples of tactical actions include cutting prices, improving gaps in service, or strengthening marketing efforts. Such actions typically draw on general resources and can be implemented quickly. Exhibit 8.6 identifies several types of strategic and tactical competitive actions that illustrate the range of actions that can occur in a rivalrous relationship tactical actions refinements or extensions of strategies usually involving minor resource comments Now competitive action Threat analysis Motivation and capability to respond Likelihood of competitive reaction Types of competitive action Sources: Adapted from Chen, M. J. 1996. Competitor Analysis and Interfirm Rivalry: Toward a Theoretical Integration Academy of Management Review. 21(1): 100-136, Ketchen, D.J.Snow C.C. & Hoover, V. L. 2004. Research on Competitive Dynamics: Recent Accomplishments and Future Challenges. Journal of Management, 30(G) 779-804 and Smith, K.G. Ferrier, W., & Grimm, C. M. 2001. King of the Hill: Delwoning the Industry leader. Academy of Management Executive, 15259-70 page 254 Why do companies launch new competitive actions? There are several reasons: Improve market position Capitalize on growing demand Expand production capacity Provide an innovative new solution Obtain first-mover advantages Underlying all of these reasons is a desire to strengthen financial outcomes, capture some of the extraordinary profits that industry leaders enjoy, and grow the business. Some companies are also motivated to launch competitive challenges because they want to build their reputation for innovativeness or efficiency. For example, Toyota's success with the Prius signaled to its competitors the potential value of high-fuel-economy cars, and these firms have responded with their own hybrids, electric cars, high-efficiency diesel engines, and even more fuel-efficient traditional gasoline engines. This is indicative of the competitive dynamic cycle. As former Intel chairman Andy Grove stated, "Business success contains the seeds of its own destruction. The more successful you are, the more people want a chunk of your business and then another chunk and then another until there is nothing left. 53 When a company enters into a market for the first time, it is an attack on existing competitors. As indicated earlier in the chapter, any of the entry strategies can be used to take competitive action. But competitive attacks come from many sources besides new entrants. Some of the most intense competition is among incumbent rivals intent on gaining strategic advantages. "Winners in business play rough and don't apologize for it," according to Boston Consulting Group authors George Stalk, Jr., and Rob Lachenauer in their book Hardball: Are You Playing to Play or Playing to Win 754 Exhibit 8.5 outlines their five strategies. The likelihood that a competitor will launch an attack depends on many factors. In the remaining sections, we discuss factors such as competitor analysis, market conditions, types of strategic actions, and the resource endowments and capabilities companies need to take competitive action Threat Analysis Prior to actually observing a competitive action, companies may need to become aware of potential competitive threats. That is, companies need to have a keen sense of who their closest competitors are and the kinds of competitive actions they might be planning.96 This may require some environmental scanning and monitoring of the sort described in Chapter 2. Awareness of the threats posed by industry rivals allows a firm to understand what type of competitive response, if any, may be necessary. threat analysis a firm's awareness of its closest compettors and the kinds of competitive actions they might be planning Reine aware of romnetitors and onenizant of whatever threats they might now is the first sten in assessing the level of comnetitive Threat Analysis Prior to actually observing a competitive action, companies may need to become aware of potential competitive threats. That is, companies need to have a keen sense of who their closest competitors are and the kinds of competitive actions they might be planning. This may require some environmental scanning and monitoring of the sort described in Chapter 2. Awareness of the threats posed by industry rivals allows a firm to understand what type of competitive response, if any, may be necessary. threat analysis afirm's awareness of its closest competitors and the kinds of competitive actions they might be planning, Being aware of competitors and cognizant of whatever threats they might pose is the first step in assessing the level of competitive threat. Once a new competitive action becomes apparent companies must determine how threatening it is to their business. Competitive dynamics are likely to be most intense among companies that are competing for the same customers or that have highly similar sets of resources. 