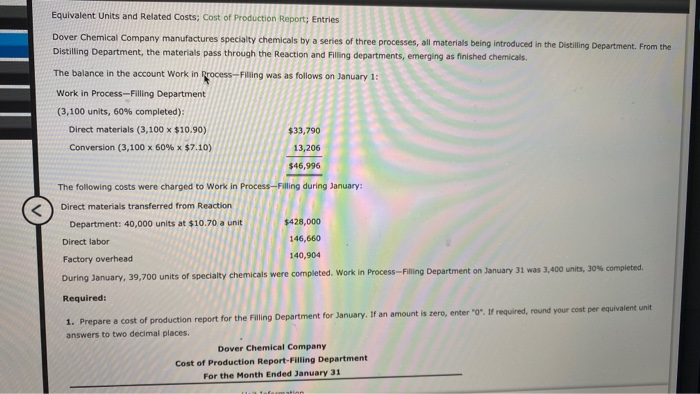

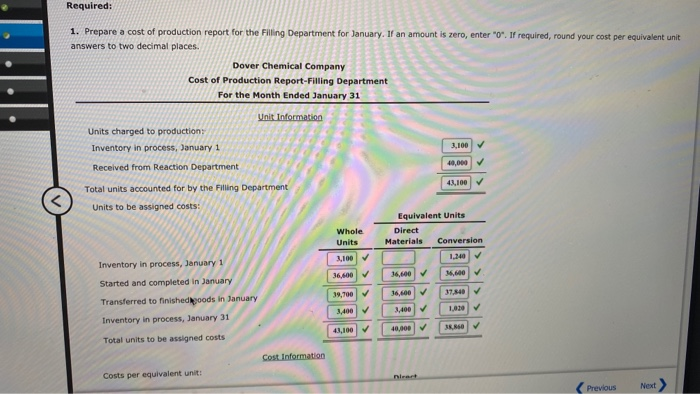

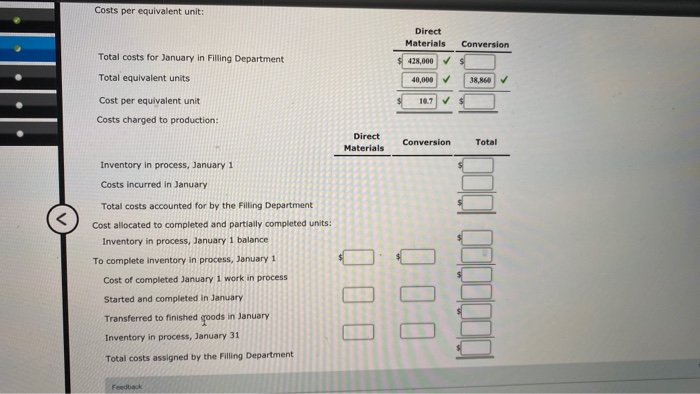

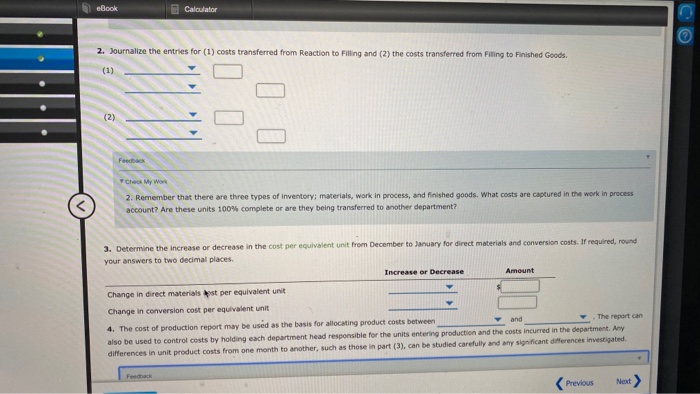

Equivalent Units and Related Costs; Cost of Production Report; Entries Dover Chemical Company manufactures specialty chemicals by a series of three processes, all materials being introduced in the Distilling Department. From the Distilling Department, the materials pass through the Reaction and Filling departments, emerging as finished chemicals The balance in the account Work in Process-Filling was as follows on January 1: Work in Process-Filling Department (3,100 units, 60% completed): Direct materials (3,100 x $10.90) $33,790 Conversion (3,100 x 60% x $7.10) 13,206 $46,996 The following costs were charged to Work in Process-Filling during January: Direct materials transferred from Reaction Department: 40,000 units at $10.70 a unit $428,000 Direct labor 146,660 Factory overhead 140,904 During January, 39,700 units of specialty chemicals were completed. Work in Process -Filling Department on January 31 was 3,400 units, 30% completed, Required: 1. Prepare a cost of production report for the Filing Department for January. If an amount is zero, enter "o". If required, round your cost per equivalent unit answers to two decimal places Dover Chemical Company Cost of Production Report-Filling Department For the Month Ended January 31 Tomatinn Required: 1. Prepare a cost of production report for the Filling Department for January. If an amount is zero, enter "0". If required, round your cost per equivalent unit answers to two decimal places. Dover Chemical Company Cost of Production Report-Filling Department For the Month Ended January 31 Unit Information Units charged to production: Inventory in process, January 1 Received from Reaction Department 2.100 4 43.100 Total units accounted for by the Filling Department Units to be assigned costs: Whole Units 3,100 Equivalent Units Direct Materials Conversion 1.140 36,400 36,600 M. Inventory in process, January 1 Started and completed in January Transferred to finished goods in January Inventory in process, January 31 39,700 36,400 37.840 3,400 1,010 43,100 40,000 3. SO Total units to be assigned costs Cost Information Costs per equivalent unit: niet Previous Next Costs per equivalent unit: Direct Materials Conversion Total costs for January in Filling Department 428,000 40,000 Total equivalent units 38,860 Cost per equivalent unit 10.7 Costs charged to production: Direct Materials Conversion Total Inventory in process, January 1 Costs incurred in January Total costs accounted for by the Filling Department Cost allocated to completed and partially completed units: Inventory in process, January 1 balance To complete inventory in process, January 1 Cost of completed January 1 work in process Started and completed in January Transferred to finished goods in January Inventory in process, January 31 Total costs assigned by the Filling Department Feedback eBook Calculator co 2. Journalize the entries for (1) costs transferred from Reaction to Filling and (2) the costs transferred from Filling to Finished Goods (1) (2) Feedback C P W 2. Remember that there are three types of inventory: materials, work in process, and finished goods. What costs are captured in the work in process account? Are these units 100% complete or are they being transferred to another department? 3. Determine the increase or decrease in the cost per equivalent unit from December to January for direct materials and conversion costs. If required, round your answers to two decimal places. Increase or Decrease Amount Change in direct materials pist per equivalent unit Change in conversion cost per equivalent unit 4. The cost of production report may be used as the basis for allocating product costs between and The report can also be used to control costs by holding each department head responsible for the units entering production and the costs incurred in the department. Any differences in unit product costs from one month to another, such as those in part (), can be studied carefully and any significant differences investigated. Feethack