Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Equitable Diversity International Inc. (EDI) buys and sells artwork from all over the world. On September 1, Year 5, EDI agreed to purchase some paintings

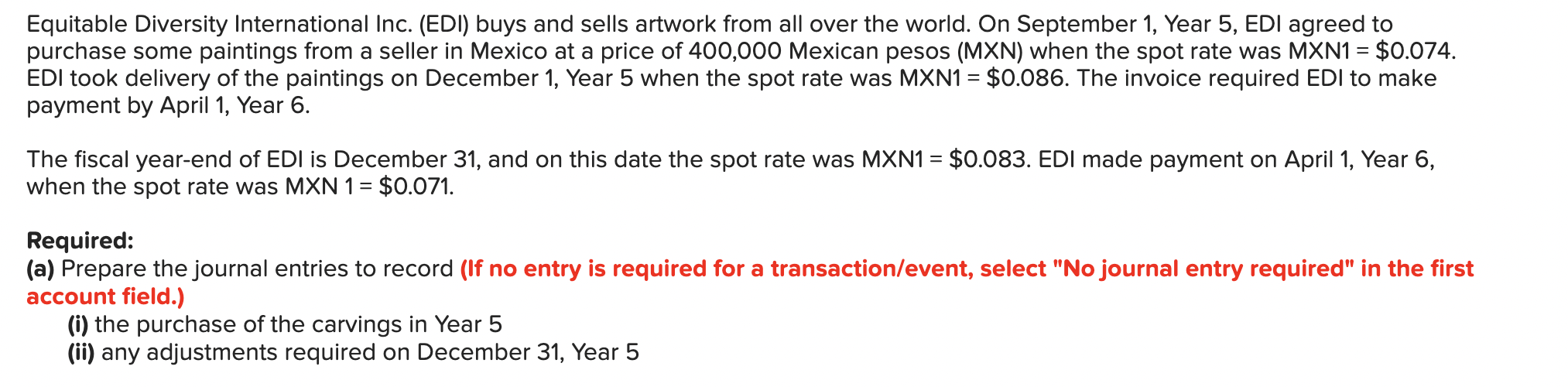

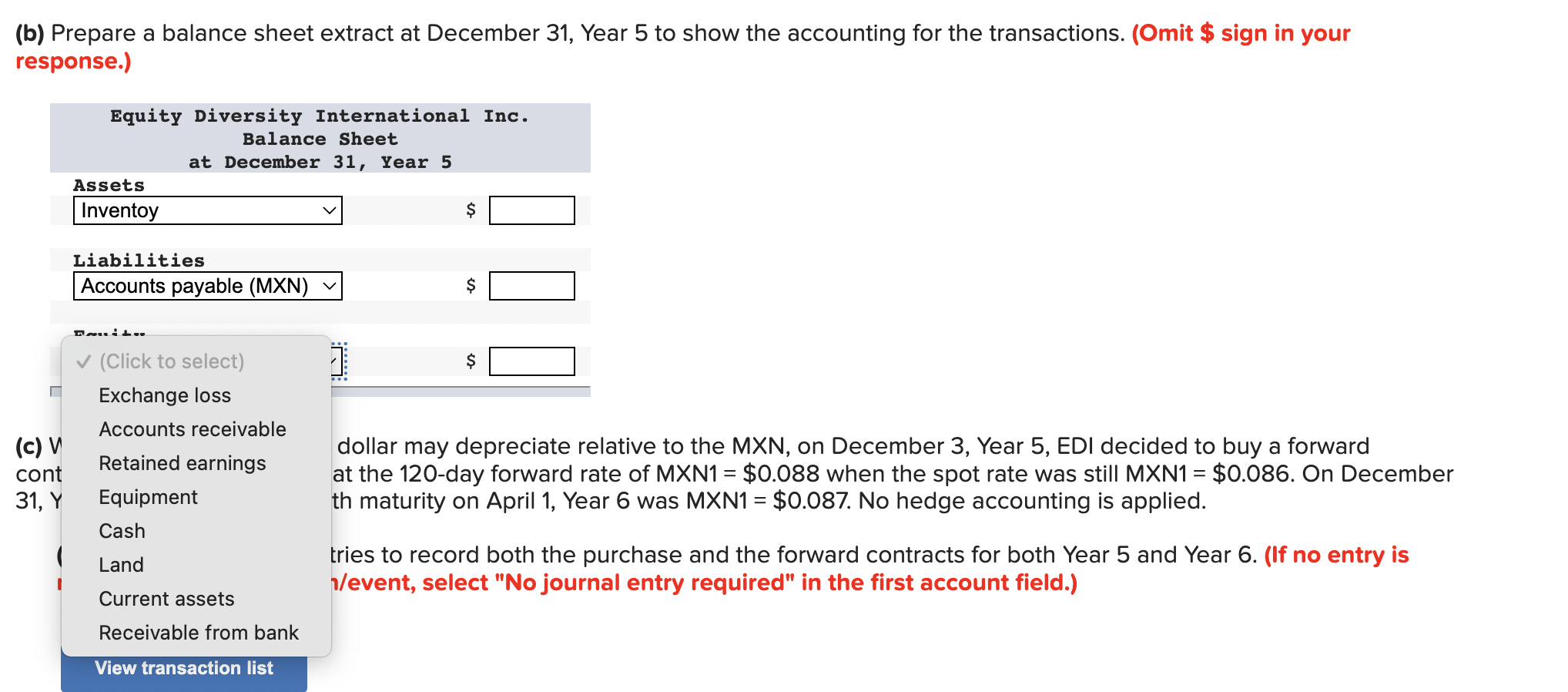

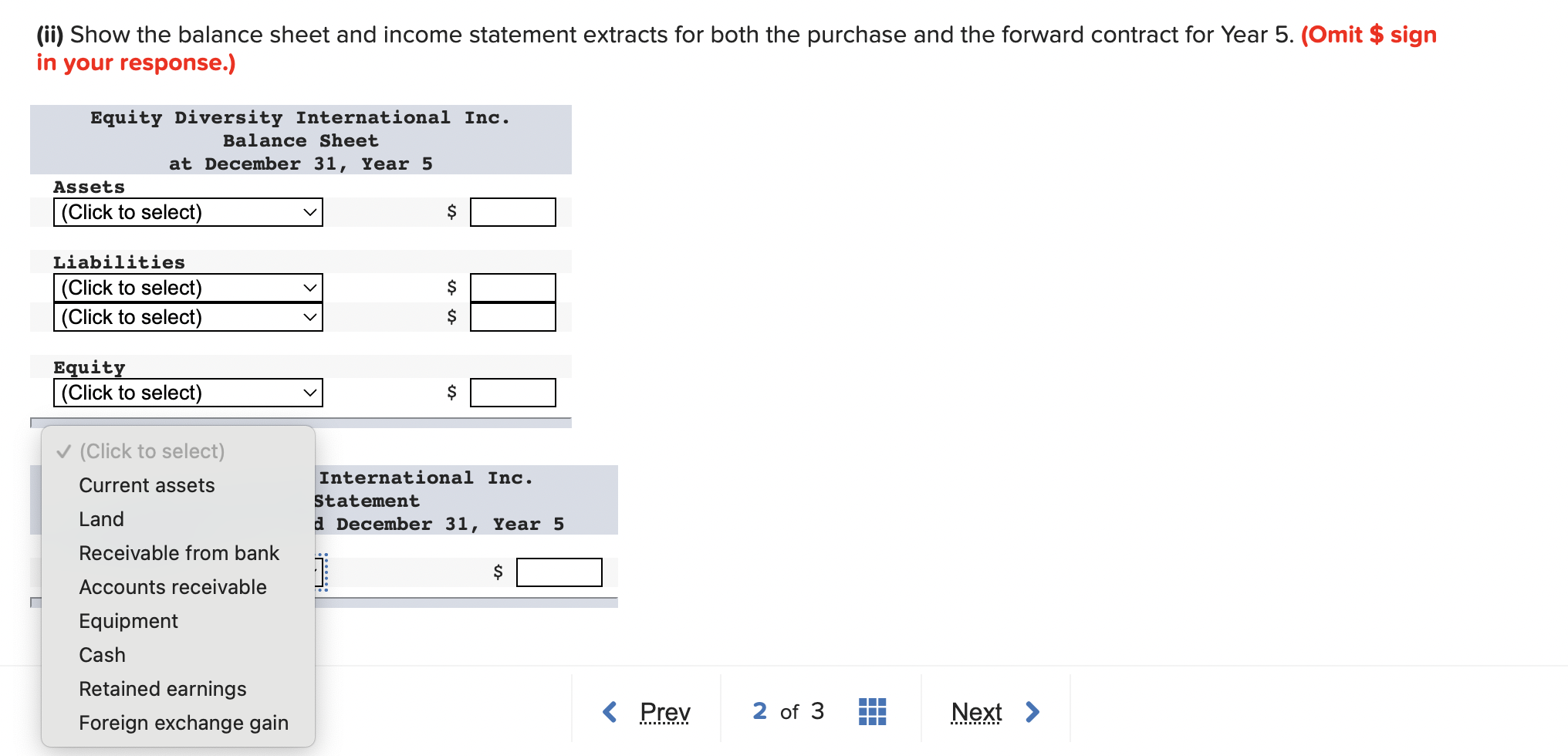

Equitable Diversity International Inc. (EDI) buys and sells artwork from all over the world. On September 1, Year 5, EDI agreed to purchase some paintings from a seller in Mexico at a price of 400,000 Mexican pesos (MXN) when the spot rate was MXN1=\$0.074. EDI took delivery of the paintings on December 1 , Year 5 when the spot rate was MXN1 $0.086. The invoice required EDI to make payment by April 1, Year 6. The fiscal year-end of EDI is December 31, and on this date the spot rate was MXN1 =$0.083. EDI made payment on April 1, Year 6, when the spot rate was MXN 1=$0.071. Required: (a) Prepare the journal entries to record (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) (i) the purchase of the carvings in Year 5 (ii) any adjustments required on December 31, Year 5 (b) Prepare a balance sheet extract at December 31, Year 5 to show the accounting for