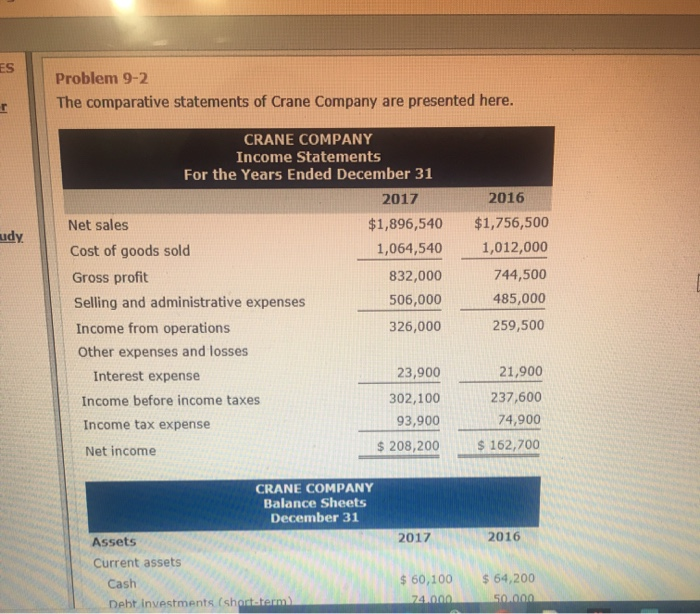

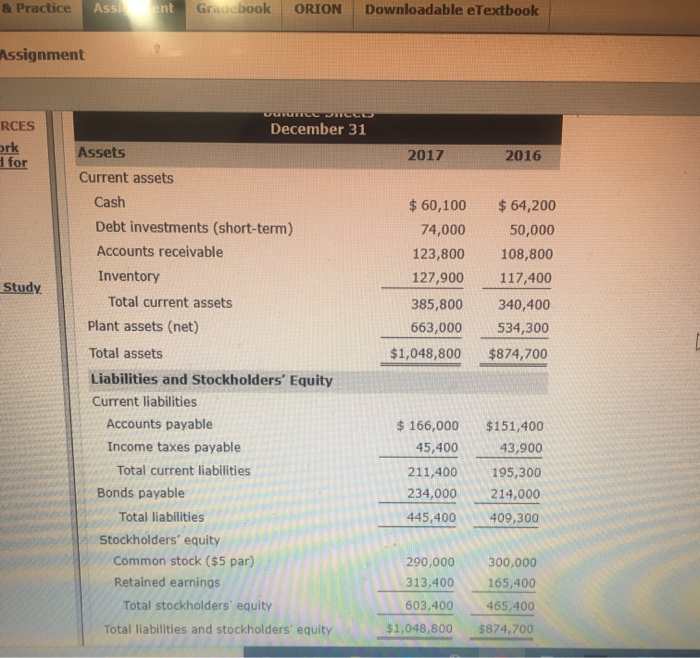

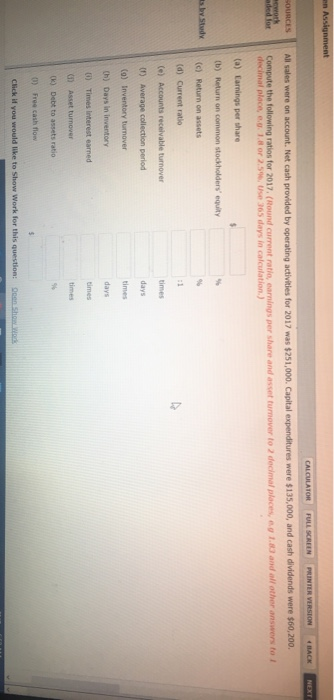

ES Problem 9-2 The comparative statements of Crane Company are presented here. 2016 udy. CRANE COMPANY Income Statements For the Years Ended December 31 2017 Net sales $1,896,540 Cost of goods sold 1,064,540 Gross profit 832,000 Selling and administrative expenses 506,000 Income from operations 326,000 Other expenses and losses Interest expense 23,900 Income before income taxes 302,100 Income tax expense 93,900 Net income $ 208,200 $1,756,500 1,012,000 744,500 485,000 259,500 21,900 237,600 74,900 $ 162,700 CRANE COMPANY Balance Sheets December 31 2017 2016 Assets Current assets Cash Debt investments (shodeterm) $ 60,100 74.000 $ 64,200 50.000 & Practice Assi ent Graudbook ORION Downloadable eTextbook Assignment RCES ork 1 for 2017 2016 Study. $ 60,100 74,000 123,800 127,900 385,800 663,000 $1,048,800 $ 64,200 50,000 108,800 117,400 340,400 534,300 $874,700 December 31 Assets Current assets Cash Debt investments (short-term) Accounts receivable Inventory Total current assets Plant assets (net) Total assets Liabilities and Stockholders' Equity Current liabilities Accounts payable Income taxes payable Total current liabilities Bonds payable Total liabilities Stockholders' equity Common stock ($5 par) Retained earnings Total stockholders' equity Total liabilities and stockholders' equity $ 166,000 45,400 211,400 234,000 445,400 $151,400 43,900 195,300 214,000 409,300 290,000 313,400 603,400 $1,048,800 300,000 165,400 465,400 $874,700 en Assignment CALCULATOR FULL SCREEN PRINTER VERSION BACK NEXT SOURCES work aded for All sales were on account. Net cash provided by operating activities for 2017 was $251,000. Capital expenditures were $135,000, and cash dividends were $60,200, Compute the following ratios for 2017. (Round current ratio, earnings per share and asset tumover to decimal places 1.0 and all other answers to! decimal plan, c.0.1.1 or 2.5 Us 365 days in calculation) (a) Earnings per share (b) Return on common stockholders' equity is by study (c) Return on assets (d) Current ratio (e) Accounts receivable turnover times (1) Average collection period days (9) Inventory turnover times (h) Days In Inventory days ) Times literest earned times 6) Asset turnover times (k) Debt to assets ratio 9 0) Free cash flow Click if you would like to show Work for this question: Ooon