Answered step by step

Verified Expert Solution

Question

1 Approved Answer

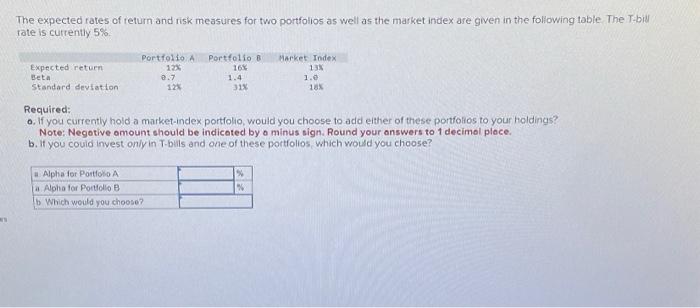

es The expected rates of return and risk measures for two portfolios as well as the market index are given in the following table. The

es The expected rates of return and risk measures for two portfolios as well as the market index are given in the following table. The T-bill rate is currently 5%. Expected return Beta Standard deviation Portfolio A 12% 0.7 12% a. Alpha for Portfolio A a. Alpha for Portfolio B b. Which would you choose? Portfolio B 16% 1.4 31% Market Index 13% 1.0 Required: a. If you currently hold a market-index portfolio, would you choose to add either of these portfolios to your holdings? Note: Negative amount should be indicated by a minus sign. Round your answers to 1 decimal place. b. If you could invest only in T-bills and one of these portfolios, which would you choose? % % 18%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started