the transactions. (Omit $ sign in your response.) (c) V cont 31,Y Accounts receivable Retained earnings Equipment Cash Land Current assets dollar may depreciate relative to the MXN, on December 3, Year 5, EDI decided to buy a forward at the 120-day forward rate of MXN1 =$0.088 when the spot rate was still MXN1=$0.086. On December th maturity on April 1, Year 6 was MXN1 =$0.087. No hedge accounting is applied. tries to record both the purchase and the forward contracts for both Year 5 and Year 6 . (If no entry is ?/event, select "No journal entry required" in the first account field.) (ii) Show the balance sheet and income statement extracts for both the purchase and the forward contract for Year 5. (Omit \$ sign in your response.)

Equitable Diversity International Inc. (EDI) buys and sells artwork from all over the world. On September 1, Year 5, EDI agreed to purchase some paintings from a seller in Mexico at a price of 400,000 Mexican pesos (MXN) when the spot rate was MXN1=\$0.074. EDI took delivery of the paintings on December 1 , Year 5 when the spot rate was MXN1 $0.086. The invoice required EDI to make payment by April 1, Year 6. The fiscal year-end of EDI is December 31, and on this date the spot rate was MXN1 =$0.083. EDI made payment on April 1, Year 6, when the spot rate was MXN 1=$0.071. Required: (a) Prepare the journal entries to record (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) (i) the purchase of the carvings in Year 5 (ii) any adjustments required on December 31, Year 5 (b) Prepare a balance sheet extract at December 31, Year 5 to show the accounting for the transactions. (Omit $ sign in your response.) (c) V cont 31,Y Accounts receivable Retained earnings Equipment Cash Land Current assets dollar may depreciate relative to the MXN, on December 3, Year 5, EDI decided to buy a forward at the 120-day forward rate of MXN1 =$0.088 when the spot rate was still MXN1=$0.086. On December th maturity on April 1, Year 6 was MXN1 =$0.087. No hedge accounting is applied. tries to record both the purchase and the forward contracts for both Year 5 and Year 6 . (If no entry is ?/event, select "No journal entry required" in the first account field.) (ii) Show the balance sheet and income statement extracts for both the purchase and the forward contract for Year 5. (Omit \$ sign in your response.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started