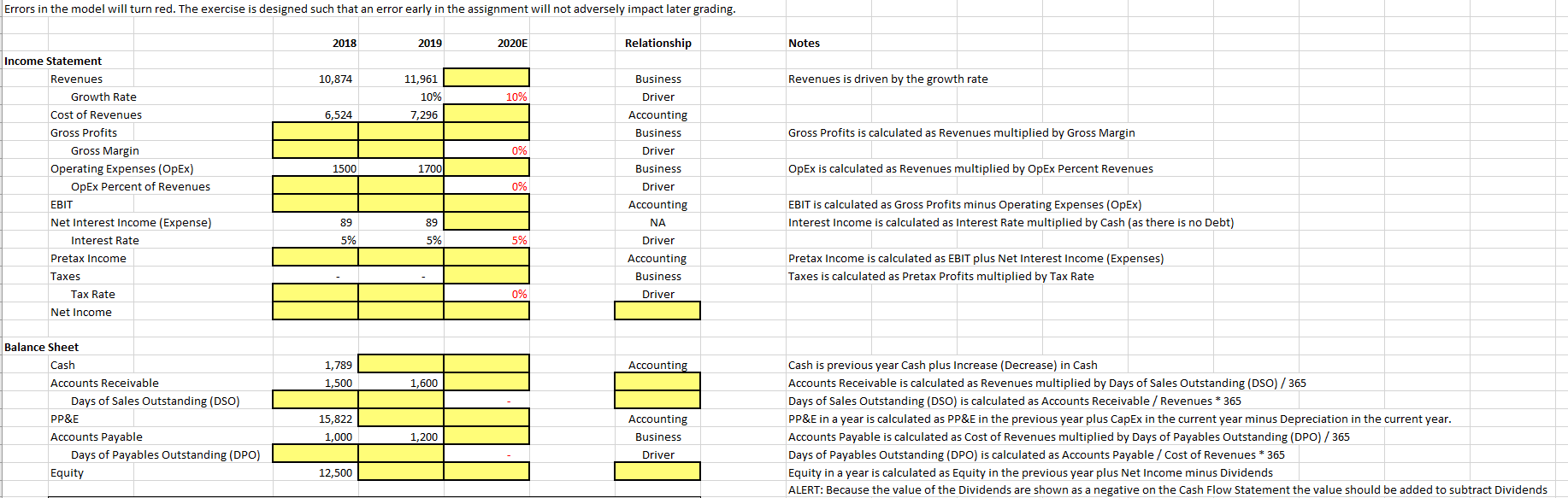

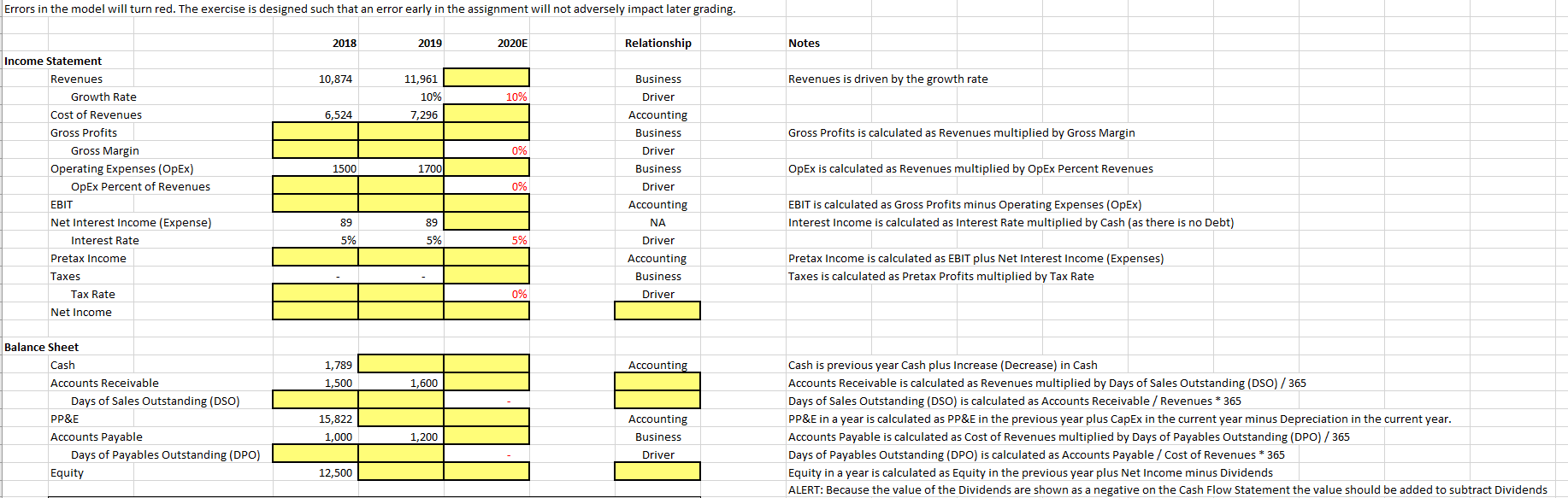

Errors in the model will turn red. The exercise is designed such that an error early in the assignment will not adversely impact later grading. 2018 2019 2020E Relationship Notes 10,874 Revenues is driven by the growth rate 11,961 10% 7,296 10% Business Driver Accounting Business 6,524 Gross Profits calculated as Revenues multiplied by Gross Margin 0% 1500 1700 Income Statement Revenues Growth Rate Cost of Revenues Gross Profits Gross Margin Operating Expenses (Opex) OpEx Percent of Revenues EBIT Net Interest Income (Expense) Interest Rate Pretax Income Taxes Tax Rate Net Income Driver Business Driver OpEx is calculated as Revenues multiplied by OpEx Percent Revenues 0% EBIT is calculated as Gross Profits minus Operating Expenses (OpEx) Interest Income is calculated as Interest Rate multiplied by Cash (as there is no Debt) 89 89 5% 5% 5% Accounting NA Driver Accounting Business Driver Pretax Income is calculated as EBIT plus Net Interest Income (Expenses) Taxes is calculated as Pretax Profits multiplied by Tax Rate 0% Accounting 1,789 1,500 1,600 Balance Sheet Cash Accounts Receivable Days of Sales Outstanding (DSO) PP&E Accounts Payable Days of Payables Outstanding (DPO) Equity 15,822 Cash is previous year Cash plus Increase (Decrease) in Cash Accounts Receivable is calculated as Revenues multiplied by Days of Sales Outstanding (DSO) / 365 Days of Sales Outstanding (DSO) is calculated as Accounts Receivable / Revenues * 365 PP&E in a year is calculated as PP&E in the previous year plus Capex in the current year minus Depreciation in the current year. Accounts Payable is calculated as Cost of Revenues multiplied by Days of Payables Outstanding (DPO)/365 Days of Payables Outstanding (DPO) is calculated as Accounts Payable / Cost of Revenues * 365 Equity in a year is calculated as Equity in the previous year plus Net Income minus Dividends ALERT: Because the value of the Dividends are shown as a negative on the Cash Flow Statement the value should be added to subtract Dividends 1,000 Accounting Business Driver 1,200 12,500 Errors in the model will turn red. The exercise is designed such that an error early in the assignment will not adversely impact later grading. 