57 Two factors are used to assess whether or not companies are close competitors: Market commonality. Whether or not competitors are vying for the same customers and how many markets they share in common For example, aircraft manufacturers Boeing and Airbus have a high degree of market commonality because they make very similar products and have many buyers in common. Resource similarity. The degree to which rivals draw on the same types of resources to compete. For example, Huawei and Nokia are telecommunications equipment providers that are based in different continents and have different histories, but they have patent rights to similar technologies, high quality engineering staffs, and global sales forces. market commonality the extent to which competitors are vying for the same customers in the same markets resource similarity the extent to which was drow from the same types of strategic resources Amazon's claim that it was earth's biggest bookstore." Because Barnes & Noble was already using the phrase "world's largest bookstore," it sued Amazon, but lost. The confrontation made it to the front pages of The Wall Street Journal, and Amazon was on its way to becoming a household name Companies planning to respond to a competitive challenge must also understand their motivation for responding. What is the intent of the competitive response? Is it merely to blunt the attack of the competitor, or is it an opportunity to enhance its competitive position? Sometimes the most a company can hope for is to minimize the damage caused by a competitive action. A company that seeks to improve its competitive advantage may be motivated to launch an attack rather than merely respond to one. For example, a number of years ago, The Wall Street Journal (WSJ) attacked the New York Times by adding a local news section to the New York edition of the WSJ. Its aim was to become a more direct competitor of the Times. The publishers of the WSJ undertook this attack when they realized the Times was in a weakened financial condition and would be unable to respond to the attack 61 A company must also assess its capability to respond. What strategic resources can be deployed to fend off a competitive attack? Does the company have an array of internal strengths it can draw on, or is it operating from a position of weakness? Consider the role of firm age and size in calculating a company's ability to respond. Most entrepreneurial new ventures start out small. The smaller size makes them more nimble compared to large firms so they can respond quickly to competitive attacks. Because they are not well-known, start-ups also have the advantage of the element of surprise in how and when they attack. Innovative uses of technology, for example, allow small firms to deploy resources in unique ways. Because they are young however, start-ups may not have the financial resources needed to follow through with a competitive response. In contrast, older and larger firms may have more resources and a repertoire of competitive techniques they can use in a counterattack. Large firms, however, tend to be slower to respond. Older firms tend to be predictable in their responses because they often lose touch with the competitive environment and rely on strategies and actions that have worked in the past. Other resources may also play a role in whether a company is equipped to retaliate. For example, one avenue of counterattack may be launching product enhancements or new product service innovations. For that approach to be successful, it requires a company to have both the intellectual capital to put forward viable innovations and the teamwork skills to prepare a new product or service and get it to market. Resources such as cross-functional teams and the social capital that makes teamwork production effective and efficient represent the type of human capital resources that enhance a company's capability to respond Tornemmela Andere Types of Competitive Actions Once an organization determines whether it is willing and able to launch a competitive action, it must determine what type of action is appropriate. The actions taken will be determined by both its resource capabilities and its motivation for responding. There are also marketplace considerations. What types of actions are likely to be most effective given a company's internal strengths and weaknesses as well as market conditions? page 257 Two broadly defined types of competitive action include strategic actions and tactical actions. Strategic actions represent major commitments of distinctive and specific resources. Examples include launching a breakthrough innovation, building a new production facility, or merging with another company. Such actions require significant planning and resources and, once initiated, are difficult to reverse strategic actions major commitments of distinctive and specific resources to strategic initiatives. Tactical actions include refinements or extensions of strategies. Examples of tactical actions include cutting prices, improving gaps in service, or strengthening marketing efforts. Such actions typically draw on general resources and can be implemented quickly. Exhibit 8.6 identifies several types of strategic and tactical competitive actions that illustrate the range of actions that can occur in a rivalrous relationship tactical actions refinements or extensions of strategies usually involving minor resource commitments. EXHIBIT 8.6 Strategic and Tactical Competitive Action Examples page 258 Some competitive actions take the form of frontal assaults, that is actions aimed directly at taking business from another company or capitalizing on industry weaknesses. This can be especially effective when firms use a low-cost strategy. The airline industry provides a good example of this head-on approach. When Southwest Airlines began its no-frills, nomeals strategy in the late 1960s, it represented a direct assault on the major carriers of the day. In Europe, Ryanair has similarly directly challenged the traditional carriers with an overall cost leadership strategy Guerrilla offensives and selective attacks provide an