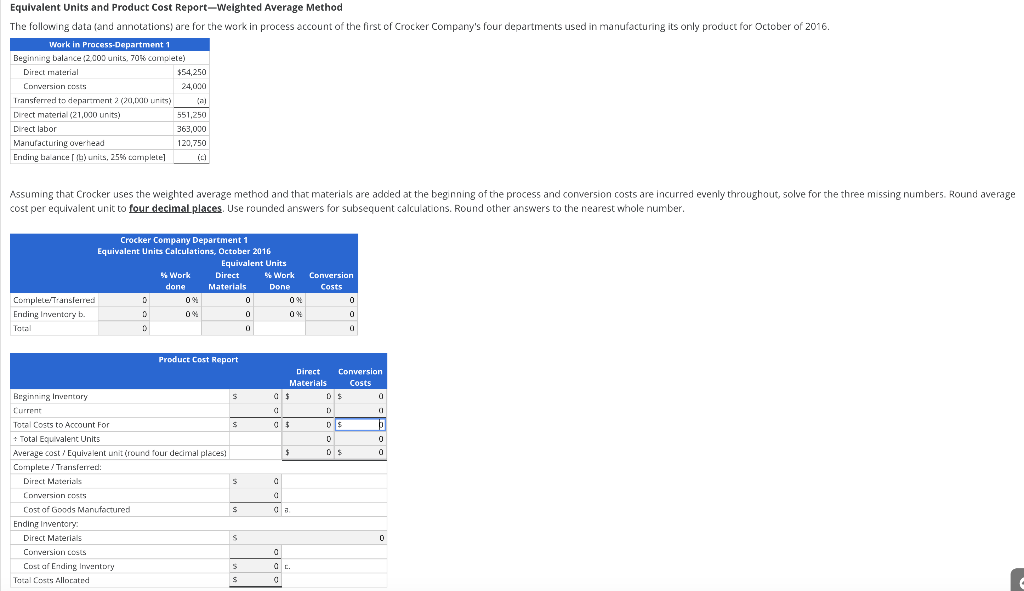

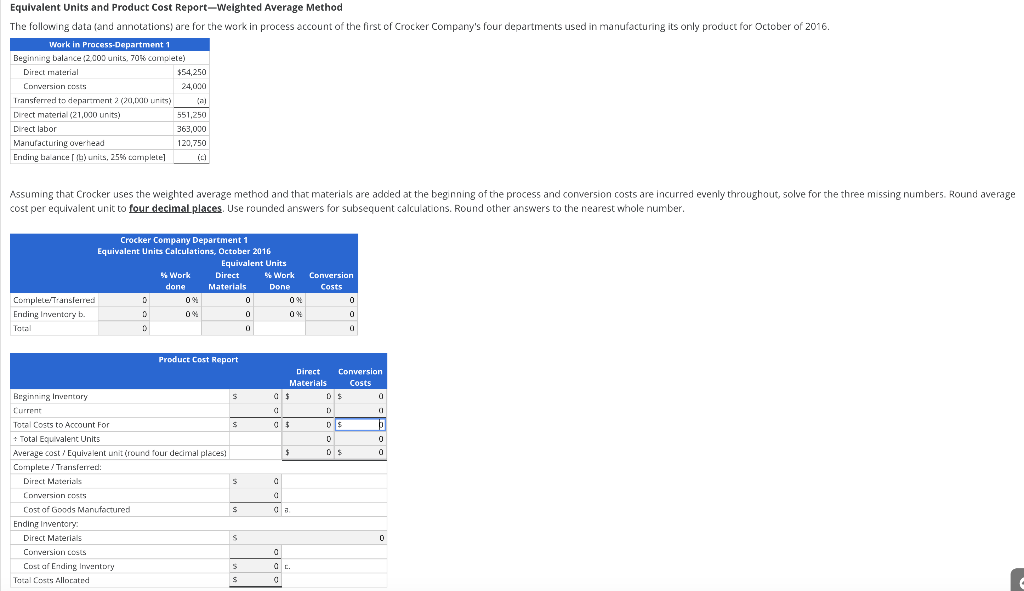

Equivalent Units and Product Cost ReportWeighted Average Method

The following data (and annotations) are for the work in process account of the first of Crocker Company's four departments used in manufacturing its only product for October of 2016.

