Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Eric just bought a house yesterday in Thunder Bay. The house was listed for $585,000 and Eric made a down payment of $150,000 and

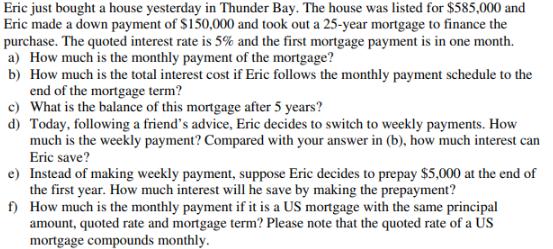

Eric just bought a house yesterday in Thunder Bay. The house was listed for $585,000 and Eric made a down payment of $150,000 and took out a 25-year mortgage to finance the purchase. The quoted interest rate is 5% and the first mortgage payment is in one month. a) How much is the monthly payment of the mortgage? b) How much is the total interest cost if Eric follows the monthly payment schedule to the end of the mortgage term? c) What is the balance of this mortgage after 5 years? d) Today, following a friend's advice, Eric decides to switch to weekly payments. How much is the weekly payment? Compared with your answer in (b), how much interest can Eric save? e) Instead of making weekly payment, suppose Eric decides to prepay $5,000 at the end of the first year. How much interest will he save by making the prepayment? f) How much is the monthly payment if it is a US mortgage with the same principal amount, quoted rate and mortgage term? Please note that the quoted rate of a US mortgage compounds monthly.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To calculate the monthly payment of the mortgage we can use the formula for a fixedrate mortgage p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started