alternative for firms with fewer resources. These draw attention to products or services by creating buzz or generating enough shock value to get some free publicity. TOMS Shoes has found a way to generate interest in its products without a large advertising budget to match Nike. Its policy of donating one pair of shoes to those in need for every pair of shoes purchased by customers has generated a lot of buzz on the Internet 5 Over 3 million people have given a "like" rating on TOMS's Facebook page. The policy has a real impact as well, with over 60 million shoes donated as of January 2017.65 Some companies limit their competitive response to defensive actions. Such actions rarely improve a company's competitive advantage, but a credible defensive action can lower the risk of being attacked and deter new entry. Several of the factors discussed earlier in the chapter, such as types of entry strategies and the use of cost leadership versus differentiation strategies, can guide the decision about what types of competitive actions to take. Before launching a given strategy however, assessing the likely response of competitors is a vital step Likelihood of Competitive Reaction The final step before initiating a competitive response is to evaluate what a competitor's reaction is likely to be. The logic of competitive dynamics suggests that once competitive actions are initiated, it is likely they will be met with competitive responses. The last step before mounting an attack is to evaluate how competitors are likely to respond Evaluating potential competitive reactions helps companies plan for future counterattacks. It may also lead to a decision to hold off-that is not to take any competitive action at all because of the possibility that a misguided or poorly planned response will generate a devastating competitive reaction How a competitor is likely to respond will depend on the factors, market dependence, competitor's resources, and the reputation of the firm that initiates the action (actor's reputation). The implications of each of these are described briefly as follows. Market Dependence of a company has a high concentration of its business in a particular industry, it has more at sake because it must depend on that industry's market for its sales. Single-industry businesses or those where one industry dominates are more likely to mount a competitive response. Young and small firms with a high degree of market dependence may be limited in how they respond due to reconstraints market dependence Market Dependence of a company has a high concentration of its business in a particular industry, it has more at stake because it must depend on that industry's market for its sales. Single-industry businesses or those where one industry dominates are more likely to mount a competitive response. Young and small firms with a high degree of market dependence may be limited in how they respond due to resource constraints market dependence degree of concentration of a firm's business in a particular industry Competitor's Resources Previously, we examined the internal resource endowments that a company must evaluate when assessing its capability to respond. Here, it is the competitor's resources that need to be considered. For example, a small firm may be unable to mount a serious attack due to lack of resources. As a result, it is more likely to react to tactical actions such as incentive pricing or 246 enhanced service offerings because they are less costly to attack than large-scale strategic actions. In contrast, a firm with financial "deep pockets" may be able to mount and sustain a costly counterattack Actor's Reputation whether a company should respond to a competitive challenge will also depend on who launched the attack against it. Compared to relatively smaller firms with less market power, competitors are more likely to respond to competitive moves by market leaders. Another consideration is how successful prior attacks have been. For example, price cutting by the big automakers usually has the desired result increased sales to price-sensitive buyers least in the short run. Given that history, when GM offers discounts or incentives, rivals Fond and Chrysler cannot afford to ignore the challenge and quickly follow suit. page 259 8.5 STRATEGY SPOTLIGHT ETHICS New competitive action Threat analysis Motivation and capability to respond Likelihood of competitive reaction Types of competitive action + inne omnitor Analis and Interfirm Pivalry Toward a Theoretical Integration Academy of Management Review, 21 242 24 Why de companies and competitive There are several Expedia desenes, and grow the busies. Some companies are also move found competitie came walue light cancy can, and the time mpended with the back on my and more folefice degre. This is indicative of the competitive mode Asema Andy Greated in c.contain the wall diction. The com you. When a company to market for the first time, the competens indicati any of the eyes can be used to le competitive action et comprends come tant. Some of the most competition incumbentang book Modell Are You Playing Pleyor Playing Wines the fores The bod that a compete will depend on many changed competiciones.com.mm.com Threat Analysis rullering competition companies wederom the companied behee.com and the complete This may requirement in and ag of the watcribed in Chapter 2. Ames lleingar of competion and come of what that they might otheep that crew complete become pam.componente danks wekely to be more among companies . Maria Wher recompensare wing for the man For emplaceme Bongd Aibus love high degree of market commerce products and a buyers in com elecommunications provides that when it comes and how it be prestige gesigsuis, and telles par255 Despre ava Recent Com company harmacy became cases where there is an importa.company website How gamme de vacances will be determined by se aadition is pair. pare is here in mabut pe in the descoperite pe Motivation and Capability to respond Owencompete with desting how to deciding way will pand berheases for pined the capabiliyopdagede de int, few series to be part of the competitiveneck to which they were ample, post called by a smaller.company way electing 244 Aman's claim that it was a boolecam & Nobleway wing the Companies posing to respond to competitive dig med mig Whe of the competitive problemack of the competere pyar Sometimes the most company can hope for is the media comed by competection Fanpa runter fyras aps. The Wall Sever for the New York Times by linge New York die bestemme direct competition. The ack when they all the Times was in de financial condition and would be mustasch op Whabe das fadalla.com Save an anyol el sghandwerkerngroepe we? Comide the role of fimage and share in calculating a company's eyed More wal. The alle samme compued lapsed heya wapewe of the low and where they technology, for example, allow all form to deploy cucina pome.com older larger im may have made of compete with Come around to be perfumesc lock with the comedy scelente Other mon may playaradelles.com benching products production. For the prachem have both the challe to make much functional man the capital them Types of competitive Actions propriate. The maker will be determined by the wala. What faciley, armering with the company. Such action gick Tactical actions includes ressogies Eames marketing elit. Sed typically 36 several types of age and will competitive contengo Charging production caping online wens. This can be especially elective wheel.com desangle for Wheels beim direct in the major care of the day. In Europe. Har handlar directly challenge wervices by creating being hack vare publicity TOMS Shoes ne in its products with a large averting bulgt i madh kelis policy of ting rating TOMS boke. The policy has mal impacts will with honda Some companies in their competitive metodelline action such any.com advantage, but credible determine action can lower the real bring med den Several of the factor de care le the chapas, kas palygio differences, compute the decise be what types of competech.com Likelihood of Competitive Reaction kwa lowcow well companie informed, med de Because of the possibility and oppose wiedeg come How a competitor is likely respond will depend on the market dependence.com the firm that in the action car's iets. The come ad edited Mark Dependence company has accions espany, depend on the industry's market for Single-industry una competitive due to its Computer Rear Previously with less that com cap a pond. He is the compresses had become Foreca 246 nhanced writing because they are only the locale Acer portation whether a company should respond to come denge will be dependenced the market. As com is how well price it Compared to live aller forms with mr pour company opend shwe bomo por com din orice, lahodd Chrysler comme 8.5 STRATEGY SPOTLIGHT ETHICS CLEANING UP IN THE SOAP BUSINESS Consumer product companies Colgate-Palmolive Procw Gamle the business regions found her a long tin, of prices for early a decade in the word of been them and clean up the market. The Art de la Concurce, tingin ter coming soon The ones sharing rong women 1000 bytes Pulsuste ning see our brand directory agreed to contengon They agreed to reach of whers. They were for Hugue tornard Christian Polive From www meetings fous ayew The meetings, which they called on checked med hende soon. They would be complepring schemes. For example PG ale product and coordinadora come mademy would be asha y complembut whether and to ofertad ending The counted for a broke down in 2004 Price with Choosing Not to React: Forbearance and Co-opetition The above discuss that there may be many cross in which the best Barbearance-ing from acting Motivation and Capability to respond Once attacked, competitors are faced with deciding how to respond. Before deciding, however, they need to evaluate not only how they will respond but also their reasons for responding and their capability to respond. Companies need to be clear about what problems a competitive response is expected to address and what types of problems it might create. There are several factors to consider. First, how serious is the impact of the competitive attack to which they are responding? For example, a large company with a strong reputation that is challenged by a small or unknown company may elect to simply keep an eye on the new competitor rather than quickly react or overreact. Part of the story of online retailer Amazon's early success is attributed to Bames & Noble's overreaction to 244 Amazon's claim that it was earth's biggest bookstore." Because Bames & Noble was already using the phrase "world's largest bookstore." it sued Amazon, but lost. The confrontation made it to the front pages of The Wall Street Journal, and Amazon was on its way to becoming a household name.co Companies planning to respond to a competitive challenge must also understand their motivation for responding. What is the intent of the competitive response? Is it merely to blunt the attack of the