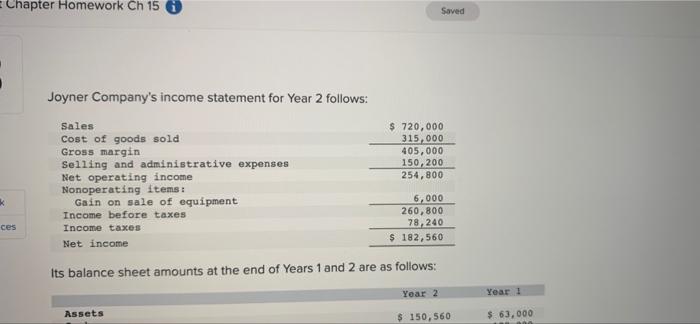

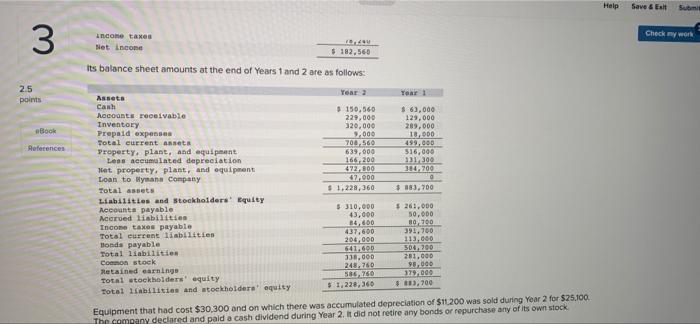

Equipment that had cost $30,300 and on which there was accumulated depreciation of $11,200 was sold during Year 2 for $25,100. The company declared and paid a cash dividend during Year 2. It did not retire any bonds or repurchase any of its own stock.

Required:

