Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Eric Parker has been studying his department's profitability reports for the past six months. He has just completed a managerial accounting course and beginning to

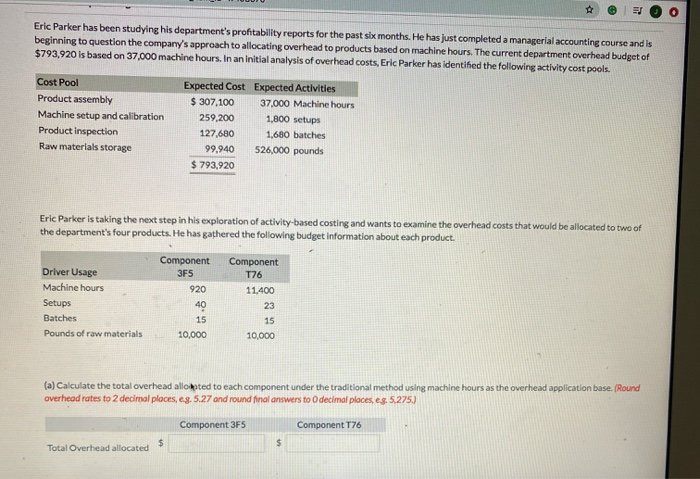

Eric Parker has been studying his department's profitability reports for the past six months. He has just completed a managerial accounting course and beginning to question the company's approach to allocating overhead to products based on machine hours. The current department overhead budget of \$793,920 is based on 37,000 machine hours. In an initial analysis of overhead costs, Eric Parker has identified the following activity cost pools. Cost Pool Product assembly Machine setup and calibration Product inspection Raw materials storage Expected Cost Expected Activities $ 307,100 37.000 Machine hours 259,200 1,800 setups 127,680 1.680 batches 99.940 526,000 pounds $ 793.920

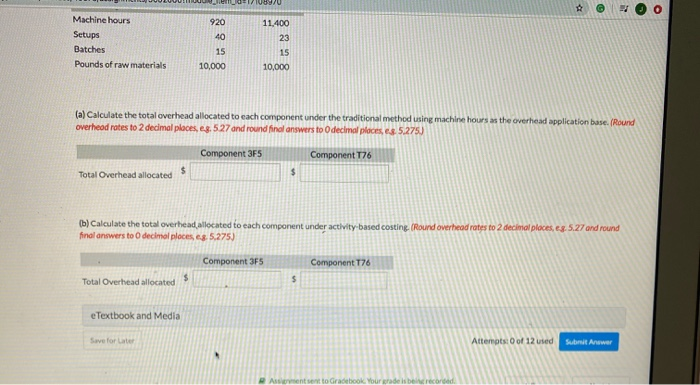

(a) Calculate the total allocated to each component under the traditional method hours as the application base ( overhead to decimal placesand round final answers to decimal places Component Component 176 Total Overhead allocated

B (b) Calculate the total overhead allocated to each component under activity based costing (Round overhead to 2 decimal places, and round answers decimal , / Component 3F5 Component Total Overhead allocated

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started