Question

Error: Analysis and Correction On July 1 of Year 8, a full years insurance premium of $2,400, covering the period July 1 of Year 8

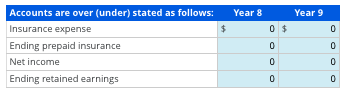

Error: Analysis and Correction On July 1 of Year 8, a full years insurance premium of $2,400, covering the period July 1 of Year 8 to June 30 of Year 9, was paid and debited to insurance expense. Assume the following: The company has a calendar scal year. January 1 of Year 8, retained earnings balance is $20,000. Year 8 reported net income (assuming the error is not discovered) is $22,800. Year 9 net income (assuming the error is not discovered) is $30,000. Year 10 net income is $40,000. Ignore taxes. Required a. List the eects of the error on aected accounts and on net income in Year 8 and Year 9. Assume no adjusting entry is made on December 31 of Year 8. Note: Indicate an understatement by using a negative sign (-) with the amount. Indicate no change by entering a zero (0).

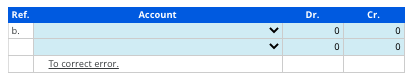

b. Prepare the entry to record the error if discovered in Year 8. Note: If a journal entry isn't required on any of the dates shown, select "N/Adebit" and "N/Acredit" as the account names and leave the Dr. and Cr. answers blank (zero).

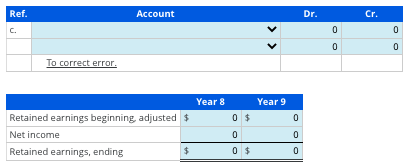

c. Prepare the entry to record the error if discovered in Year 9. Prepare the Year 8 and Year 9 retained earnings sections of the statement of stockholders equity. Note: If a journal entry isn't required on any of the dates shown, select "N/Adebit" and "N/Acredit" as the account names and leave the Dr. and Cr. answers blank (zero).

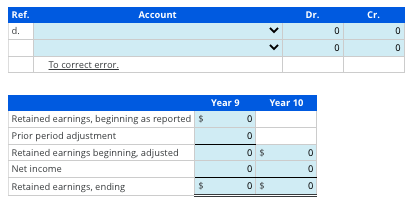

d. Prepare the entry (if needed) to record the error if discovered in Year 10. Prepare the Year 9 and Year 10 retained earnings sections of the statement of stockholders equity. Note: If a journal entry isn't required on any of the dates shown, select "N/Adebit" and "N/Acredit" as the account names and leave the Dr. and Cr. answers blank (zero).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started