Answered step by step

Verified Expert Solution

Question

1 Approved Answer

es Account Cash Accounts receivable Prepaid insurance Equipment Accumulated depreciation, equipment Accounts payable Abraham Nuna, capital Abraham Nuna, withdrawals Revenues Depreciation expense, equipment Salaries

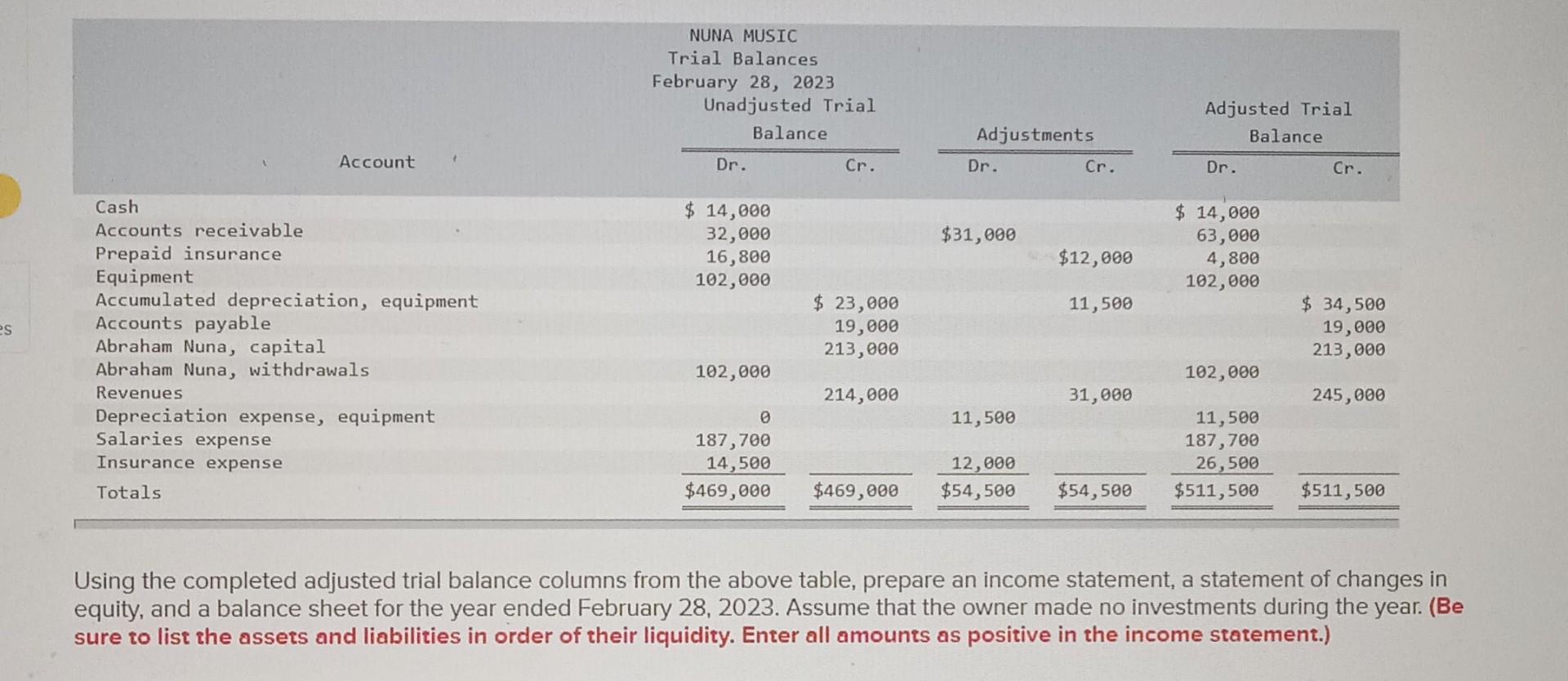

es Account Cash Accounts receivable Prepaid insurance Equipment Accumulated depreciation, equipment Accounts payable Abraham Nuna, capital Abraham Nuna, withdrawals Revenues Depreciation expense, equipment Salaries expense Insurance expense Totals NUNA MUSIC Trial Balances February 28, 2023 Unadjusted Trial Dr. Balance $ 14,000 32,000 16,800 102,000 102,000 0 187,700 14,500 $469,000 Cr. $ 23,000 19,000 213,000 214,000 Adjustments Dr. $31,000 11,500 12,000 $469,000 $54,500 Cr. $12,000 11,500 31,000 Adjusted Trial Dr. Balance $ 14,000 63,000 4,800 102,000 102,000 11,500 187,700 26,500 $54,500 $511,500 Cr. $ 34,500 19,000 213,000 245,000 $511,500 Using the completed adjusted trial balance columns from the above table, prepare an income statement, a statement of changes in equity, and a balance sheet for the year ended February 28, 2023. Assume that the owner made no investments during the year. (Be sure to list the assets and liabilities in order of their liquidity. Enter all amounts as positive in the income statement.)

Step by Step Solution

★★★★★

3.37 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

REPORT OF INCOME FOR THE MONTH ENDED February 28 2023 Revenue 214000 from music sales based on adjus...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started