Ernest is a sole proprietor with employees where would report the payroll tax deferral on wages paid to his employees?

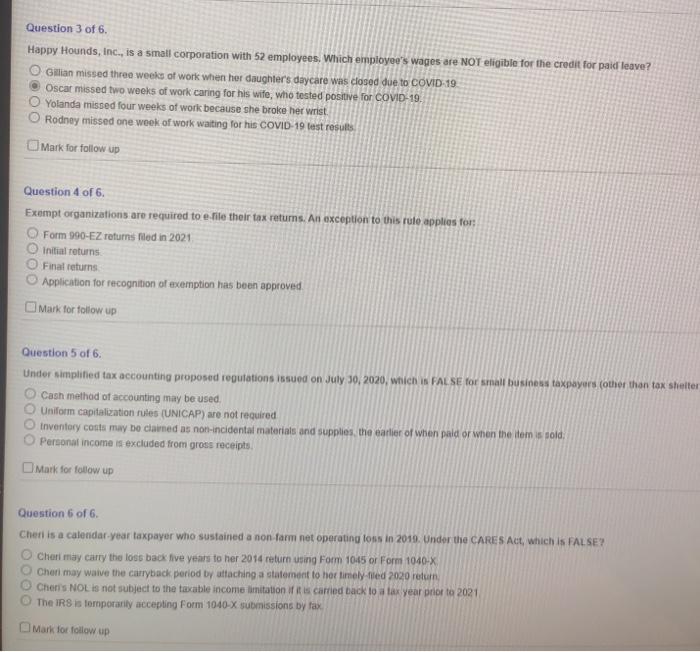

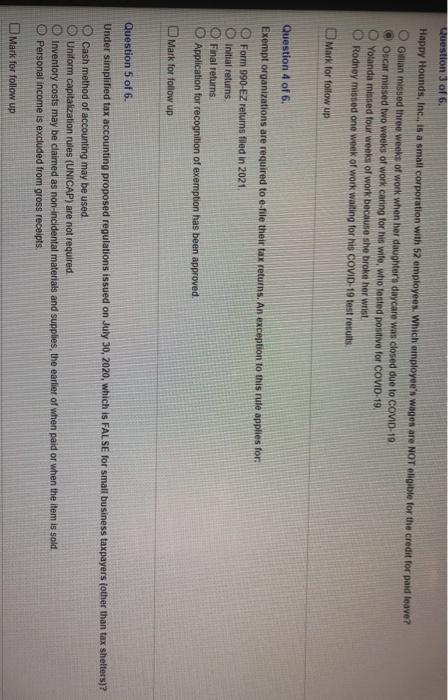

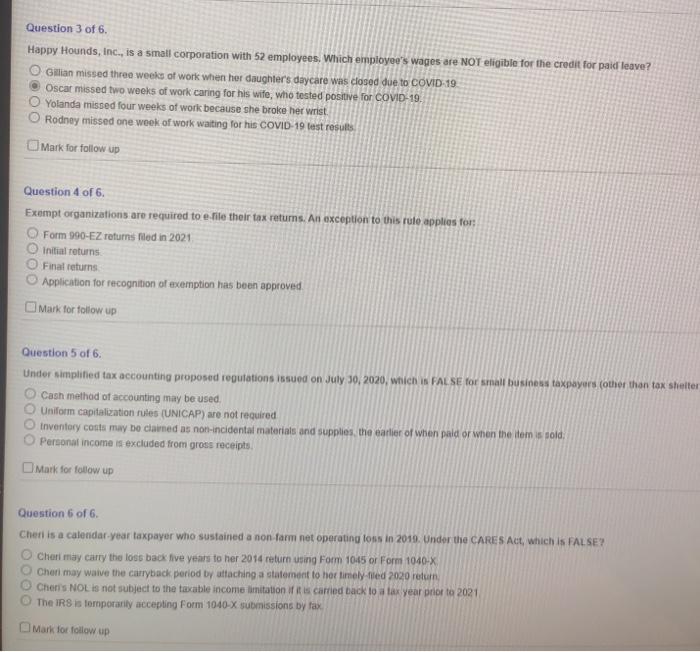

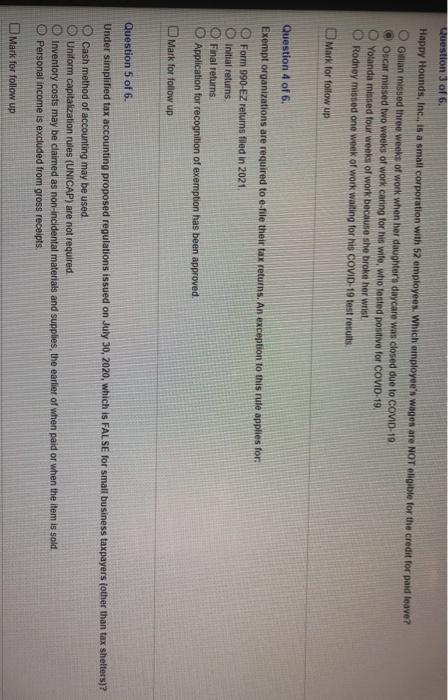

Question 3 of 6. Happy Hounds, inc., is a small corporation with 52 employees. Which employee's wages are NOT eligible for the credit for paid leave? O Gillian missed three weeks of work when her daughter's daycare was closed due to COVID-19 Oscar missed two weeks of work caring for his wife, who tested positive for COVID-19. O Yolanda missed four weeks of work because she broke her wrist. Rodney missed one week of work waiting for his COVID-19 test results Mark for follow up Question 4 of 6. Exempt organizations are required to e-file their tax returns. An exception to this rule applies for: Form 990-EZ returns med in 2021 Initial returns Final returns Application for recognition of exemption has been approved Mark for follow up Question 5 of 6. Under simplified tax accounting proposed regulations issued on July 30, 2020, which iN FALSE for small business taxpayers (other than tax shelter Cash method of accounting may be used. Uniform capitalization rules (UNICAP) are not required Inventory conts may be claimed as non-incidental materials and supplies the earlier of when paid or when the item is sold Personal income is excluded from gross receipts Mark for follow up Question 6 of 6. Cheti is a calendar year taxpayer who sustained a non farm net operating loss in 2019. Under the CARES Act, which is FALSE? Chatimay carry the loss back five years to her 2014 return using Form 1045 or Form 1040-X Cheri may waive the carryback period by attaching a statement to her timely tiled 2020 return Cherr's NOL is not subject to the taxable income limitation if it is carried back to a fax year prior to 2021 The IRS is temporarily accepting Form 1040-X submissions by fax Mark for follow up Question 3 of 6. Happy Hounds, Inc., is a small corporation with 52 employees. Which employee's wages are NOT eligible for the credit for paid leave? O Olan missed three weeks of work when her daughter's daycare was closed due to COVID-10 @Oscar missed two weeks of work caring for his wife, who tested positive for COVID-19 Yolanda mited four weeks of work because she broke her wrist. Rodney missed one week of work waiting for his COVID-19 test results Marx for follow up Question 4 of 6. Exempt organizations are required to e-file their tax retums. An exception to this rule applies for Form 990-EZ returns filed in 2021, Initial returns Final returns Application for recognition of exemption has been approved. Mark for follow up Question 5 of 6. Under simplified tax accounting proposed regulations issued on July 30, 2020, which is FALSE for small business taxpayers (other than tax shelters)? Cash method of accounting may be used Undform capitalization rules (UNICAP) are not required Inventory costs may be claimed as non-incidental materials and supplies, the earlier of when paid or when the item is sold Personal income is excluded from gross receipts Mark for follow up