Answered step by step

Verified Expert Solution

Question

1 Approved Answer

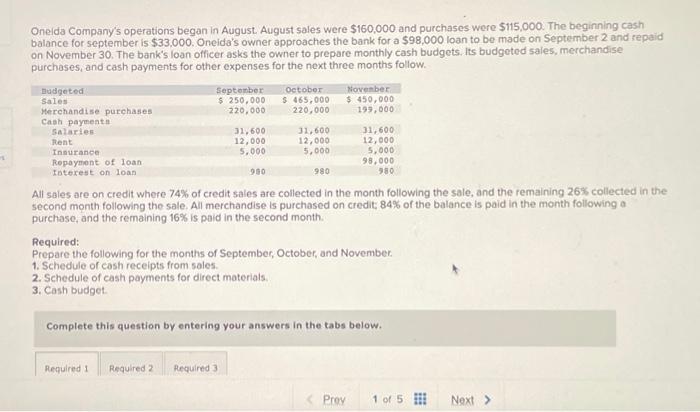

es Oneida Company's operations began in August. August sales were $160,000 and purchases were $115,000. The beginning cash balance for september is $33,000. Oneida's owner

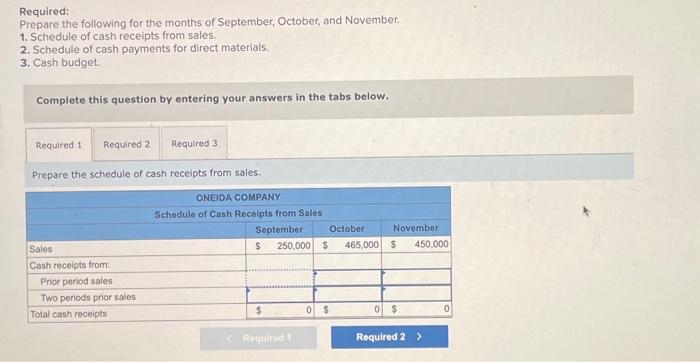

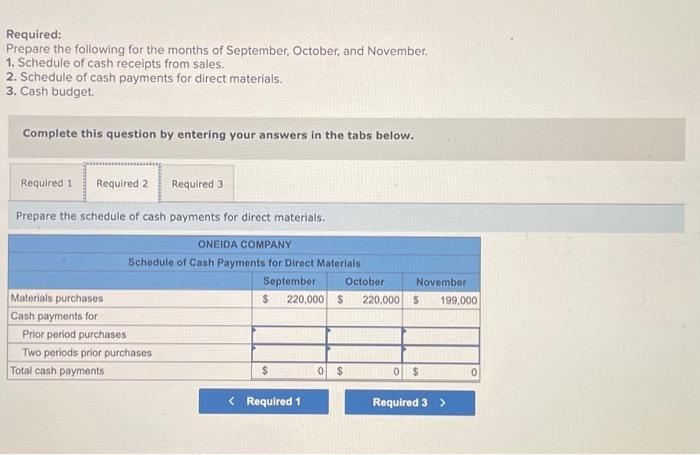

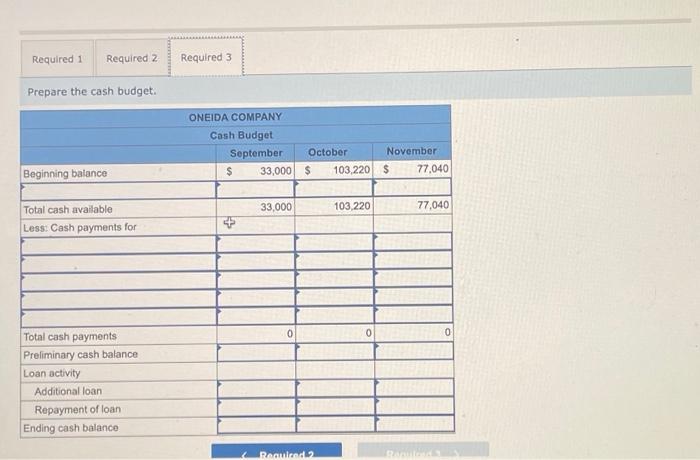

es Oneida Company's operations began in August. August sales were $160,000 and purchases were $115,000. The beginning cash balance for september is $33,000. Oneida's owner approaches the bank for a $98,000 loan to be made on September 2 and repaid on November 30. The bank's loan officer asks the owner to prepare monthly cash budgets. Its budgeted sales, merchandise purchases, and cash payments for other expenses for the next three months follow. Budgeted Sales Merchandise purchases Cash payments Salaries Rent Insurance Repayment of loan Interest on loan September $ 250,000 220,000 31,600 12,000 5,000 980 October $ 465,000 220,000 Required 1 Required 2 Required 3 31,600 12,000 5,000 980 November $ 450,000 199,000 31,600 12,000 5,000 98,000 980 All sales are on credit where 74% of credit sales are collected in the month following the sale, and the remaining 26% collected in the second month following the sale. All merchandise is purchased on credit; 84% of the balance is paid in the month following a purchase, and the remaining 16% is paid in the second month. Required: Prepare the following for the months of September, October, and November. 1. Schedule of cash receipts from sales. 2. Schedule of cash payments for direct materials. 3. Cash budget. Complete this question by entering your answers in the tabs below. Prev 1 of 5 www www www Next >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started