Question

Equity method 5. On January 1, 2002, Alsop Corp. acquired 30,000 shares out of the 100,000 outstanding ordinary shares of Stone Services Inc. for

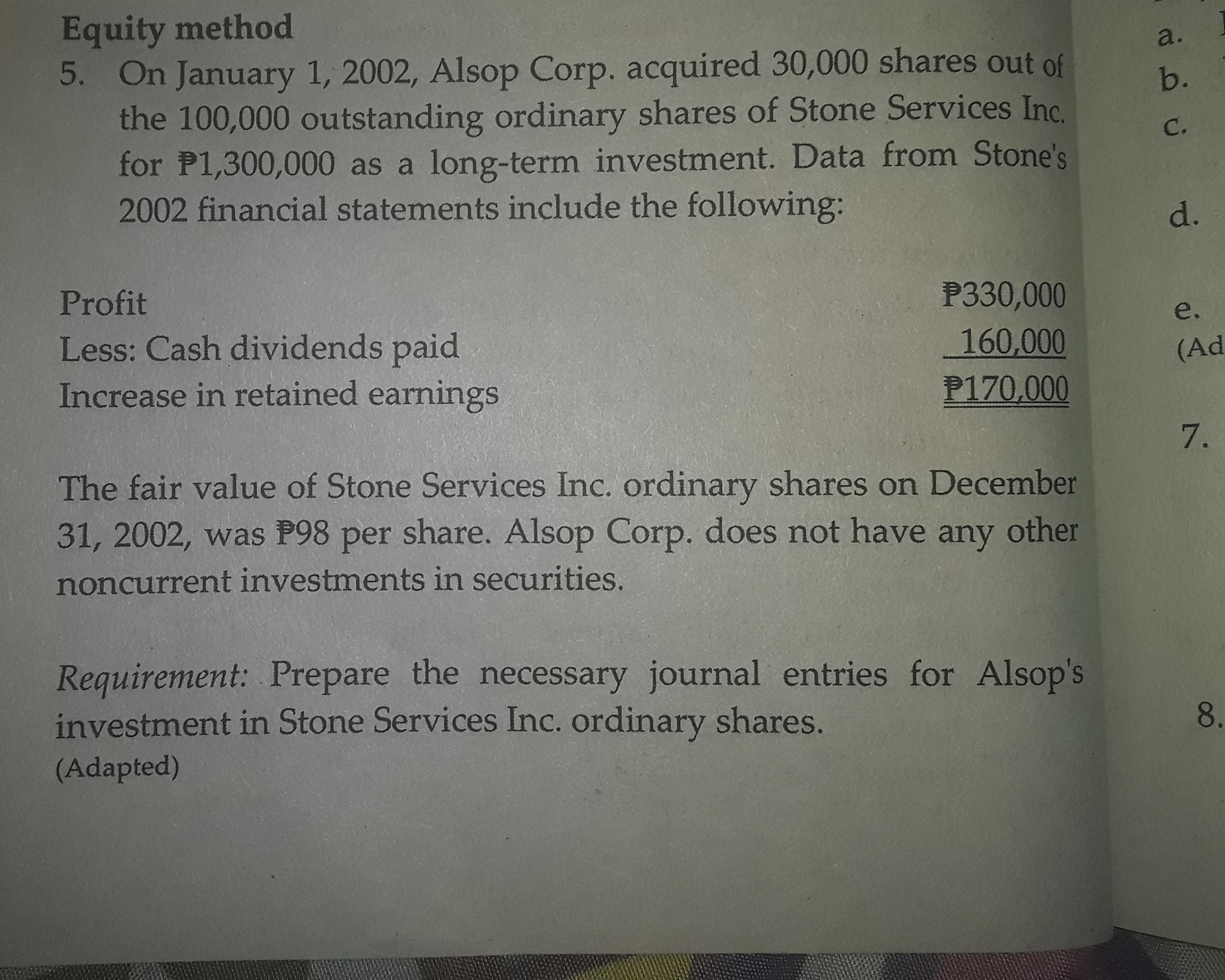

Equity method 5. On January 1, 2002, Alsop Corp. acquired 30,000 shares out of the 100,000 outstanding ordinary shares of Stone Services Inc. for P1,300,000 as a long-term investment. Data from Stone's 2002 financial statements include the following: a. b. . d. Profit P330,000 Less: Cash dividends paid Increase in retained earnings e. 160,000 (Ad P170,000 The fair value of Stone Services Inc. ordinary shares on December 31, 2002, was P98 per share. Alsop Corp. does not have any other noncurrent investments in securities. Requirement: Prepare the necessary journal entries for Alsop's investment in Stone Services Inc. ordinary shares. 8. (Adapted) 7.

Step by Step Solution

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Entries in the books Mcop Comp when inves tments anu nunchased Investment in ston senvi lafinc ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Economics

Authors: R. Glenn Hubbard

6th edition

978-0134797731, 134797736, 978-0134106243

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App