Answered step by step

Verified Expert Solution

Question

1 Approved Answer

epton Inc. is a bioengineering firm founded five years ago by a team of biologists. A ven- ture capitalist has funded Lepton's research during

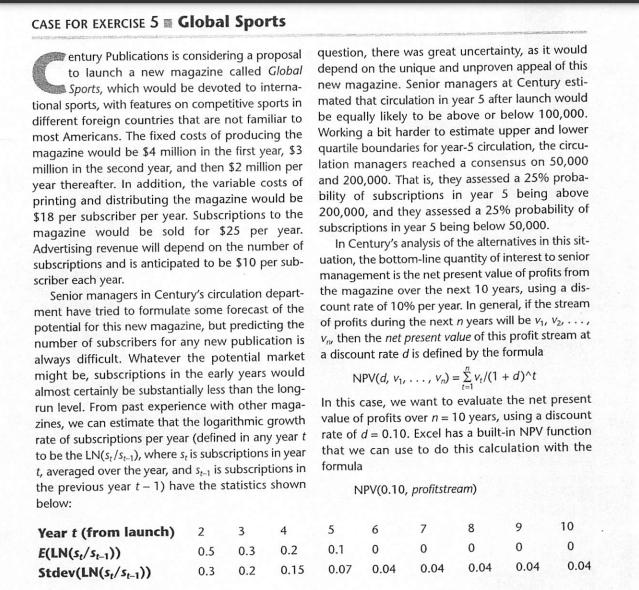

epton Inc. is a bioengineering firm founded five years ago by a team of biologists. A ven- ture capitalist has funded Lepton's research during most of this time in exchange for a control- ling interest in the firm. Lepton's research during this period has been focused on the problem of developing a bacterium that can synthesize HP-273, a protein with great pharmacological and medical potential. This year, using new methods of genetic engineering, Lepton has at last succeeded in creat- ing a bacterium that produces synthetic HP-273 protein. Lepton can now get a patent for this bacterium, but the patented bacterium will be worthless unless the FDA approves the synthetic protein that it pro- duces for pharmacological use. The process of get- ting FDA approval has two stages. The first stage involves setting up a pilot plant and testing the syn- thetic protein on animal subjects to get the prelim- inary certification of safety that is required before any human testing can be done. The second stage involves an extensive medical study for safety and effectiveness using human subjects. Lepton's engineers believe that the cost of the first stage could equally likely be above or below $9 million, has probability 0.25 of being below $7 mil- lion, and has probability 0.25 of being above $11 million. The probability of successfully getting a pre- liminary certification of safety at the end of this first stage is 0.3. The cost of taking the synthetic protein though the second-stage extensive medical study has a net present value that is equally likely to be above or below $20 million, has probability 0.25 of being below $16 million, and has probability 0.25 of being above $24 million. Given first-stage certification, if Lepton takes the synthetic HP-273 protein through this second stage, then the conditional probability of getting full FDA approval for its pharmacological use is 0.6. If Lepton gets full FDA approval for pharmaco- logical use of the synthetic HP-273 protein, then Lepton will sell its patent for producing the protein to a major pharmaceutical company. Given full FDA approval, the returns to Lepton from selling its patent would have a present value that is equally likely to be above or below $120 million, has prob- ability 0.25 of being below $90 million, and has probability 0.25 of being above $160 million. Lepton's management has been operating on the assumption that they would be solely responsi- ble for the development of the protein throughout this process, which we may call Plan A. But there are two other alternatives that the owner wants to consider: Plan B: Lepton has received an offer to sell its HP-273 patent for $4 million now, before under- taking any costs in the first stage of the approval process. Plan C: If Lepton succeeds in getting preliminary FDA certification at the end of the first stage, then it could sell a 50% share of the HP-273 project to another bioengineering firm for $25 million. Lepton would then pay only half of the second-stage costs, but it would get only half of the income (if any) from selling the patent. In your analysis of this situation, you may assume that each of the three unknown quantities described (the stage 1 cost, the stage 2 cost after a success at stage 1, and the value of the patent after a success at stage 2) has a probability distribution in the Generalized-Lognormal family. CASE FOR EXERCISE 5 Global Sports C entury Publications is considering a proposal to launch a new magazine called Global Sports, which would be devoted to interna- tional sports, with features on competitive sports in different foreign countries that are not familiar to most Americans. The fixed costs of producing the magazine would be $4 million in the first year, $3 million in the second year, and then $2 million per year thereafter. In addition, the variable costs of printing and distributing the magazine would be $18 per subscriber per year. Subscriptions to the magazine would be sold for $25 per year. Advertising revenue will depend on the number of subscriptions and is anticipated to be $10 per sub- scriber each year. Senior managers in Century's circulation depart- ment have