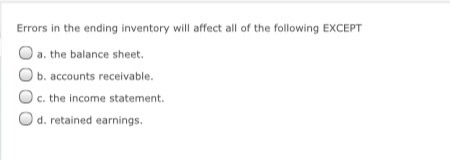

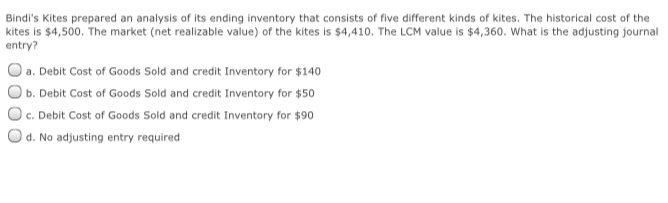

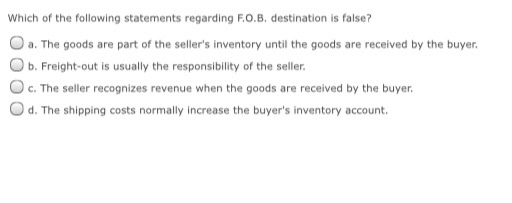

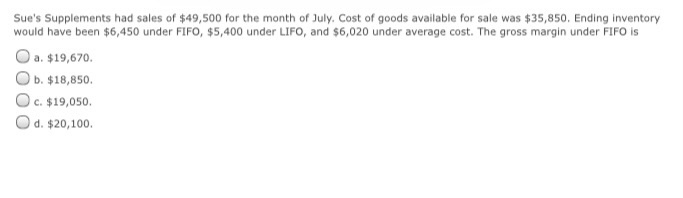

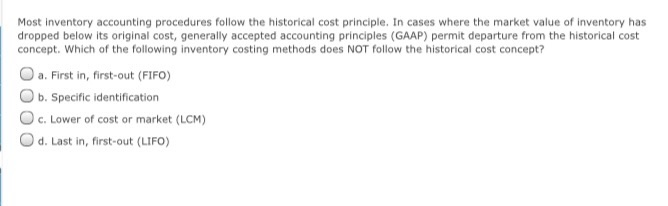

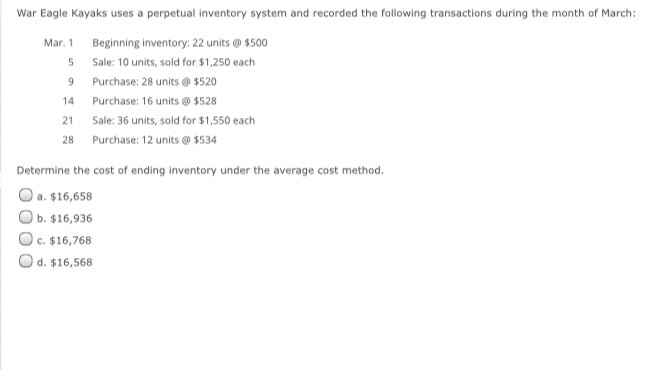

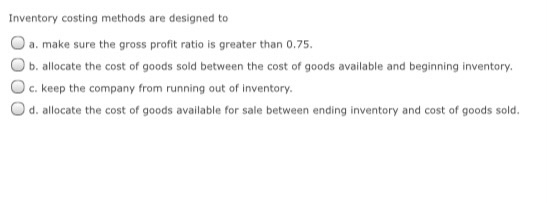

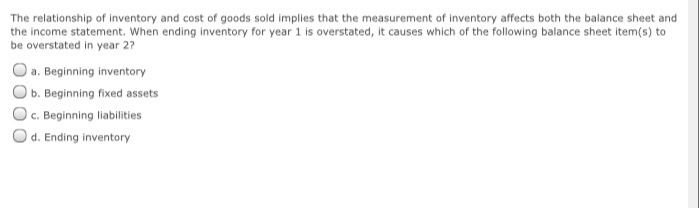

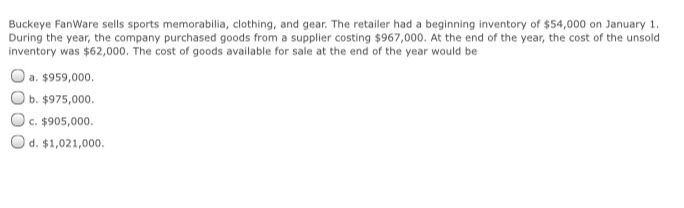

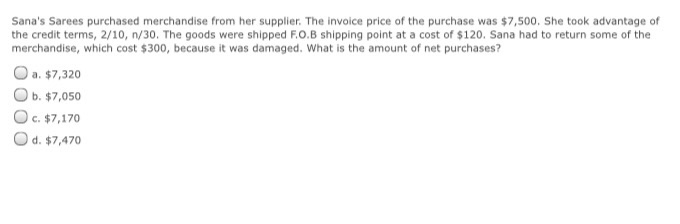

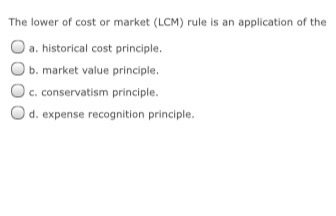

Errors in the ending inventory will affect all of the following EXCEPT O a. the balance sheet O b. accounts receivable. O c. the income statement. O d. retained earnings Bindi's Kites prepared an analysis of its ending inventory that consists of five different kinds of kites. The historical cost of the kites is $4,500. The market (net realizable value) of the kites is $4,410. The LCM value is $4,360. What is the adjusting journal entry? a. Debit Cost of Goods Sold and credit Inventory for $140 O b. Debit Cost of Goods Sold and credit Inventory for $50 Oc. Debit Cost of Goods Sold and credit Inventory for $90 d. No adjusting entry required Which of the following statements regarding F.0.B, destination is false? a. The goods are part of the seller's inventory until the goods are received by the buyer. b. Freight-out is usually the responsibility of the seller. c. The seller recognizes revenue when the goods are received by the buyer. d. The shipping costs normally increase the buyer's inventory account Sue's Supplements had sales of $49,500 for the month of July. Cost of goods available for sale was $35,850. Ending inventory would have been $6,450 under FIFO, $5,400 under LIFO, and $6,020 under average cost. The gross margin under FIFO is O a $19,670. O b. $18,850 O c. $19,050 O d. $20,100. Most inventory accounting procedures follow the historical cost principle. In cases where the market value of inventory has dropped below its original cost, generally accepted accounting principles (GAAP) permit departure from the historical cost concept. Which of the following inventory costing methods does NOT follow the historical cost concept? a. First in, first-out (FIFO) b. Specific identification c. Lower