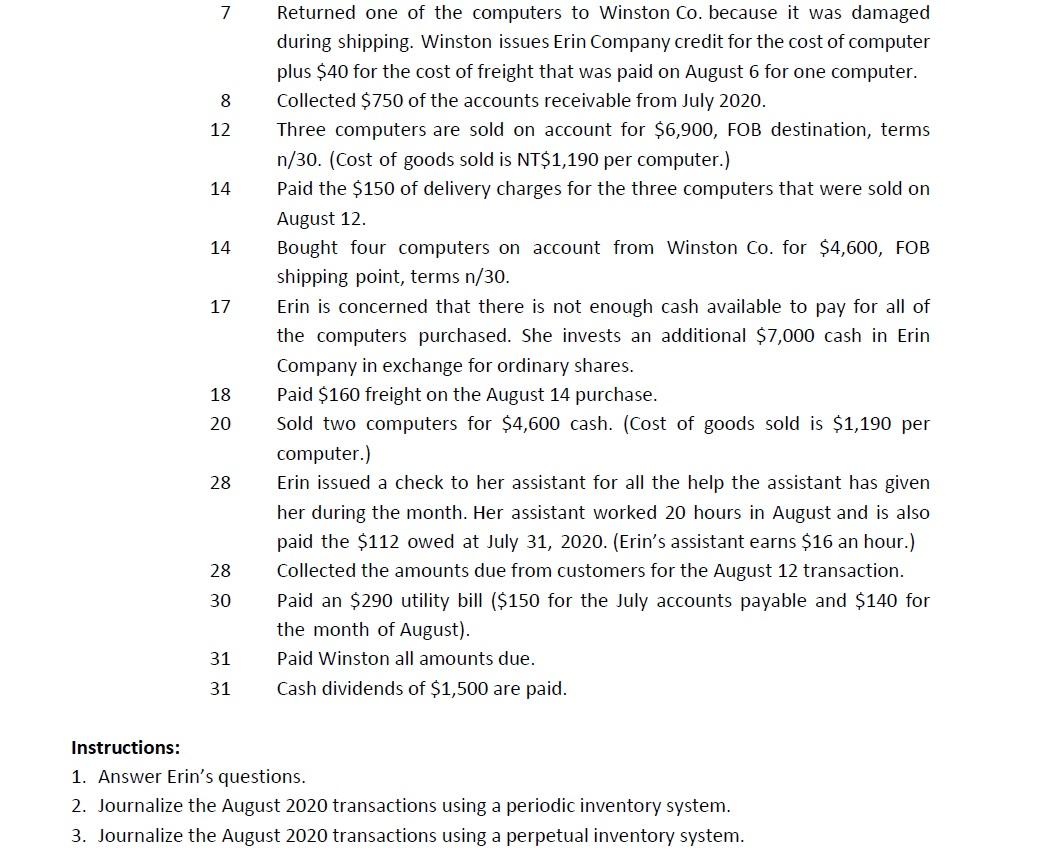

Erin Company had such a successful business first few months, she is considering other opportunities to develop her business. One opportunity is the sale of computers. The owner of Winston Co. has approached Erin to become the exclusive distributor of computer in her state. The current cost of a computer is approximately $1,150, and Erin would sell each one for $2,300. Erin comes to you for advice on how to account for these computers. Erin asks you the following questions. 1. "Would you consider these computers to be inventory or should they be classified as supplies or equipment?" 2. "I've learned a little about keeping track of inventory using both the perpetual and the periodic systems of accounting for inventory. Which system do you think is better? Which one would you recommend for the type of inventory that I want to sell?" 3. "How often do I need to count inventory if I maintain it using the perpetual system? Do I need to count inventory at all?" The following transactions happen during the month of August. Aug. 4 Bought five computers on account from Winston Co. for $5,750, FOB shipping point, terms n/30. 6 Paid $200 freight on the August 4 purchase. 7 8 12 14 14 17 Returned one of the computers to Winston Co. because it was damaged during shipping. Winston issues Erin Company credit for the cost of computer plus $40 for the cost of freight that was paid on August 6 for one computer. Collected $750 of the accounts receivable from July 2020. Three computers are sold on account for $6,900, FOB destination, terms n/30. (Cost of goods sold is NT$1,190 per computer.) Paid the $150 of delivery charges for the three computers that were sold on August 12. Bought four computers on account from Winston Co. for $4,600, FOB shipping point, terms n/30. Erin is concerned that there is not enough cash available to pay for all of the computers purchased. She invests an additional $7,000 cash in Erin Company in exchange for ordinary shares. Paid $160 freight on the August 14 purchase. Sold two computers for $4,600 cash. (Cost of goods sold is $1,190 per computer.) Erin issued a check to her assistant for all the help the assistant has given her during the month. Her assistant worked 20 hours in August and is also paid the $112 owed at July 31, 2020. (Erin's assistant earns $16 an hour.) Collected the amounts due from customers for the August 12 transaction. Paid an $290 utility bill ($150 for the July accounts payable and $140 for the month of August). Paid Winston all amounts due. Cash dividends of $1,500 are paid. 18 20 28 28 30 31 31 Instructions: 1. Answer Erin's questions. 2. Journalize the August 2020 transactions using a periodic inventory system. 3. Journalize the August 2020 transactions using a perpetual inventory system. CASE 2 (20%) Erin Company had such a successful business first few months, she is considering other opportunities to develop her business. One opportunity is the sale of computers. The owner of Winston Co. has approached Erin to become the exclusive distributor of computer in her state. The current cost of a computer is approximately $1,150, and Erin would sell each one for $2,300. Erin comes to you for advice on how to account for these computers. Erin asks you the following questions. 1. "Would you consider these computers to be inventory or should they be classified as supplies or equipment?" 2. "I've learned a little about keeping track of inventory using both the perpetual and the periodic systems of accounting for inventory. Which system do you think is better? Which one would you recommend for the type of inventory that I want to sell?" 3. "How often do I need to count inventory if I maintain it using the perpetual system? Do I need to count inventory at all?" The following transactions happen during the month of August. Aug. 4 Bought five computers on account from Winston Co. for $5.750, FOB shipping point, terms n/30. 