competitor, or is it an opportunity to enhance its competitive position? Sometimes the most a company can hope for is to minimize the damage caused by a competitive action A company that seeks to improve its competitive advantage may be motivated to launch an attack rather than merely respond to one. For example, a number of years ago. The Wall Street Journal (WSJ) attacked the New York Times by adding a local news section to the New York edition of the WS). Its aim was to become a more direct competitor of the Times. The publishers of the WS/ undertook this attack when they realized the Times was in a weakened financial condition and would be unable to respond to the attack. A company must also assess its capability to respond. What strategic resources can be deployed to fend off a competitive attack? Does the company have an array of internal strengths it can draw on, or is it operating from a position of weakness? Consider the role of firm age and size in calculating a company's ability to respond. Most entrepreneurial new ventures start out small. The smaller size makes them more nimble compared to large firms so they can respond quickly to competitive attacks. Because they are not well-known, start-ups also have the advantage of the element of surprise in how and when they attack. Innovative uses of technology, for example, allow small firms to deploy resources in unique ways. Because they are young, however, start-ups may not have the financial resources needed to follow through with a competitive response. In contrast, older and larger firms may have more resources and a repertoire of competitive techniques they can use in a counterattack. Large firms, however, tend to be slower to respond. Older firms tend to be predictable in their responses because they often lose touch with the competitive environment and rely on strategies and actions that have worked in the past. Other resources may also play a role in whether a company is equipped to retaliate. For example, one avenue of counterattack may be launching product enhancements or new product service innovations. For that approach to be successful, it requires a company to have both the intellectual capital to put forward viable innovations and the teamwork skills to prepare a new product or service and get it to market. Resources such as cross-functional teams and the social capital that makes teamwork production effective and efficient represent the type of human capital resources that enhance a company's capability to respond. Types of Competitive Actions Once an organization determine whether it is willing and able to launch a competitive action, it must determine what type of action is appropriate. The actions taken will be determined by both its resource capabilities and its motivation for responding. There are also marketplace considerations. What types of actions are likely to be most effective given a company's internal strengths and weaknesses as well as market conditions? page 257 Two broadly defined types of competitive action include strategic actions and tactical actions. Strategic actions represent major commitments of distinctive and specific resources. Examples include Launching a breakthrough innovation, building a new production facility, or merging with another company. Such actions require significant planning and resources and, once initiated, are difficult to reverse strategic actions major commitments of distinctive and specific resources to strategic initiatives Tactical actions include refinements or extensions of strategies. Examples of tactical actions include cutting prices, improving gaps in service, or strengthening marketing efforts. Such actions typically draw on general resources and can be implemented quickly. Exhibit 8.6 identifies several types of strategic and tactical competitive actions that illustrate the range of actions that can occur in a rivalrous relationship tactical actions refinements or extensions of strategies usually involving minor resource comments Now competitive action Threat analysis Motivation and capability to respond Likelihood of competitive reaction Types of competitive action Sources: Adapted from Chen, M. J. 1996. Competitor Analysis and Interfirm Rivalry: Toward a Theoretical Integration Academy of Management Review. 21(1): 100-136, Ketchen, D.J.Snow C.C. & Hoover, V. L. 2004. Research on Competitive Dynamics: Recent Accomplishments and Future Challenges. Journal of Management, 30(G) 779-804 and Smith, K.G. Ferrier, W., & Grimm, C. M. 2001. King of the Hill: Delwoning the Industry leader. Academy of Management Executive, 15259-70 page 254 Why do companies launch new competitive actions? There are several reasons: Improve market position Capitalize on growing demand Expand production capacity Provide an innovative new solution Obtain first-mover advantages Underlying all of these reasons is a desire to strengthen financial outcomes, capture some of the extraordinary profits that industry leaders enjoy, and grow the business. Some companies are also motivated to launch competitive challenges because they want to build their reputation for innovativeness or efficiency. For example, Toyota's success with the Prius signaled to its competitors the potential value of high-fuel-economy cars, and these firms have responded with their own hybrids, electric cars, high-efficiency diesel engines, and even more fuel-efficient traditional gasoline engines. This is indicative of the competitive dynamic cycle. As former Intel chairman Andy