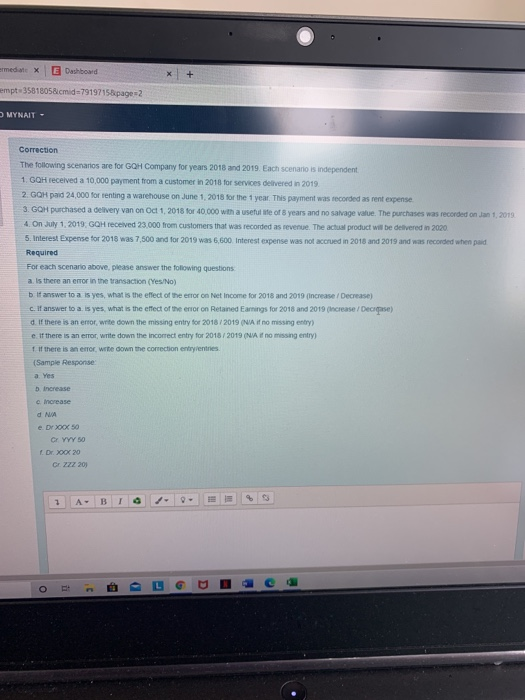

ermedaX E Dashboard empt35818058 cmid=7919715&page=2 MYNAIT - Correction The following scenarios are for GOH Company for years 2018 and 2019. Each scenario is independent 1.GQH received a 10,000 payment from a customer in 2018 for services delivered in 2019. 2. GOH pard 24,000 for renting a warehouse on June 1, 2018 for the year. This payment was recorded as rent expense 3. GOH purchased a delivery van on Oct 1, 2018 for 40.000 with a useful life of 8 years and no salvage value. The purchases was recorded on Jan 1, 2019 4. On July 1, 2019. GOH received 23.000 from customers that was recorded as revenue. The actual product will be delivered in 2020 5. Interest Expense for 2018 was 7,500 and for 2019 was 6,600 Interest expense was not accrued in 2018 and 2019 and was recorded when paid Required For each scenario above, please answer the following questions a. Is there an error in the transaction (Yes/No) b. If answer to a is yes, what is the effect of the error on Net Income for 2018 and 2019 Increase / Decrease) C. If answer to a. is yes, what is the effect of the error on Retained Earnings for 2018 and 2019 (Increase / Decrqase) d. If there is an error, write down the missing entry for 2018/2019 (NA if no missing entry) If there is an error, write down the incorrect entry for 2018/2019 (NAi no missing entry) 1 If there is an error wite down the correction entry entries (Sample Response a Yes increase c. Increase d NA e Dr XCX 50 CY YYY 50 1. Dr. XOX 20 CE ZZZ 20) 1 A B o ermedaX E Dashboard empt35818058 cmid=7919715&page=2 MYNAIT - Correction The following scenarios are for GOH Company for years 2018 and 2019. Each scenario is independent 1.GQH received a 10,000 payment from a customer in 2018 for services delivered in 2019. 2. GOH pard 24,000 for renting a warehouse on June 1, 2018 for the year. This payment was recorded as rent expense 3. GOH purchased a delivery van on Oct 1, 2018 for 40.000 with a useful life of 8 years and no salvage value. The purchases was recorded on Jan 1, 2019 4. On July 1, 2019. GOH received 23.000 from customers that was recorded as revenue. The actual product will be delivered in 2020 5. Interest Expense for 2018 was 7,500 and for 2019 was 6,600 Interest expense was not accrued in 2018 and 2019 and was recorded when paid Required For each scenario above, please answer the following questions a. Is there an error in the transaction (Yes/No) b. If answer to a is yes, what is the effect of the error on Net Income for 2018 and 2019 Increase / Decrease) C. If answer to a. is yes, what is the effect of the error on Retained Earnings for 2018 and 2019 (Increase / Decrqase) d. If there is an error, write down the missing entry for 2018/2019 (NA if no missing entry) If there is an error, write down the incorrect entry for 2018/2019 (NAi no missing entry) 1 If there is an error wite down the correction entry entries (Sample Response a Yes increase c. Increase d NA e Dr XCX 50 CY YYY 50 1. Dr. XOX 20 CE ZZZ 20) 1 A B o