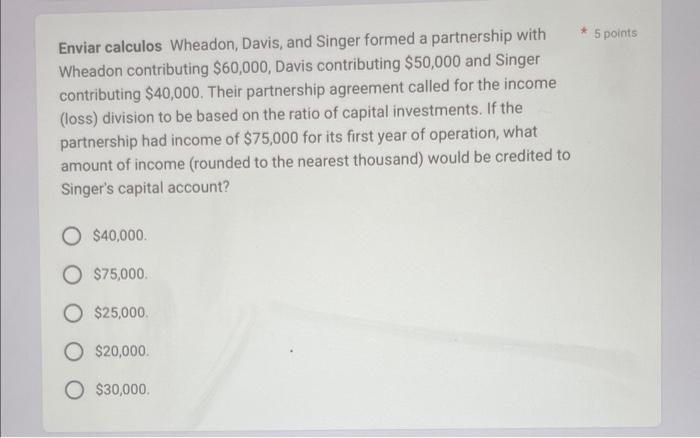

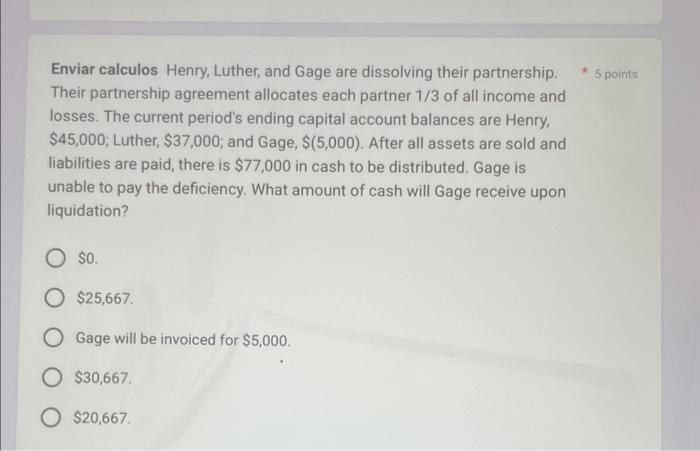

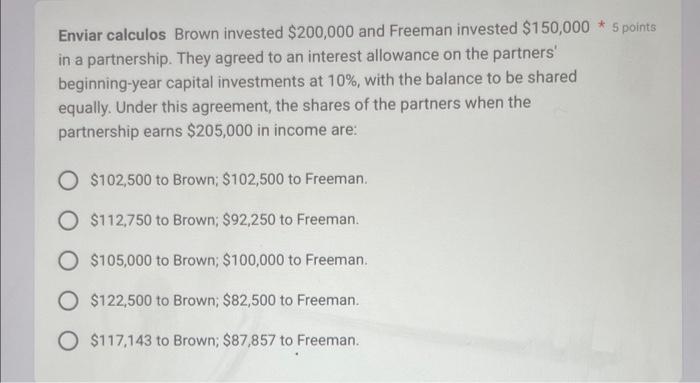

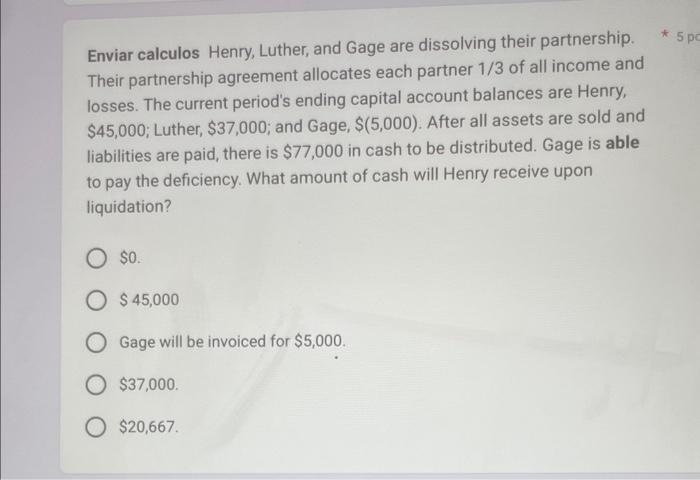

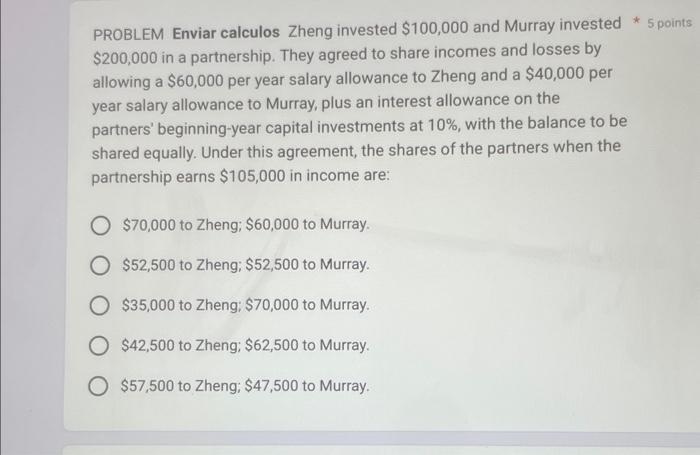

Enviar calculos Wheadon, Davis, and Singer formed a partnership with 5 points Wheadon contributing $60,000, Davis contributing $50,000 and Singer contributing $40,000. Their partnership agreement called for the income (loss) division to be based on the ratio of capital investments. If the partnership had income of $75,000 for its first year of operation, what amount of income (rounded to the nearest thousand) would be credited to Singer's capital account? $40,000 $75,000 $25,000 $20,000. $30,000. Enviar calculos Henry, Luther, and Gage are dissolving their partnership. * 5 points Their partnership agreement allocates each partner 1/3 of all income and losses. The current period's ending capital account balances are Henry, $45,000; Luther, $37,000; and Gage, $(5,000). After all assets are sold and liabilities are paid, there is $77,000 in cash to be distributed. Gage is unable to pay the deficiency. What amount of cash will Gage receive upon liquidation? S0. $25,667. Gage will be invoiced for $5,000. $30,667. $20,667. Enviar calculos Brown invested $200,000 and Freeman invested $150,000 points in a partnership. They agreed to an interest allowance on the partners' beginning-year capital investments at 10%, with the balance to be shared equally. Under