Grove stated, "Business success contains the seeds of its own destruction. The more successful you are, the more people want a chunk of your business and then another chunk and then another until there is nothing left. 53 When a company enters into a market for the first time, it is an attack on existing competitors. As indicated earlier in the chapter, any of the entry strategies can be used to take competitive action. But competitive attacks come from many sources besides new entrants. Some of the most intense competition is among incumbent rivals intent on gaining strategic advantages. "Winners in business play rough and don't apologize for it," according to Boston Consulting Group authors George Stalk, Jr., and Rob Lachenauer in their book Hardball: Are You Playing to Play or Playing to Win 754 Exhibit 8.5 outlines their five strategies. The likelihood that a competitor will launch an attack depends on many factors. In the remaining sections, we discuss factors such as competitor analysis, market conditions, types of strategic actions, and the resource endowments and capabilities companies need to take competitive action Threat Analysis Prior to actually observing a competitive action, companies may need to become aware of potential competitive threats. That is, companies need to have a keen sense of who their closest competitors are and the kinds of competitive actions they might be planning.96 This may require some environmental scanning and monitoring of the sort described in Chapter 2. Awareness of the threats posed by industry rivals allows a firm to understand what type of competitive response, if any, may be necessary. threat analysis a firm's awareness of its closest compettors and the kinds of competitive actions they might be planning Reine aware of romnetitors and onenizant of whatever threats they might now is the first sten in assessing the level of comnetitive Threat Analysis Prior to actually observing a competitive action, companies may need to become aware of potential competitive threats. That is, companies need to have a keen sense of who their closest competitors are and the kinds of competitive actions they might be planning. This may require some environmental scanning and monitoring of the sort described in Chapter 2. Awareness of the threats posed by industry rivals allows a firm to understand what type of competitive response, if any, may be necessary. threat analysis afirm's awareness of its closest competitors and the kinds of competitive actions they might be planning, Being aware of competitors and cognizant of whatever threats they might pose is the first step in assessing the level of competitive threat. Once a new competitive action becomes apparent companies must determine how threatening it is to their business. Competitive dynamics are likely to be most intense among companies that are competing for the same customers or that have highly similar sets of resources. 57 Two factors are used to assess whether or not companies are close competitors: Market commonality. Whether or not competitors are vying for the same customers and how many markets they share in common For example, aircraft manufacturers Boeing and Airbus have a high degree of market commonality because they make very similar products and have many buyers in common. Resource similarity. The degree to which rivals draw on the same types of resources to compete. For example, Huawei and Nokia are telecommunications equipment providers that are based in different continents and have different histories, but they have patent rights to similar technologies, high quality engineering staffs, and global sales forces. market commonality the extent to which competitors are vying for the same customers in the same markets resource similarity the extent to which was drow from the same types of strategic resources Amazon's claim that it was earth's biggest bookstore." Because Barnes & Noble was already using the phrase "world's largest bookstore," it sued Amazon, but lost. The confrontation made it to the front pages of The Wall Street Journal, and Amazon was on its way to becoming a household name Companies planning to respond to a competitive challenge must also understand their motivation for responding. What is the intent of the competitive response? Is it merely to blunt the attack of the competitor, or is it an opportunity to enhance its competitive position? Sometimes the most a company can hope for is to minimize the damage caused by a competitive action. A company that seeks to improve its competitive advantage may be motivated to launch an attack rather than merely respond to one. For example, a number of years ago, The Wall Street Journal (WSJ) attacked the New York Times by adding a local news section to the New York edition of the WSJ. Its aim was to become a more direct competitor of the Times. The publishers of the WSJ undertook this attack when they realized the Times was in a weakened financial condition and would be unable to respond to the attack 61 A company must also assess its capability to respond. What strategic resources can be deployed to fend off a competitive attack? Does the company have an array of internal strengths it can draw on, or is it operating from a position of weakness? Consider the role of firm age and size in calculating a company's ability to respond. Most entrepreneurial new ventures start out small. The smaller size makes them more nimble compared to large firms so they can respond quickly to competitive