Equipment costing $1,500 will be purchased in cash during April. The company would like to maintain a cash balance of at least $4,000 at the end of each month. The company can borrow in even amounts of $1,000 at the beginning of each month, as needed. Borrowing is unlimited. The interest rate on these loans is 1% per month and interest is not compounded. The company will make repayments, plus interest, to the extent possible, at the end of the quarter. If all debt is not able to be repaid, interest cost will be based on the amount of the principal repaid only. . 1) Prepare a Cash Budget for Sangiovese for the quarter ending June 30, 2020. Show activity by month and in total. 2) Prepare a Budgeted Income Statement for the quarter ending June 30, 2020. Show activity only for the quarter and not by individual months.

B Group Data

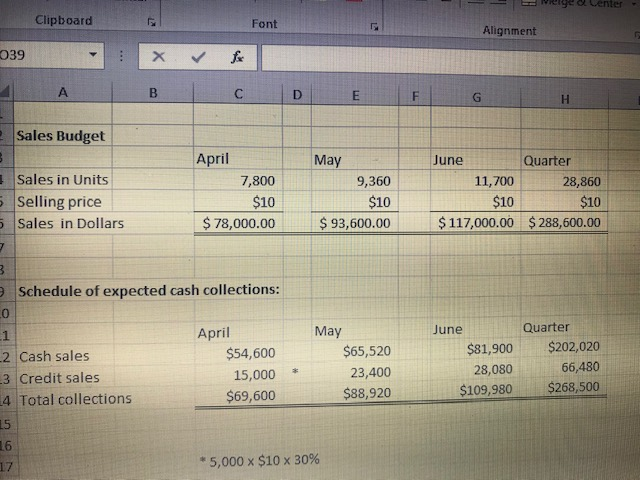

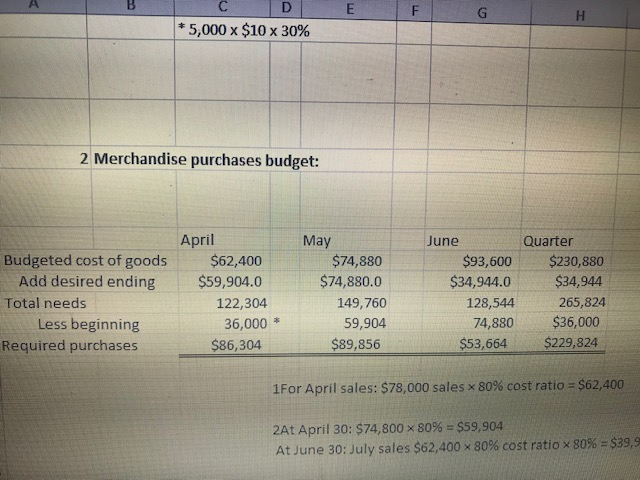

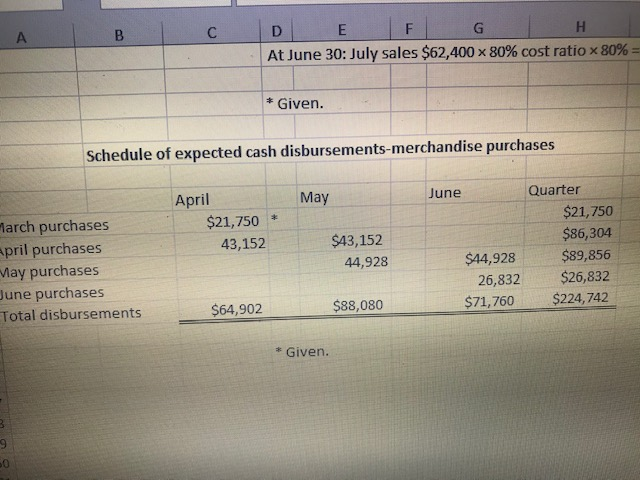

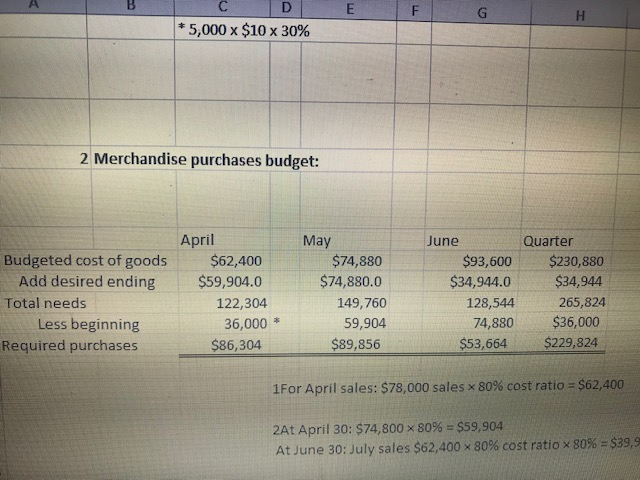

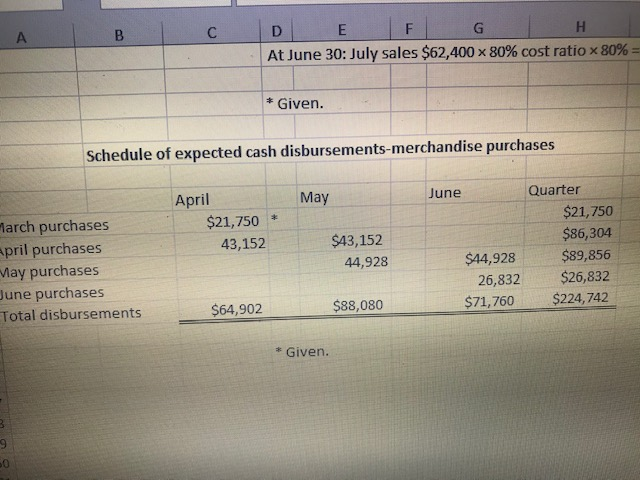

Merged center Clipboard Font Alignment 039 : x for 4 CDEFGHI Sales Budget April Sales in Units 5 Selling price 5 Sales in Dollars 7,800 $10 $ 78,000.00 May 9,360 $10 $ 93,600.00 June 11,700 $10 $ 117,000.00 Quarter 28,860 $10 $288,600.00 m Schedule of expected cash collections: o 2 Cash sales 3 Credit sales 4 Total collections April $54,600 15,000 $69,600 May $65,520 23,400 $88,920 June $81,900 28,080 $109,980 Quarter $202,020 66,480 $268,500 19 *5,000 x $10 x 30% E C D * 5,000 x $10 x 30% F G H 2 Merchandise purchases budget: Budgeted cost of goods Add desired ending Total needs Less beginning Required purchases April $62,400 $59,904.0 122,304 36,000 * $86,304 May $74,880 $74,880.0 149,760 59,904 $89,856 June $93,600 $34,944.0 128,544 74,880 $53,664 Quarter $230,880 $34,944 265,824 $36,000 $229,824 