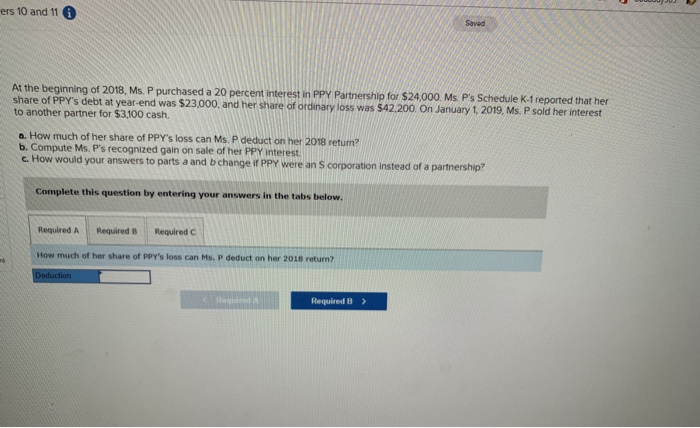

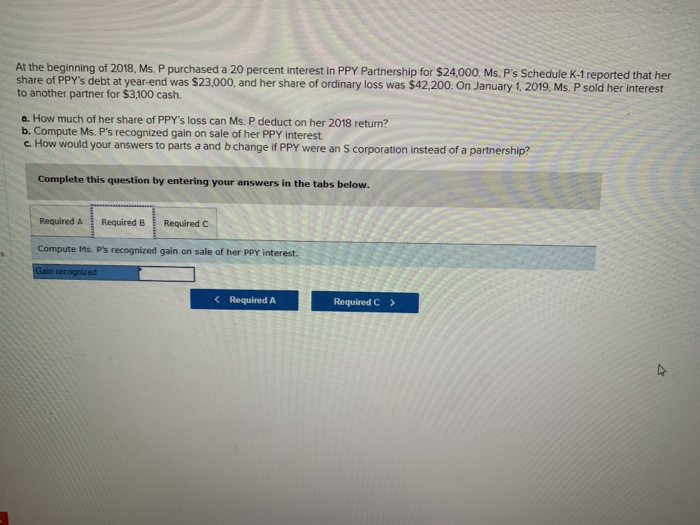

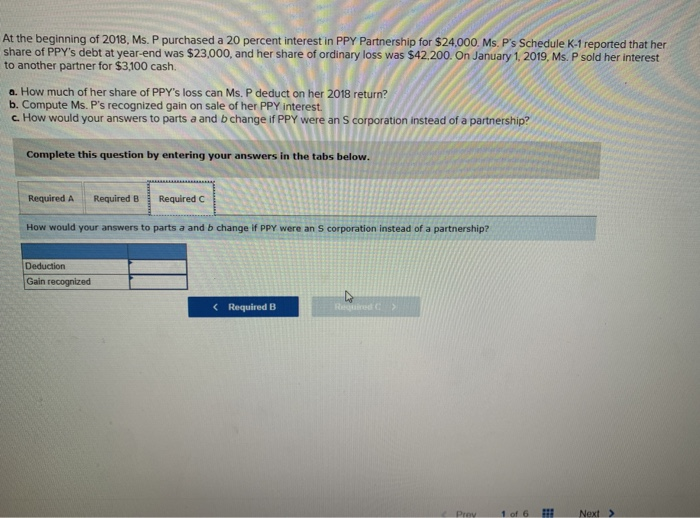

ers 10 and 11 6 Saved At the beginning of 2018., Ms. P purchased a 20 percent interest in PY Partnership for $24,000. Ms P's Scheduie K-1 reported that her share of PPY's debt at year-end was $23,000. and her share of ordinary loss was S42.200 On January 1, 2019, Ms. sold her interest to another partner for $3,100 cash. a. How much of her share of PPY's loss can Ms. P deduct on her 2018 retum b. Compute Ms. P's recognized gain on sale of her PPY interest. c. How would your answers to parts a and bchange if PPY were an S corporation instead of a partnership? Complete this question by entering your answers in the tabs below Required A Required B Required C How much of her share of PPY's loss can Ms. P deduct on her 2018 return? Required B> At the beginning of 2018, Ms. P purchased a 20 percent interest in PPY Partnership for $24,000 Ms.P's Schedule K-1 reported that her share of PPY's debt at year-end was $23,000, and her share of ordinary loss was $42,200. On January 1, 2019, Ms. P sold her interest to another partner for $3,100 cash. a. How much of her share of PPY's loss can Ms. P deduct on her 2018 return? b. Compute Ms. P's recognized gain on sale of her PPY interest c. How would your answers to parts a and b change if PPY were an S corporation instead of a partnership? Complete this question by entering your answers in the tabs below. Required ARequired B Required C Compute Ms. P's recognized gain on sale of her PPY interest. Required A Required C At the beginning of 2018, Ms. P purchased a 20 percent interest in PPY Partnership for $24,000. Ms. P's Schedule K-1 reported that her share of PPY's debt at year-end was $23,000, and her share of ordinary loss was $42.200. On January 1. 2019, Ms. P sold her interest to another partner for $3,100 cash. a. How much of her share of PPY's loss can Ms. P deduct on her 2018 return? b. Compute Ms. P's recognized gain on sale of her PPY interest c. How would your answers to parts a and b change if PPY were an S corporation instead of a partnership? Complete this question by entering your answers in the tabs below. Required A Required 8Required C How would your answers to parts a and b change if PPY were an S corporation instead of a partnership? Required B Next >