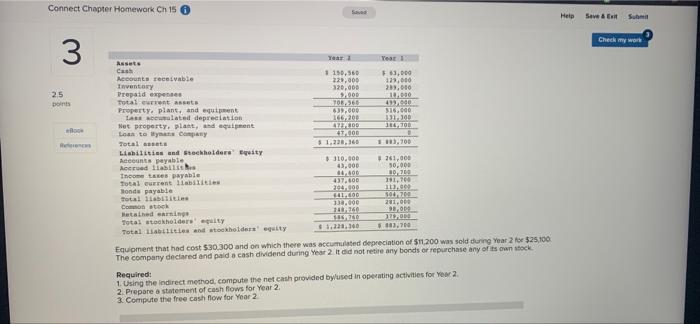

1. Using the indirect method, compute the net cash provided by/used in operating activities for Year 2.

2. Prepare a statement of cash flows for Year 2.

3. Compute the free cash flow for Year 2.

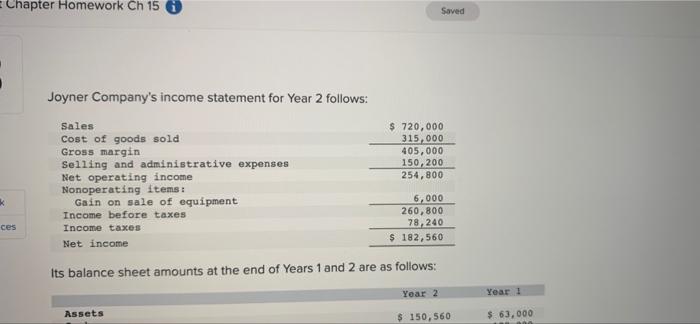

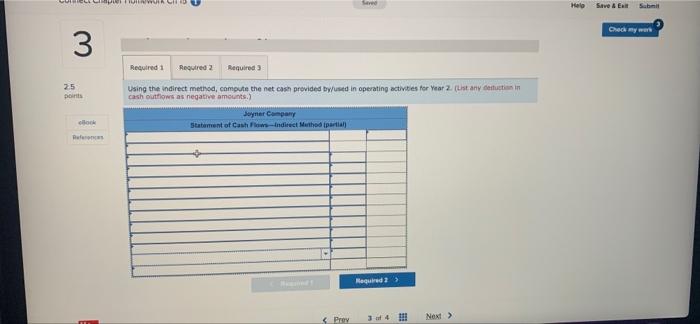

k Chapter Homework Ch 15 i ces Saved Joyner Company's income statement for Year 2 follows: Sales: $ 720,000 Cost of goods sold 315,000 Gross margin 405,000 150,200 Selling and administrative expenses Net operating income 254,800 Nonoperating items: Gain on sale of equipment 6,000 Income before taxes 260,800 78,240 Income taxes Net income $ 182,560 Its balance sheet amounts at the end of Years 1 and 2 are as follows: Year 2 Assets $ 150,560 Year 1 $ 63,000 1000 3 2.5 points eBook References income taxes Net Income 15,440 $182,560 Its balance sheet amounts at the end of Years 1 and 2 are as follows: Year 2 Assets Cash $ 63,000 Accounts receivable Inventory $ 150,560 229,000 320,000 129,000 289,000 Prepaid expenses 9,000 18,000 Total current assets 708,560 499,000 Property, plant, and equipment 639,000 $16,000 166,200 131,300 Less accumulated depreciation Net property, plant, and equipment Loan to Hyeans company 472,800 384,700 47,000 0 Total assets $1,228,360 $ 183,700 Liabilities and Stockholders' Equity Accounts payable $ 310,000 $261,000 Accrued liabilities 50,000 43,000 84,600 Income taxes payable 80,700 437,600 Total current liabilities 391,700 204,000 113,000 Bonds payable 641,600 504,700 Total liabilities Common stock 338,000 281,000 248,760 98,000 Retained earnings 586,760 379,009 Total stockholders' equity $1,228,360 $883,700 Total liabilities and stockholders' equity Equipment that had cost $30,300 and on which there was accumulated depreciation of $11,200 was sold during Year 2 for $25,100. The company declared and paid a cash dividend during Year 2. It did not retire any bonds or repurchase any of its own stock. Help Save & Exit Submit Check my work Connect Chapter Homework Ch 15 3 Year 1 Assets Cash 150,560 F63,000 Accounts receivable Inventory 229,000 129,000 320,000 289,000 Prepaid expenses $.000 10,000 Total current assets 708,565 499,000 Property, plant, and equipment 639,000 $16,000 Lass accumulated depreciation 166,200 131-300 Net property, plant, and equipment Loan to Bynas Company 473,800 417,000 Total assets $1,228,360 183,700 Liabilities and Stockholders' Equity Accounts payable, $310,000 #241,000 Accrued liabilit 43,000 50,000 44.400 30,769 Income taxes payable Total current liabilities 437,400 191,700 Bonds payable 294,900 313,999 total liabilities 441.600 104,700 Common stock 338.000 201,000 Retained earnings 248.760 146/240 98,00 Total stockholders' equity 10,00 $1,228,340 $493,700 Total liabilities and stockholders' equity Equipment that had cost $30,300 and on which there was accumulated depreciation of $11,200 was sold during Year 2 for $25,100 The company declared and paid a cash dividend during Year 2. It did not retire any bonds or repurchase any of its own stock Required: 1. Using the indirect method, compute the net cash provided by used in operating activities for Year 2 2. Prepare a statement of cash flows for Year 2. 3. Compute the free cash flow for Year 2 2,5 points Book Referenc Year 1 Seved Help Save & Exit Submit Check my work 3 2.5 points papier FIEN/MUTA CHIED eBook References Seved Required 1 Required 2 Required 3 Using the indirect method, compute the net cash provided by/used in operating activities for Year 2. (List any estuction in cash outflows as negative amounts) Joyner Company Statement of Cash Flows-Indirect Method (partial) 34 Next > Help Save & Exit Submit Check my werk