this agreement, the shares of the partners when the partnership earns $205,000 in income are: $102,500 to Brown; $102,500 to Freeman. $112,750 to Brown; $92,250 to Freeman. $105,000 to Brown; $100,000 to Freeman. $122,500 to Brown; $82,500 to Freeman. $117,143 to Brown; $87,857 to Freeman. Enviar calculos Henry, Luther, and Gage are dissolving their partnership. Their partnership agreement allocates each partner 1/3 of all income and losses. The current period's ending capital account balances are Henry, $45,000; Luther, $37,000; and Gage, $(5,000). After all assets are sold and liabilities are paid, there is $77,000 in cash to be distributed. Gage is able to pay the deficiency. What amount of cash will Henry receive upon liquidation? $0. $45,000 Gage will be invoiced for $5,000. $37,000. $20,667. PROBLEM Enviar calculos Zheng invested $100,000 and Murray invested * 5 point $200,000 in a partnership. They agreed to share incomes and losses by allowing a $60,000 per year salary allowance to Zheng and a $40,000 per year salary allowance to Murray, plus an interest allowance on the partners' beginning-year capital investments at 10%, with the balance to be shared equally. Under this agreement, the shares of the partners when the partnership earns $105,000 in income are: $70,000 to Zheng; $60,000 to Murray. $52,500 to Zheng; $52,500 to Murray. $35,000 to Zheng; $70,000 to Murray. $42,500 to Zheng; $62,500 to Murray. $57,500 to Zheng; $47,500 to Murray