Answered step by step

Verified Expert Solution

Question

1 Approved Answer

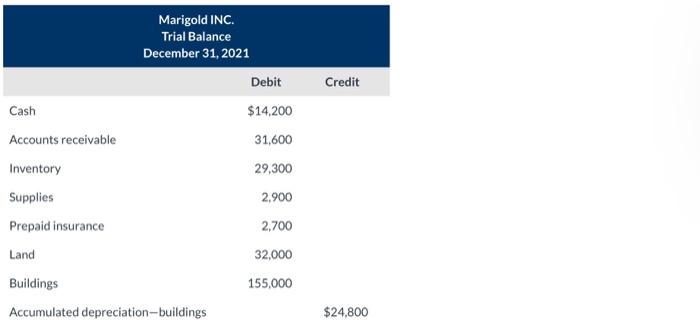

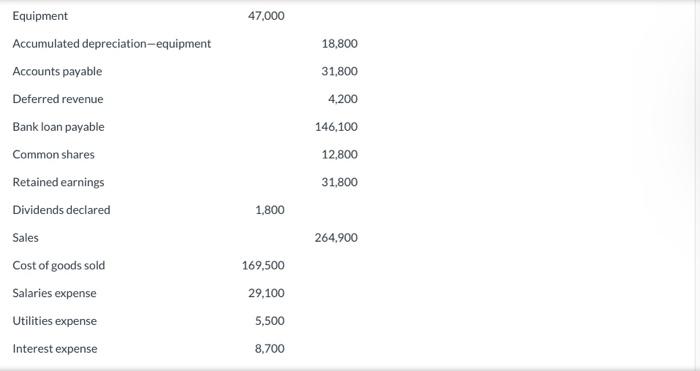

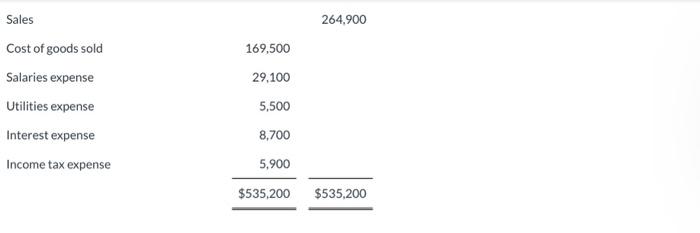

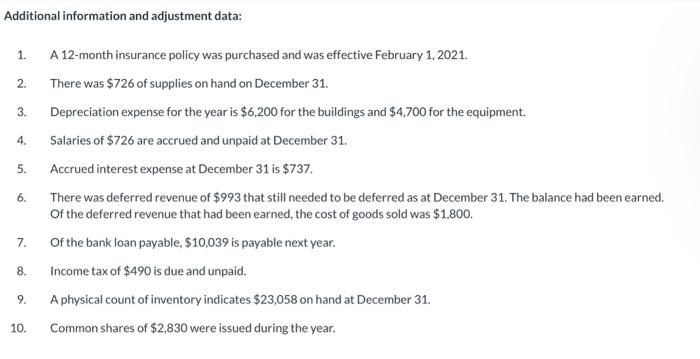

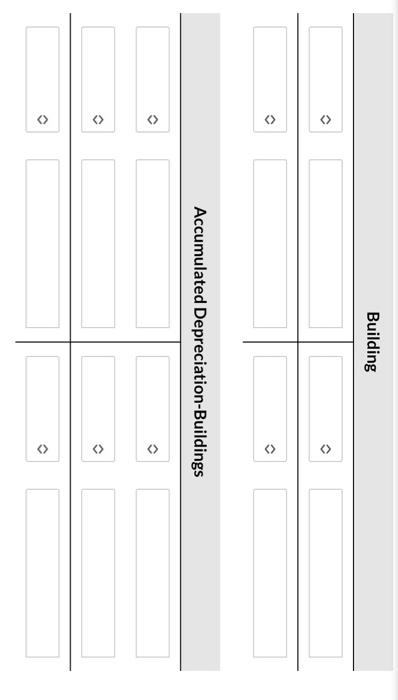

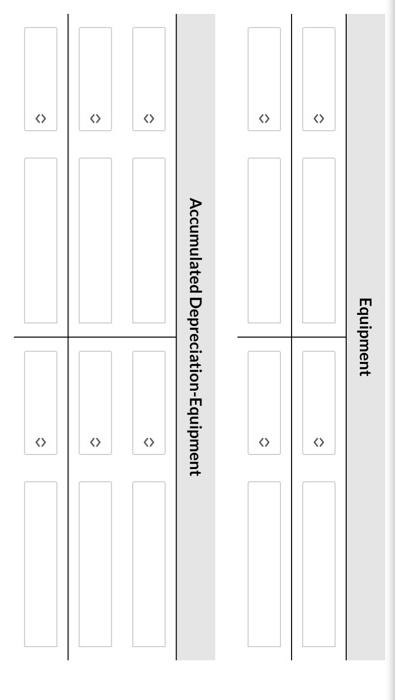

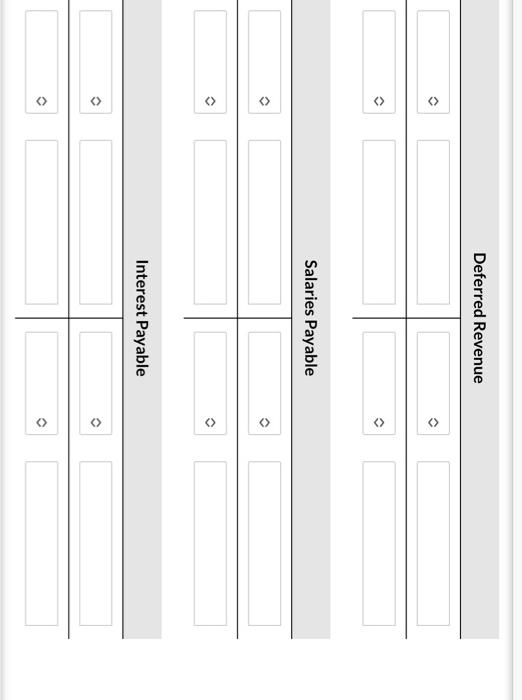

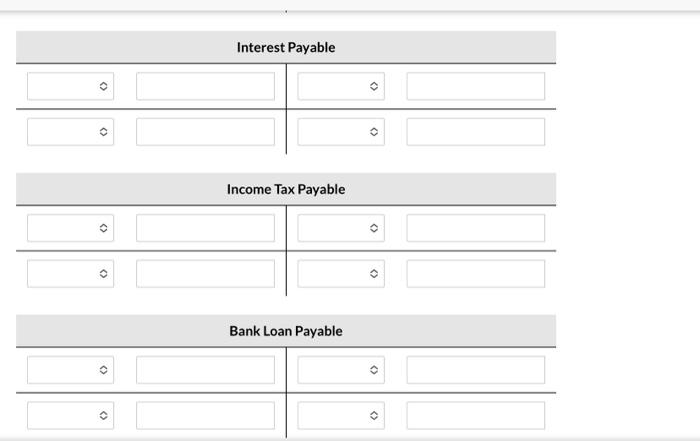

Equipment 47,000 Accumulated depreciation-equipment Accounts payable Deferred revenue 4,200 Bank loan payable 146,100 Common shares 12,800 Retained earnings 31,800 Dividends declared 1,800 Sales 264,900 Cost

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started