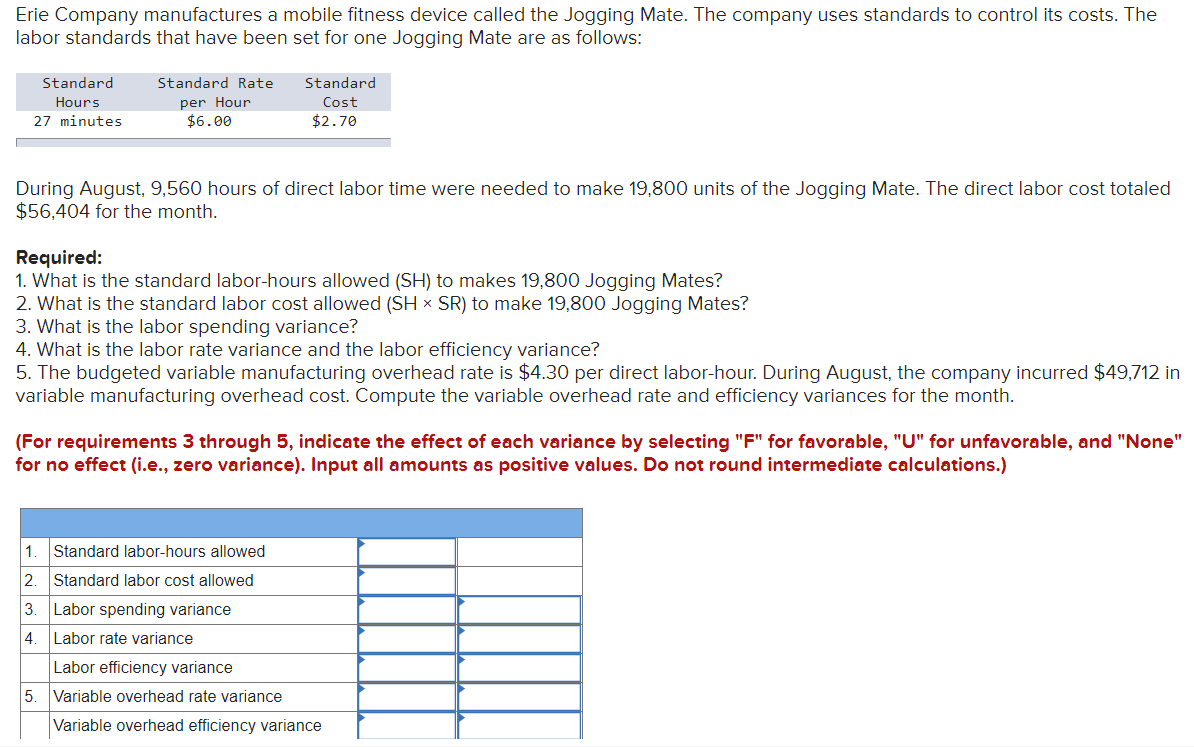

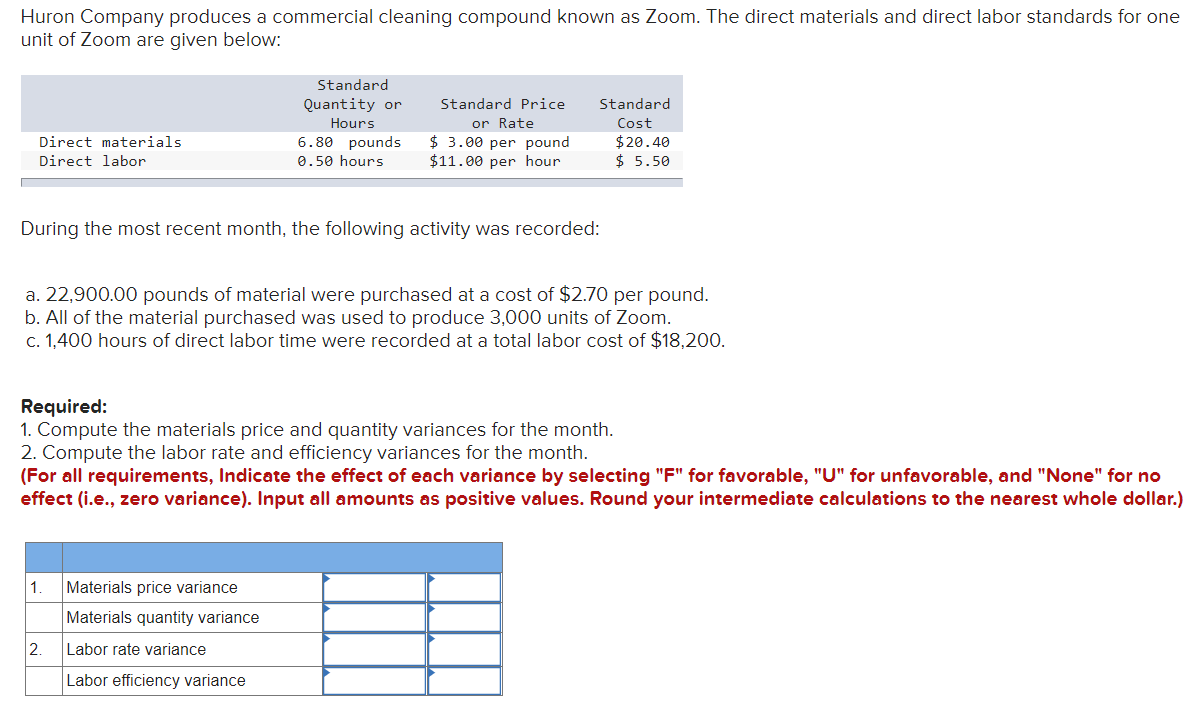

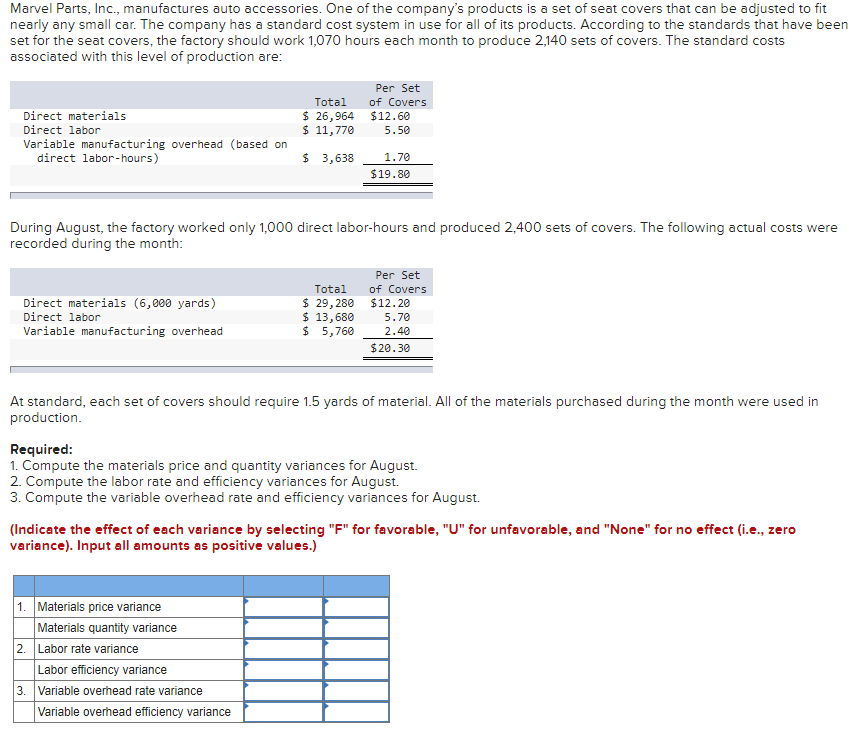

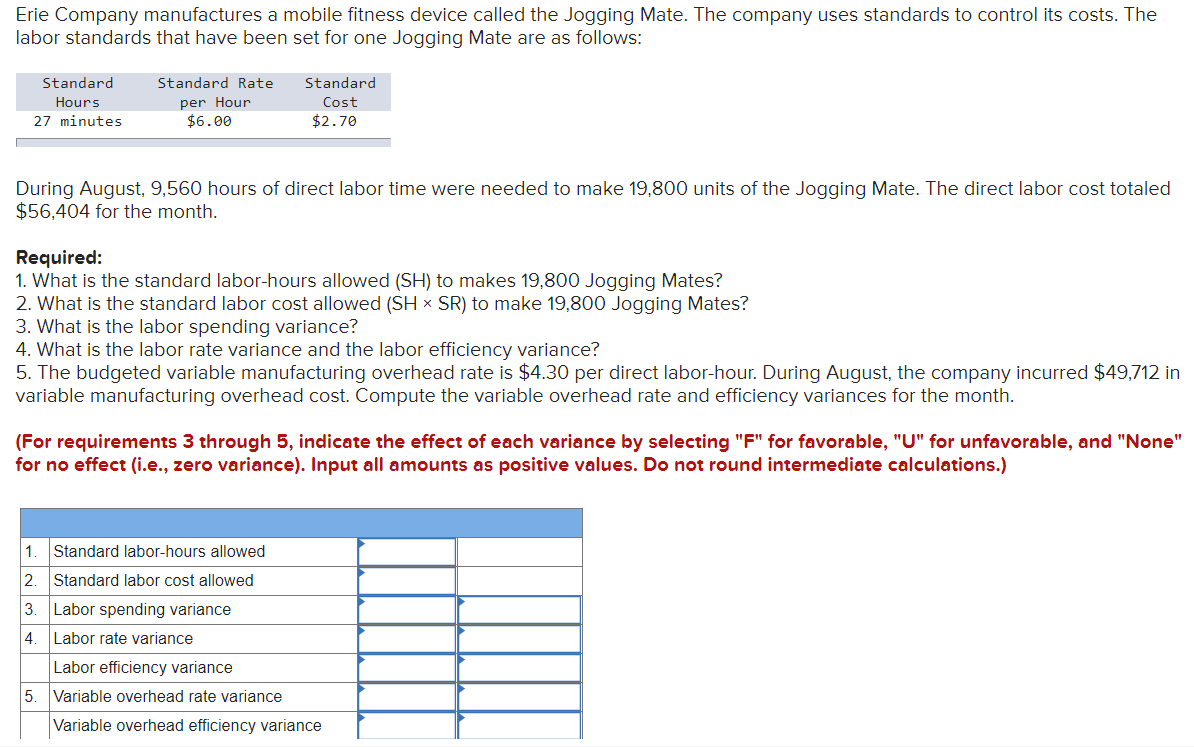

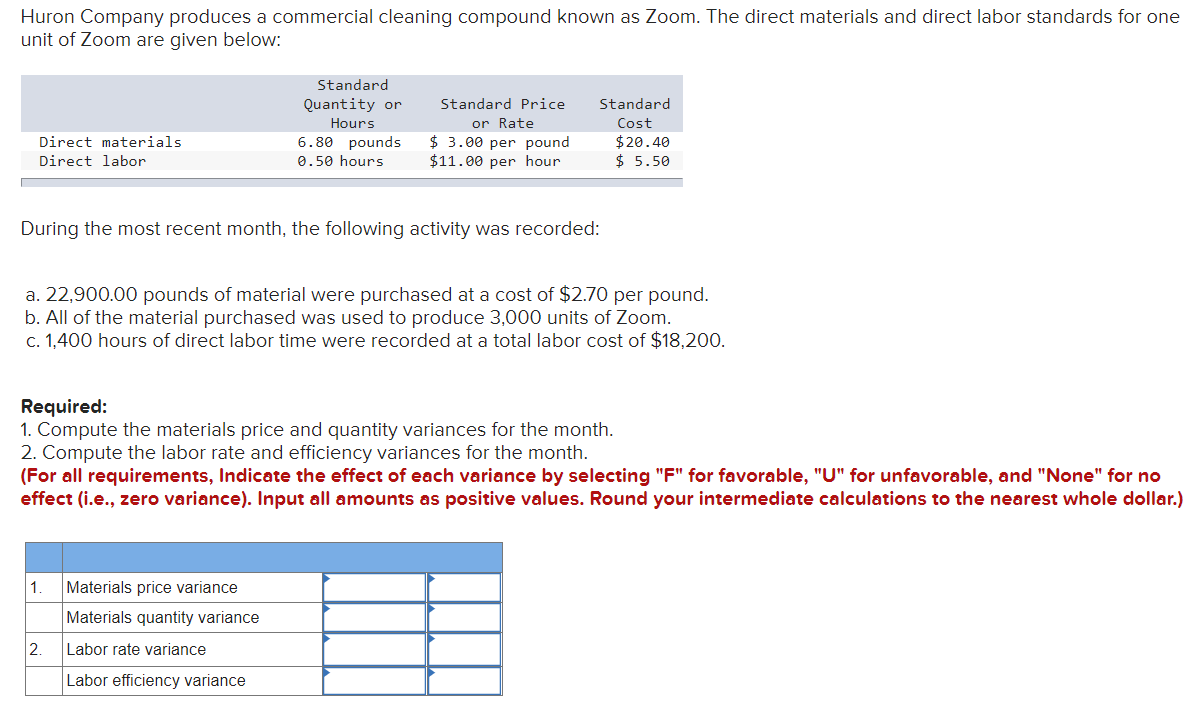

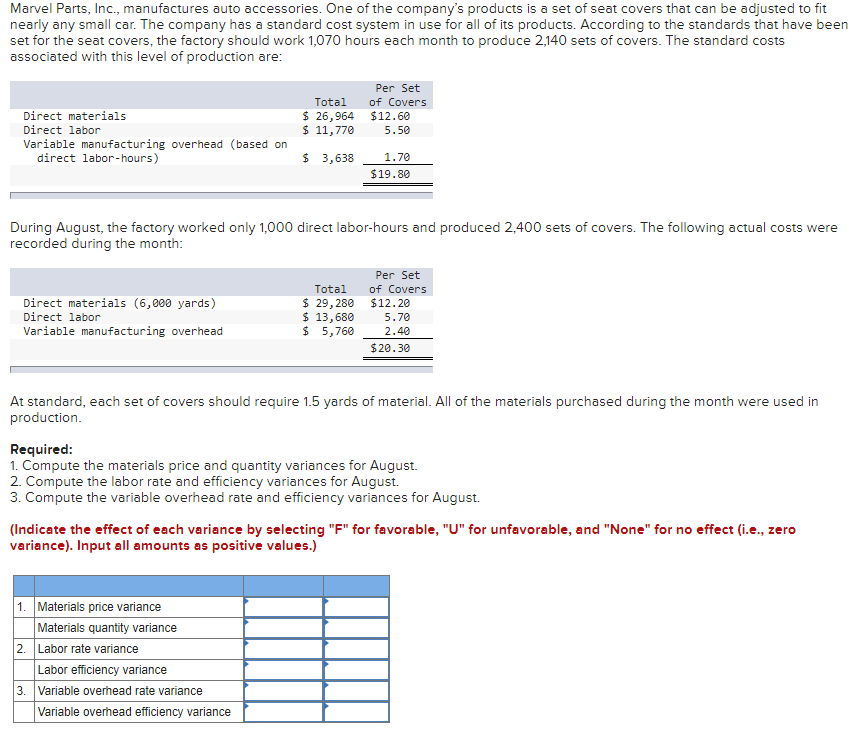

Erie Company manufactures a mobile fitness device called the Jogging Mate. The company uses standards to control its costs. The labor standards that have been set for one Jogging Mate are as follows: Standard Hours 27 minutes Standard Rate per Hour $6.00 Standard Cost $2.70 During August, 9,560 hours of direct labor time were needed to make 19,800 units of the Jogging Mate. The direct labor cost totaled $56,404 for the month. Required: 1. What is the standard labor-hours allowed (SH) to makes 19,800 Jogging Mates? 2. What is the standard labor cost allowed (SH ~ SR) to make 19,800 Jogging Mates? 3. What is the labor spending variance? 4. What is the labor rate variance and the labor efficiency variance? 