Answered step by step

Verified Expert Solution

Question

1 Approved Answer

error. The error was corrected. (c) The General Fund transferred $8,000 to the Special Revenue Fund during the year. What is the net effect

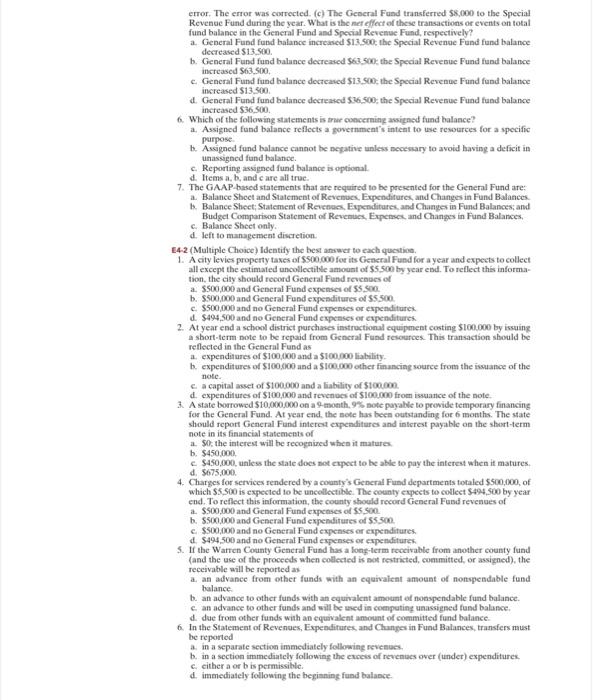

error. The error was corrected. (c) The General Fund transferred $8,000 to the Special Revenue Fund during the year. What is the net effect of these transactions or events on total fund balance in the General Fund and Special Revenue Fund, respectively? a. General Fund fund balance increased $13.500, the Special Revenue Fund fund balance decreased $13,500. b. General Fund fund balance decreased $63,500; the Special Revenue Fund fund balance increased $63,500. c. General Fund fund balance decreased $13,500; the Special Revenue Fund fund balance increased $13,500. d. General Fund fund balance decreased $36,500; the Special Revenue Fund fund balance increased $36,500. 6. Which of the following statements is true concerning assigned fund balance? a. Assigned fund balance reflects a government's intent to use resources for a specific purpose. b. Assigned fund balance cannot be negative unless necessary to avoid having a deficit in unassigned fund balance. c. Reporting assigned fund balance is optional. d. Items a, b, and c are all true. 7. The GAAP-based statements that are required to be presented for the General Fund are: a. Balance Sheet and Statement of Revenues, Expenditures, and Changes in Fund Balances. b. Balance Sheet; Statement of Revenues, Expenditures, and Changes in Fund Balances; and Budget Comparison Statement of Revenues, Expenses, and Changes in Fund Balances. c. Balance Sheet only. d. left to management discretion. E4-2 (Multiple Choice) Identify the best answer to each question. 1. A city levies property taxes of $500,000 for its General Fund for a year and expects to collect all except the estimated uncollectible amount of $5,500 by year end. To reflect this informa- tion, the city should record General Fund revenues of a. $500,000 and General Fund expenses of $5.500 b. $500,000 and General Fund expenditures of $5,500. c. $500,000 and no General Fund expenses or expenditures d. $494,500 and no General Fund expenses or expenditures 2. At year end a school district purchases instructional equipment costing $100,000 by issuing a short-term note to be repaid from General Fund resources. This transaction should be reflected in the General Fund as a. expenditures of $100,000 and a $100,000 liability. b. expenditures of $100,000 and a $100,000 other financing source from the issuance of the note. ca capital asset of $100,000 and a liability of $100,000. d. expenditures of $100,000 and revenues of $100,000 from issuance of the note. 3. A state borrowed $10,000,000 on a 9-month. 9% note payable to provide temporary financing for the General Fund. At year end, the note has been outstanding for 6 months. The state should report General Fund interest expenditures and interest payable on the short-term note in its financial statements of a. 50, the interest will be recognized when it matures. b. $450,000. $450,000, unless the state does not expect to be able to pay the interest when it matures. d. $675,000. 4. Charges for services rendered by a county's General Fund departments totaled $500,000, of which $5,500 is expected to be uncollectible. The county expects to collect $494,500 by year. end. To reflect this information, the county should record General Fund revenues of a. $500,000 and General Fund expenses of $5.500 b. $500,000 and General Fund expenditures of $5,500. c. $500,000 and no General Fund expenses or expenditures. d. $494,500 and no General Fund expenses or expenditures 5. If the Warren County General Fund has a long-term receivable from another county fund (and the use of the proceeds when collected is not restricted, committed, or assigned), the receivable will be reported as a. an advance from other funds with an equivalent amount of nonspendable fund balance. b. an advance to other funds with an equivalent amount of nonspendable fund balance. c. an advance to other funds and will be used in computing unassigned fund balance. d. due from other funds with an equivalent amount of committed fund balance. 6. In the Statement of Revenues, Expenditures, and Changes in Fund Balances, transfers must be reported a. in a separate section immediately following revenues. b. in a section immediately following the excess of revenues over (under) expenditures. c. either a or b is permissible. d. immediately following the beginning fund balance.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started