Question

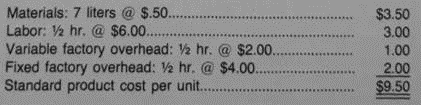

Equivalent production and standard costing variance analysis. The standard cost card for Torno Companys product is: Data for November: (a) 1,000 units (40% converted) were

Equivalent production and standard costing variance analysis. The standard cost card for Torno Companys product is:

Data for November:

(a) 1,000 units (40% converted) were in process at the beginning of the month. 5,050 units were started during the month.

5,000 units were transferred to finished goods.

800 units (25% converted) were in process at the end of the month.

(b) Materials are all added at the beginning of the process. Conversion costs are incurred evenly throughout the process. Inspection takes place when the units are 80% converted. Under normal conditions, no spoilage should occur.

(c) 40 000 liters of materials were purchased for $ 19,200 and were charged to inventory at standard cost.

(d) 37 000 liters of materials were issued to production

(e) Direct labor payroll was $15,600 for 2,400 hours.

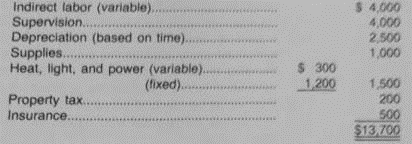

(f) Actual factory overhead costs were

(g) Marketing and administrative expenses were: Variable, $1 per unit sold Fixed, $13,500.

(h) Normal output for a month is 4,000 units.

Required:

(1) Compute the November equivalent production for materials and for conversion costs.

(2) Determine the standard cost of:

(a) Units transferred to finished goods.

(b) Abnormal spoilage, to be charged directly to a current period expense account.

(c) Ending inventory of work in process.

(3) Compute the (a) materials price and quantity variances, (b) labor rate and efficiency variances, and (c) factory overhead variances, using the four-variance method. Indicate whether the variances are favorable or unfavorable.

(CGAAC adapted)

Materials: 7 liters @ \$.50. Labor:1/2 hr.@\$6.00. Variable factory overhead: 1/2 hr. @ $2.00. $3.50 Fixed factory overhead: 1/2hr. $4.00. Standard product cost per unit. Indirect labor (variable) Supervision. Depreciation (based on time) Supplies. Heat, light, and power (variable) Property tax (fixed) InsuranceStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started