attacks. Because they are not well-known, start-ups also have the advantage of the element of surprise in how and when they attack. Innovative uses of technology, for example, allow small firms to deploy resources in unique ways. Because they are young however, start-ups may not have the financial resources needed to follow through with a competitive response. In contrast, older and larger firms may have more resources and a repertoire of competitive techniques they can use in a counterattack. Large firms, however, tend to be slower to respond. Older firms tend to be predictable in their responses because they often lose touch with the competitive environment and rely on strategies and actions that have worked in the past. Other resources may also play a role in whether a company is equipped to retaliate. For example, one avenue of counterattack may be launching product enhancements or new product service innovations. For that approach to be successful, it requires a company to have both the intellectual capital to put forward viable innovations and the teamwork skills to prepare a new product or service and get it to market. Resources such as cross-functional teams and the social capital that makes teamwork production effective and efficient represent the type of human capital resources that enhance a company's capability to respond Tornemmela Andere Types of Competitive Actions Once an organization determines whether it is willing and able to launch a competitive action, it must determine what type of action is appropriate. The actions taken will be determined by both its resource capabilities and its motivation for responding. There are also marketplace considerations. What types of actions are likely to be most effective given a company's internal strengths and weaknesses as well as market conditions? page 257 Two broadly defined types of competitive action include strategic actions and tactical actions. Strategic actions represent major commitments of distinctive and specific resources. Examples include launching a breakthrough innovation, building a new production facility, or merging with another company. Such actions require significant planning and resources and, once initiated, are difficult to reverse strategic actions major commitments of distinctive and specific resources to strategic initiatives. Tactical actions include refinements or extensions of strategies. Examples of tactical actions include cutting prices, improving gaps in service, or strengthening marketing efforts. Such actions typically draw on general resources and can be implemented quickly. Exhibit 8.6 identifies several types of strategic and tactical competitive actions that illustrate the range of actions that can occur in a rivalrous relationship tactical actions refinements or extensions of strategies usually involving minor resource commitments. EXHIBIT 8.6 Strategic and Tactical Competitive Action Examples page 258 Some competitive actions take the form of frontal assaults, that is actions aimed directly at taking business from another company or capitalizing on industry weaknesses. This can be especially effective when firms use a low-cost strategy. The airline industry provides a good example of this head-on approach. When Southwest Airlines began its no-frills, nomeals strategy in the late 1960s, it represented a direct assault on the major carriers of the day. In Europe, Ryanair has similarly directly challenged the traditional carriers with an overall cost leadership strategy Guerrilla offensives and selective attacks provide an alternative for firms with fewer resources. These draw attention to products or services by creating buzz or generating enough shock value to get some free publicity. TOMS Shoes has found a way to generate interest in its products without a large advertising budget to match Nike. Its policy of donating one pair of shoes to those in need for every pair of shoes purchased by customers has generated a lot of buzz on the Internet 5 Over 3 million people have given a "like" rating on TOMS's Facebook page. The policy has a real impact as well, with over 60 million shoes donated as of January 2017.65 Some companies limit their competitive response to defensive actions. Such actions rarely improve a company's competitive advantage, but a credible defensive action can lower the risk of being attacked and deter new entry. Several of the factors discussed earlier in the chapter, such as types of entry strategies and the use of cost leadership versus differentiation strategies, can guide the decision about what types of competitive actions to take. Before launching a given strategy however, assessing the likely response of competitors is a vital step Likelihood of Competitive Reaction The final step before initiating a competitive response is to evaluate what a competitor's reaction is likely to be. The logic of competitive dynamics suggests that once competitive actions are initiated, it is likely they will be met with competitive responses. The last step before mounting an attack is to evaluate how competitors are likely to respond Evaluating potential competitive reactions helps companies plan for future counterattacks. It may also lead to a decision to hold off-that is not to take any competitive action at all because of the possibility that a misguided or poorly planned response will generate a devastating competitive reaction How a competitor is likely to respond will depend on the factors, market dependence, competitor's resources, and the rep