of cost or market (LCM) Od. Last in, first-out (LIFO) 5 War Eagle Kayaks uses a perpetual inventory system and recorded the following transactions during the month of March: Mar. 1 Beginning inventory: 22 units @ $500 Sale: 10 units, sold for $1,250 each Purchase: 28 units @ $520 14 Purchase: 16 units @ $528 21 Sale: 36 units, sold for $1,550 each 28 Purchase: 12 units @ $534 9 Determine the cost of ending inventory under the average cost method. O a $16,658 O b. $16,936 O c. $16,768 O d. $16,568 Inventory costing methods are designed to a. make sure the gross profit ratio is greater than 0.75. b. allocate the cost of goods sold between the cost of goods available and beginning inventory. c. keep the company from running out of inventory. d. allocate the cost of goods available for sale between ending inventory and cost of goods sold. The relationship of inventory and cost of goods sold implies that the measurement of inventory affects both the balance sheet and the income statement. When ending inventory for year 1 is overstated, it causes which of the following balance sheet item(s) to be overstated in year 2? a. Beginning inventory b. Beginning fixed assets c. Beginning liabilities d. Ending inventory Buckeye FanWare sells sports memorabilia, clothing, and gear. The retailer had a beginning inventory of $54,000 on January 1. During the year, the company purchased goods from a supplier costing $967,000. At the end of the year, the cost of the unsold inventory was $62,000. The cost of goods available for sale at the end of the year would be a $959,000 O b. $975,000 C. $905,000 Od. $1,021,000 Sana's Sarees purchased merchandise from her supplier. The invoice price of the purchase was $7,500. She took advantage of the credit terms, 2/10, n/30. The goods were shipped F.O.B shipping point at a cost of $120. Sana had to return some of the merchandise, which cost $300, because it was damaged. What is the amount of net purchases? O a $7,320 O b. $7,050 C. $7,170 Od $7,470 The lower of cost or market (LCM) rule is an application of the a historical cost principle. b. market value principle. c. conservatism principle. O d. expense recognition principle