Answered step by step

Verified Expert Solution

Question

1 Approved Answer

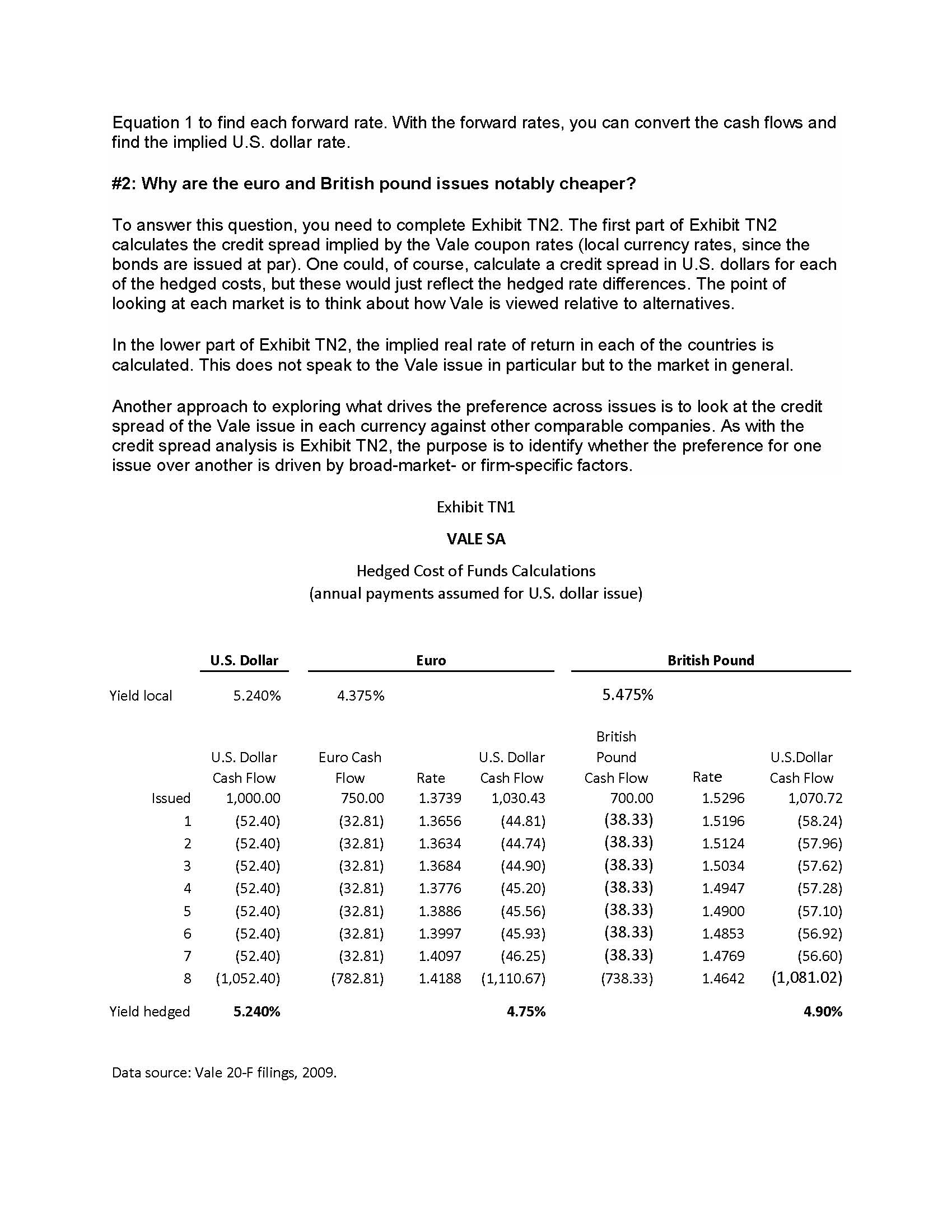

Equation 1 to find each forward rate. With the forward rates, you can convert the cash flows and find the implied U . S .

Equation to find each forward rate. With the forward rates, you can convert the cash flows and

find the implied US dollar rate.

#: Why are the euro and British pound issues notably cheaper?

To answer this question, you need to complete Exhibit TN The first part of Exhibit TN

calculates the credit spread implied by the Vale coupon rates local currency rates, since the

bonds are issued at par One could, of course, calculate a credit spread in US dollars for each

of the hedged costs, but these would just reflect the hedged rate differences. The point of

looking at each market is to think about how Vale is viewed relative to alternatives.

In the lower part of Exhibit TN the implied real rate of return in each of the countries is

calculated. This does not speak to the Vale issue in particular but to the market in general.

Another approach to exploring what drives the preference across issues is to look at the credit

spread of the Vale issue in each currency against other comparable companies. As with the

credit spread analysis is Exhibit TN the purpose is to identify whether the preference for one

issue over another is driven by broadmarket or firmspecific factors.

Exhibit TN

VALE SA

Hedged Cost of Funds Calculations

annual payments assumed for US dollar issue

Yield local

US Dollar

US Dollar

Issued

Euro

Euro Cash

Flow

US Dollar

Rate

Cash Flow

British Pound

British

Pound

Rate

USDollar

Cash Flow

Yield hedged

Data source: Vale F filings,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started