tried to formulate some forecast of the potential for this new magazine, but predicting the number of subscribers for any new publication is always difficult. Whatever the potential market might be, subscriptions in the early years would almost certainly be substantially less than the long- run level. From past experience with other maga- zines, we can estimate that the logarithmic growth rate of subscriptions per year (defined in any year t to be the LN(S,/s,-1), where s, is subscriptions in year t, averaged over the year, and s, is subscriptions in the previous year t-1) have the statistics shown below: Year t (from launch) 2 3 4 E(LN(s,/St-1)) 0.5 0.3 0.2 Stdev (LN(S/St-1)) 0.3 0.2 0.15 question, there was great uncertainty, as it would depend on the unique and unproven appeal of this new magazine. Senior managers at Century esti- mated that circulation in year 5 after launch would be equally likely to be above or below 100,000. Working a bit harder to estimate upper and lower quartile boundaries for year-5 circulation, the circu- lation managers reached a consensus on 50,000 and 200,000. That is, they assessed a 25% proba- bility of subscriptions in year 5 being above 200,000, and they assessed a 25% probability of subscriptions in year 5 being below 50,000. In Century's analysis of the alternatives in this sit- uation, the bottom-line quantity of interest to senior management is the net present value of profits from the magazine over the next 10 years, using a dis- count rate of 10% per year. In general, if the stream of profits during the next n years will be V, V,..., V, then the net present value of this profit stream at a discount rate d is defined by the formula NPV(d, V,..., V)= ve/(1+d)^t In this case, we want to evaluate the net present value of profits over n = 10 years, using a discount rate of d= 0.10. Excel has a built-in NPV function that we can use to do this calculation with the formula NPV(0.10, profitstream) 5 0.1 0.07 6 0 0.04 8 7 0 0 0.04 0.04 90 . 0.04 10 0 0.04 Stdev(LN(S/St-1)) 0.3 0.2 0.15 The circulation managers felt comfortable assuming that growth of Global Sports would have statistics similar to these, with subscriptions climb- ing at first and then leveling off at some plateau level after five years. The question remained, How high would this plateau be? On this important 148 Exercises 1. Estimate the expected value and standard deviation of the current owner's profits from Lepton under Plan A and Plan C (see case on p. 147). Then make a cumulative risk profile for each plan. If the current owner of Lepton wants to maximize the expected value of profits, then what plan should we recom- mend and what is the lowest price at which Lepton should consider selling its HP-273 patent now? 0.07 0.04 0.04 CHAPTER 4 Continuous Random Variables. Base your answers on simulation data that include enough so that the radius of your 95% con- fidence interval for the expected value of profit is less than $2 million for both Plan A and Plan C. (That is, you should be able to generate 95% confi- dence intervals of the form x ty, where y is less than $2 million.) How many simulations did you use? What is your 95% confidence interval for expected profit under each plan? 2. (a) Among the three unknown quantities described where profitstream denotes a range of 10 cells (in a row, or in a column) that list the simulated profits over the next 10 years (with the first year's profit at the left or top of the range). For a fuller explanation of net present value, see Section 9.1. lottery paying either $100 million or $0, each with probability 1/2? 4. Consider the following five unknown quantities: (a) The number on the last numbered page of this book. (No peeking!) (b) Age of Columbus when he died. (c) Distance from Chicago to Seattle in miles. (d) Melting point of aluminum (specify F or C). (e) Population of Italy on January 1, 1973. For each of these unknown quantities, assess sub- jective quartile boundary points Q, Q2, Q3, such that Q < Q Q3 and you would be indifferent among the following four lotteries: Lottery 1: You get $5000 if the unknown is less than Qu, but get $0 otherwise. Lottery 2: You get $5000 if the unknown is the form x y, where y is less than $2 million.) How many simulations did you use? What is your 95% confidence interval for expected profit under each plan? 2. (a) Among the three unknown quantities described in the Lepton case (the stage 1 cost, the stage 2 cost, and the value of the patent), which have Normal distributions? Compute the mean and the standard deviation for each Normal random variable. (b) Among the three unknown quantities described in the Lepton case, which have Lognormal dis- tributions? Compute the log-mean and the log- standard-deviation for each Lognormal random variable. (c) Compute the probability that the stage 1 cost will be between $8 and $12 million. Also com- pute the probability that it will be more than $12 million. 