equifitivim number of laboratory aide is

250.\ Suppose the federal governmerit of Epigterne has decided to institute an hourly payroll tax of

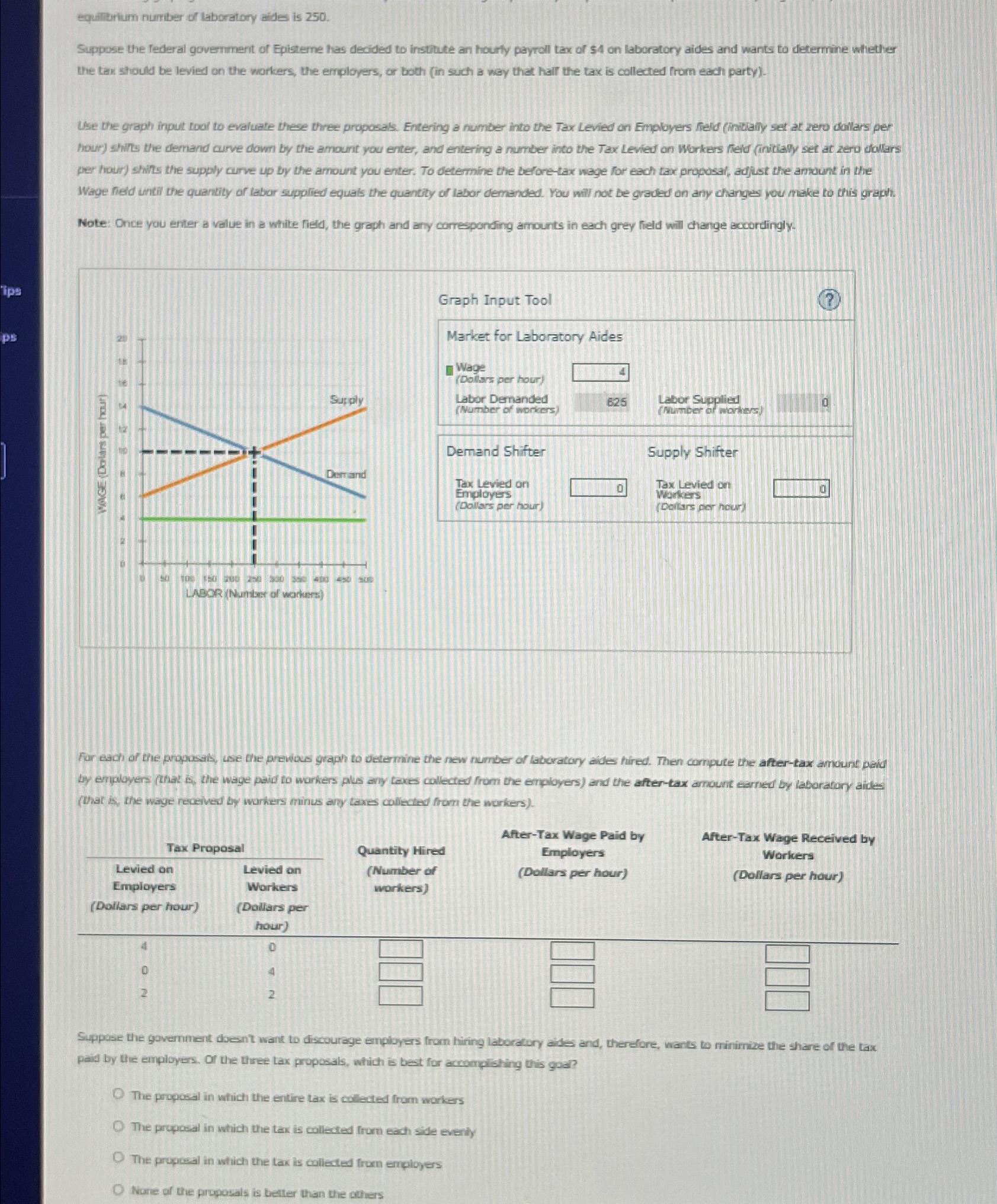

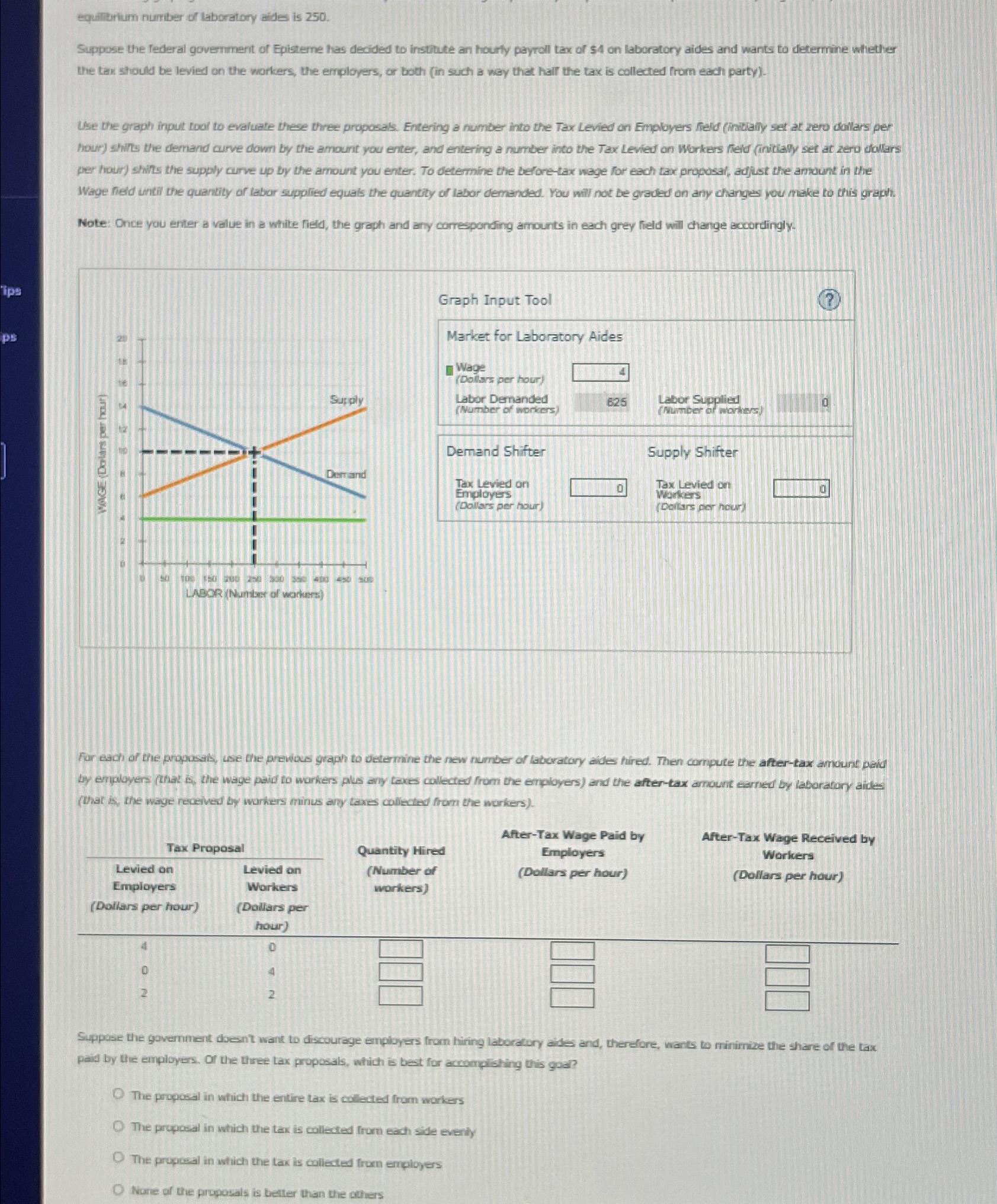

$4 on laboratory aides and wants to determine whether the tax should be levied on the workers, the employers, or both (in such a wey that half the tax is cellected trom each party).\ Use the graph input fool to evaluate thee three proposals. Entering a number into the Tax Levied on Employers fleld (iniblany set at zero doilars per hour) shilts the demand curve down by the amourit you enter, and entering a number into the Tax Levied on Workers reld (anitlally set at zero dollars per hour) shils the supply curve up by the amount you enter. To determine the belore-tax wage for eech tax proposal, adjut the andunt in the Wage field untii the quantity af labor supplied equals the quantity of labor demanded. You will not be graded on any changes you make to this graphi.\ Note: Once you enter a value in a white field, the graph and any correponding amounts in eadi grey held will diange accordingly-\ Graph Input Tool\ (?)\ Market for Laboratory Aides\ Wage\ (Dollars per hour)\ Labor Demanded\ (Number of inoricess)\ 625\ Labor Sugplied\ (Mumber ar montiers)\ Supply Shifter\ Demand Shifter\ Tax Levied on Employers (Dailars per hour)\ Tax Levied on wokkas (Doltsrs por hour) by employers (that is the wage paid to warkers plis any texes collected from the employers) and the after-tax amount earned by laboratory aide (What is the waye roceived by warkers minus any taxes collected from the warkers).\ Tax Proposal\ \\\\table[[Tax. Propasal,\\\\table[[Quantity Hires],[(Number of],[workers)]]],[\\\\table[[Levied on],[Employers],[(Dollars per hour)]],\\\\table[[Levied on],[Workers],[(Dollars per],[hour)]]],[4,0,],[0,4,],[2,2,]]\ After-Tax Wage Paid by Employers\ (Dollars per hour)\ After-Tax Wage Received by Warkers\ (Dollars per hour)\ Suppase the gavernment doent want to discourage employers from hiring laboratory aids and, therefore, wants to marimize the share of the tax paid by the employers. Or the three tax proposals, which is best for accomplishing this god?