equity value per share : ______

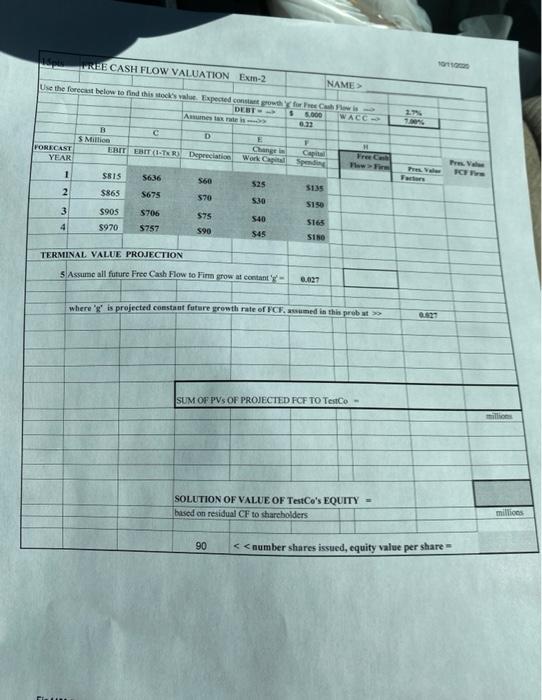

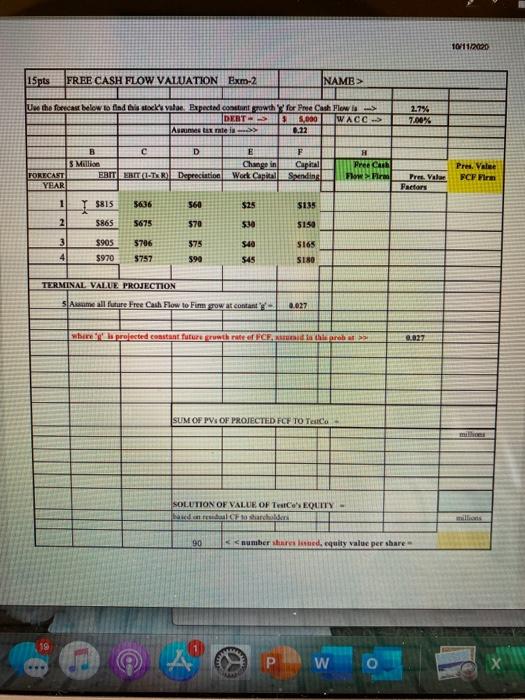

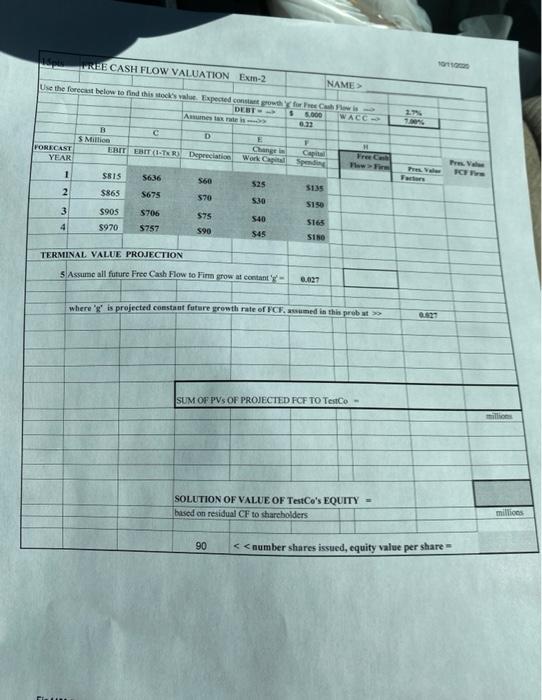

10/11/2X120 15 pts FREE CASH FLOW VALUATION Exm-2 NAME> 2.7% Use the forecast below to find this skats Expected constant rowth for Pre Cash Flowi DERT 13,000 WACC) Asumes on rate in 0.12 7.00% E B D s Million FORECAST EBIT EBIT CIT Depreciation YEAR Change in Work Canta! F Capital Sending! Free Caib Form Pres. Valee FCF Fire Free Vale Factors 1 _$815 5636 560 $25 $135 2 5865 5675 570 $30 $150 3 $75 $165 $905 $970 5706 $757 $40 $45 4 390 S180 TERMINAL VALUE PROJECTION Small future Free Cash Flow to Firm grow at contant 0.027 bir projected constant future rowth rate of FCE a this proba 0.027 SUM OF PVS OF PROJECTED FCF TO TO SOLUTION OF VALUE OF T'EQUITY- en el anchor 90 numbered equity value per share 59 W FREE CASH FLOW VALUATION Exm-2 NAME> Use the forest below to find this sock' Texpected controw for Free DEST 5.000 013 WACE D S Million ERT EBIT (ITR) Depreciation E Change Work FORECAST YEAR H Spending Pres. FC 1 S815 5636 560 2 $865 S675 570 530 S150 3 5706 5905 $970 $75 540 S165 4 $757 SS 545 SINO TERMINAL VALUE PROJECTION S Assume all future Free Cash Flow to Finn grow at constant 0.027 where it is projected constant future prowth rate of FCF. sumed in this probat >> SUM OF PVS OF PROJECTED FCF TO Tesco SOLUTION OF VALUE OF TestCo's EQUITY = based on residual CF to shareholders millions 90 2.7% Use the forecast below to find this skats Expected constant rowth for Pre Cash Flowi DERT 13,000 WACC) Asumes on rate in 0.12 7.00% E B D s Million FORECAST EBIT EBIT CIT Depreciation YEAR Change in Work Canta! F Capital Sending! Free Caib Form Pres. Valee FCF Fire Free Vale Factors 1 _$815 5636 560 $25 $135 2 5865 5675 570 $30 $150 3 $75 $165 $905 $970 5706 $757 $40 $45 4 390 S180 TERMINAL VALUE PROJECTION Small future Free Cash Flow to Firm grow at contant 0.027 bir projected constant future rowth rate of FCE a this proba 0.027 SUM OF PVS OF PROJECTED FCF TO TO SOLUTION OF VALUE OF T'EQUITY- en el anchor 90 numbered equity value per share 59 W FREE CASH FLOW VALUATION Exm-2 NAME> Use the forest below to find this sock' Texpected controw for Free DEST 5.000 013 WACE D S Million ERT EBIT (ITR) Depreciation E Change Work FORECAST YEAR H Spending Pres. FC 1 S815 5636 560 2 $865 S675 570 530 S150 3 5706 5905 $970 $75 540 S165 4 $757 SS 545 SINO TERMINAL VALUE PROJECTION S Assume all future Free Cash Flow to Finn grow at constant 0.027 where it is projected constant future prowth rate of FCF. sumed in this probat >> SUM OF PVS OF PROJECTED FCF TO Tesco SOLUTION OF VALUE OF TestCo's EQUITY = based on residual CF to shareholders millions 90

equity value per share : ______

equity value per share : ______