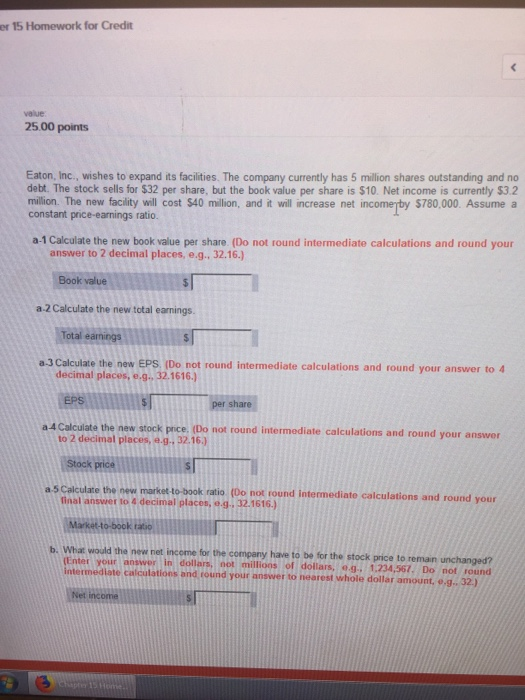

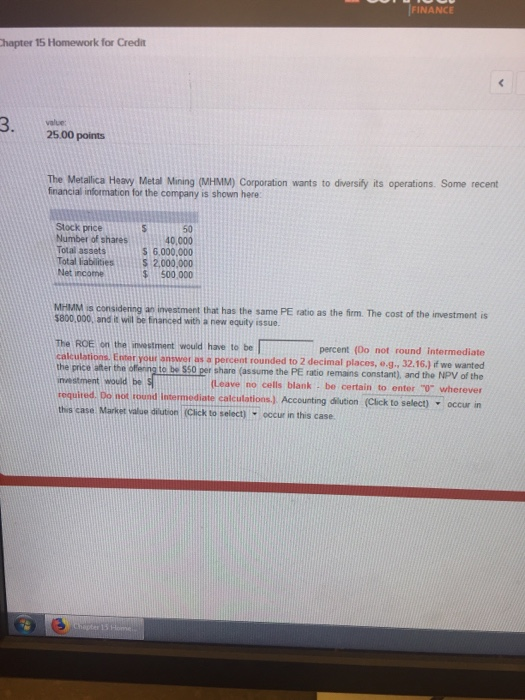

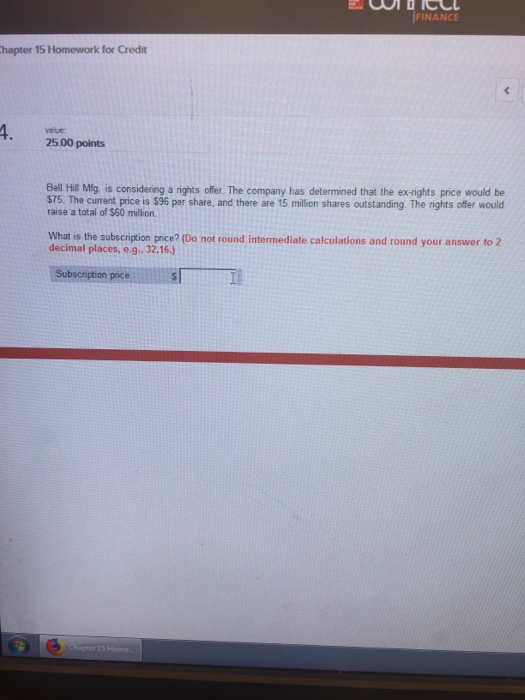

er 15 Homework for Credit value 25.00 points Eaton, Inc., wishes to expand its facilities. The company currently has 5 million shares outstanding and no debt. The stock sells for $32 per share, but the book value per share is $10. Net income is currently $3.2 million. The new facility will cost $40 million, and it will increase net income by $780,000. Assume a constant price-earnings ratio. a-1 Calculate the new book value per share. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Book value a 2 Calculate the new total earnings. Total earnings a-3 Calculate the new EPS. (Do not round intermediate calculations and round your answer to 4 decimal places, e.g., 32.1616.) per share a 4 Calculate the new stock price. (Do not round intermediate calculations and round your answer to 2 decimal places, 9... 32.16.) Stock price a 5 Calculate the new market-to-book ratio (Do not found intermediate calculations and round your final answer to 4 decimal places, ... 32. 1616.) Market-to-book ratio b. What would the new net income for the company have to be for the stock price to remain unchanged? (Enter your answer in dollars, not millions of dollars, ... 1,234,567. Do not found Intermediate calculations and round your answer to nearest whole dollar amount ... 32.) Net income FINANCE Chapter 15 Homework for Credit 25.00 points The Metallica Heavy Metal Mining (MHMM) Corporation wants to diversify its operations. Some recent financial information for the company is shown here Stock price Number of shares Total assets Total liabilities Net income 40.000 S 6.000.000 $ 2,000,000 500.000 MHMM is considering an investment that has the same PE ratio as the firm. The cost of the investment is $800,000, and it will be financed with a new equity issue The ROE on the investment would have to be percent (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places, o... 32.16.) if we wanted the price after the offenng to be 550 per share (assume the PE ratio remains constant), and the NPV of the instment would be s (Leave no cells blank - be certain to enter "0" wherever requited. Do not found Intermediate calculations) Accounting dilution (Click to select) - occur in this case Market value dilution (Click to select) - occur in this case. = FINANCE Chapter 15 Homework for Credit value 25.00 points Bell Hill Mig, is considering a rights offer. The company has determined that the ex-rights price would be $75. The current price is $96 per share, and there are 15 million shares outstanding. The rights offer would raise a total of $60 million What is the subscription price? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g. 32.16.) Subscription price