Answered step by step

Verified Expert Solution

Question

1 Approved Answer

= Equity Method Investment with Cost in Excess of Book Value Revco Corporation purchases 35 percent of the voting stock of Ronco Pharmaceuticals on January

=

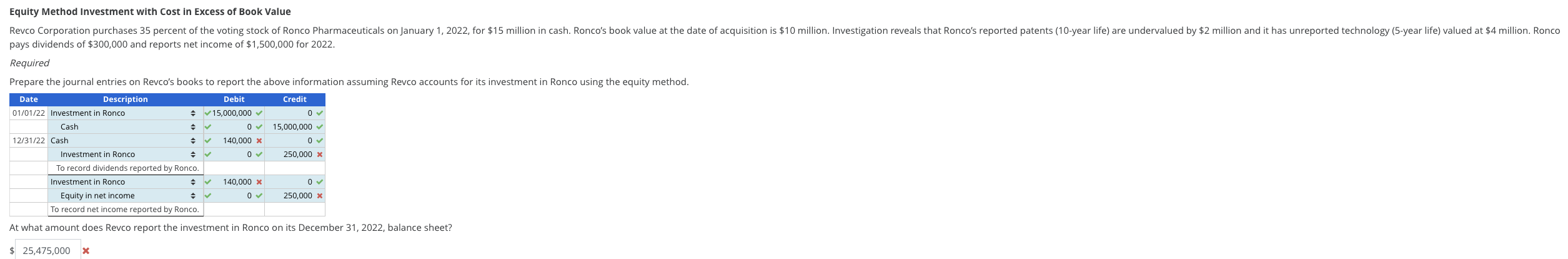

= Equity Method Investment with Cost in Excess of Book Value Revco Corporation purchases 35 percent of the voting stock of Ronco Pharmaceuticals on January 1, 2022, for $15 million in cash. Ronco's book value at the date of acquisition is $10 million. Investigation reveals that Ronco's reported patents (10-year life) are undervalued by $2 million and it has unreported technology (5-year life) valued at $4 million. Ronco pays dividends of $300,000 and reports net income of $1,500,000 for 2022. Required Prepare the journal entries on Revco's books to report the above information assuming Revco accounts for its investment in Ronco using the equity method. Date Description 01/01/22 Investment in Ronco Debit Credit Cash 12/31/22 Cash Investment in Ronco = To record dividends reported by Ronco. Investment in Ronco Equity in net income 15,000,000 0 140,000 x 0 15,000,000 250,000 x 140,000 x 250,000 x To record net income reported by Ronco. At what amount does Revco report the investment in Ronco on its December 31, 2022, balance sheet? $ 25,475,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started