Answered step by step

Verified Expert Solution

Question

1 Approved Answer

es Saved Help Save & Exit Submit Check my work Problem 5-1A (Static) Compute the net pay for Evelyn Khan and Margaret Rheinhart. Assume

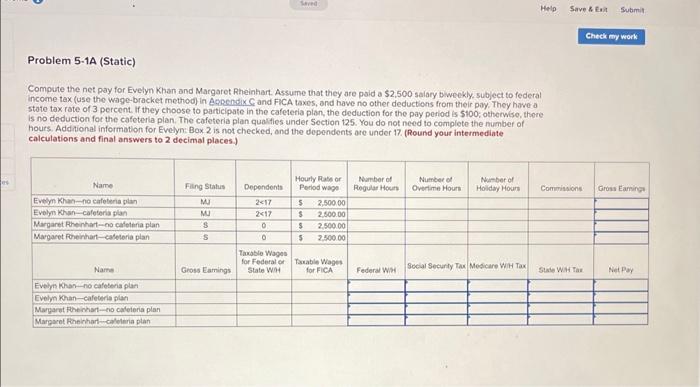

es Saved Help Save & Exit Submit Check my work Problem 5-1A (Static) Compute the net pay for Evelyn Khan and Margaret Rheinhart. Assume that they are paid a $2,500 salary biweekly, subject to federal income tax (use the wage-bracket method) in Appendix C and FICA taxes, and have no other deductions from their pay. They have a state tax rate of 3 percent. If they choose to participate in the cafeteria plan, the deduction for the pay period is $100; otherwise, there is no deduction for the cafeteria plan. The cafeteria plan qualifies under Section 125. You do not need to complete the number of hours. Additional information for Evelyn: Box 2 is not checked, and the dependents are under 17. (Round your intermediate calculations and final answers to 2 decimal places.) Name Filing Status Dependents Hourly Rate or Period wage Number of Regular Hours Number of Overtime Hours Number of Holiday Hours Commissions Gross Earings Evelyn Khan-no cafeteria plan MJ 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started