Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ernestico PLC is a US software company with headquarters in San Francisco. The company is working on a plan to develop new software (Plagisoft) that

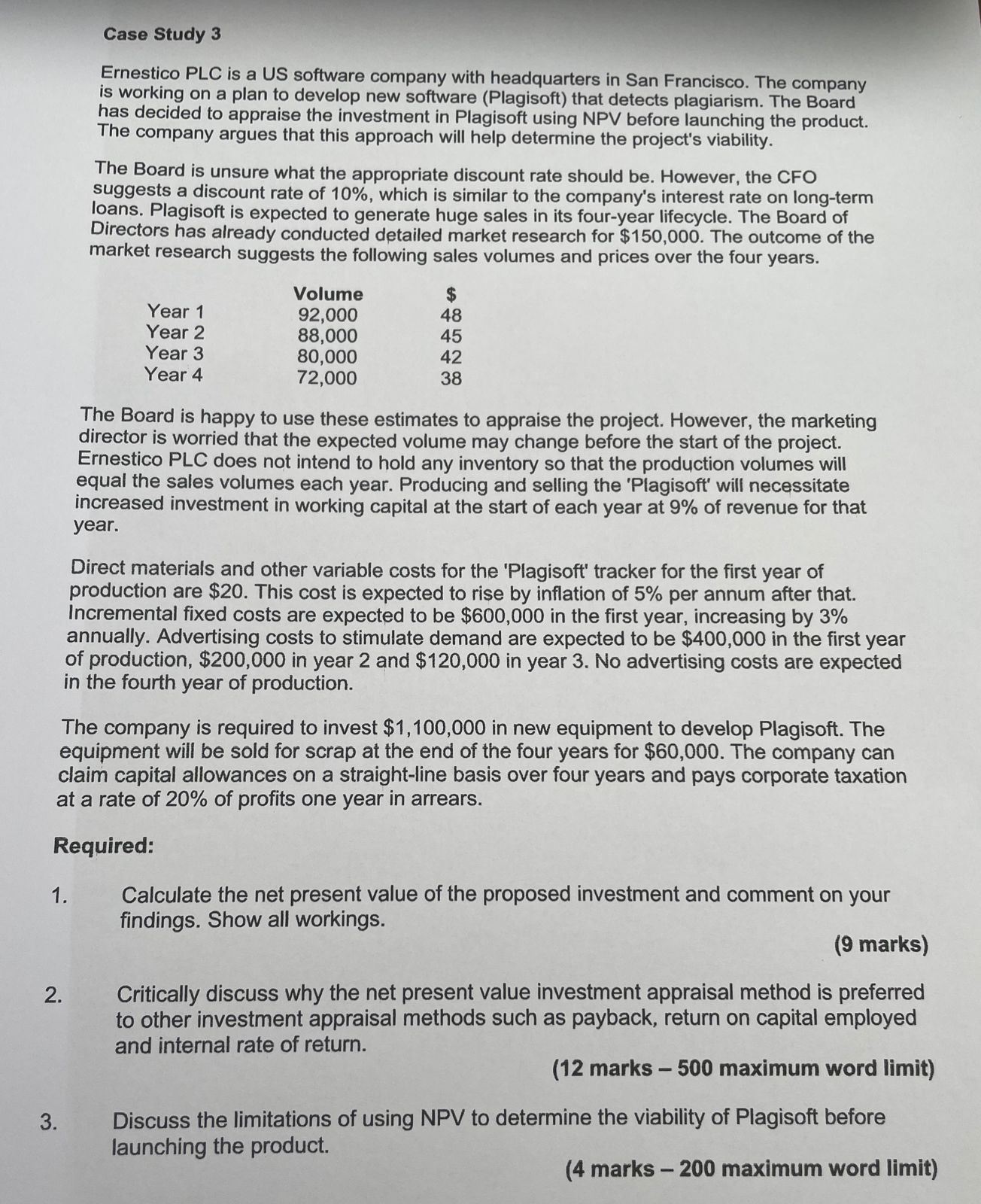

Ernestico PLC is a US software company with headquarters in San Francisco. The company is working on a plan to develop new software (Plagisoft) that detects plagiarism. The Board has decided to appraise the investment in Plagisoft using NPV before launching the product. The company argues that this approach will help determine the project's viability. The Board is unsure what the appropriate discount rate should be. However, the CFO suggests a discount rate of 10%, which is similar to the company's interest rate on long-term loans. Plagisoft is expected to generate huge sales in its four-year lifecycle. The Board of Directors has already conducted detailed market research for $150,000. The outcome of the market research suggests the following sales volumes and prices over the four years. The Board is happy to use these estimates to appraise the project. However, the marketing director is worried that the expected volume may change before the start of the project. Ernestico PLC does not intend to hold any inventory so that the production volumes will equal the sales volumes each year. Producing and selling the 'Plagisoft' will necessitate increased investment in working capital at the start of each year at 9% of revenue for that year. Direct materials and other variable costs for the 'Plagisoft' tracker for the first year of production are $20. This cost is expected to rise by inflation of 5% per annum after that. Incremental fixed costs are expected to be $600,000 in the first year, increasing by 3% annually. Advertising costs to stimulate demand are expected to be $400,000 in the first year of production, $200,000 in year 2 and $120,000 in year 3. No advertising costs are expected in the fourth year of production. The company is required to invest $1,100,000 in new equipment to develop Plagisoft. The equipment will be sold for scrap at the end of the four years for $60,000. The company can claim capital allowances on a straight-line basis over four years and pays corporate taxation at a rate of 20% of profits one year in arrears. Required: 1. Calculate the net present value of the proposed investment and comment on your findings. Show all workings. (9 marks) 2. Critically discuss why the net present value investment appraisal method is preferred to other investment appraisal methods such as payback, return on capital employed and internal rate of return. (12 marks - 500 maximum word limit) 3. Discuss the limitations of using NPV to determine the viability of Plagisoft before launching the product. (4 marks - 200 maximum word limit)