5. The budgeted variable manufacturing overhead rate is $4.30 per direct labor-hour. During August, the company incurred $49,712 in variable manufacturing overhead cost. Compute the variable overhead rate and efficiency variances for the month. (For requirements 3 through 5, indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (.e., zero variance). Input all amounts as positive values. Do not round intermediate calculations.) 1. Standard labor-hours allowed 2. Standard labor cost allowed 3. Labor spending variance 4. Labor rate variance Labor efficiency variance 5. Variable overhead rate variance Variable overhead efficiency variance Huron Company produces a commercial cleaning compound known as Zoom. The direct materials and direct labor standards for one unit of Zoom are given below: Standard Quantity or Hours 6.80 pounds 0.50 hours Direct materials Direct labor Standard Price or Rate $ 3.00 per pound $11.00 per hour Standard Cost $20.40 $ 5.50 During the most recent month, the following activity was recorded: a. 22,900.00 pounds of material were purchased at a cost of $2.70 per pound. b. All of the material purchased was used to produce 3,000 units of Zoom. C. 1,400 hours of direct labor time were recorded at a total labor cost of $18,200. Required: 1. Compute the materials price and quantity variances for the month. 2. Compute the labor rate and efficiency variances for the month. (For all requirements, Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values. Round your intermediate calculations to the nearest whole dollar.) 1 Materials price variance Materials quantity variance 2 Labor rate variance Labor efficiency variance Marvel Parts, Inc., manufactures auto accessories. One of the company's products is a set of seat covers that can be adjusted to fit nearly any small car. The company has a standard cost system in use for all of its products. According to the standards that have been set for the seat covers, the factory should work 1,070 hours each month to produce 2,140 sets of covers. The standard costs associated with this level of production are: Direct materials Direct labor Variable manufacturing overhead (based on direct labor-hours) Per Set Total of Covers $ 26,964 $12.60 $ 11,770 5.50 $ 3,638 1.70 $19.80 During August, the factory worked only 1,000 direct labor-hours and produced 2,400 sets of covers. The following actual costs were recorded during the month: Direct materials (6,000 yards) Direct labor Variable manufacturing overhead Total $ 29, 280 $ 13,680 $ 5,760 Per Set of Covers $12.20 5.70 2.40 $20.30 At standard, each set of covers should require 1.5 yards of material. All of the materials purchased during the month were used in production. Required: 1. Compute the materials price and quantity variances for August. 2. Compute the labor rate and efficiency variances for August. 3. Compute the variable overhead rate and efficiency variances for August. (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values.) 1. Materials price variance Materials quantity variance 2. Labor rate variance Labor efficiency variance 3. Variable overhead rate variance Variable overhead efficiency variance