1For April sales: $78,000 sales x 80% cost ratio = $62,400 2At April 30: $74,800 x 80% = $59,904 At June 30: July sales $62,400 x 80% cost ratio x 80% = $39,9 B C D E F G H At June 30: July sales $62,400 x 80% cost ratio x 80% = * Given. Schedule of expected cash disbursements-merchandise purchases May June April $21,750 * 43,152 larch purchases april purchases May purchases une purchases Total disbursements $43,152 44,928 Quarter $21,750 $86,304 $89,856 $26,832 $224,742 $44,928 26,832 $71,760 $ 64,902 $88,080 * Given. Merged center Clipboard Font Alignment 039 : x for 4 CDEFGHI Sales Budget April Sales in Units 5 Selling price 5 Sales in Dollars 7,800 $10 $ 78,000.00 May 9,360 $10 $ 93,600.00 June 11,700 $10 $ 117,000.00 Quarter 28,860 $10 $288,600.00 m Schedule of expected cash collections: o 2 Cash sales 3 Credit sales 4 Total collections April $54,600 15,000 $69,600 May $65,520 23,400 $88,920 June $81,900 28,080 $109,980 Quarter $202,020 66,480 $268,500 19 *5,000 x $10 x 30% E C D * 5,000 x $10 x 30% F G H 2 Merchandise purchases budget: Budgeted cost of goods Add desired ending Total needs Less beginning Required purchases April $62,400 $59,904.0 122,304 36,000 * $86,304 May $74,880 $74,880.0 149,760 59,904 $89,856 June $93,600 $34,944.0 128,544 74,880 $53,664 Quarter $230,880 $34,944 265,824 $36,000 $229,824 1For April sales: $78,000 sales x 80% cost ratio = $62,400 2At April 30: $74,800 x 80% = $59,904 At June 30: July sales $62,400 x 80% cost ratio x 80% = $39,9 B C D E F G H At June 30: July sales $62,400 x 80% cost ratio x 80% = * Given. Schedule of expected cash disbursements-merchandise purchases May June April $21,750 * 43,152 larch purchases april purchases May purchases une purchases Total disbursements $43,152 44,928 Quarter $21,750 $86,304 $89,856 $26,832 $224,742 $44,928 26,832 $71,760 $ 64,902 $88,080 * Given