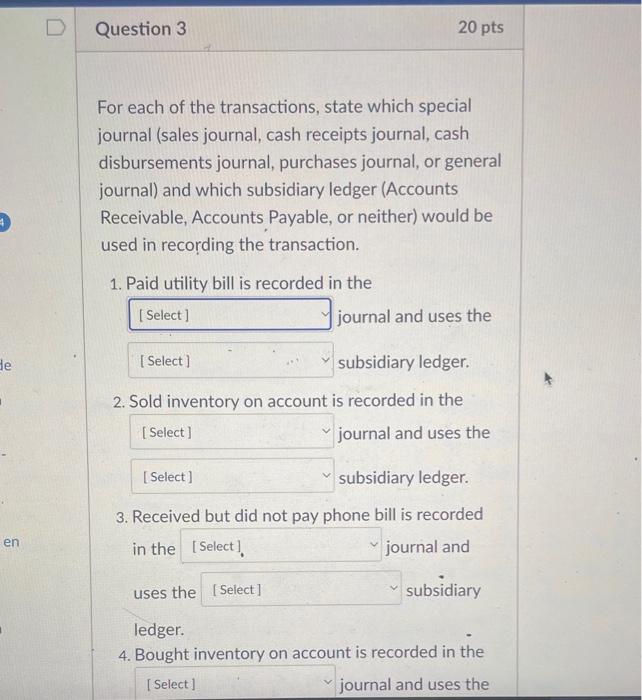

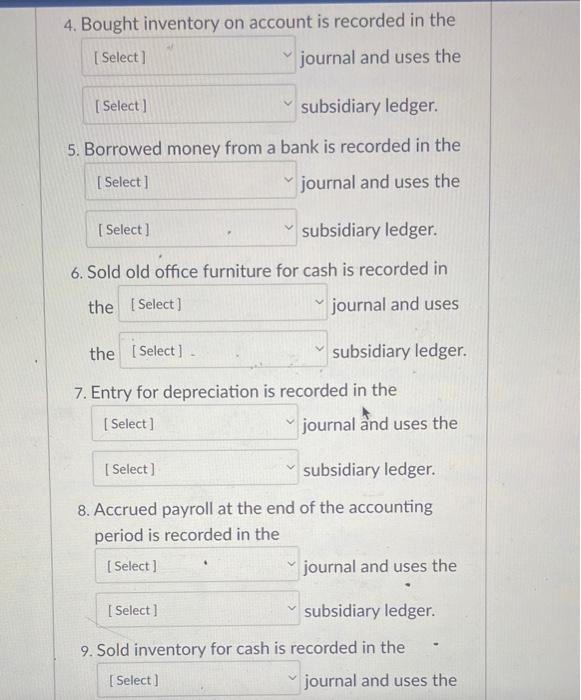

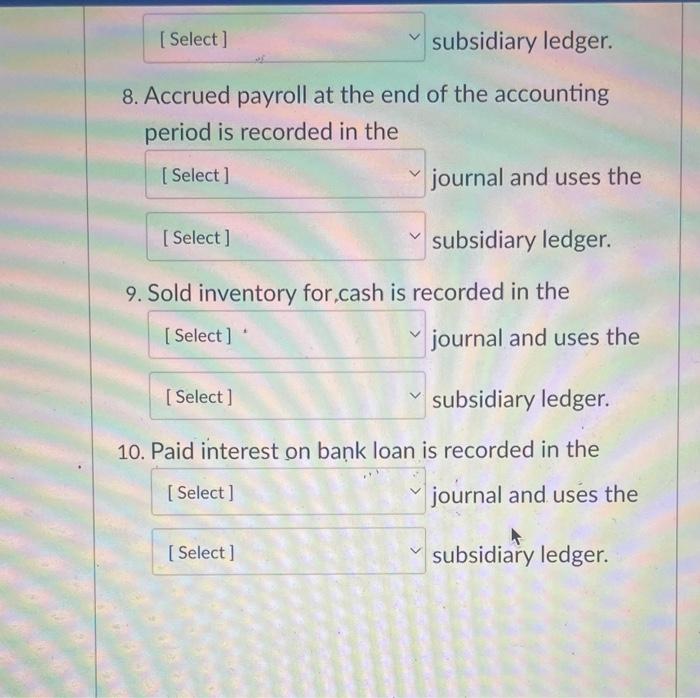

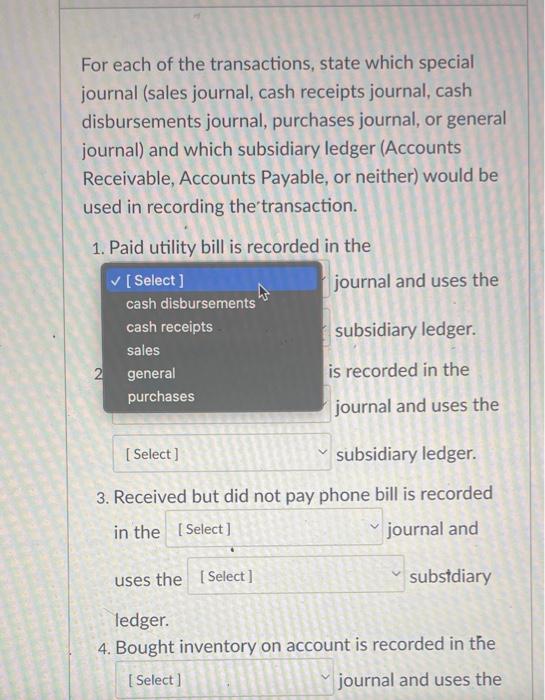

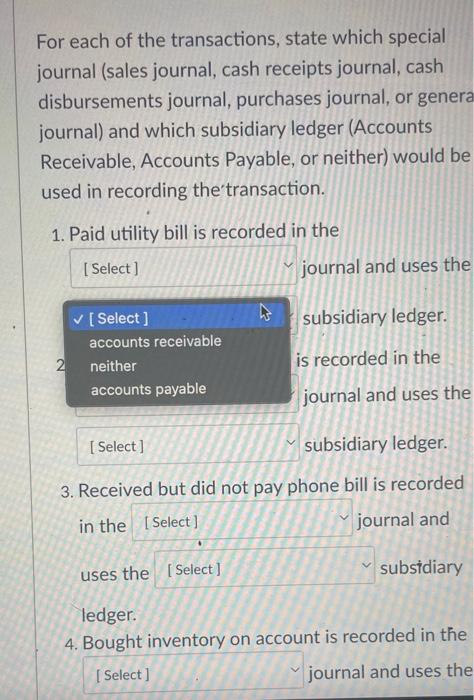

Eor each of the transactions, state which special ournal (sales journal, cash receipts journal, cash disbursements journal, purchases journal, or general journal) and which subsidiary ledger (Accounts Receivable, Accounts Payable, or neither) would be used in recording the transaction. 1. Paid utility bill is recorded in the journal and uses the subsidiary ledger. 2. Sold inventory on account is recorded in the journal and uses the subsidiary ledger. 3. Received but did not pay phone bill is recorded in the journal and uses the subsidiary ledger. 4. Bought inventory on account is recorded in the 4. Bought inventory on account is recorded in the journal and uses the subsidiary ledger. 5. Borrowed money from a bank is recorded in the journal and uses the subsidiary ledger. 6. Sold old office furniture for cash is recorded in the journal and uses the subsidiary ledger. 7. Entry for depreciation is recorded in the journal nd uses the subsidiary ledger. 8. Accrued payroll at the end of the accounting period is recorded in the journal and uses the subsidiary ledger. 9. Sold inventory for cash is recorded in the journal and uses the 8. Accrued payroll at the end of the accounting period is recorded in the journal and uses the subsidiary ledger. 9. Sold inventory for,cash is recorded in the journal and uses the subsidiary ledger. 10. Paid interest on bank loan is recorded in the journal and uses the subsidiary ledger. For each of the transactions, state which special journal (sales journal, cash receipts journal, cash disbursements journal, purchases journal, or general journal) and which subsidiary ledger (Accounts Receivable, Accounts Payable, or neither) would be used in recording the transaction. 1. Paid utility bill is recorded in the journal and uses the subsidiary ledger. is recorded in the journal and uses the subsidiary ledger. 3. Received but did not pay phone bill is recorded in the journal and uses the substdiary ledger. 4. Bought inventory on account is recorded in the journal and uses the For each of the transactions, state which special journal (sales journal, cash receipts journal, cash disbursements journal, purchases journal, or genera journal) and which subsidiary ledger (Accounts Receivable, Accounts Payable, or neither) would be used in recording the transaction. 1. Paid utility bill is recorded in the journal and uses the subsidiary ledger. is recorded in the journal and uses the subsidiary ledger. 3. Received but did not pay phone bill is recorded in the journal and uses the subsidiary ledger. 4. Bought inventory on account is recorded in the journal and uses the