3. The venture capitalist who owns Lepton Inc. has said that a lottery paying either $100 million or $0, each with probability 1/2, would be worth just $42 million to him. Assume that he has constant risk tolerance. (a) What is his risk-tolerance constant? (b) Based on your simulation data from Exercise 1, estimate his certainty equivalent for the HP- 273 patent under Plan A and under Plan C. Which plan looks best for him, with such risk tolerance? among the following four lotteries: Lottery 1: You get $5000 if the unknown is less than Q, but get $0 otherwise. Exercises Lottery 2: You get $5000 if the unknown is between Q, and Q, but get $0 otherwise. Lottery 3: You get $5000 if the unknown is between Q and Q3, but get $0 otherwise. Lottery 4: You get $5000 if the unknown is greater than Q, but get $0 otherwise. Then compute the points with 1% and 99% cumu- lative probability in the corresponding Generalized- Lognormal distribution by the formulas GENLINV(0.01, Q, Q Q3) and GENLINV(0.99, Qu Q, Q3). Check whether this Generalized-Lognormal dis- tribution is a good fit to your actual beliefs by asking whether you think that the unknown has a 1/100 probability of being less than GENLINV(0.01, Q, Q2, Q3), and whether you think that the unknown has a 1/100 probability of being greater than GENLINV(0.99, Q, Q2, Q3). If not, then try to reassess the three quartile points until you also get a reasonable 1% point and 99% point from these GENLINV formulas. Suggestions: If GENLINV(0.01, Q, Q, Q3) seems too low, then try increasing Q, or decreasing Q. If GENLINV(0.01, Q, Q Q3) seems too high, then try decreasing Q, or increasing Q- If GENLINV(0.99, Q, Q Q3) seems too low, then try increasing Q, or decreasing Q- (c) What would be the highest risk tolerance for this decision maker such that you would rec- ommend Plan B, selling the HP-273 patent now for $4 million? At this level of risk tolerance, what would be his certainty equivalent for a 5. In the Global Sports case on page 148, If GENLINV(0.99, Q, Q, Q) seems too high, then try decreasing Q, or increasing Q. 149 Which plan looks best for him, with such risk tolerance? (c) What would be the highest risk tolerance for this decision maker such that you would rec- ommend Plan B, selling the HP-273 patent now for $4 million? At this level of risk tolerance, what would be his certainty equivalent for a Exercises (a) Make a simulation model of this situation, use it to estimate the expected net present value of profits from the proposed magazine over the next 10 years, and show the cumulative distri- bution of this net present value, under the assumption that Century will publish this mag- azine for all of the 10 years regardless of its performance. (b) Consider an alternative plan in which, after publishing the magazine for one year, the mag- azine will be terminated if fewer than 35,000 then try decreasing Q, or increasing Q2- If GENLINV(0.99, Q Q Q3) seems too low, then try increasing Q, or decreasing Q- If GENLINV(0.99, Q, Q2, Q3) seems too high, then try decreasing Q, or increasing Q. 5. In the Global Sports case on page 148, 149 subscriptions are sold in the first year (in which case profits will go to $0 in all subsequent years). But if 35,000 or more subscriptions are sold in the first year, then the magazine will be continued, as in part (a), for the rest of the decade. Based on simulation data from your model, estimate the expected net present value of profits under this plan, and show the cumu- lative distribution of the net present value under this plan.

Step by Step Solution

★★★★★

3.33 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

To analyze the situation we can use decision tree analysis to evaluate the three alternative plans Plan A Plan B and Plan C for Lepton Inc in developing and commercializing the synthetic HP273 protein ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started