Work in Process-Department 1Beginning balance (2,000 units, 70% complete)Direct material$54,250Conversion costs24,000Transferred to department 2 (20,000 units)(a)Direct material (21,000 units)551,250Direct labor363,000Manufacturing overhead120,750Ending balance [ (b) units, 25% complete](c)

Assuming that Crocker uses the weighted average method and that materials are added at the beginning of the process and conversion costs are incurred evenly throughout, solve for the three missing numbers. Round average cost per equivalent unit to four decimal places. Use rounded answers for subsequent calculations. Round other answers to the nearest whole number.

Equivalent Units and Product Cost Report-Weighted Average Method The following data (and annotations) are for the work in process account of the first of Crocker Company's four departments used in manufacturing its only product for October of 2016. Work in Process-Department 1 Beginning balance 2.009 units, 7056 complete) Direct material $54,250 Conversion costs 24,000 Transferred to department 2 (20,XID Units) laj Direct material (21,000 units) 551,250 Direct labor 363,000 Manufacturing overhead 129,750 Ending ba ante tu) untits, 25% complete Assuming that Crocker uses the weighted average method and that materials are added at the beginning of the process and conversion costs are incurred evenly throughout, solve for the three missing numbers. Round average cost per equivalent unit to four decimal places. Use rounded answers for subsequent calculations. Round other answers to the nearest whole number. Crocker Company Department 1 Equivalent Units Calculations, October 2016 Equivalent Units Work Direct 5 Work done Materials Done Complele:Transferred 0 09 Ending Inventory 0% 0 09 Tacal Conversion Costs 0 0 0 0 Product Cost Report S Direct Conversion Materials Costs 0 $ DS 0 0 D 0 0 $ 0 DE 10 0 0 $ OS 0 S 5 Beginning Inventory Current Total Costs to Account For Total Equivalent Units Average cost / Equivalent unit (round four decimal pleces) Complele / Transferred: Direct Materials Conversion costs Cost of Goods Manufactured Ending inventory Direct Materials Conversion LOSS Cost al Ending Inventory Total Costs Allocated s S 0 0 5 O. S 0 Equivalent Units and Product Cost Report-Weighted Average Method The following data (and annotations) are for the work in process account of the first of Crocker Company's four departments used in manufacturing its only product for October of 2016. Work in Process-Department 1 Beginning balance 2.009 units, 7056 complete) Direct material $54,250 Conversion costs 24,000 Transferred to department 2 (20,XID Units) laj Direct material (21,000 units) 551,250 Direct labor 363,000 Manufacturing overhead 129,750 Ending ba ante tu) untits, 25% complete Assuming that Crocker uses the weighted average method and that materials are added at the beginning of the process and conversion costs are incurred evenly throughout, solve for the three missing numbers. Round average cost per equivalent unit to four decimal places. Use rounded answers for subsequent calculations. Round other answers to the nearest whole number. Crocker Company Department 1 Equivalent Units Calculations, October 2016 Equivalent Units Work Direct 5 Work done Materials Done Complele:Transferred 0 09 Ending Inventory 0% 0 09 Tacal Conversion Costs 0 0 0 0 Product Cost Report S Direct Conversion Materials Costs 0 $ DS 0 0 D 0 0 $ 0 DE 10 0 0 $ OS 0 S 5 Beginning Inventory Current Total Costs to Account For Total Equivalent Units Average cost / Equivalent unit (round four decimal pleces) Complele / Transferred: Direct Materials Conversion costs Cost of Goods Manufactured Ending inventory Direct Materials Conversion LOSS Cost al Ending Inventory Total Costs Allocated s S 0 0 5 O. S 0