6 Paid $200 freight on the August 4 purchase. Erin Company had such a successful business first few months, she is considering other opportunities to develop her business. One opportunity is the sale of computers. The owner of Winston Co. has approached Erin to become the exclusive distributor of computer in her state. The current cost of a computer is approximately $1,150, and Erin would sell each one for $2,300. Erin comes to you for advice on how to account for these computers. Erin asks you the following questions. 1. "Would you consider these computers to be inventory or should they be classified as supplies or equipment?" 2. "I've learned a little about keeping track of inventory using both the perpetual and the periodic systems of accounting for inventory. Which system do you think is better? Which one would you recommend for the type of inventory that I want to sell?" 3. "How often do I need to count inventory if I maintain it using the perpetual system? Do I need to count inventory at all?" The following transactions happen during the month of August. Aug. 4 Bought five computers on account from Winston Co. for $5,750, FOB shipping point, terms n/30. 6 Paid $200 freight on the August 4 purchase. 7 8 12 14 14 17 Returned one of the computers to Winston Co. because it was damaged during shipping. Winston issues Erin Company credit for the cost of computer plus $40 for the cost of freight that was paid on August 6 for one computer. Collected $750 of the accounts receivable from July 2020. Three computers are sold on account for $6,900, FOB destination, terms n/30. (Cost of goods sold is NT$1,190 per computer.) Paid the $150 of delivery charges for the three computers that were sold on August 12. Bought four computers on account from Winston Co. for $4,600, FOB shipping point, terms n/30. Erin is concerned that there is not enough cash available to pay for all of the computers purchased. She invests an additional $7,000 cash in Erin Company in exchange for ordinary shares. Paid $160 freight on the August 14 purchase. Sold two computers for $4,600 cash. (Cost of goods sold is $1,190 per computer.) Erin issued a check to her assistant for all the help the assistant has given her during the month. Her assistant worked 20 hours in August and is also paid the $112 owed at July 31, 2020. (Erin's assistant earns $16 an hour.) Collected the amounts due from customers for the August 12 transaction. Paid an $290 utility bill ($150 for the July accounts payable and $140 for the month of August). Paid Winston all amounts due. Cash dividends of $1,500 are paid. 18 20 28 28 30 31 31 Instructions: 1. Answer Erin's questions. 2. Journalize the August 2020 transactions using a periodic inventory system. 3. Journalize the August 2020 transactions using a perpetual inventory system. CASE 2 (20%) Erin Company had such a successful business first few months, she is considering other opportunities to develop her business. One opportunity is the sale of computers. The owner of Winston Co. has approached Erin to become the exclusive distributor of computer in her state. The current cost of a computer is approximately $1,150, and Erin would sell each one for $2,300. Erin comes to you for advice on how to account for these computers. Erin asks you the following questions. 1. "Would you consider these computers to be inventory or should they be classified as supplies or equipment?" 2. "I've learned a little about keeping track of inventory using both the perpetual and the periodic systems of accounting for inventory. Which system do you think is better? Which one would you recommend for the type of inventory that I want to sell?" 3. "How often do I need to count inventory if I maintain it using the perpetual system? Do I need to count inventory at all?" The following transactions happen during the month of August. Aug. 4 Bought five computers on account from Winston Co. for $5.750, FOB shipping point, terms n/30. 6 Paid $200 freight on the August 4 purchase