Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Enzo Ltd is a CCPC located to Moose Jaw, SK. The company also has some operations in the United States. Enzo had the following

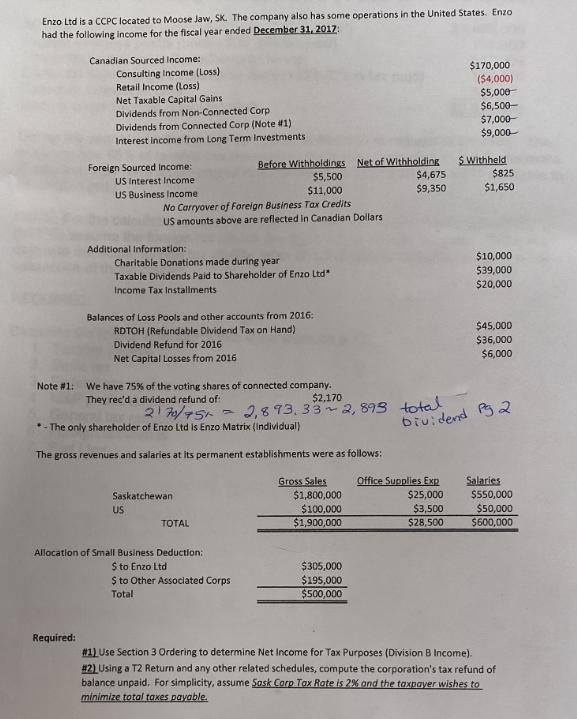

Enzo Ltd is a CCPC located to Moose Jaw, SK. The company also has some operations in the United States. Enzo had the following income for the fiscal year ended December 31, 2017: Canadian Sourced Income: Consulting Income (Loss) Retail Income (Loss) Net Taxable Capital Gains Dividends from Non-Connected Corp Dividends from Connected Corp (Note #1) $170,000 ($4,000) $5,000 $6,500- $7,000- Interest income from Long Term Investments $9,000 Foreign Sourced Income: Before Withholdings Net of Withholding $ Withheld US Interest Income US Business Income $5,500 $4,675 $825 $11,000 $9,350 $1,650 No Carryover of Foreign Business Tax Credits US amounts above are reflected in Canadian Dollars Additional Information: Charitable Donations made during year Taxable Dividends Paid to Shareholder of Enzo Ltd" Income Tax Installments $10,000 $39,000 $20,000 Balances of Loss Pools and other accounts from 2016: RDTOH (Refundable Dividend Tax on Hand) Dividend Refund for 2016 Net Capital Losses from 2016 Note #1: We have 75% of the voting shares of connected company. They rec'd a dividend refund of: 2170/751 A $2,170 2,893. 332, 893 total The only shareholder of Enzo Ltd is Enzo Matrix (Individual) The gross revenues and salaries at its permanent establishments were as follows: $45,000 $36,000 $6,000 Dividend Pg 2 Saskatchewan US TOTAL Gross Sales $1,800,000 $100,000 $1,900,000 Allocation of Small Business Deduction: $ to Enzo Ltd $305,000 $ to Other Associated Corps. Total $195,000 $500,000 Required: Office Supplies Exp Salaries $25,000 $550,000 $3,500 $28,500 $50,000 $600,000 #1) Use Section 3 Ordering to determine Net Income for Tax Purposes (Division B Income). #2) Using a T2 Return and any other related schedules, compute the corporation's tax refund of balance unpaid. For simplicity, assume Sask Carp Tax Rate is 2% and the taxpayer wishes to minimize total taxes payable.

Step by Step Solution

★★★★★

3.38 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

To determine the Net Income for Tax Purposes Division B Income using Section 3 Ordering we need to f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started