\ The proposal in which the entire tax is collected from warkers\ The propusat in which the tar is callected frum each side everily\ The prupical in which the Lax is coileded from empioyers\ None of tie proposals ts better than the ochers

equiliturim number of taboratory aides is 250. Suppose the federal governmerit of Episterne hes decided to instoute an hourly payroll tax of $4 on laboratory aides and wants to determine whether the tak should be levied on the workers, the employers, or both (in such a wey that hall the tax is collected from eadi party). Use the graph input fool to evaluate these three proposals. Entering a number into the Tax Levied on Employers feld (iniblainy set at zero doilars per hour) shils the demand curve down by the amourit you enter, and entering a number into the Tax Levied on Workers reld (iniclally set at zero dollars per hour) shils the supply curve up by the arnount you enter. To determine the belore-tax wage for each tax proposal, adjat the andunt in the Wage fied unti the quantity af labur supplied equals the quantity of labor demanded. You will not be graded on any changes you make to this graph. Note: Once you enter a value in a while Tied, the graph and any corresponding amounts in each grey field will change accordingly- Graph Input Tool (?) Market for Laboratory Aides - Wage (Dollers per hour) Labor Demanded (Number of workers) a by erpiluyers (that is, the wage paid to warkers plis any texes callected from the employers) and the after-tax amount earned by labaratory aide (what is, the wage recived by warkers minus ary taxes callected from the workers). Suppese the gavernmat doent want to fiscourage employers from hiring laboratory aids and, therefore, wants to mirimize the share of the tax paid by the employers. Or the three tax proposeds, which is bet for accomplishing this god? The proposal in which the entire tax