Question

Ernest Silva, a single taxpayer, earned $30,000 working days as a waiter and $5,000 working nights as a part-time janitor in a local factory. He

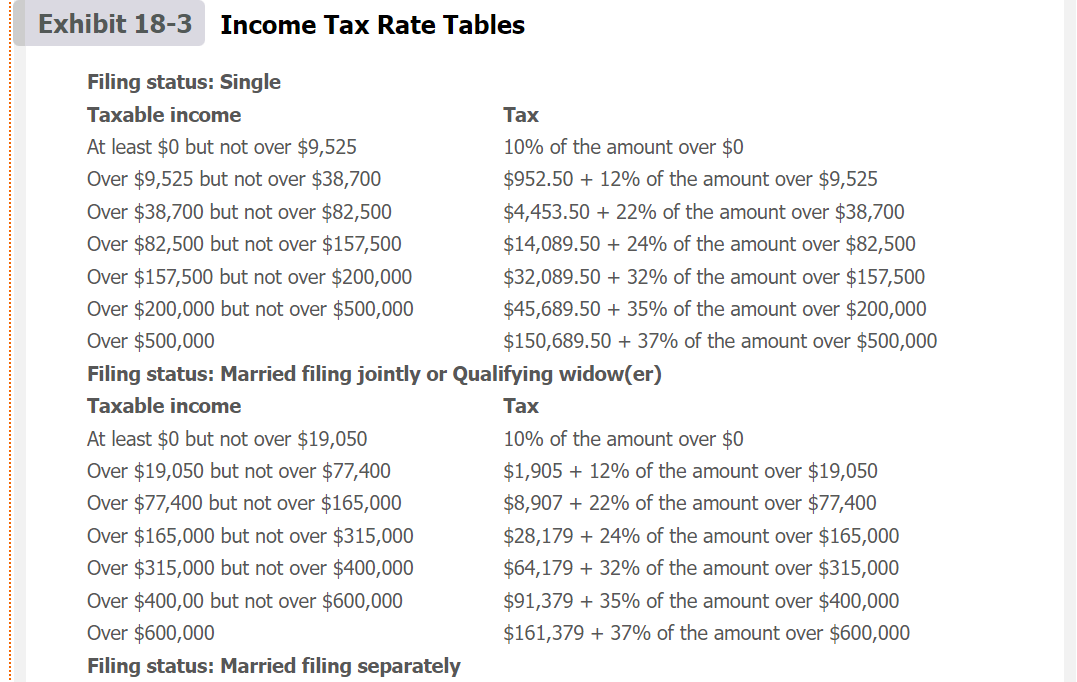

Ernest Silva, a single taxpayer, earned $30,000 working days as a waiter and $5,000 working nights as a part-time janitor in a local factory. He itemizes the following deductions: $8,000 interest on his house, $3,000 state taxes, $2,000 donation to his church, and $1,000 donation to the Salvation Army. Calculate taxable income using the itemized deduction, and then using Exhibit 18-3 in your ebook, compute the amount of tax liability.

Ernest Silva, a single taxpayer, earned $30,000 working days as a waiter and $5,000 working nights as a part-time janitor in a local factory. He itemizes the following deductions: $8,000 interest on his house, $3,000 state taxes, $2,000 donation to his church, and $1,000 donation to the Salvation Army. Calculate taxable income using the itemized deduction, and then using Exhibit 18-3 in your ebook, compute the amount of tax liability.

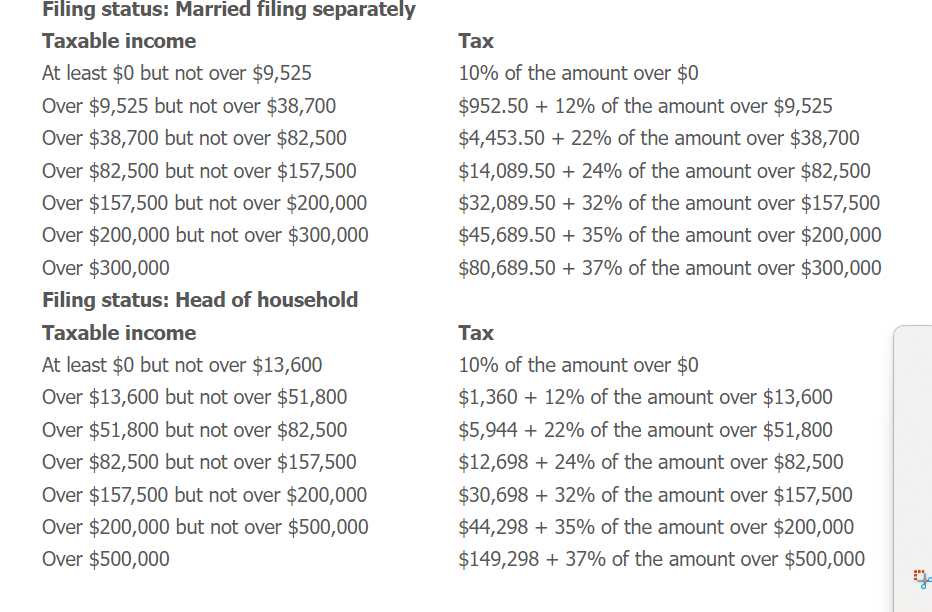

Income Tax Rate Tables Filing status: Married filing separately Taxable income Tax At least $0 but not over $9,52510% of the amount over $0 Over $9,525 but not over $38,700$952.50+12% of the amount over $9,525 Over $38,700 but not over $82,500$4,453.50+22% of the amount over $38,700 Over $82,500 but not over $157,500$14,089.50+24% of the amount over $82,500 Over $157,500 but not over $200,000$32,089.50+32% of the amount over $157,500 Over $200,000 but not over $300,000$45,689.50+35% of the amount over $200,000 Over $300,000$80,689.50+37% of the amount over $300,000 Filing status: Head of household Taxable income Tax At least $0 but not over $13,60010% of the amount over $0 Over $13,600 but not over $51,800$1,360+12% of the amount over $13,600 Over $51,800 but not over $82,500$5,944+22% of the amount over $51,800 Over $82,500 but not over $157,500$12,698+24% of the amount over $82,500 Over $157,500 but not over $200,000$30,698+32% of the amount over $157,500 Over $200,000 but not over $500,000$44,298+35% of the amount over $200,000 Over $500,000 $149,298+37% of the amount over $500,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started