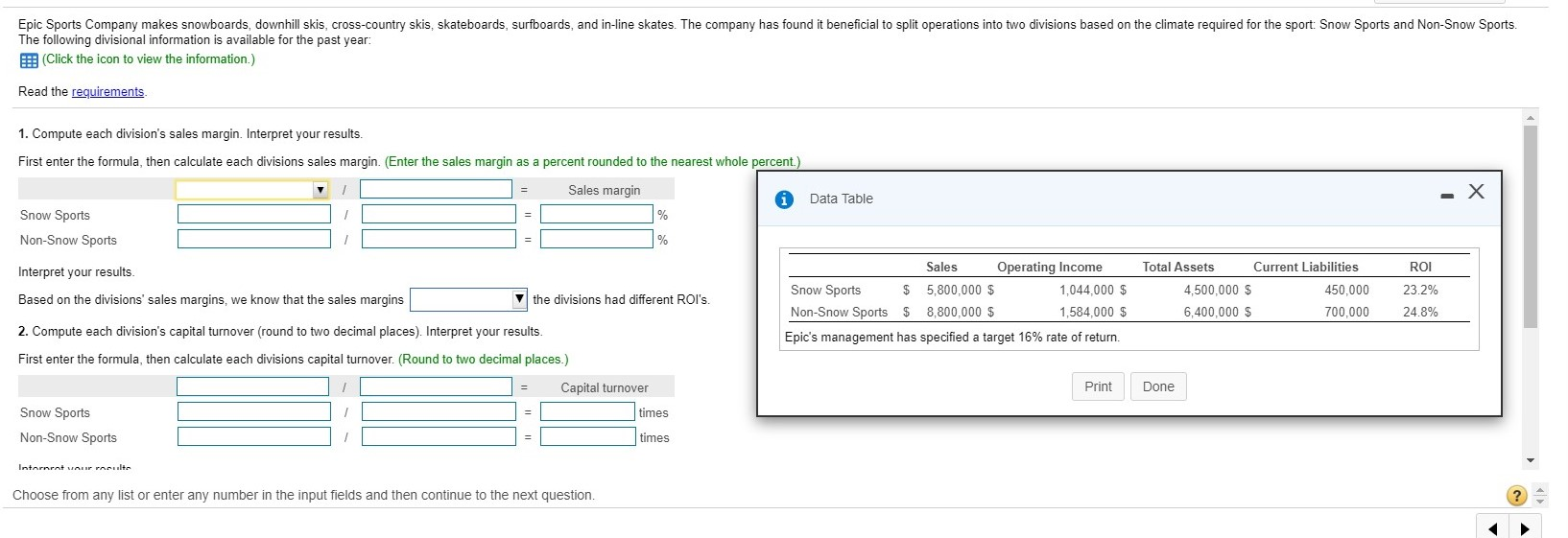

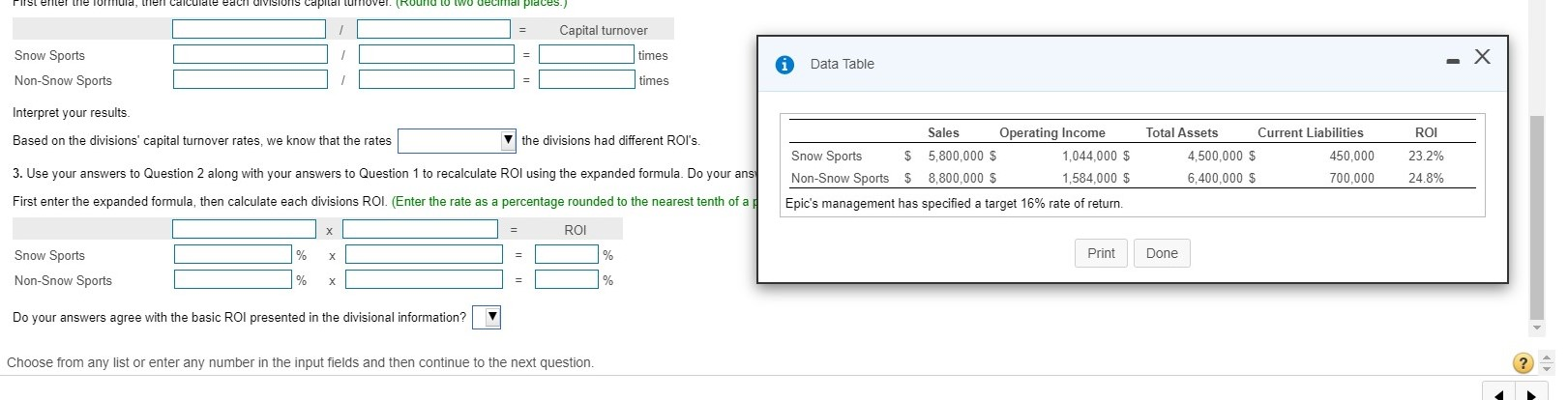

Epic Sports Company makes snowboards, downhill skis, cross-country skis, skateboards, surfboards, and in-line skates. The company has found it beneficial to split operations into two divisions based on the climate required for the sport: Snow Sports and Non-Snow Sports. The following divisional information is available for the past year: (Click the icon to view the information.) Read the requirements 1. Compute each division's sales margin. Interpret your results. First enter the formula, then calculate each divisions sales margin. (Enter the sales margin as a percent rounded to the nearest whole percent.) Sales margin Data Table X Snow Sports Non-Snow Sports Interpret your results. ROI Total Assets Current Liabilities 4,500,000 $ 450.000 6,400,000 $ 700,000 23.2% Based on the divisions' sales margins, we know that the sales margins Sales Operating Income Snow Sports $ 5,800,000 $ 1,044,000 $ Non-Snow Sports $ 8,800,000 $ 1,584,000 $ Epic's management has specified a target 16% rate of return. the divisions had different ROI's. 24.8% 2. Compute each division's capital turnover (round to two decimal places). Interpret your results. First enter the formula, then calculate each divisions capital turnover. (Round to two decimal places.) 1 Capital turnover Print Done 1 times Snow Sports Non-Snow Sports times Internet var racite Choose from any list or enter any number in the input fields and then continue to the next question. First enter the formule, then calculele ederi divisions capital turnover. (Round to two decimal places. Capital turnover Snow Sports times -X Data Table Non-Snow Sports times Interpret your results. ROI Based on the divisions' capital turnover rates, we know that the rates the divisions had different ROI's. Sales Operating Income Snow Sports $ 5,800,000 $ 1,044,000 $ Non-Snow Sports 8,800,000 $ 1,584,000 $ Epic's management has specified a target 16% rate of return Total Assets Current Liabilities 4,500,000 $ 450,000 6,400,000 $ 700,000 23.2% 24.8% 3. Use your answers to Question 2 along with your answers to Question 1 to recalculate ROI using the expanded formula. Do your ans First enter the expanded formula, then calculate each divisions ROI. (Enter the rate as a percentage rounded to the nearest tenth of a $ ROI % X % Print Done Snow Sports Non-Snow Sports % X % Do your answers agree with the basic ROI presented in the divisional information? Choose from any list or enter any number in the input fields and then continue to the next