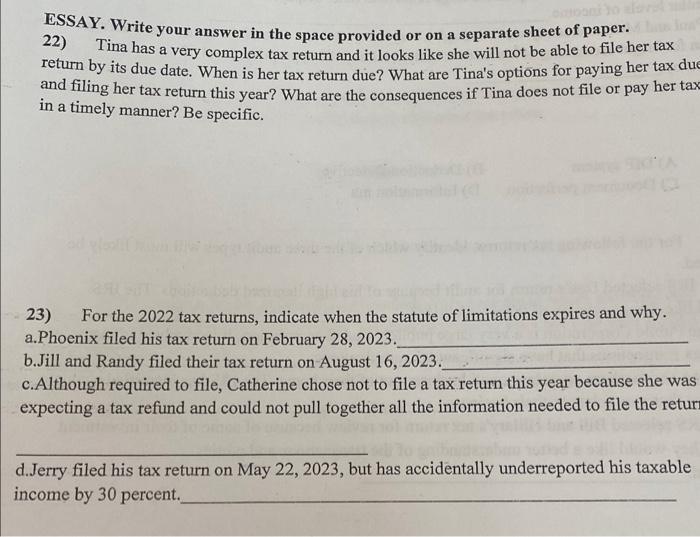

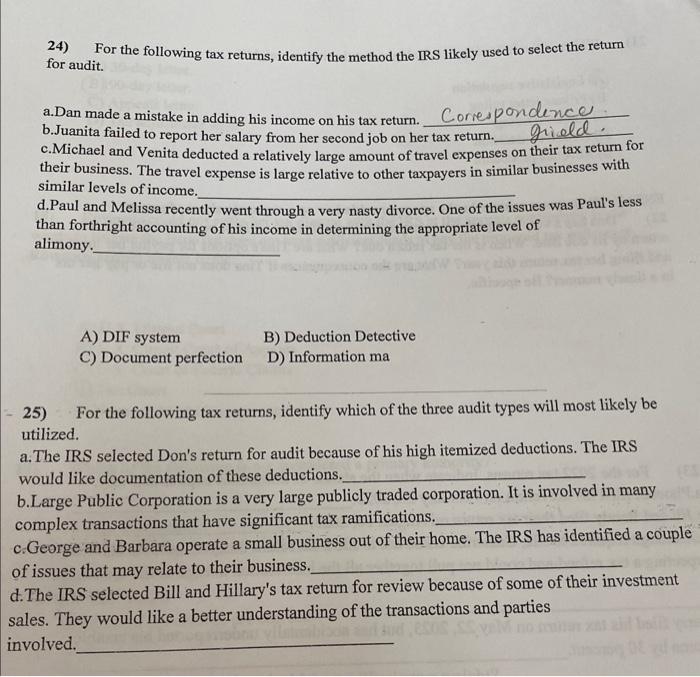

ESSAY. Write your answer in the space provided or on a separate sheet of paper. 22) Tina has a very complex tax return and it looks like she will not be able to file her tax return by its due date. When is her tax return due? What are Tina's options for paying her tax du and filing her tax return this year? What are the consequences if Tina does not file or pay her tax in a timely manner? Be specific. 23) For the 2022 tax returns, indicate when the statute of limitations expires and why. a.Phoenix filed his tax return on February 28, 2023. b.Jill and Randy filed their tax return on August 16,2023. c. Although required to file, Catherine chose not to file a tax return this year because she was expecting a tax refund and could not pull together all the information needed to file the retur d.Jerry filed his tax return on May 22, 2023, but has accidentally underreported his taxable income by 30 percent. 24) For the following tax returns, identify the method the IRS likely used to select the return for audit. a.Dan made a mistake in adding his income on his tax return. Correspondence b. Juanita failed to report her salary from her second job on her tax return. Giicld. c.Michael and Venita deducted a relatively large amount of travel expenses on their tax return for their business. The travel expense is large relative to other taxpayers in similar businesses with similar levels of income. d.Paul and Melissa recently went through a very nasty divorce. One of the issues was Paul's less than forthright accounting of his income in determining the appropriate level of alimony. A) DIF system B) Deduction Detective C) Document perfection D) Information ma 25) For the following tax returns, identify which of the three audit types will most likely be utilized. a. The IRS selected Don's return for audit because of his high itemized deductions. The IRS would like documentation of these deductions. b.Large Public Corporation is a very large publicly traded corporation. It is involved in many complex transactions that have significant tax ramifications. c.George and Barbara operate a small business out of their home. The IRS has identified a couple of issues that may relate to their business. d. The IRS selected Bill and Hillary's tax return for review because of some of their investment sales. They would like a better understanding of the transactions and parties involved