Question

Plastix Pty Ltd is a company that provides equipment and services used to support the production of semiconductors. Specifically, Plastix makes devices for process control

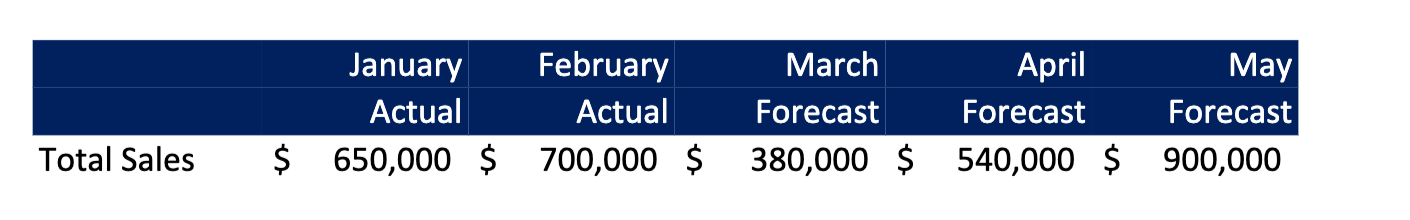

Plastix Pty Ltd is a company that provides equipment and services used to support the production of semiconductors. Specifically, Plastix makes devices for process control that enable semiconductor manufacturers to check semiconductor wafers for flaws in the production process. Management at Plastix is in the process of budgeting for the next 12 months. To do so, it is first budgeting for the next three months as a preliminary stage involving lots of change in the business. The next three months are March, April and May. Plastix provides the following information regarding its actual and future sales:

Management expects that 40% of sales are on credit. Of those credit sales, 40% are also collected in the month of the sale. 40% are collected in the month after the month of sale. 20% are collected two months after the sale. In a memo to your team (who are preparing the budgets), management also provides the following information: - The company has an obligation to repay $40,000 in debt in April and $180,000 in debt in May. There is no debt to be repayed in the other month. - Cost of sales is 40% of sales revenue. - The company has regular deliveries of inventory to ensure that it can continue to meet the demand for consumables and it's own production. These are at 70% of prior month sales. The inventory is paid for in the month following delivery.

Management expects that 40% of sales are on credit. Of those credit sales, 40% are also collected in the month of the sale. 40% are collected in the month after the month of sale. 20% are collected two months after the sale. In a memo to your team (who are preparing the budgets), management also provides the following information: - The company has an obligation to repay $40,000 in debt in April and $180,000 in debt in May. There is no debt to be repayed in the other month. - Cost of sales is 40% of sales revenue. - The company has regular deliveries of inventory to ensure that it can continue to meet the demand for consumables and it's own production. These are at 70% of prior month sales. The inventory is paid for in the month following delivery.

- Salaries and wage expenses add up to $80,000 per month. A further 30% is added for a variety of on costs. These amounts are paid in the same month. - Utilities costs are $10,000, $6,000, $14,000 and $25,000 in each of February, March, April and May, respectively. These costs are paid in the month following. - On the final day in March, the company commissions a long-term support contract for the following 12 months, to be used monthly. The contract is paid upfront on the same day. The contract is worth $72,000, and is made up of monthly cost allocations of equal size. - The company has several items of PPE. At the end of March, it purchases another piece of factory equipment worth $70,000. Depreciation prior to the purchase was $12,000 per month. Following, the purchase of the new vehicle, depreciation is expected to increase to $17,000 per month. - Management expects to pay $15,000 in interest each month. - The tax rate is 30%. Company income tax is then paid later in the year, but a provision is made during the month that profit is made.

a)

Indicate which of the following statements is most correct by placing the number in the marked square -> 1 Budgeting allows us to precisely figure out future outcomes 2 The accuracy of budgeting is constant 3 Budgeting is an imprecise task that nevertheless is useful for planning and control 4 Items 1 and 3 5 Items 2 and 3 6 Items 1, 2 and 3 7 None are correct

b)

Indicate which of the following statements is most correct by placing the number in the marked square -> 1 Businesses should ensure that absolutely every person has the change to participate in the budgeting process. 2 Businesses should ensure that their budgeting process is totally objective, reliant on formulas and models to predict outcomes. 3 Businesses should ensure that they seek feedback and information from a variety of sources to input into budgets. 4 Businesses should ensure that budgeting is only engaged in by members of senior management and accountants.

c)

Indicate which of the following statements is most correct by placing the number in the marked square -> 1 Providing targets that are easy is a good approach because it provides strong motivation to employees to perform 2 Providing targets that are easy is not a good approach because it will demoralise workers 3 Providing targets that are easy may not be a good approach because it does not sufficiently motivate staff to work hard 4 Using extremely difficult targets for employees has no effect on employee performance

January February Actual Actual $ 650,000 $ 700,000 $ March April Forecast Forecast 380,000 $ 540,000 $ May Forecast 900,000 Total SalesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started