is collected from warkers The pripusal in which the tar is callected frum each side everily The prupiosal in which the tax is coileded from empioyers None of the prunosiale is befter than the cthers equiliturim number of taboratory aides is 250. Suppose the federal governmerit of Episterne hes decided to instoute an hourly payroll tax of $4 on laboratory aides and wants to determine whether the tak should be levied on the workers, the employers, or both (in such a wey that hall the tax is collected from eadi party). Use the graph input fool to evaluate these three proposals. Entering a number into the Tax Levied on Employers feld (iniblainy set at zero doilars per hour) shils the demand curve down by the amourit you enter, and entering a number into the Tax Levied on Workers reld (iniclally set at zero dollars per hour) shils the supply curve up by the arnount you enter. To determine the belore-tax wage for each tax proposal, adjat the andunt in the Wage fied unti the quantity af labur supplied equals the quantity of labor demanded. You will not be graded on any changes you make to this graph. Note: Once you enter a value in a while Tied, the graph and any corresponding amounts in each grey field will change accordingly- Graph Input Tool (?) Market for Laboratory Aides - Wage (Dollers per hour) Labor Demanded (Number of workers) a by erpiluyers (that is, the wage paid to warkers plis any texes callected from the employers) and the after-tax amount earned by labaratory aide (what is, the wage recived by warkers minus ary taxes callected from the workers). Suppese the gavernmat doent want to fiscourage employers from hiring laboratory aids and, therefore, wants to mirimize the share of the tax paid by the employers. Or the three tax proposeds, which is bet for accomplishing this god? The proposal in which the entire tax is collected from warkers The pripusal in which the tar is callected frum each side everily The prupiosal in which the tax is coileded from empioyers None of the prunosiale is befter than the cthers