Ernestico PLC is a US software company with headquarters in San Francisco. The company is working on a plan to develop new software (Plagisoft) that detects plagiarism. The Board has decided to appraise the investment in Plagisoft using NPV before launching the product. The company argues that this approach will help determine the project's viability. The Board is unsure what the appropriate discount rate should be. However, the CFO suggests a discount rate of 10%, which is similar to the company's interest rate on long-term loans. Plagisoft is expected to generate huge sales in its four-year lifecycle. The Board of Directors has already conducted detailed market research for $150,000. The outcome of the market research suggests the following sales volumes and prices over the four years. The Board is happy to use these estimates to appraise the project. However, the marketing director is worried that the expected volume may change before the start of the project. Ernestico PLC does not intend to hold any inventory so that the production volumes will equal the sales volumes each year. Producing and selling the 'Plagisoft' will necessitate increased investment in working capital at the start of each year at 9% of revenue for that year. Direct materials and other variable costs for the 'Plagisoft' tracker for the first year of production are $20. This cost is expected to rise by inflation of 5% per annum after that. Incremental fixed costs are expected to be $600,000 in the first year, increasing by 3% annually. Advertising costs to stimulate demand are expected to be $400,000 in the first year of production, $200,000 in year 2 and $120,000 in year 3. No advertising costs are expected in the fourth year of production. The company is required to invest $1,100,000 in new equipment to develop Plagisoft. The equipment will be sold for scrap at the end of the four years for $60,000. The company can claim capital allowances on a straight-line basis over four years and pays corporate taxation at a rate of 20% of profits one year in arrears. Required: 1. Calculate the net present value of the proposed investment and comment on your findings. Show all workings. (9 marks) 2. Critically discuss why the net present value investment appraisal method is preferred to other investment appraisal methods such as payback, return on capital employed and internal rate of return. (12 marks - 500 maximum word limit) 3. Discuss the limitations of using NPV to determine the viability of Plagisoft before launching the product. (4 marks - 200 maximum word limit) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started