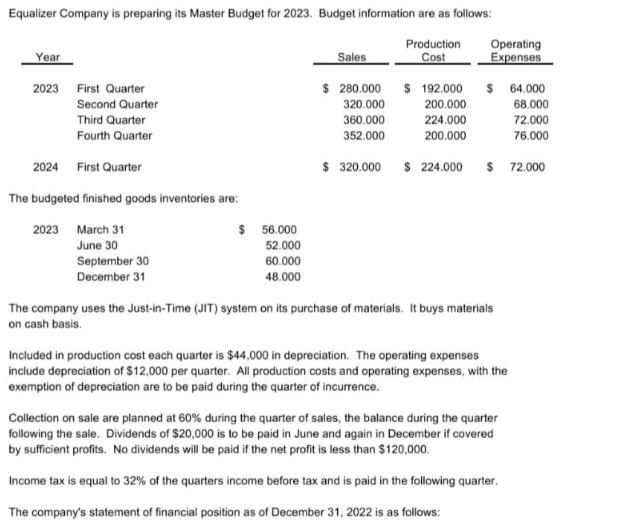

Question: Equalizer Company is preparing its Master Budget for 2023. Budget information are as follows: Production Cost Year 2023 First Quarter Second Quarter Third Quarter

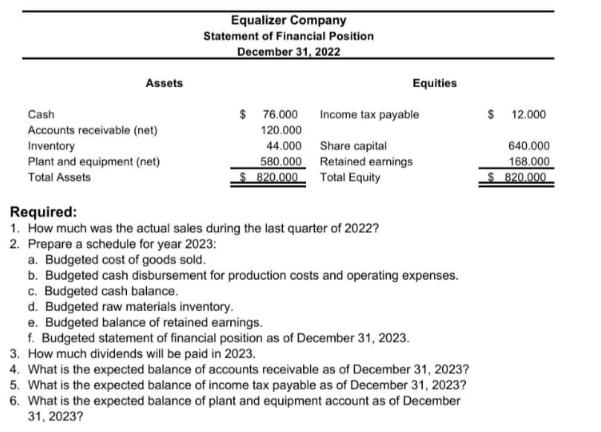

Equalizer Company is preparing its Master Budget for 2023. Budget information are as follows: Production Cost Year 2023 First Quarter Second Quarter Third Quarter Fourth Quarter 2024 First Quarter The budgeted finished goods inventories are: $ 2023 March 31 June 30 September 30 December 31 56.000 52.000 60.000 48.000 Sales $ 280.000 320.000 360.000 352.000 Operating Expenses $ 192.000 $ 64.000 200.000 68.000 224.000 72.000 200.000 76.000 $ 320.000 $ 224.000 $ 72.000 The company uses the Just-in-Time (JIT) system on its purchase of materials. It buys materials on cash basis. Included in production cost each quarter is $44,000 in depreciation. The operating expenses include depreciation of $12,000 per quarter. All production costs and operating expenses, with the exemption of depreciation are to be paid during the quarter of incurrence. Collection on sale are planned at 60% during the quarter of sales, the balance during the quarter following the sale. Dividends of $20,000 is to be paid in June and again in December if covered by sufficient profits. No dividends will be paid if the net profit is less than $120,000. Income tax is equal to 32% of the quarters income before tax and is paid in the following quarter. The company's statement of financial position as of December 31, 2022 is as follows: Assets Cash Accounts receivable (net) Inventory Plant and equipment (net) Total Assets Equalizer Company Statement of Financial Position December 31, 2022 $ 76.000 120.000 44.000 580.000 $ 820.000 Required: 1. How much was the actual sales during the last quarter of 2022? 2. Prepare a schedule for year 2023: Equities Income tax payable Share capital Retained earnings Total Equity d. Budgeted raw materials inventory. e. Budgeted balance of retained earnings. a. Budgeted cost of goods sold. b. Budgeted cash disbursement for production costs and operating expenses. c. Budgeted cash balance. f. Budgeted statement of financial position as of December 31, 2023. 3. How much dividends will be paid in 2023. 4. What is the expected balance of accounts receivable as of December 31, 2023? 5. What is the expected balance of income tax payable as of December 31, 2023? 6. What is the expected balance of plant and equipment account as of December 31, 2023? $ 12.000 640.000 168.000 820.000

Step by Step Solution

3.41 Rating (154 Votes )

There are 3 Steps involved in it

1 The actual sales during the last quarter of 2022 is not given in the information provided so we cannot determine this amount 2 a Budgeted cost of goods sold First Quarter 64000 production cost 12000 ... View full answer

Get step-by-step solutions from verified subject matter experts