2018 2019 2020E Relationship Notes 10,874 Revenues is driven by the growth rate 11,961 10% 7,296 10% Business Driver Accounting Business 6,524 Gross Profits calculated as Revenues multiplied by Gross Margin 0% 1500 1700 Income Statement Revenues Growth Rate Cost of Revenues Gross Profits Gross Margin Operating Expenses (Opex) OpEx Percent of Revenues EBIT Net Interest Income (Expense) Interest Rate Pretax Income Taxes Tax Rate Net Income Driver Business Driver OpEx is calculated as Revenues multiplied by OpEx Percent Revenues 0% EBIT is calculated as Gross Profits minus Operating Expenses (OpEx) Interest Income is calculated as Interest Rate multiplied by Cash (as there is no Debt) 89 89 5% 5% 5% Accounting NA Driver Accounting Business Driver Pretax Income is calculated as EBIT plus Net Interest Income (Expenses) Taxes is calculated as Pretax Profits multiplied by Tax Rate 0% Accounting 1,789 1,500 1,600 Balance Sheet Cash Accounts Receivable Days of Sales Outstanding (DSO) PP&E Accounts Payable Days of Payables Outstanding (DPO) Equity 15,822 Cash is previous year Cash plus Increase (Decrease) in Cash Accounts Receivable is calculated as Revenues multiplied by Days of Sales Outstanding (DSO) / 365 Days of Sales Outstanding (DSO) is calculated as Accounts Receivable / Revenues * 365 PP&E in a year is calculated as PP&E in the previous year plus Capex in the current year minus Depreciation in the current year. Accounts Payable is calculated as Cost of Revenues multiplied by Days of Payables Outstanding (DPO)/365 Days of Payables Outstanding (DPO) is calculated as Accounts Payable / Cost of Revenues * 365 Equity in a year is calculated as Equity in the previous year plus Net Income minus Dividends ALERT: Because the value of the Dividends are shown as a negative on the Cash Flow Statement the value should be added to subtract Dividends 1,000 Accounting Business Driver 1,200 12,500