Question

Tai, age 35, recently purchased a new home. The purchase price was $470,000 and his monthly mortgage payment is $2.180. Property tax is $2,175

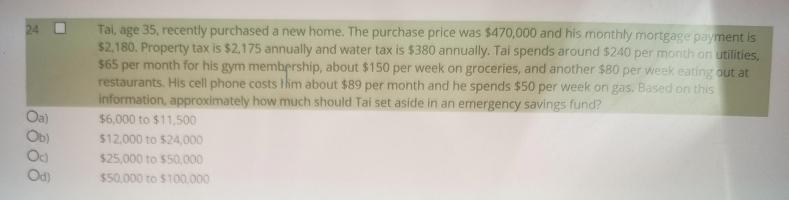

Tai, age 35, recently purchased a new home. The purchase price was $470,000 and his monthly mortgage payment is $2.180. Property tax is $2,175 annually and water tax is $380 annually. Tai spends around $240 per monith on utifities, 24 per month for his gym membership, about $150 per week on groceries, and another $80 per week eating out at restaurants. His cell phone costs thm about $89 per month and he spends $50 per week on gas. Based on this information, approximately how much should Tai set aside in an emergency savings fund? $6,000 to $11,500 $65 Oa) Ob) $12.000 to $24,000 $25,000 to $50,000 Od) $50,000 to $100.000 18888

Step by Step Solution

3.40 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Personal Financial Planning

Authors: Lewis J. Altfest

2nd edition

1259277186, 978-1259277184

Students also viewed these Banking questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App